Microstrategy’s stock (Nasdaq: MSTR) has traded above the value of its underlying bitcoin holdings, reflecting structural advantages unavailable to direct cryptocurrency ownership or spot exchange-traded products (ETPs). That market premium is measured against the company’s net asset value (NAV), which represents the per-share worth of its bitcoin holdings after accounting for liabilities. Michael Saylor, executive chairman of Microstrategy, which has rebranded as Strategy, shared on Aug. 13 on social media platform X:

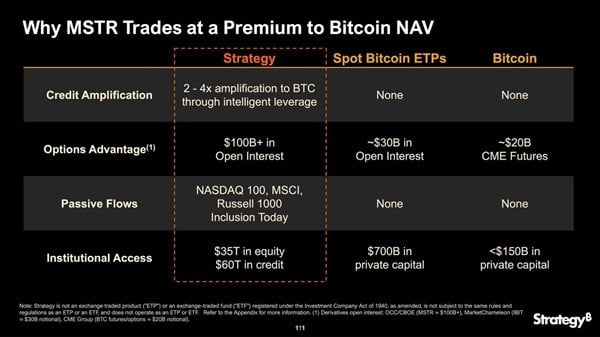

MSTR trades at a premium to bitcoin NAV due to Credit Amplification, an Options Advantage, Passive Flows, and superior Institutional Access that equity and credit instruments provide compared to commodities.

These elements collectively give Microstrategy leverage and liquidity advantages that bitcoin itself does not possess.

The company’s ability to apply 2x to 4x leverage to bitcoin through equity-based financing, described by Saylor as “credit amplification,” provides a performance boost during bullish market phases. This contrasts with both spot bitcoin ETPs and direct bitcoin holdings, which lack such leverage capabilities. Microstrategy also benefits from more than $100 billion in open interest in traditional options markets, surpassing the roughly $30 billion in open interest for spot bitcoin ETPs and $20 billion for CME bitcoin futures.

Why MSTR trades at a premium to bitcoin NAV. Source: Michael Saylor

Additionally, as a constituent of indices such as the Nasdaq 100, MSCI, and Russell 1000, Microstrategy captures passive investment flows that do not extend to bitcoin or its spot-based ETPs.

Institutional reach marks another major distinction. Equity markets provide potential access to $35 trillion in equity and $60 trillion in credit, dwarfing the $700 billion in private capital available to spot bitcoin ETPs and the less than $150 billion for direct bitcoin. While critics see the valuation gap as excessive, proponents contend that these market dynamics justify the premium, as they enable Microstrategy to amplify returns and broaden its investor base beyond the limits of commodity-based bitcoin exposure.

The company began acquiring bitcoin in 2020, adopting it as a primary treasury asset. Strategy funds its purchases through debt and equity offerings, making it the largest corporate holder of bitcoin and a de facto proxy for investors. As of its latest public filing, Strategy holds approximately 628,946 BTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。