Author: Axel Bitblaze

Compiled by: Tim, PANews

Many people are probably wondering whether the current trend in the crypto market is a fluctuation before breaking new highs or a signal that the market has peaked.

In fact, it’s not that simple. The situation will vary greatly in the short, medium, and long term.

I will provide a comprehensive interpretation of BTC, ETH, and altcoins before entering each phase:

Now let’s get straight to the point: the next few months will determine how this cycle develops, and I believe this tweet is worth revisiting.

Let’s start with what is currently happening.

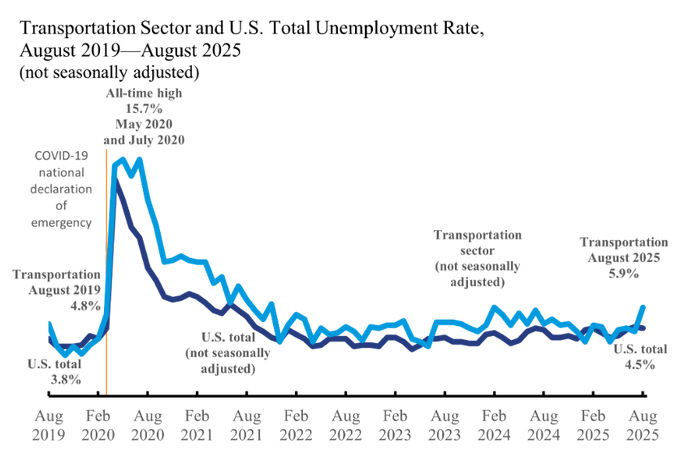

Data released last Friday showed that the unemployment rate rose to 4.3%, the highest level since 2021.

Non-farm payrolls increased by only 22,000 jobs, while the expected number was more than three times that.

For years, the U.S. job market has been surprisingly strong.

Even with a slowdown in growth, hiring remains robust.

This report changed that trend.

For the first time since the pandemic, both the unemployment rate and hiring rate flashed red simultaneously.

The market reacted immediately to this news.

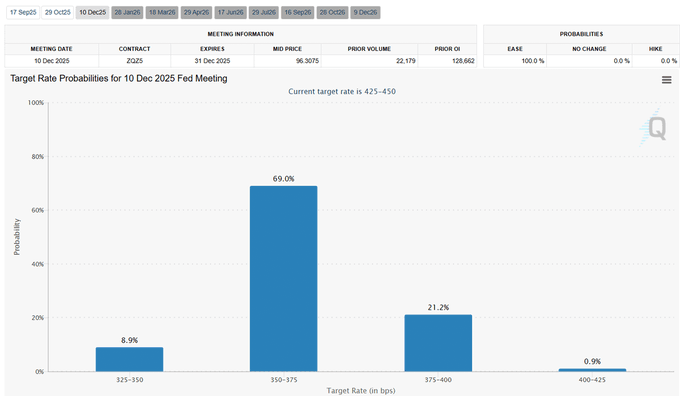

Futures market pricing shows that the market believes there is a 100% chance of a rate cut in September.

Most expect a 25 basis point cut, but the Federal Reserve may still choose to cut by 50 basis points.

Additionally, traders believe there is over a 75% chance of three or more rate cuts by 2025.

A turning point has finally appeared.

But one thing you need to understand is that a rate cut does not mean everything will rise immediately without falling.

The reason is that rate cuts do not impact all aspects overnight.

For cryptocurrencies, the short-term, medium-term, and long-term outlooks will be very different.

Short-term Impact

The short-term impact may be bearish.

When the unemployment rate rises, it first triggers market fears of an economic recession.

This is why gold is hitting historical highs while risk assets are performing poorly.

Here’s what might happen:

- Bitcoin may retest recent lows.

- Ethereum and altcoins may drop by 10-20%, or even more.

But this does not mean the cycle is over.

This reflects the behavior pattern of traders when negative economic data first hits: selling risk assets and turning to safe assets.

Medium-term Impact

As the Federal Reserve is about to implement rate cuts, the bond market will adjust, and yields will decline.

Lower yields mean increased borrowing activity, leading to increased spending.

Additionally, it will help companies increase borrowing to expand their businesses or conduct buybacks.

Increased spending means corporate profit growth, and their stock prices will soar.

When stocks rise, Bitcoin and altcoins often see even larger increases.

A new change has emerged in this cycle: institutional entry.

Spot Bitcoin and Ethereum ETFs have opened a direct channel for pension funds and asset management companies; the approval of altcoin ETFs is also imminent.

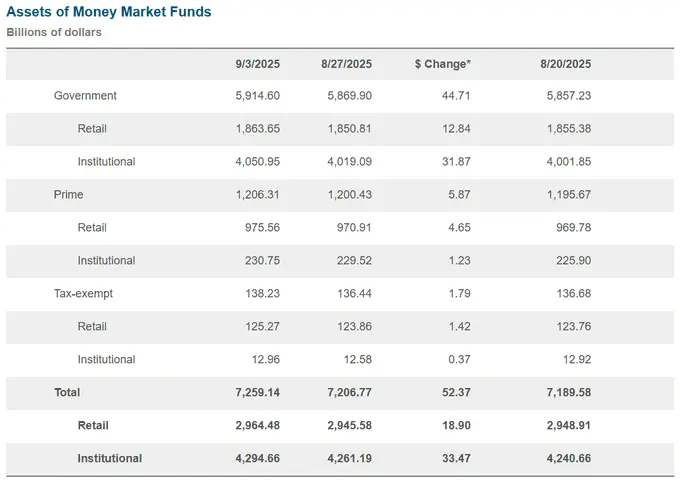

Moreover, there is $7.2 trillion sitting in money market funds, and once Treasury yields start to decline, this capital will flow out.

Imagine, even if only 1% of that capital flows into cryptocurrencies, it would be enough to push Bitcoin and altcoins to new highs.

That’s why the fourth quarter of 2025 looks so important.

Liquidity will begin to return.

Stocks will see more buying.

And cryptocurrencies may be the biggest winners among all risk assets.

Bitcoin usually leads the trend, while altcoins lag behind, but in past cycles, their largest gains occurred near the end.

If history repeats itself, as Bitcoin stabilizes at higher levels, early 2026 could be a frenzy phase for altcoins.

Long-term Impact

After the medium-term rebound, risks will re-emerge.

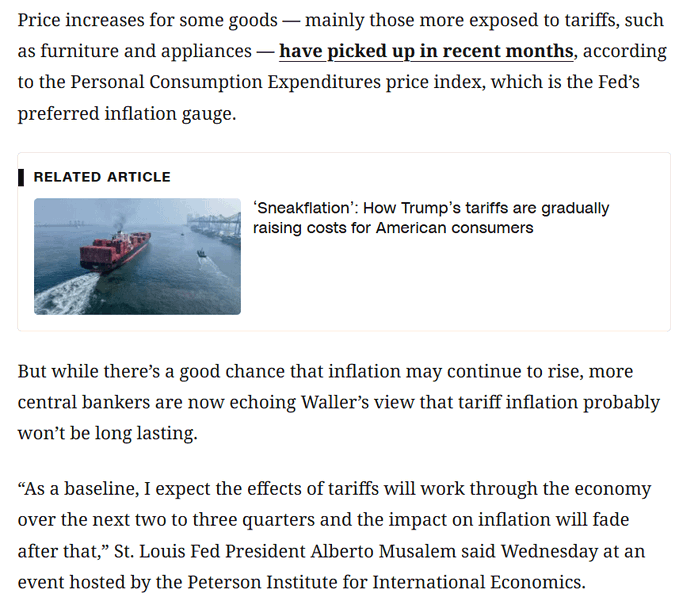

Tariffs introduced earlier this year will take 6-8 months to fully reflect in inflation data.

This suggests that early 2026 may be a time when inflation rises again.

If inflation rises while the unemployment rate remains high, concerns about stagflation may force the Federal Reserve to pause rate cuts or even raise rates again.

The coexistence of a weak job market and rising prices has historically marked the end of economic cycles.

Environmental factors could trigger a stock market crash and a bear market for cryptocurrencies.

So the script is as follows:

- Short-term (next 3-4 weeks): market turbulence, pullbacks, panic selling.

- Medium-term (Q4 2025 to January 2026): liquidity returns, Bitcoin hits new highs, altcoins enter a frenzy phase.

- Long-term (from Q1 2026): rising inflation risks, the Federal Reserve's response may mark the cycle's peak.

Final Thoughts

Last Friday's weak employment data indicates one thing: the Federal Reserve will pivot.

Typically, a pivot in Federal Reserve policy means poor economic conditions, so a short-term adjustment seems very likely.

But as things develop, I believe the crypto market will be the biggest winner in Q4 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。