Written by: 1912212.eth, Foresight News

On the evening of August 22, Federal Reserve Chairman Jerome Powell's speech finally injected a dose of confidence into the precarious cryptocurrency market. At the Jackson Hole annual meeting, Powell stated that a shift in risk balance may require policy adjustments, indicating that the risks to employment are on the rise. The market interpreted Powell as seemingly preparing for an interest rate cut in September.

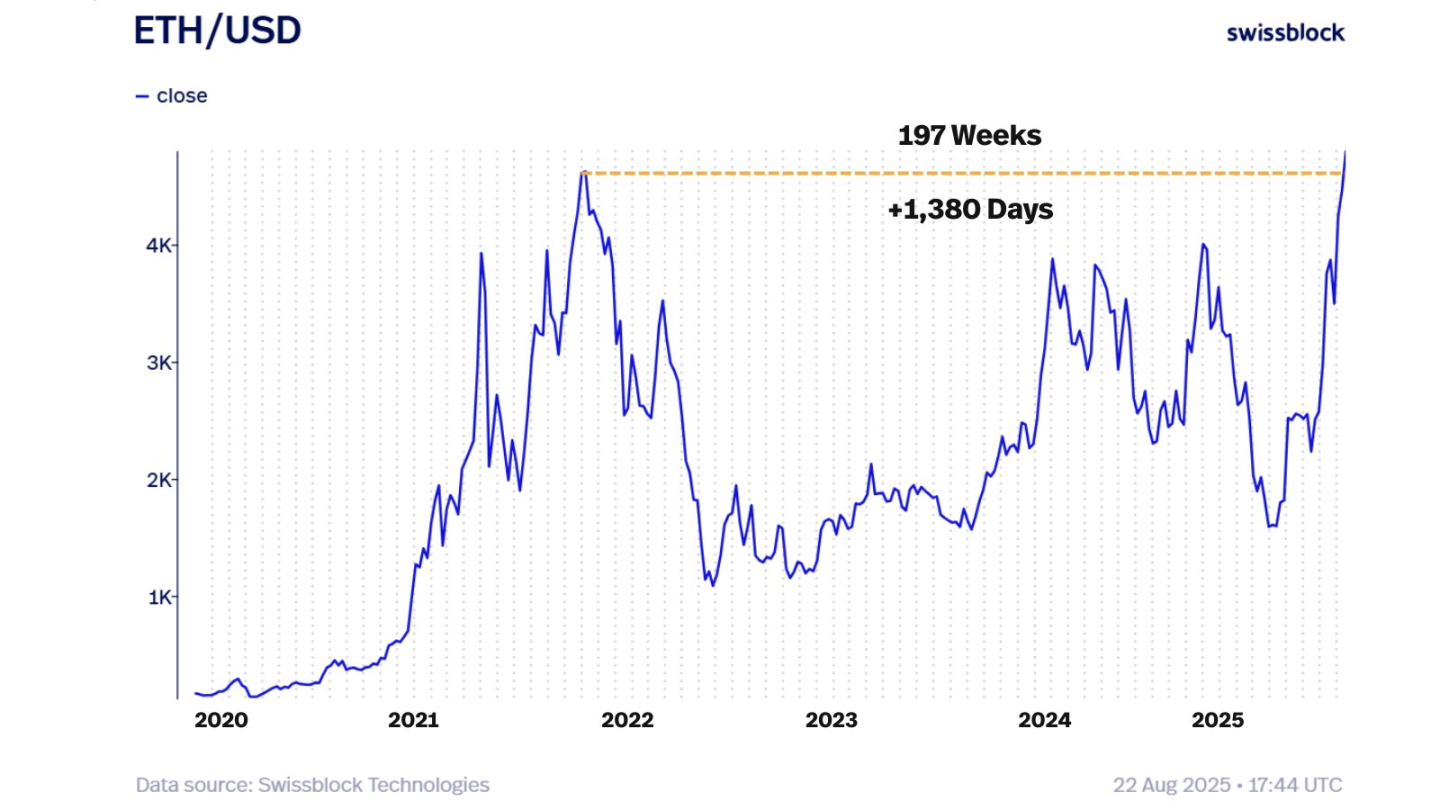

Affected by this positive news, BTC quickly reclaimed the $112,000 mark, rising 2.95% in one hour and briefly climbing above $117,000. ETH performed even better, surging from around $4,200 and finally reaching a historic high of $4,887.59 around 5 AM on August 23. The ETH/BTC exchange rate rose to 0.0418, setting a new high since October 2024. Many altcoins benefited from the market surge, experiencing a strong rebound.

In terms of contract data, Coinglass showed that over the past 24 hours, the total liquidations across the network exceeded $694 million, with short positions liquidating over $468 million.

Powell's Softening Stance, Market Expects Two Rate Cuts This Year

Before Powell's speech, the market had a pessimistic outlook, fearing a hawkish turn, leading some traders to choose to sit on the sidelines, resulting in a significant drop in the cryptocurrency market before the conference.

Unexpectedly, Powell's significant remarks indicated that the current situation means rising downside risks for employment. This shift in risk balance may imply the need for interest rate cuts.

Powell mentioned that stable labor market indicators, such as the unemployment rate, allow the Federal Reserve to cautiously consider adjusting its monetary policy stance, opening the door for a rate cut in September.

According to CME's "FedWatch" data, the probability of a rate cut in September increased to 91.2% after Powell's speech.

Nick Timiraos, a prominent journalist for The Wall Street Journal known as the "voice of the Federal Reserve," reported that Fed Chairman Powell opened the door for a rate cut as early as next month's meeting, stating that the employment market may face a more severe slowdown, which could alleviate concerns about inflation driven by rising costs from tariffs. However, Powell's remarks emphasized concerns about inflation, easing market expectations for a series of aggressive rate cuts by the Fed. Inflation has been above the Fed's 2% target for over four years.

Deutsche Bank expects the Fed to cut rates by 25 basis points in both September and December, whereas the bank previously predicted that the Fed would only cut rates in December 2025.

Kathy Bostjancic, Chief Economist at Nationwide, stated that the Fed will cumulatively cut rates by 75 basis points by the end of the year. She noted, "Powell has adopted a noticeably more dovish tone and has significantly opened the door for a rate cut in September, believing that the downside risks to employment are rising significantly. This supports our judgment of a 25 basis point cut next month, and we continue to expect the Fed to cumulatively cut rates by 75 basis points by the end of the year, as the labor market will weaken further, while inflation rises only moderately and temporarily."

According to The Kobeissi Letter's analysis of Fed Chairman Powell's speech today: "Today's remarks indicate that their (the Fed's) top priority has shifted to supporting the labor market. The change in risk balance may require policy adjustments, specifically referring to the labor market. Therefore, employment reports will determine future rate cuts."

The Fed's next interest rate decision will be announced at 2 AM Beijing time on September 18.

Optimistic Performance of Ethereum Spot ETF and Stablecoin Data

As one of the important indicators for monitoring market capital flows, the data for Bitcoin spot ETFs is not optimistic, showing significant net outflows in recent days, reflecting strong market risk aversion.

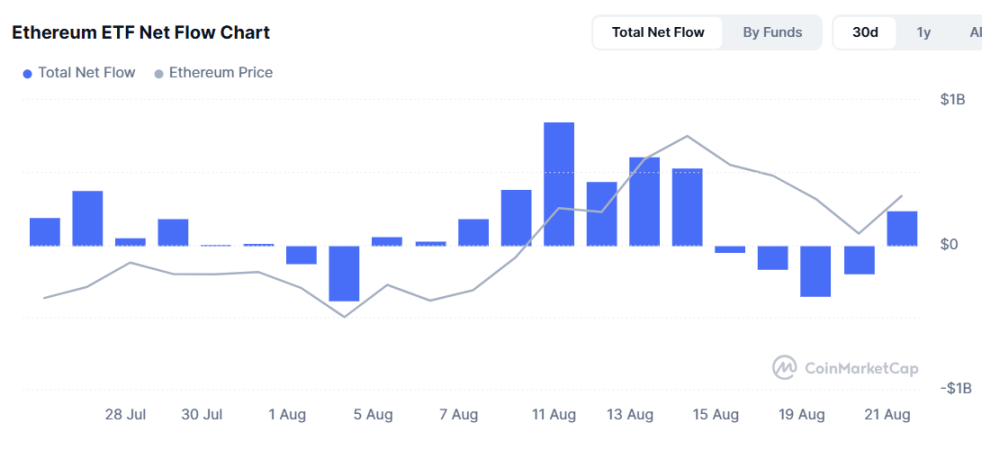

However, the Ethereum spot ETF saw a net inflow of $287.61 million on August 21 after four consecutive days of net outflows. The total net inflow now stands at $12.09 billion. It is evident that the market may be betting on Ethereum for higher returns.

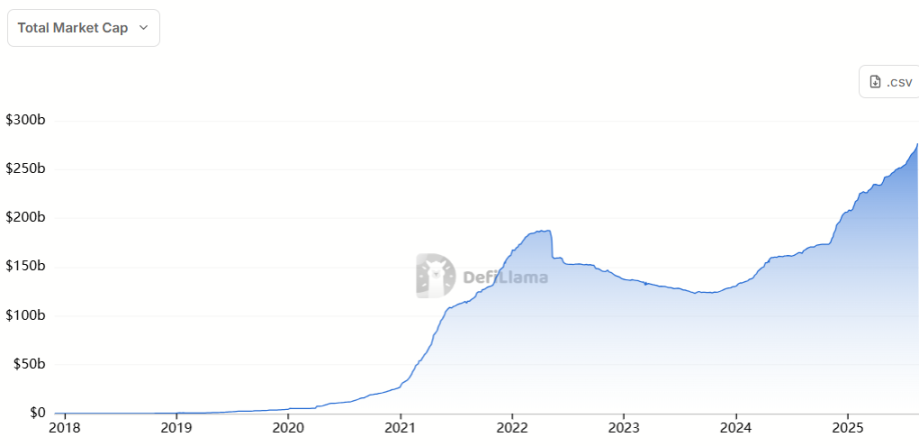

Stablecoin data continues to show inflows.

According to defiLlama data, the total market capitalization of stablecoins is currently $277.74 billion, with a total increase of 0.96% over the past seven days, amounting to $2.645 billion. Among them, USDT saw a monthly increase of 2.6%, USDC a monthly increase of 4.63%, and USDe a monthly increase of 80.87%.

Additionally, the popular project WLFI token will begin trading and its initial claim on September 1 at 8:00 PM, with 20% of the shares available for early supporters to claim simultaneously, and it will be listed on DeFi DEX and major CEX platforms. As a DeFi project supported by the Trump family, WLFI carries a political halo, and its token trading launch may attract significant attention from politically inclined cryptocurrency investors, especially domestic users in the U.S., which could help boost the market in the short term and inject liquidity.

Market Views

Raoul Pal, a former Goldman Sachs executive and founder of the macro research firm Real Vision, released a technical analysis suggesting that Total3 (altcoins excluding BTC and ETH) is about to reach a turning point.

Data analysis firm Altcoin Vector indicated that as ETH provides upward momentum and a ripple effect for other tokens, once ETH stabilizes above its historical high, altcoins may experience a comprehensive breakout.

Weiss crypto analyst Juan stated that altcoins will only go wild after ETH breaks $5,000, with the peak of this round of increases likely occurring between September 13 and 20, with the latter being more probable. Before that, the overall market is expected to trend upward.

Click to learn about job openings at ChainCatcher

Recommended Reading:

Backroom: Tokenization of information, a solution to data redundancy in the AI era? | CryptoSeed

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。