Metaplanet News: Firm’s BTC Stack Reaches 20,136 Coins After New Buy

Metaplanet News: Bitcoin Latest purchase

Japan’s Metaplanet Inc. has once again strengthened its strategy with the acquisition of an additional 136 BTC worth around $15.2 million (2.251 billion yen). This purchase was made at an average price of around $111,666 per coin.

The firm's coin holding reached 20,136 BTC. The cumulative investment now stands at $2.05 billion, with an average purchase price of $103,196 per coin. The company's CEO Simon Gerovich has recently announced it on X post .

Source: X

The firm has achieved an impressive BTC yield of 487% year-to-date in 2025, which is showing the effectiveness of its treasury operations. The company evaluates its performance through key metrics such as BTC Yield and BTC gain.

This purchase underlines its long-term commitment to coin as a core treasury asset. This latest move will further signal confidence in Bitcoin’s role within global finance strategies.

Metaplanet Bitcoin Strategy

On September 1, 2025 the firm added 1,009 BTC in its treasury which brought Metaplanet BTC total holding to 20,000 coins. Here is the whole purchasing history of formerly known Japan’s MicroStrategy purchasing, shared by the firm.

Source: Official site

The company buys Bitcoin every week, as shown in the data, what does it mean? Why is the firm accumulating the asset on a weekly basis?

-

Metaplanet believing to slowly grow its Bitcoin treasury?

-

Does the firm see Bitcoin as a long-term store of value similar to gold?

-

Is the company following Saylor’s Strategy plans?

-

Can Metaplanet’s steady Bitcoiin buys make it richer and boost its global BTC ranking?

Whatever the reason could be, it is clear that firm's Bitcoin Strategy is slowly boosting its holding, as Bitcoiin is the most expensive coin in crypto, this asset will give a long term benefit to the firm.

Future Implications

As per the data it might be possible that in the next week, the firm continues its buying for the digital gold. These small, steady purchases are not only strengthening its treasury but also boosting overall market confidence, especially during times when the coins faces heavy dips.

Big firms like Metaplanet and MicroStrategy, through their continuous accumulation, are helping support Bitcoin ETFs and indirectly contributing to stability in the market.

This consistent buying activity is also creating upward surges in the price, showing strong institutional belief in its long-term value.

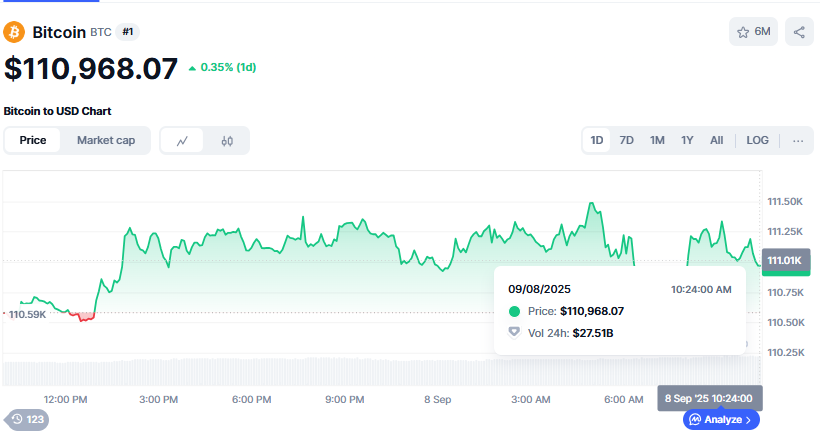

Currently, the coin is running at $110,950 with a rise of 0.34% recorded in 24 hours, as per the data of CoinMarketCap.

Source: CMC

Recently, the continuous accumulation of asset, Strategy’s CEO Michael Saylor has ranked 491 according to Bloomberg Billionaires Index and 379, as per Forbes data. This holdings has made Michael Saylor’s net worth around $7.37 billion and $8.8 billion according to the data of Bloomberg and Forbes. It might be a signal for many who are still in confusion.

Bitcoin price predictions

As the firms are buying the most expensive coins , when it is facing large dips and small surges, shows a strong confidence.

As per my opinion, soon the prices will surge to around $120k till the month end.

And as per the predictions of top investors with their prediction the digital gold coin will surge its prices :

-

Brian Armstrong, CEO of Coinbase predicts : $1 million by 2030.

-

VanEck, Global Investment manager predicts: $180k by the year end.

-

Steven, analyst predicts: $150k by 2025

-

Michael Saylor, Strategy’s Co-founder predicts: $21 million by 2046.

Conclusion

Metaplanet’s consistent digital asset accumulation shows its firm belief in BTC as a long-term asset. This strategy not only secures its treasury but also reinforces market confidence globally.

Disclaimer: This article is intended for educational and informational purposes only. The content reflects our analysis and opinion. It is not financial advice. Always conduct your own research and consult a professional before making any investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。