Author: Da Bu

In the battlefield of cryptocurrency, risks far outweigh opportunities. How can ordinary traders continuously find profitable opportunities? Let's take a look at these real stories: user King David captured the SUI trend in advance, achieving an astonishing 77% return in just one day; another trader, SenatorSkelz, followed the SOL whale dynamics, quickly built a position, and gained considerable profits; user Brown accurately timed the ETH price reversal, entering at $4,466 and selling at $4,772, pocketing the profits. How were they able to seize opportunities so precisely and quickly? The answer lies in MEXC's newly launched AI trading tool system, which integrates vast market data, filters out ineffective noise, and transforms key signals into actionable suggestions, significantly enhancing efficiency and reducing trial-and-error costs.

1. Practical Evaluation — How MEXC AI Tools Change Traders' Fate?

(1) AI Recommended Trading Pairs Enhance Return Rates

The AI trading assistant launched by MEXC can intelligently filter potential cryptocurrencies based on multiple indicators such as on-chain activity and social heat, generating an "AI Select List." According to user feedback, these AI-recommended trading pairs often achieve considerable return rates.

For example, a seasoned user, King David, shared on Twitter his experience of capturing the SUI trend in advance through MEXC AI: utilizing the SUI ecosystem dynamic signals monitored by AI, he achieved a 77% return in just one day, demonstrating the high efficiency of the AI recommended list. Another community member reported that when they saw SUI showing strong trend signals on the MEXC AI Select List, they realized the opportunity earlier than most and timely built a position. This series of real cases indicates that MEXC AI scans vast amounts of data to discover "dark horse" cryptocurrencies in advance, significantly improving ordinary investors' efficiency in identifying high-return opportunities.

At the same time, MEXC AI's integration of multi-source data analysis far surpasses manual screening in efficiency. For instance, MEXC AI automatically scans social trends, news dynamics, and on-chain data to list potential tokens. Compared to individual investors who spend a lot of time and effort monitoring the market for opportunities, AI tools work around the clock, quickly processing information and providing conclusions, greatly enhancing the speed of market decision-making.

(2) AI Real-Time Trading Signals Increase Win Rates

In addition to providing lists, MEXC AI can also generate real-time trading signals and help users quickly seize opportunities through a one-click ordering function.

For example, user SenatorSkelz discovered that AI pushed a SOL whale dynamic and immediately followed the AI Bot's suggestion to buy, ultimately gaining considerable profits. Similarly, another trader, King David, shared his experience of achieving a 53% profit in futures using AI real-time signals: while most people were still watching to see if ETH could break through, his MEXC AI bot had already issued a bullish signal, helping him position long before the market started. This shows that the real-time intelligence provided by AI, combined with the agile execution capability of "one-click ordering," effectively shortens the time gap from information acquisition to order execution, allowing users to enter the market at the first moment of a market surge.

Moreover, MEXC AI's automated trading function makes the trading process more effortless and efficient. User Cheesky described his experience using the AI Bot as if he had a professional trader working for him around the clock. Thus, with the help of AI real-time signals and automatic ordering functions, users can capture market movements without constantly monitoring the market, significantly increasing the success rate and convenience of seizing trading opportunities.

(3) AI Automated Discipline Brings Rational Trading

In a highly volatile market, MEXC AI also plays a role in assisting rational decision-making. Its automated discipline (such as take-profit and stop-loss strategies) can effectively help users remain calm during panic markets, thereby minimizing losses or even turning crises into opportunities.

User MrKhay let the AI Bot execute a strategy when ETH broke through the monthly structure, capturing the price increase. TheMain also provided similar feedback, stating that he avoided conventional retail traps during a false BTC breakout; the AI Bot identified the support structure and automatically went long, also profiting from the rebound. User Brown once captured the on-chain capital changes and sentiment reversals of ETH with the AI Bot, accurately entering at $4,466 and later selling at $4,772, securing substantial profits.

It is evident that MEXC AI filters out market noise, avoiding blind chasing of price increases or decreases, and instead turns what could have been a trap-like false breakout into a profit opportunity. Traders are less likely to be swayed by momentary fear or greed, allowing them to maintain their footing in extreme market conditions and even seize reversal opportunities.

So, how can one replicate the successful experiences mentioned above? Next, we will delve into the specific application scenarios and practical methods of MEXC AI tools to help you quickly get started and tackle trading challenges one by one.

2. Operation Guide — How to Use MEXC's Three Major AI Tools for Efficient Profit

MEXC offers three major AI tools that cover various trading scenarios and can be used in combination to significantly enhance profit opportunities.

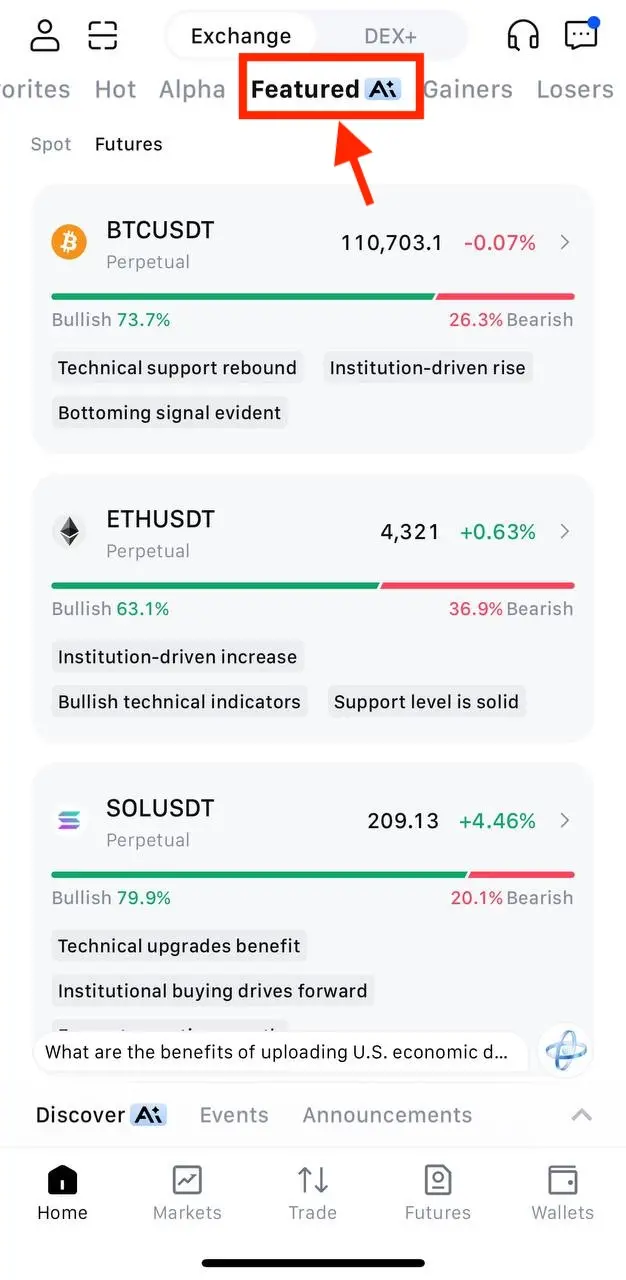

Scenario 1: Discover Trading Opportunities — Quickly Filter with AI Lists

When you open the exchange and face hundreds of cryptocurrencies with no direction, the AI list can help narrow down your selection, reducing the manual filtering process that originally took 1-2 hours to just a few minutes, quickly locking in potential targets.

Usage Method:

- Open "Selected AI" and check the long-short ratio and AI analysis tags.

- If you find a cryptocurrency with a high bullish ratio, accompanied by positive signal tags such as "technical support rebound," "increased capital inflow," "institutional push upward," etc., this often indicates upward potential, and you may consider adopting a long strategy.

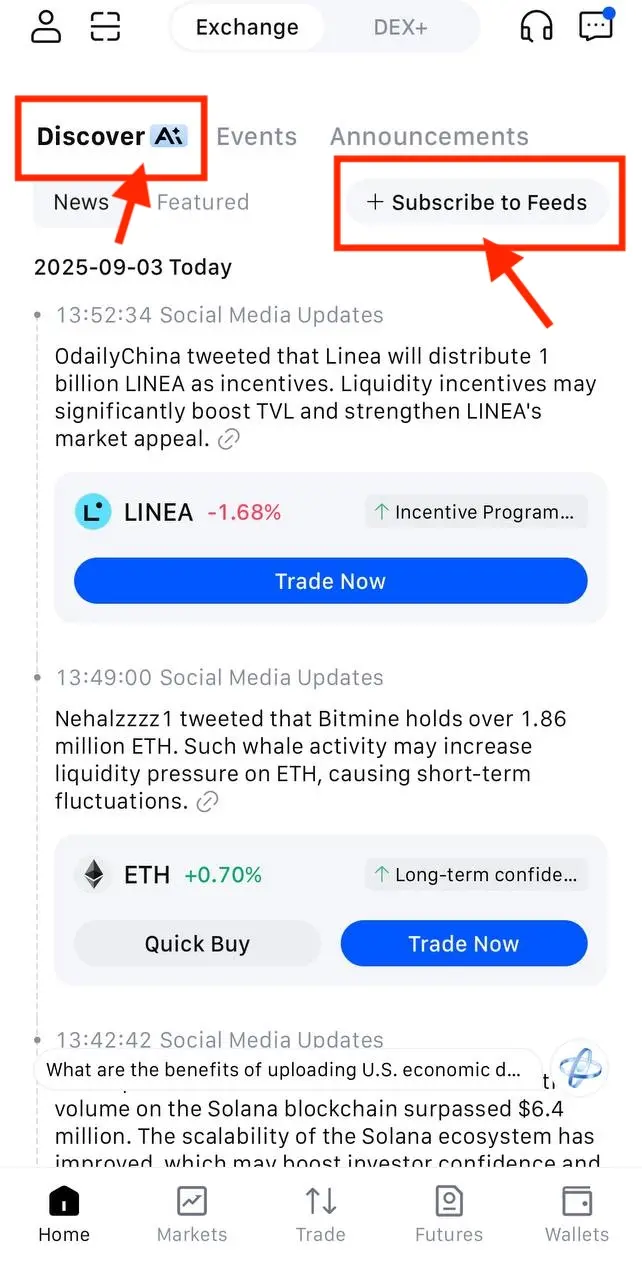

Scenario 2: Capture Sudden Market Movements — Seize Opportunities with AI News

The core of trading is arbitraging the time difference in the digestion of market information. MEXC's AI news system not only captures key information in real-time but also provides in-depth analysis, helping traders establish a first-mover advantage before the market fully reacts, seizing the "first-mover" window, which often determines profit and loss in highly volatile markets.

Usage Method:

- Open "Discover AI," check the latest news push, and click "Subscribe to News" to receive key intelligence such as on-chain whale activities, institutional movements, policy benefits, and technical breakthroughs in real-time, along with AI analysis tips, allowing you to quickly formulate and execute trading strategies.

- For example, if the AI news suddenly pushes that a large institution has purchased ETH for about $100 million, this could enhance ETH's upward momentum. With the confirmation of large capital inflows, users can quickly build a position before the price fully reflects this information, ahead of other retail investors' reaction speed.

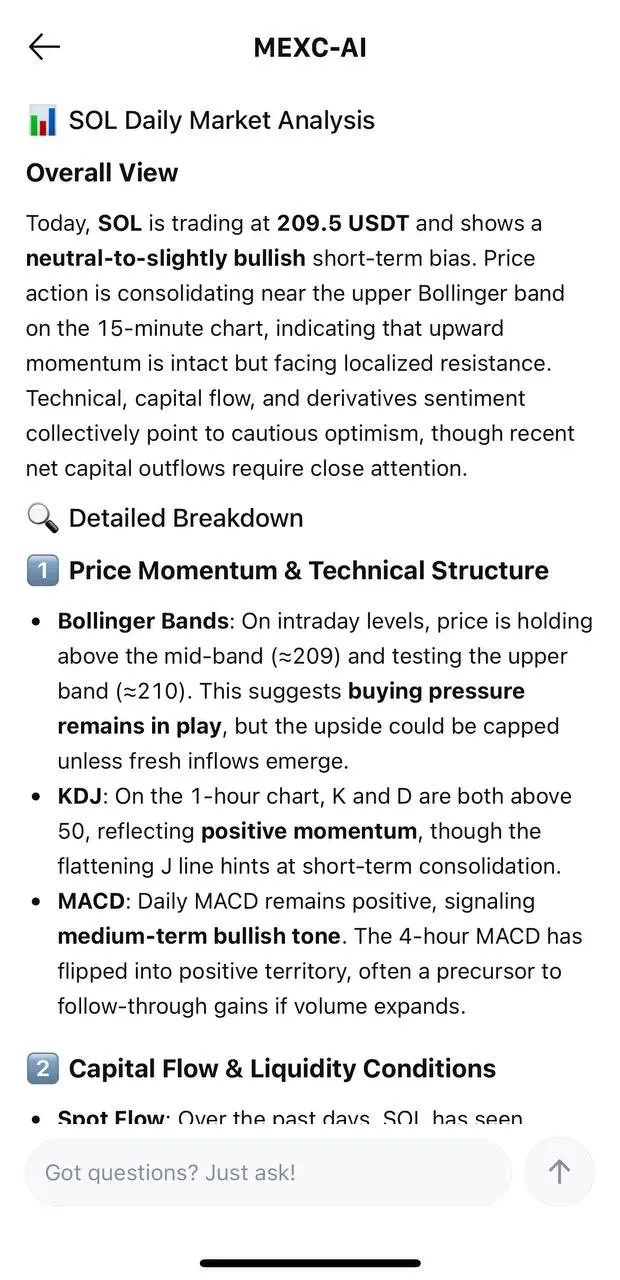

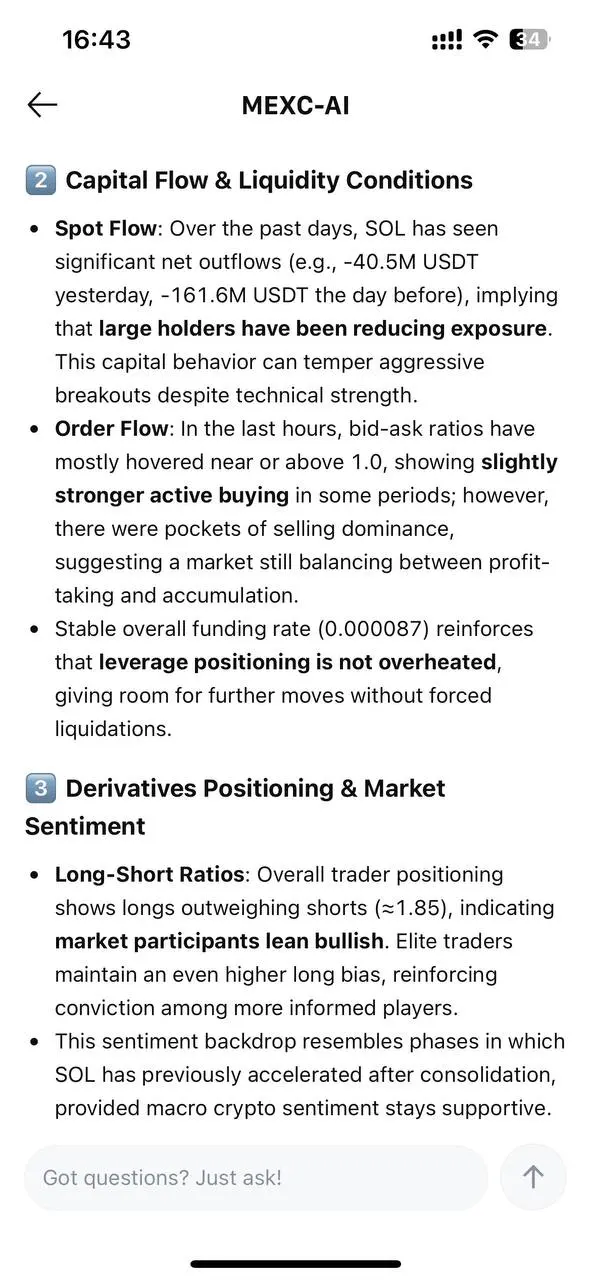

Scenario 3: In-Depth Analysis of a Single Cryptocurrency and Customized Strategies — Formulate Precise Plans with MEXC - AI Q&A Assistant

When facing a single cryptocurrency or personalized trading needs, traders often encounter the following core confusions:

- "Should I buy or sell XX coin?"

- "What stage is the current market in?"

- "What trading opportunities are there?"

- "What are the potential risks?"

These questions essentially revolve around timing, trend judgment, opportunity identification, and risk control. MEXC - AI Q&A Assistant provides comprehensive answers through intelligent analysis and personalized suggestions, saving users a lot of research time.

Usage Method:

- Focus on specific tokens to quickly gain market insights.

Whether you are optimistic about a cryptocurrency and plan to trade short-term or continuously track a token for potential layout, you can ask MEXC - AI questions such as, "How is the market for XXX coin today?" or "Analyze the recent trend and technical situation of XXX coin." MEXC - AI will provide logically rigorous and comprehensive analysis:

- Real-time data support: including technical signals, contract long-short ratios, capital inflow and outflow situations, etc.

- Opportunity identification: combining social media discussion heat, market performance, and related indicators to uncover potential opportunities.

- Risk alerts: based on real-time data, reminding users of potential risk points.

- Trend conclusions: providing bullish or bearish judgments after comprehensive analysis.

- Operational strategy suggestions: offering long/short choices (short-term or medium to long-term), entry points, stop-loss, and take-profit settings to help users avoid blind trading.

- Customized strategies for beginners, clarifying funds and goals.

For trading novices with limited market knowledge, they can directly state their funds and target needs, such as, "I have 10,000 USDT and want to make a 30% profit in a month; please provide a detailed strategy." MEXC - AI will tailor a practical plan:

Target feasibility assessment: objectively analyzing whether the target is realistic and providing rational suggestions. For example, the above target is considered a high-difficulty target.

Fund and position management: guiding fund allocation logic, such as based on "BTC leading the rise — sector rotation — popular coin effect," reasonably distributing funds to different cryptocurrencies.

Timing and rhythm control: guiding operational timing, including:

Entry timing: such as "buying on dips or during consolidation."

Switching timing: such as "entering altcoins during BTC's sideways period."

Take-profit timing: such as "taking partial profits every 5-10% increase."

Emergency plans: providing risk response measures to ensure users can effectively protect themselves during market fluctuations.

3. Conclusion: Drawing AI Trading Inspiration from User Stories

As seen from the above, MEXC AI trading tools are empowering ordinary traders, helping them find discipline and strategies with the assistance of AI. From guessing market movements to relying on the clear insights provided by AI, these ordinary users are beginning to view the market like professionals, executing trades based on their own judgments, thereby significantly improving their win rates and profit stability.

It is important to emphasize that while AI can empower, it is not omnipotent. MEXC AI provides data-driven decision-making reference tools; it can serve as a "capable assistant" for traders but cannot replace all risk management. As shown in the above cases, the key to the success of users utilizing AI lies in their organic combination of AI signals with personal strategies: trusting the objective analysis provided by AI while making judgments based on their own risk tolerance and investment plans to maximize the value of MEXC AI. Looking ahead, integrating AI strategies into personal trading philosophies may become one of the pathways for ordinary investors to achieve professional profitability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。