Author: Luohantang Perspective

Speaker: Shen Kang

Shen Kang: Graduated from the Department of Aerospace Engineering at Fudan University, holds an MBA from the University of Chicago Booth School of Business, and is a CFA charterholder. He has held key positions at several financial institutions including PIMCO, Solomon Brothers, and Bosera Asset Management. In 2019, he founded Hash Global, focusing on investment and practice in the digital asset and Web3 fields, promoting the construction of a more prosperous Web3 ecosystem.

The following is the original text of Shen Kang's speech:

Good afternoon, everyone. I am very pleased to communicate with you today at the Luohantang annual meeting. The topic I am sharing today is "The Resonance of Web3 and AI: Driving Finance Towards Internetization and Digitization." This topic may sound a bit convoluted and not very intuitive. However, the core message I want to convey is quite simple: I want to clarify one thing: why is it said that finance supported by Web3 is the true internetized and digitized finance? Once this point is made clear, I believe everyone will have a deeper understanding of the significance of Web3 for finance and AI.

From Electronic Ledger to Digital Ledger: The Financial Revolution of Web3

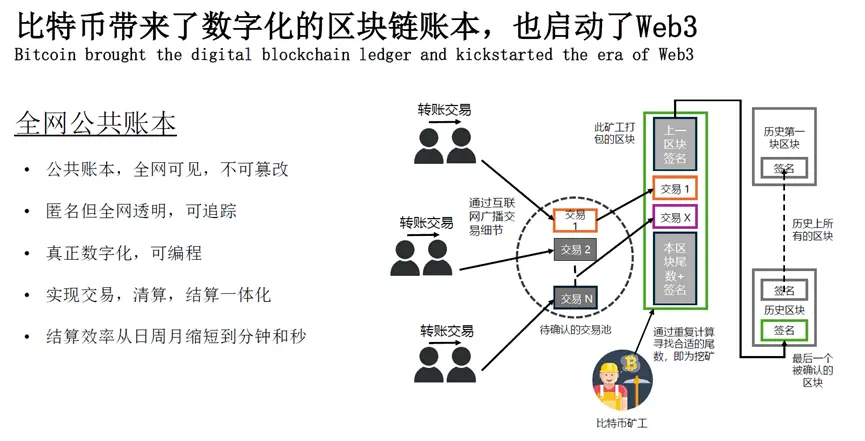

I believe everyone has been paying a lot of attention to the development of AI and is relatively familiar with it, but Web3 may still be quite unfamiliar. Before introducing and reviewing the development of Web3, I would like to first discuss the existing traditional banking financial system. The traditional financial system is actually built on an electronic system of double-entry bookkeeping, which means that each institution has its own ledger: there is a need for a large amount of data verification work between banks, between banks and brokers, and among branches of banks, often working overtime for a single number. This means that the capital markets built on it are also fragmented. Our current banking financial system is electronic, rather than truly digital.

You can recall that when we buy things on the internet, we actually use "two networks." When I place an order on Taobao, the information is transmitted to the seller via the internet; however, the underlying fund settlement is conducted between my bank, such as China Construction Bank, and the seller's bank, such as Bank of China. When we complete an online purchase, the information travels over the internet, while the funds travel through the interbank financial settlement network.

Web3 finance, on the other hand, is completely different. Taking Bitcoin as an example, in addition to solving the problem of value storage, it also brings a digital blockchain ledger. The characteristic of this ledger is that it is visible to the entire network and cannot be tampered with. Shopping with a Web3 wallet only requires downloading a browser extension wallet, and payments can be made using USD stablecoins, HKD stablecoins, or digital RMB, without needing bank infrastructure to complete the entire shopping process. The speed of peer-to-peer transaction processing is so fast that you hardly notice it, it truly integrates commerce and finance into one, completing transactions on the same network, achieving financial internetization, and enabling everything to be assetized. Understanding this point will help everyone better grasp why Web3 is the inevitable choice for the future of finance.

Web3: The Next Generation of Internet Infrastructure

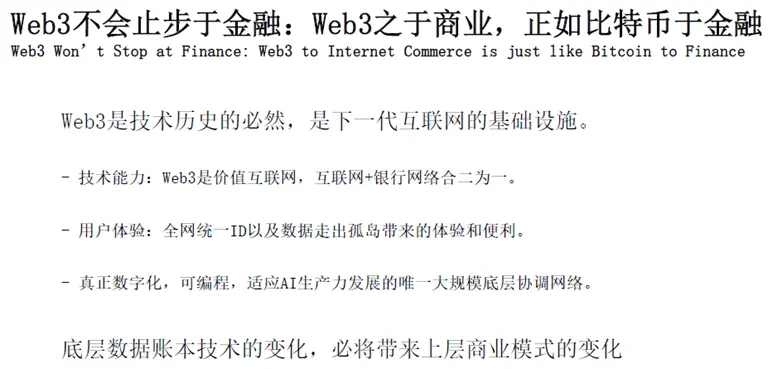

I believe the development of Web3 has dual characteristics. On one hand, as the predecessor of Web3, crypto finance has accumulated about 600 million users, which is roughly equivalent to the scale of internet users in 1999. Therefore, we have already seen payment-oriented financial applications like stablecoins and DeFi; however, the Web3 body, as the next generation of internet infrastructure, may only be at the level of 1994-1995. In my personal judgment, the mainstream application explosion of Web3 will still require about two years because there are currently not enough users willing or naturally inclined to use Web3 wallets to interact with the internet.

But I believe that Web3 technology will undoubtedly become the infrastructure of the next generation of the internet. It will bring a better user experience because a unified ID across the network can free data from silos and enable convenient sharing. It is the only large-scale underlying coordination network that truly adapts to the development of AI productivity. The significance of Web3 for business is akin to that of Bitcoin for finance — changes in the underlying data ledger technology will inevitably lead to changes in upper-level business models.

"De-platformed" Finance: The True Face of the Web3 Ecosystem

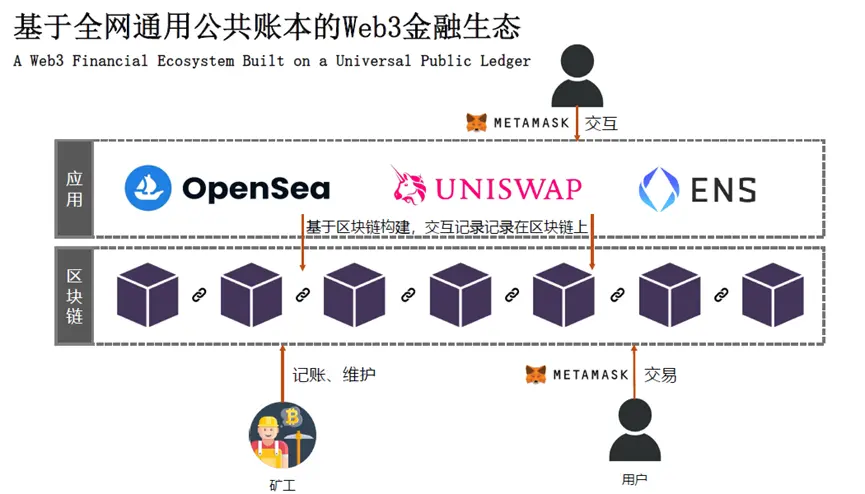

Based on a universally applicable public ledger, what does the financial ecosystem of Web3 look like? Unlike traditional finance, in Web3, whether you are an on-chain broker, bank, or exchange, all transaction records are stored on the intermediate blockchain. Users interact with these financial institutions not through bank accounts, but through a "wallet." You can think of this wallet as a unified entry point that is not locked by any platform, which makes Web3 essentially a "de-platformed" finance.

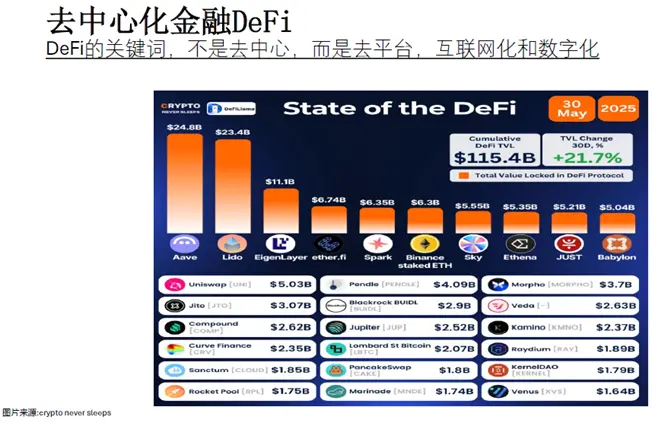

You may often hear the term "decentralized finance" (DeFi), but I prefer to call it "de-platformed," as it does not eliminate centralization or regulation; rather, it must comply with regulation. Since all on-chain users' IDs are unified across the network and all transaction records are traceable, it is actually easier to be regulated. Therefore, compliance and embracing regulation will be the mainstream trend for DeFi in the future. Currently, the scale of DeFi is about 115 billion USD, with the application ecosystems on mainstream chains like Bitcoin, Ethereum, and Binance Smart Chain rapidly developing, with increasing activity and capital volume.

Web3's "iPhone Moment": Stablecoins Ignite the Growth Flywheel

I believe everyone has recently noticed a piece of news that the United States and Hong Kong have successively passed legislation related to stablecoins. For the Web3 financial industry, this is a very important turning point, and many people refer to it as Web3's "iPhone moment."

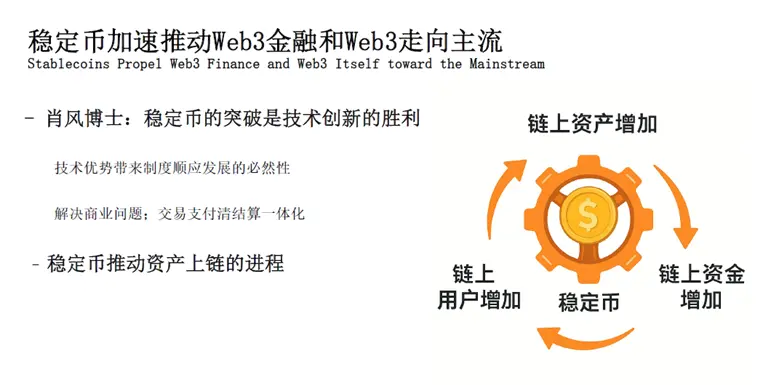

I think that the passing of stablecoin-related regulations at this point must have profound strategic considerations behind it. Although there are various interpretations of this matter, I believe the most insightful perspective comes from Dr. Xiao Feng of Hong Kong's HashKey Group. He believes that the breakthrough of stablecoins is a victory for technological innovation; it is not a random decision made by any country or government to adopt this technology, but rather the advantages of the technology itself that dictate that the system needs to adapt to the development of technology.

In my view, the development of on-chain finance needs to get a "flywheel" turning: the continuous increase of on-chain funds, on-chain users, and high-quality on-chain assets. This flywheel originally turned very slowly, but with the compliance of stablecoins, off-chain funds can more easily enter on-chain, greatly accelerating the flywheel's speed. I believe that stablecoins will significantly accelerate and promote Web3 finance towards the mainstream.

Additionally, I would like to illustrate "the internetization of finance" through two examples. The first example is that you may have recently heard about Trump issuing cryptocurrency. Regardless of the ethical issues surrounding his team's issuance of the coin, this event well demonstrates the advantages of Web3 technology. In the traditional stock market, if a manipulator wants to control the market, it often involves multiple related parties and is limited by time and geography — for example, manipulators in Hong Kong can generally only influence Hong Kong investors. However, Trump Coin is issued on the blockchain, and no matter where you are in the world, global users can trade the same capital asset 24/7. The market price is formed on a globally universal ledger, which is truly internetized assets.

The second example is something you may be more familiar with: Real World Assets (RWA), which refers to mapping off-chain real assets onto the blockchain through tokenization. In this way, on-chain assets become digital tokens, no longer limited to a specific broker's ledger or a particular securities exchange, gaining global liquidity. Whether it is money market funds or stocks, they can be tokenized, allowing users to trade and transfer them anytime and anywhere after purchase, significantly improving efficiency.

The 'NVIDIA' of Web3 Finance: Binance and BNB

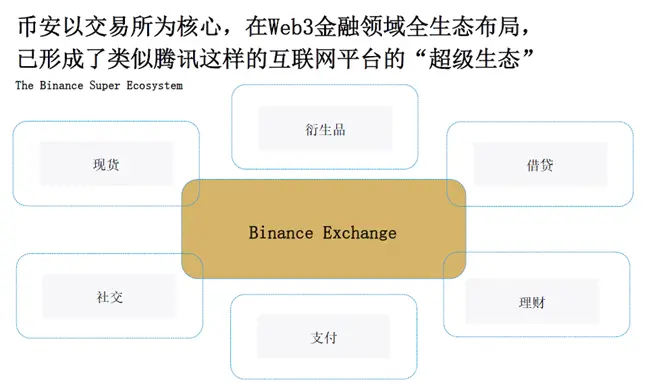

Next, I would like to briefly introduce Binance Exchange and its issued platform token — BNB. The uniqueness of BNB lies in the fact that it possesses both equity attributes and is an economic token. Binance Exchange is currently the largest digital asset exchange in the world, holding an absolute leading position. Its trading volume has reached twice that of the New York Stock Exchange, thanks to its global platform advantages, supporting 24/7 operations, with a user base of up to 270 million. Frankly speaking, no traditional exchange can achieve this.

Binance's business has transcended simple trading, resembling a super ecosystem built by an internet giant, encompassing various functions such as spot trading, lending, wealth management, payment, and even social networking. In this ecosystem, BNB not only has a transaction fee discount function but also has stock buybacks as value support, and possesses currency attributes similar to QQ game tokens. Many people are accustomed to using traditional value investment frameworks to evaluate BNB, but I believe that Web3 products cannot simply apply stock valuation logic.

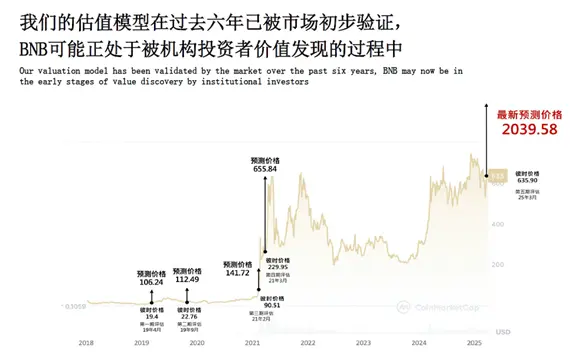

Therefore, since 2019, we have attempted to use the "currency equation" (MV=PQ) to evaluate BNB, as its essence is closer to that of a currency. We first conducted an evaluation in April 2019 and have completed six phases to date. My judgment is that BNB's current situation is similar to what I saw when I returned to China and observed Moutai — at that time, almost no institutional investors were optimistic about it, and it was mainly bought by retail investors; now, institutional investors are gradually beginning to recognize and understand the true value of BNB.

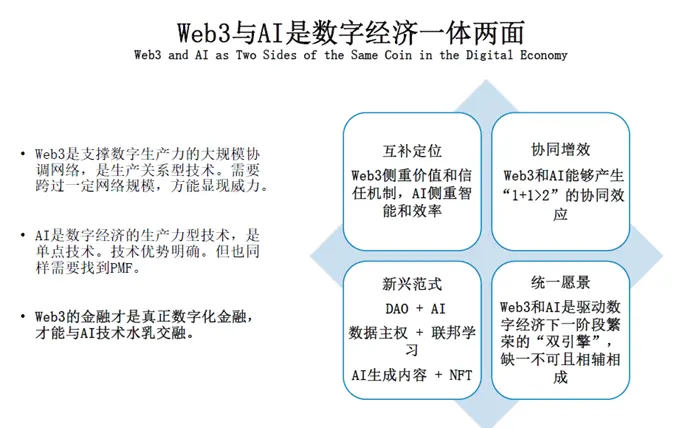

The time is almost up, and finally, I want to talk about the integration of Web3 and AI in the financial sector. I believe that finance driven by Web3 is the true digital finance; only truly digital finance can perfectly integrate with AI technology, bringing the greatest multiplicative synergy.

Web3 finance has the characteristics of being digital and programmable, with its address composed of a string of complex characters. This "language" is clearly not suitable for direct reading or memorization by humans, but it naturally aligns with the processing methods of AI. In the future, the financial needs and services of AI may only be realized through Web3, as it is impossible to open a traditional bank account for an AI entity, and it is difficult to handle microtransactions of one ten-thousandth of a dollar, let alone respond to its tens of thousands of service call requests within a minute.

Finally, I want to emphasize that AI is empowering the application of Web3 in the financial sector, while Web3 is providing decentralized data and computing power solutions for AI. The integrated development of these two cutting-edge technologies is accelerating the construction of a new generation of internet infrastructure, driving profound changes in the global financial system and business models.

Thank you, everyone!

Click to learn about job openings at ChainCatcher

Recommended reading:

Backroom: Tokenization of Information, Solutions for Data Redundancy in the AI Era? | CryptoSeed

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。