Author: Bruce

Introduction: Huge Financing Under SEC Investigation Clouds

NASDAQ-listed company ALT5 Sigma ($ALTS) officially announced on August 18, 2025, the completion of its milestone $1.5 billion financing. However, almost simultaneously, a media report surfaced regarding a potential investigation by the U.S. Securities and Exchange Commission (SEC), which the company quickly denied. The ink on this deal was barely dry before it fell into a "Rashomon" scenario.

So, what is the real situation? What strategic intentions and risks are hidden behind this transaction?

1. Catalyst: A Complete Transformation of $1.5 Billion

ALT5 raised a total of $1.5 billion through a targeted issuance and private financing, officially establishing its transformation route from a niche B2B crypto service company to a Digital Asset Treasury (DAT) company. The so-called "Digital Asset Treasury" can be understood as a listed entity focused on the centralized holding and management of digital assets, similar to an "asset reserve holding company" in the crypto field.

The key point is that this transformation is not merely a capital injection but involves a crypto ecosystem with strong political and financial backgrounds—World Liberty Financial (WLF)—entering the public market through the compliant listed platform of ALT5. As a result, the stock price of $ALTS will essentially be closely related to the $WLFI ecosystem.

2. New Identity: Treasury Strategy Centered on $WLFI

After the financing is completed, ALT5 will focus its digital treasury strategy on the $WLFI token. According to the announcement, ALT5 will hold approximately 7.5% of the total issuance of $WLFI tokens after the financing is completed.

In the future, the company will adopt a "mNAV appreciation strategy" (multiple to Net Asset Value): by issuing new shares when the stock price is above the net asset value to exchange for cash, and then further purchasing more digital assets, thereby amplifying the corresponding token holdings per share and forming a value leverage.

(Note: mNAV refers to the multiple of the company's valuation in the secondary market to the net value of its underlying digital assets, serving as a valuation tool similar to the MicroStrategy ($MSTR) model.)

This strategy essentially transforms ALT5's equity into an "amplifier of $WLFI tokens."

3. New Cabinet: Deep Integration of Politics, Business, and Crypto Technology

The new board lineup directly reveals the political and business intentions behind this transformation:

Zach Witkoff (Chairman): Co-founder and CEO of World Liberty Financial, primarily responsible for financial capital connections.

Eric Trump (Director): Son of Donald Trump and Executive Vice President of the Trump Organization, his involvement not only brings the Trump family's business network but also signifies ALT5's political endorsement in U.S. political and business relations.

Zach Fulkman (Board Observer): Co-founder and COO of WLF.

Matt Morgan (Chief Investment Officer): Responsible for executing the new treasury strategy.

Jonathan Hugh (Chief Financial Officer): With 25 years of experience in global capital markets, previously CFO of market maker GSR, he will inject institutional-level compliance and operational strength into the team.

This board combination is not common on Wall Street—the combination of "political background + popular digital assets + family brand effect" may allow ALT5 to enjoy higher market attention in the future, but it also faces higher political risks.

4. Transaction Structure Analysis: Terms and Key Partners

The total financing amount is $1.5 billion, which includes:

Targeted Issuance (Cash Portion): Raising $750 million in cash from global institutional investors and well-known crypto funds, including the prominent U.S. hedge fund Point72.

Simultaneous Private Placement (Token Portion): World Liberty Financial exchanges $750 million worth of $WLFI tokens for ALT5 equity.

Additionally, Kraken cryptocurrency exchange has been appointed as the asset manager for the new treasury, responsible for the custody and operation of the tokens. This step hedges some compliance concerns from investors.

5. WLF Ecosystem: A "New Financial" Attempt Under Trump's Vision

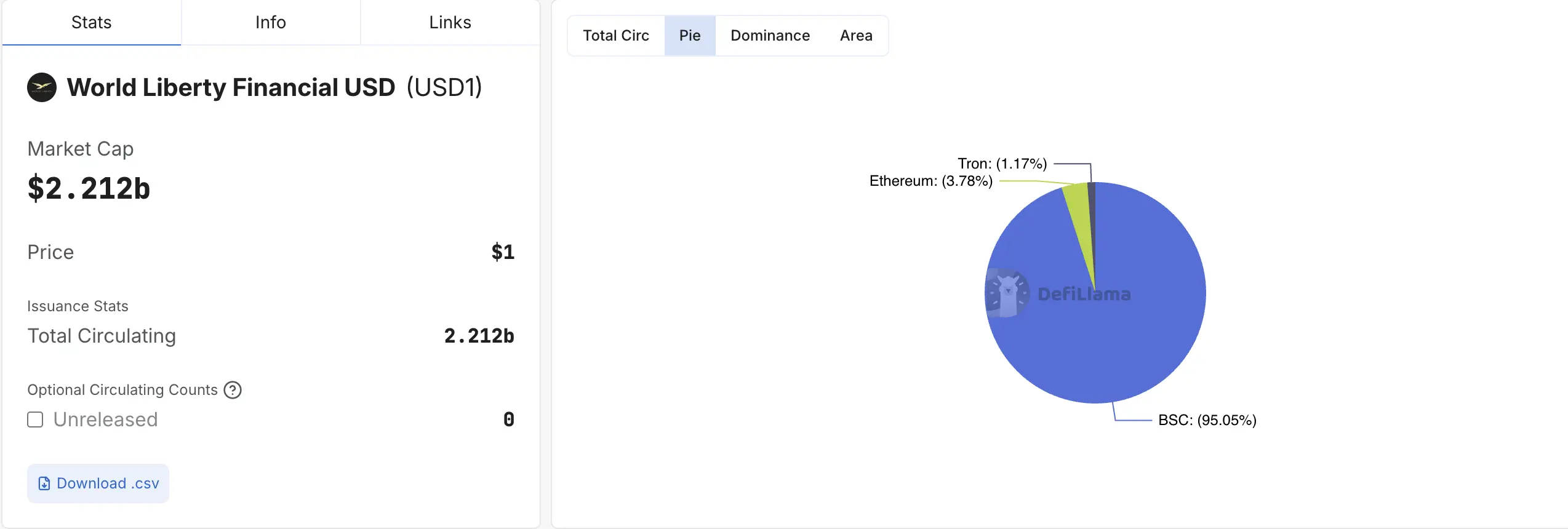

According to public information, World Liberty Financial is committed to creating a comprehensive financial system with strong Trumpist characteristics, its core product, the USD1 stablecoin, is promoted as "the fastest-growing stablecoin," with a current supply exceeding $2.2 billion, primarily issued on the Binance Smart Chain (BSC).

This entry into ALT5 marks the first time this ecosystem has gained access to a public market financing platform, providing an opportunity to establish more direct connections with mainstream investors.

6. Operational Foundation: ALT5's Existing Compliance Business

Unlike many companies that operate merely as capital shells, ALT5 has been providing B2B crypto trading infrastructure globally since 2018, processing over $5 billion in digital asset transactions. Its core products include:

ALT5 Prime: An institutional-grade OTC platform.

ALT5 Pay: A solution for global merchants to accept crypto payments.

This part of the business provides a compliance and operational foundation for WLF's expansion and increases ALT5's actual business content, distinguishing it from a single token holding company.

7. Value Reassessment and Competitor Comparison

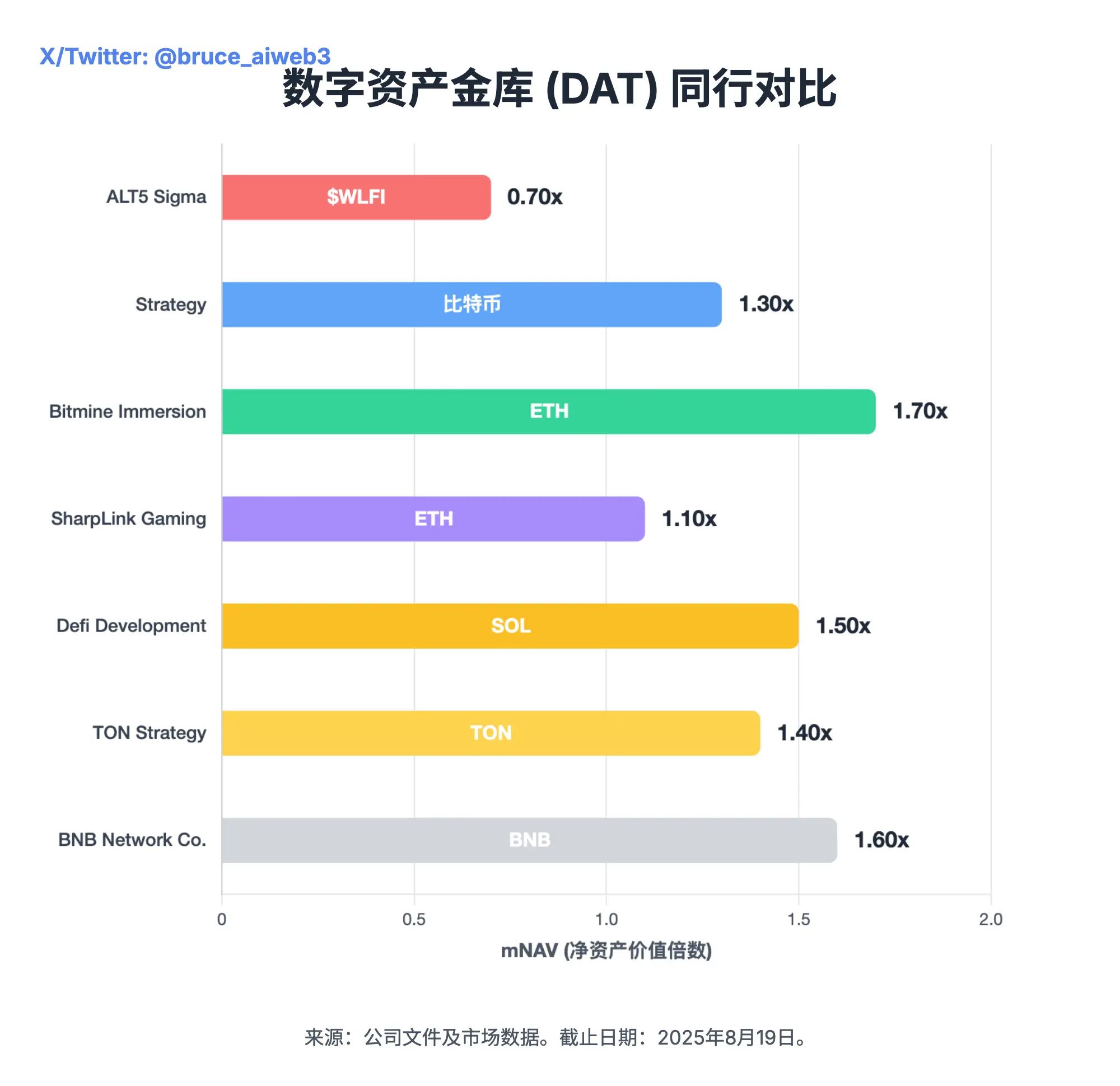

As of August 19, 2025, the mNAV multiple of $ALTS is only 0.7 times, lower than the general level of peers, how to narrow the mNAV discount will become the first challenge for the management.

8. "Rashomon": SEC Investigation Rumors and Official Denials

As the transaction was completed, market attention shifted to regulatory risks:

Media Report: The Information reported that the SEC is investigating investor Jon Isaac, involving profit inflation and potential insider trading related to the $ALTS transaction.

Official Denial: Both ALT5 and Isaac clarified on social media that he is not a company executive or advisor and is "unaware" of any investigation.

Document Evidence: However, SEC public documents indicate that ALT5 indeed signed a two-year consulting agreement with Isaac in March 2024, and there was a debt-for-equity swap.

Historical Background: Isaac and ALT5's predecessor company JanOne were sued by the SEC for financial fraud in 2021, and the case is still under review.

As of now, the SEC has not officially confirmed whether it has launched a formal investigation into ALT5, leaving significant uncertainty.

9. Future Outlook: A High-Risk Political Financial Gamble

It is foreseeable that ALT5 will be caught in a vortex of capital, politics, and regulatory triple games in the future:

Bullish Scenario: If it can leverage the resources of the Trump family and Kraken's compliance endorsement to successfully bring WLF into the mainstream market, $ALTS may become a unique leveraged investment tool.

Bearish Scenario: If the SEC investigation is substantiated, or if liquidity issues with WLFI become prominent, combined with equity dilution pressure, the company may fall into long-term stagnation or even legal risks.

In summary, ALT5's future is a typical case of "high risk + high return." It is not only a capital operation but also a comprehensive game of politics, finance, and blockchain, making it one of the most topical and controversial cases in the current market.

Risk Warning: Digital asset prices are highly volatile; investment should be cautious. This article is for informational reference only and does not constitute investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。