Selected News

Hyperliquid's August revenue exceeds $100 million, setting a historical record

BGB upgraded to Morph public chain token, with a one-time burn of 220 million tokens

Linea network's DeFi TVL reaches a historical high, with a 60.30% increase in the past week

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

WLFI: WLFI is the governance token of World Liberty Finance, officially launched today, sparking significant discussion on Twitter. Supported by the Trump family, this issuance is seen as an important event in the crypto industry, with public focus on its potential impact on financial freedom and governance models. Despite ongoing concerns about insider operations and token distribution, its cross-chain capabilities and collaborations with platforms like Chainlink and Raydium are widely regarded as core advantages. This launch has also triggered debates about the Trump family's influence in the crypto market and WLFI's long-term prospects.

HUMAFINANCE: HUMAFINANCE has gained widespread attention for launching its first season airdrop campaign. This event distributed 12.5 million $HUMA tokens to eligible users who staked over 3000 $HUMA since August 1, 2025, and linked their Solana wallet on Kaito. The campaign has sparked discussions about reward distribution, eligibility criteria, and wallet binding requirements. Some users expressed satisfaction with the rewards, while others voiced dissatisfaction due to qualification and communication issues. The community is also looking forward to future developments and the upcoming PayFi summit.

LINEA: LINEA has attracted attention today for its pre-launch trading (supporting leverage) on major platforms like Binance contracts and Hyperliquid. As an extension of Ethereum, its native ETH yield and protocol-level ETH burn features have been highlighted. Market discussions also focus on its valuation compared to other layer two solutions and integration with high-yield platforms like Etherex. With the TGE approaching and strategic support from ConsenSys, market interest continues to rise.

XION: XION has gained significant attention due to the conclusion of the first month of the XION x KaitoAI RISE event, which distributed over 33,000 $XION to the top 50 creators. This event has been recognized for its innovative approach to decentralized narratives, transforming community interaction into a continuous on-chain narrative. Additionally, the market is focused on XION's upcoming token unlock and its strategic layout in the South Korean market, further enhancing its popularity and engagement on social media.

LINK: Chainlink (LINK) has received high attention for playing a key role in the cross-chain transfer of the World Liberty Finance governance token WLFI, with its CCIP technology considered an important infrastructure for decentralized finance and traditional finance. The endorsement from industry leader Charles Hoskinson further enhances its influence. Meanwhile, Chainlink's collaboration with Solv Protocol to enhance secure exchange rate oracles and its partnership with the U.S. Department of Commerce for on-chain data verification solidify its core position in the crypto industry.

Selected Articles

Behind this $40 billion project stands a group of modern "gatekeepers." There are Chinese billionaires who invested $75 million, founders of trading platforms seeking presidential pardons, stablecoin experts deeply engaged in the Asian market, and an Eastern force described as "capable of elevating the Trump family's wealth while also bringing them back to poverty overnight." As the wealth of American political families intertwines with Eastern capital, and as China influences the global crypto landscape through the Hong Kong market, a new geopolitical game is unfolding.

Against the backdrop of a cooling overall market sentiment, Bitcoin and Ethereum prices have seen a pullback, and the discussion around mainstream altcoins has also declined. However, among the "blockbuster" projects that continue to be hotly debated in the community, besides the recently launched WLFI, another major focus is the new stablecoin-specific blockchain Plasma, co-invested by stablecoin giant Tether and Silicon Valley legend investor Peter Thiel, with the token being XPL, which has already launched contract trading on multiple mainstream exchanges.

On-chain Data

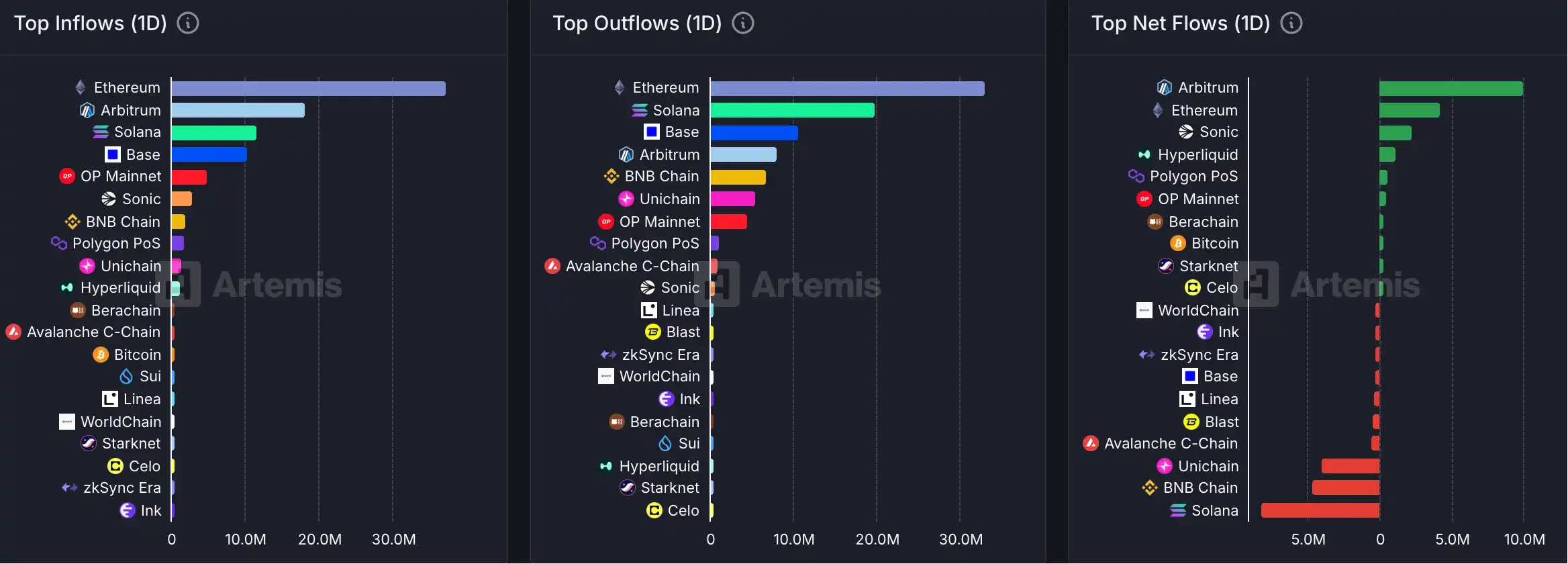

On-chain capital flow situation for the week of September 2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。