1. Market Observation

In the current environment, the market is closely watching the future moves of the Federal Reserve. According to the CME "FedWatch" tool, the market generally expects a rate cut in September, with a probability as high as 75%. However, several Federal Reserve officials have expressed caution about this. Cleveland Fed President Mester and Kansas City Fed President George both believe that there is currently no sufficient reason for a rate cut unless there is clear data to support it, and they have expressed concerns about persistent inflation that may be triggered by tariffs. Atlanta Fed President Bostic maintains the expectation of one rate cut this year but emphasizes the high uncertainty of the forecast. In contrast, former St. Louis Fed President and one of the candidates for the next Fed chair, Bullard, has publicly called for a 100 basis point rate cut this year. Decision-makers are facing a dilemma between a weak labor market and inflation above the 2% target. At this critical moment, the Federal Reserve is also embroiled in a political storm due to allegations of mortgage fraud against Governor Lisa Cook, with the U.S. Department of Justice hinting at a possible investigation, adding more variables to an already complex situation. The market is holding its breath for Fed Chair Powell's speech at the Jackson Hole annual meeting, hoping to find clear signals regarding the future direction of monetary policy.

In response to the current volatility in the crypto market, HashKey Chief Analyst Jeffrey Ding has proposed his analytical framework. He points out that the price decline of Bitcoin and Ethereum can be categorized into two distinctly different types: healthy pullbacks in an uptrend and trend reversals in the market cycle. Pullbacks are usually triggered by market deleveraging and are considered short-term adjustments, such as the market continuing its upward trend after experiencing a sharp drop of 20%-30% in early 2021. In contrast, trend reversals are more complex, often accompanied by prolonged consolidation at the top range and macroeconomic negative factors, such as regulatory tightening in 2018 and the global rate hike cycle in 2022. Jeffrey Ding emphasizes that accurately distinguishing between these two types of declines is crucial for investors to assess the market stage and formulate corresponding strategies.

Regarding Bitcoin, the market is currently closely monitoring the effectiveness of key support levels. Multiple analysts have pointed out that the $110,000 to $112,000 range is an important support area. Analyst Ali believes that if it falls below $112,000, the price may further drop to $108,000; Daan Crypto Trades suggests that the local low may be between $109,850 and $111,900. Altcoin Sherpa expects a rebound in the price around the $110,000 to $112,000 range, while Michael van de Poppe warns that if it breaks below this range, it may further retreat to $90,000 to $100,000. According to CryptoQuant analysis, the current price weakness is related to slowing demand and profit-taking, with data showing that apparent demand for Bitcoin has decreased by two-thirds since July, and ETF purchases have also dropped to the lowest level since April. However, the analysis also suggests that $110,000, as the realization price for on-chain traders, may become a solid support. Technically, Arslan Butt points out that Bitcoin has broken below the ascending wedge and is facing resistance at the 50-day moving average of $116,103. Key price levels include: if it falls below $112,000, it may test $108,000 and $105,150; if it breaks through the $116,000 to $117,000 range, the rebound targets may be $120,900 and $124,450. Regarding the peak of this cycle, Glassnode data indicates that the bull market may peak within the next two to three months, Rekt Capital predicts the peak may occur between September and October 2025, while KillaXBT forecasts it may reach $140,000 in the fourth quarter of this year and suggests that investors should consider exit strategies at that time.

For Ethereum, its price movement is also under close scrutiny by analysts. Analyst Ali points out that Ethereum is currently consolidating in a descending channel between $4,342 and $4,219. If it can break above $4,342, it is expected to continue its upward trend to the $4,516 to $4,623 range; conversely, if it falls below the $4,219 support, it may retreat to $4,061 to $3,862. Meanwhile, analyst Open4profit observes that Ethereum has formed a potential bullish structure with a descending wedge breakout and a head-and-shoulders bottom pattern, with the neckline resistance around $4,380. However, if the price falls below $4,160, this bullish view will be invalidated. Notably, the market has observed a significant capital rotation, with a whale investor holding over $1.6 billion in assets converting $113 million worth of Bitcoin into Ethereum and establishing a large number of Ethereum spot and perpetual long positions, indicating optimism about Ethereum's future performance. BitMEX founder Arthur Hayes has also revealed that he has re-purchased ETH and expects it to rise to $20,000 in this cycle.

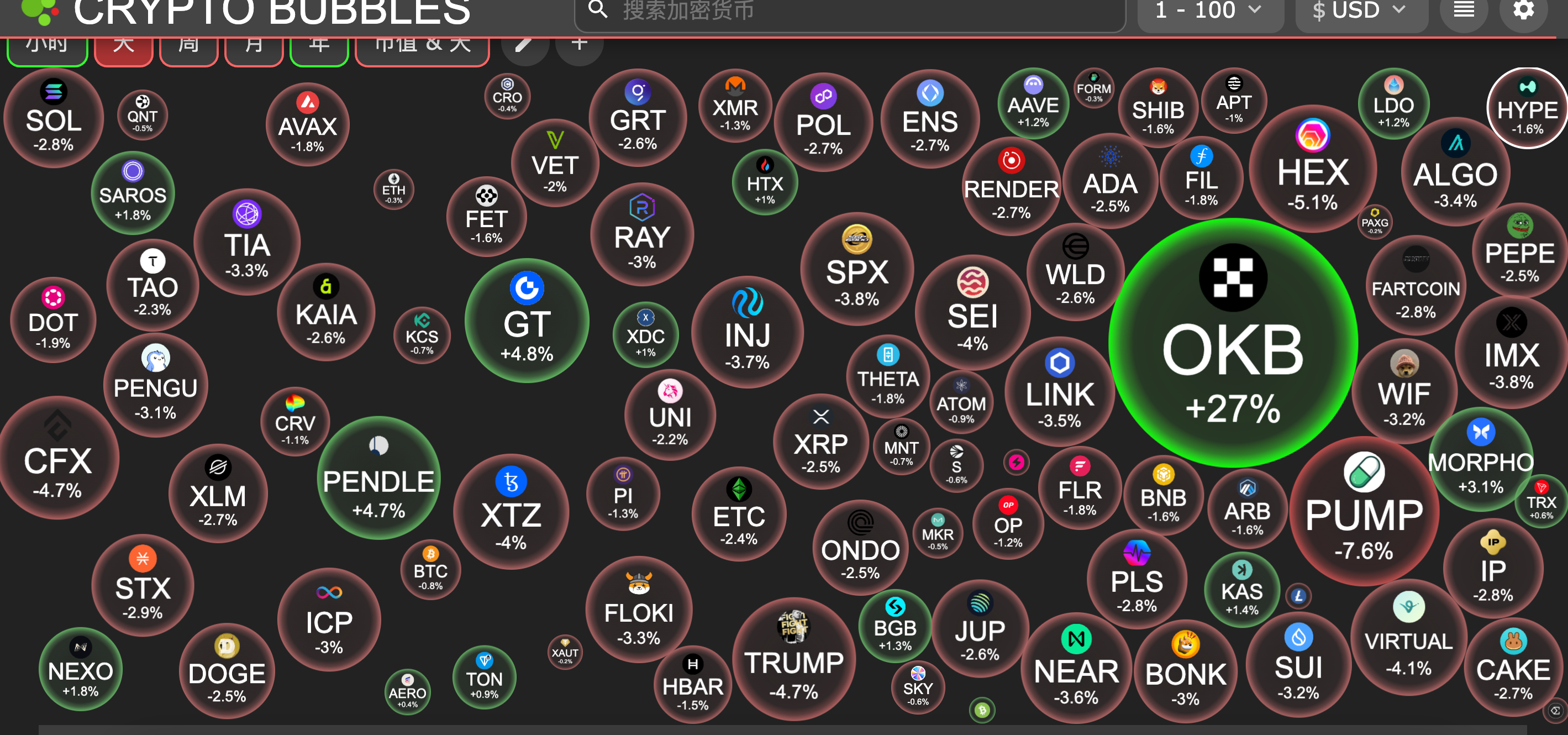

Recently, platform tokens have performed particularly well, with BNB breaking through $880 yesterday to set a new all-time high, and OKB also reaching a new all-time high of $258 today, with an increase of over 430% in the past two weeks. Huobi's platform token $HT has also shown strong performance, rising 308% within 24 hours. Additionally, rapper "Kanye" announced the issuance of the meme coin YZY yesterday. Although BitMEX founder Arthur Hayes and Huang Licheng are optimistic about YZY's performance, its market capitalization has fallen from a peak of about $3 billion to below $800 million.

2. Key Data (as of August 22, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $113,041 (YTD +21.02%), daily spot trading volume $31.895 billion

Ethereum: $4,285.50 (YTD +29.23%), daily spot trading volume $26.317 billion

Fear and Greed Index: 51 (Neutral)

Average GAS: BTC: 1.03 sat/vB, ETH: 0.14 Gwei

Market share: BTC 58.7%, ETH 13.5%

Upbit 24-hour trading volume ranking: AERO, XRP, ETH, API3, BTC

24-hour BTC long-short ratio: 49.43%/50.57%

Sector performance: The entire crypto market suffered setbacks, with the AI sector down 2.67% and the NFT sector down 2.23%

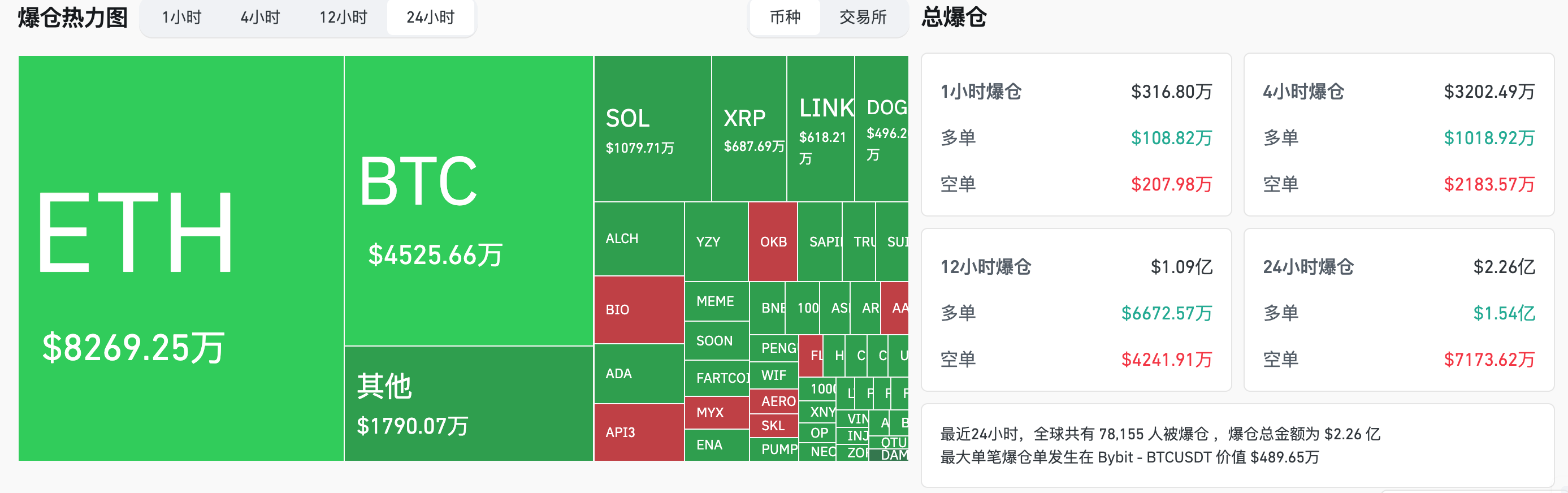

24-hour liquidation data: A total of 78,155 people were liquidated globally, with a total liquidation amount of $220 million, including $45.25 million in BTC, $82.69 million in ETH, and $10.79 million in SOL

BTC medium to long-term trend channel: upper line ($116,701.48), lower line ($114,390.56)

ETH medium to long-term trend channel: upper line ($4,283.42), lower line ($4,198.60)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of August 21)

Bitcoin ETF: -$194 million, continuing five days of net outflow

Ethereum ETF: +$288 million, turning into net inflow after four days of outflow

4. Today's Outlook

Binance Alpha will launch FreeStyle Classic (FST) on August 24

SOON (SOON) will unlock approximately 41.88 million tokens at 4:30 PM on August 23, accounting for 13.04% of the current circulation, valued at approximately $12.1 million;

Top 100 largest gains today: OKB up 26.6%, Gate up 5%, Pendle up 4.6%, Morpho up 2.9%, Mantle up 7.8%.

5. Hot News

Hemi Tokenomics Released, 25% Allocated to Team and Core Contributors

The First Buyer of YZY is Suspected to be Naseem, a 100x Profiteer from TRUMP

Verb Technology Holds $780 Million in Assets, Including $713 Million in TON

Whale Holding BTC for 7 Years Sells Approximately $235 Million in BTC for ETH Within 24 Hours

USV Transfers $31.09 Million in UNI to Coinbase Prime, Still Holds Approximately $69.82 Million

U.S. August Manufacturing PMI Hits 39-Month High, Composite PMI Hits 8-Month High

Kanye Injects $34 Million in YZY into the YZY Liquidity Pool

Coinbase Adds Five Assets: AWE, DOLO, FLOCK, LAYER, and SPX to Listing Roadmap

This article is supported by HashKey. HashKey Exchange is the largest licensed virtual asset exchange in Hong Kong and the most trusted fiat gateway for crypto assets in Asia. It aims to set a new benchmark for virtual asset exchanges in terms of compliance, fund security, and platform protection.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。