Top100 Public Bitcoin Treasury Ranking 2025: Saylor MicroStrategy Lead

The recent changes in crypto have turned the market upside down. However, BTC still dominates at 57.7% as the most popular cryptocurrency, not just among retail investors but also among publicly traded companies with Bitcoin as a treasury asset.

By 2025, corporate interest has increased, as regulatory clarity in the United States after 2024 leads to a greater acceptance of digital assets in the mainstream financial world.

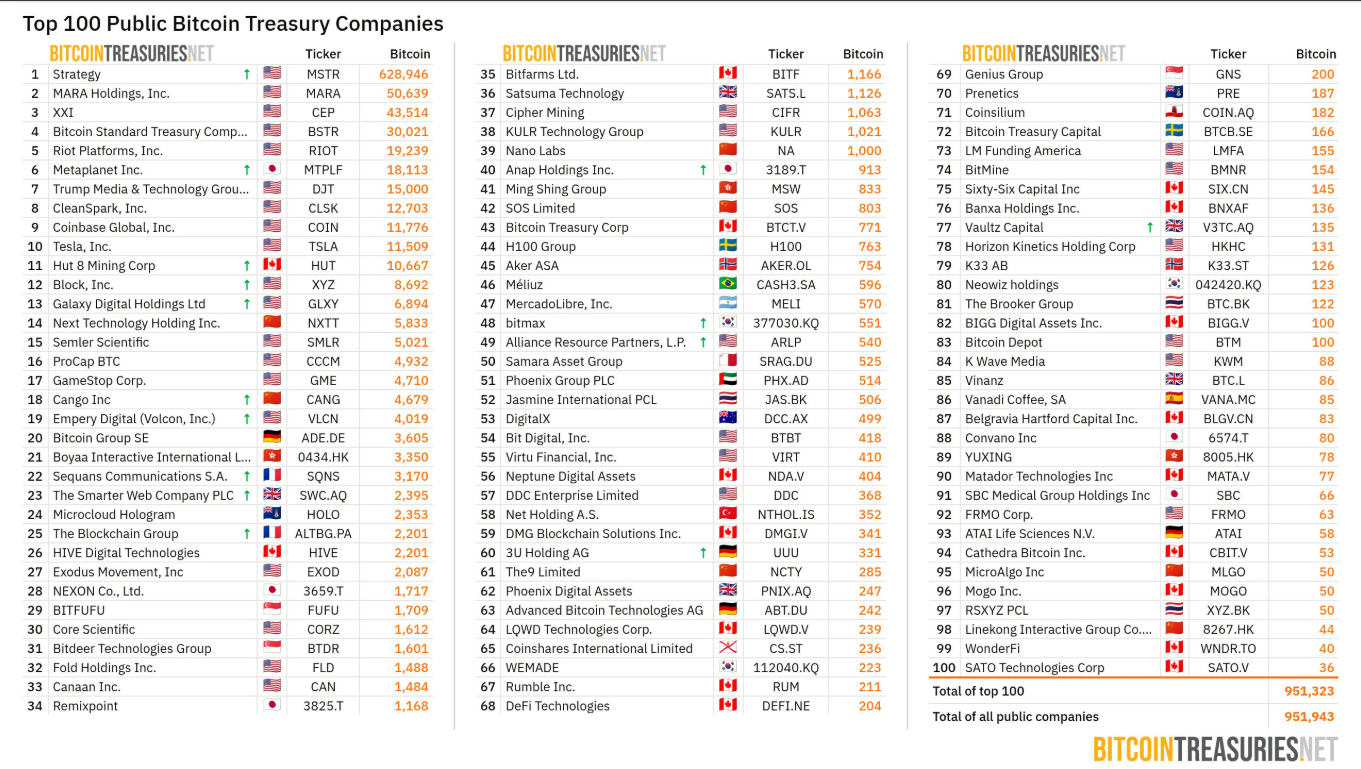

The top 100 public treasury companies now jointly hold a staggering 951,323 BTC, reflecting a strategic shift toward crypto adoption.

Top 100 Public Bitcoin Treasury Companies

Over the last seven days, 15 public companies increased their holdings, totalling 951323, highlighting a strong institutional appetite. Notable additions include Galaxy Digital with 2,894 and Metaplanet with 518 BTC.

These acquisitions align with a broader trend seen in Ether treasury companies, which have amassed 3.8% of ETH circulation since June 2025, suggesting that digital assets are increasingly viewed as strategic reserves for long-term portfolio growth.

Given below is the table that shows the Top 100 companies with their ticker and total number of holdings:

Source: BitcoinTreasuries.NFT X

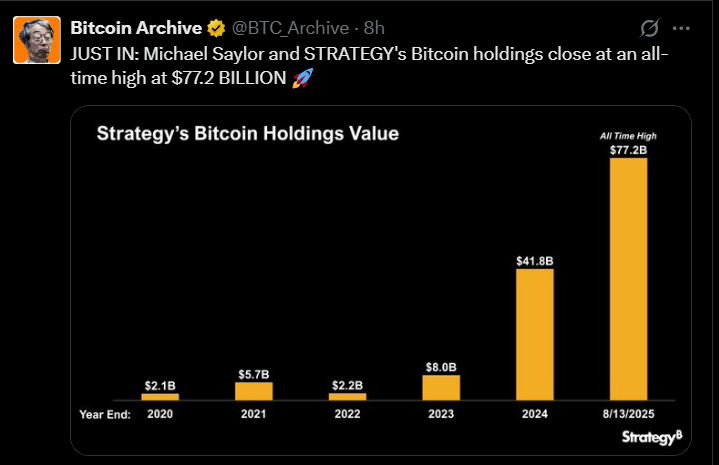

Michael Saylor's MicroStrategy on Top

MicroStrategy, led by Michael Saylor, continues to dominate corporate Bitcoin holdings. The treasury now stands at $77.2 billion. A few days ago, Microstrategy hold $74B , reaffirming its position as a leader.

Saylor’s strategy of consistent accumulation during market dips has paid off, inspiring other public companies to explore a diversification tool.

Source: X

Rise in Bitcoin Holdings

As the market capitalization approaches $2.45 trillion in the middle of 2025, the companies are gradually investing in crypto treasuries, which can help to stabilise and diversify the financial portfolio.

Although some discrepancies in reported holdings exist, for instance, between HODL15Capital and BitcoinTreasuries.NET, this is primarily because of different data collection methods and real-time industry updates.

Bitcoin Price Prediction

Currently, BTC price is $121647, up 2.0% in the past 24 hours, with a trading volume of $65.81 billion and a market cap of $2.45 trillion. Corporate optimism is mirrored in market forecasts. Many crypto enthusiasts predicted the price, whereas Kevin O’Leary, known for his bullish stance on Crypto, predicts the cryptocurrency could reach $250,000 by 2027.

On the other side, the author of Rich Dad Poor Dad, Robert Kiyosaki, predicts the price of BTC to reach $1 million by 2030 . He adds that investment in gold, silver, oil, and this cryptocurrency will be beneficial at the time of a market crash. Michael Saylor also boldly estimated the same $1 million price.

Additionally, Jack Dorsey’s Block Inc. also shows interest in BTC investments, as Block holds 8584 BTC . His vision strengthens the pillars of Block. Analysts cite Bitcoin’s scarcity, institutional adoption, and growing integration into corporate finance as key drivers behind these predictions.

Source: X

Impact and Conclusion

Corporate inflows help stabilize the crypto industry and make it liquid, which aids in maintaining price floors. Regulatory clarity, technological advancements like the new mining chip by Jack Dorsey's Block. Institutional accumulation also promotes retail confidence, which, in turn, forms a positive feedback loop for long-term growth. The conclusion drawn from the above statistics and information is positive for the cryptocurrency in 2025.

Also read: SpaceX BTC Holding Surpasses $1 Billion in Long-Term Strategy免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。