ETF Shake-up: Bitcoin Funds Post Second-Highest Weekly Loss While Ether Snaps Record Inflow Run

The tide finally turned. After 14 straight weeks of gains, ether exchange-traded funds (ETFs) closed red. Bitcoin funds? They bled hard, posting their second-largest weekly outflow on record.

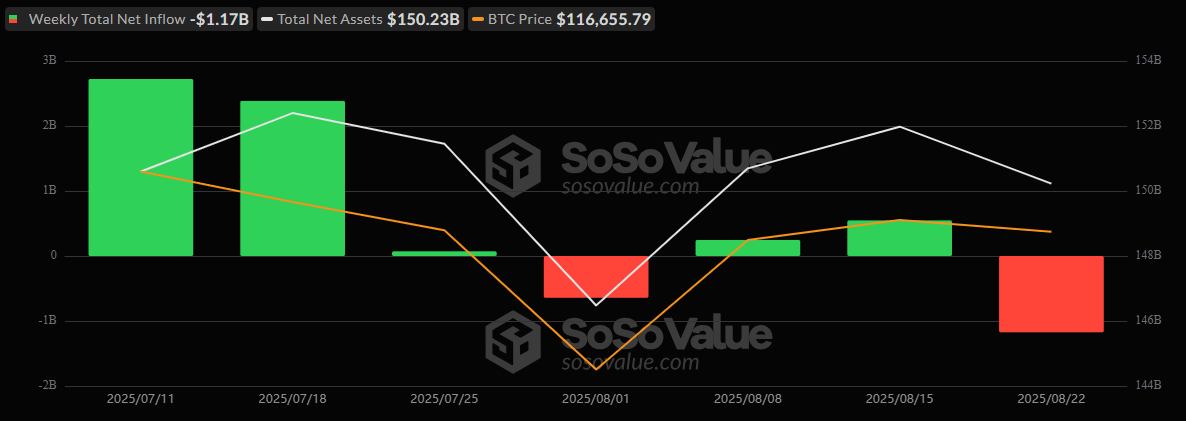

From Aug. 18 to 22, bitcoin ETFs saw a crushing $1.17 billion net outflow, with every single day closing in the red. The heaviest hit came on Tuesday, August 19, when investors yanked $523.31 million in a single session. By Friday, BTC funds had suffered six consecutive days of exits, signaling investor caution despite strong daily trading volumes.

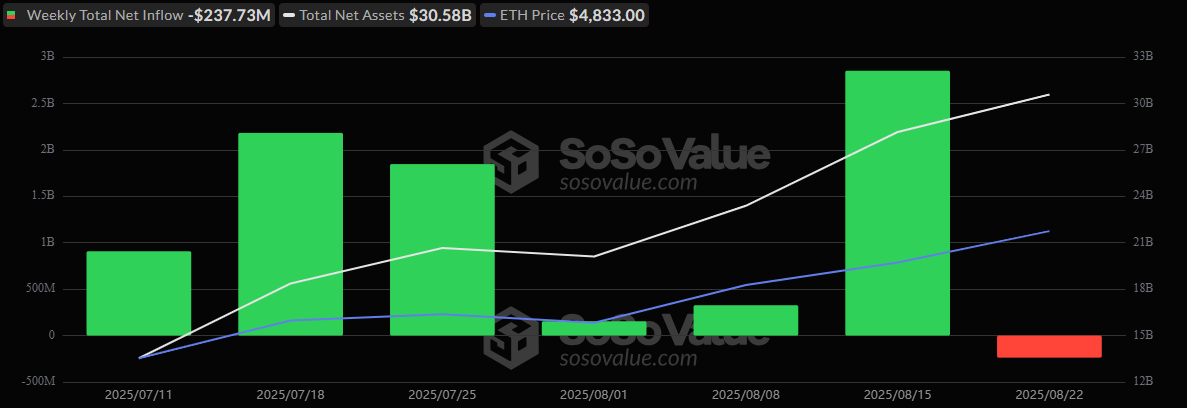

Ether ETFs were not spared. A $429.73 million outflow on Tuesday set the tone for the week, erasing gains from strong rebounds on Thursday and Friday, when ether funds pulled in $287.61 million and $341.16 million, respectively. In the end, the streak was broken: ether ETFs registered a $237.73 million net outflow, snapping 14 weeks of inflows.

Bitcoin ETFs Weekly Inflow and Outflow Contrast – July to August. Source: Sosovalue

Fund-by-Fund Weekly Flows

For bitcoin ETFs, the damage was concentrated on Blackrock’s IBIT, which shed a staggering $615.02 million. Fidelity’s FBTC (-$235.24 million), Ark 21Shares’ ARKB (-$182.37 million), Grayscale’s GBTC (-$118.09 million), and Bitwise’s BITB (-$60.78 million) also logged heavy exits, along with a $2.55 million exit on Grayscale’s Bitcoin Mini Trust.

Modest support came from Vaneck’s HODL (+$26.41 million) and Franklin’s EZBC (+$13.49 million), but it wasn’t nearly enough. By week’s end, Bitcoin ETFs’ net assets slipped to $150.23 billion, down from $153.43 billion a week earlier.

Ether ETFs Inflow and Outflow Contrast – July to August. Source: Sosovalue

Ether ETFs told a similar story. The net weekly outflow was led by Grayscale’s ETHE (-$88.97 million) and Fidelity’s FETH (-$79.65 million). Grayscale’s Ether Mini Trust (-$50.42 million), Blackrock’s ETHA (-$8.26 million), Invesco’s QETH (-$7.44 million), and Franklin’s EZET (-$7.43 million) contributed further to the net loss.

Only Bitwise’s ETHW (+$2.52 million) and Vaneck’s ETHV (+$1.91 million) ended the week in the green. However, trading activity soared, with a record $7 billion single-day turnover on Friday, Aug. 22, and net assets closed at $30.54 billion, their highest on record.

The pattern is telling: bitcoin’s outflows were broad-based, dominated by Blackrock’s IBIT, which alone shed over $615 million. Ether’s downturn, meanwhile, was shallower, cushioned by smaller but modest inflows from Bitwise and Vaneck.

With bitcoin ETFs now facing their harshest week in months and ether snapping a record streak, the new trading week will be a pivotal one. Will the inflows resume, or are we in for another bearish week in the ETF space?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。