The original text is from The Smart Ape

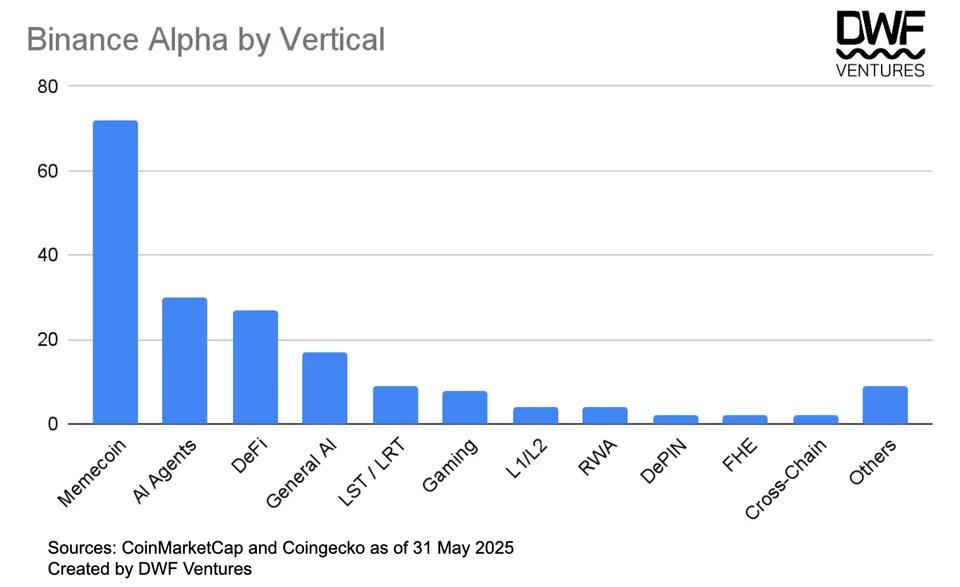

Editor's note: Since the launch of the Binance Web3 wallet and Binance Alpha, the usage and trading volume of the Binance Web3 wallet have skyrocketed, making Binance a leader in wallets and DEXs within just a few months. As a result, many exchanges have begun to emulate Binance's model, such as OKX Boost, Bitget Wallet Alpha, and Gate Alpha.

However, this model also has many drawbacks for the market and the community, including unfairness to the community, trading manipulation, and lack of sustainability… The following summarizes the drawbacks of the Binance Alpha product, which also reflects the adverse effects that such products from exchanges bring to the market, guiding the crypto market towards a more unhealthy development.

In summary, Binance Alpha is a section within the Binance Web3 wallet where early projects can launch, making trading more convenient. Users can also earn Alpha points by trading tokens that have launched on Binance Alpha, qualifying them for airdrops of newly launched tokens.

However, it is completely different from Binance's spot or contract trading. Just because a token is launched on Binance Alpha does not guarantee it will be listed on Binance's spot market. Of the tokens launched on Alpha, less than 7% ultimately make it to spot trading.

So, since there is already a spot market, why did Binance launch Alpha? There are both official and unofficial reasons.

The official reason is that Binance Alpha aims to be a discovery zone where users can trade very early tokens directly from the Binance wallet. Compared to spot trading, Binance Alpha is positioned as more "degen," requiring projects to prove they have stronger fundamentals and liquidity.

But the real reason may be that Binance understands user demand: to generate profits. The truly important aspect of the entire product is the Alpha points. They encourage users to use the Binance wallet, creating more trading volume, bringing more users and more revenue to Binance.

This also allows Binance to test a large number of projects without bearing the reputational risk of failed listings on the spot market.

Unfairness to the Community

Most projects that launch on Binance Alpha ultimately alienate their own communities.

Imagine that you have been supporting a project from the early days, testing every new feature, continuously providing feedback, staying active on Discord, and helping newcomers learn.

When the TGE arrives, you expect your efforts to be rewarded. But instead, you see the token launch first on Binance Alpha, and before you receive your community allocation, the project has already airdropped to Alpha point miners.

Then, these airdrop miners sell off the tokens, causing the price to plummet, leaving you with only scraps.

This is the reality for most projects that launch on Binance Alpha, and many people are frustrated by it.

The Price Drop Effect of Alpha Token Launches

Almost all tokens launched on the Binance Alpha platform fail to survive in the long term.

Tokens launched on the Binance Alpha platform continue to decline after launch.

Everyone wants to know what percentage of tokens will be airdropped to Binance Alpha users. But Binance has never disclosed this information. They only reveal the amount of each airdrop and the required point threshold, never disclosing the total token pool size.

It is estimated that the percentage of tokens airdropped depends on the project, but typically ranges from 2.5% to 5% of the total supply. This percentage is already quite high, as these tokens are allocated to Binance users at the time of the project's launch, rather than to the actual community.

So it is not surprising that these tokens are immediately sold off, causing the token price to plummet.

Recently, the MYX project airdropped tokens worth over $4,000 to Binance Alpha platform users, considering they are not the original community members, this amount is substantial.

Trading Volume Manipulation

Launching on Binance Alpha is becoming a necessary step before launching on Binance's spot market. This means that every project on Alpha faces immense pressure to demonstrate strong appeal to ensure a quick entry into the spot market.

One of the main criteria Binance focuses on is trading volume.

So guess what happens? Project teams artificially inflate trading volume to enhance appeal. There are various ways to artificially boost trading volume: wash trading, large distributions of Alpha points, or secretly raising prices before selling.

The problem is that such projects do not build a loyal community; instead, they mainly attract opportunistic "farmers," which is not sustainable in the long run.

Lack of Sustainability

Some may argue that Binance Alpha has indeed raised the prices of some project tokens. Binance Alpha creates scarcity and attention, naturally attracting traders seeking early entry opportunities. Users accumulate Alpha points to qualify for airdrops, which requires them to increase trading volume, all of which boosts project liquidity and market capitalization.

But all of this is unsustainable. Most users are not there for the project itself; they are there for the points. Once the point rewards end, activity will collapse.

Binance Alpha has also not brought any real product innovation. Its core is a showcase platform with an airdrop mechanism, making it difficult to maintain interest once the initial hype fades.

Moreover, tokens launched on Binance Alpha can already be traded directly on DEXs, often at lower prices. The only reason people use Alpha is for the airdrops.

This makes it difficult for any project to establish lasting value through launching on Binance Alpha, and more and more communities are becoming aware of this.

No Guarantee of Spot Market Listing

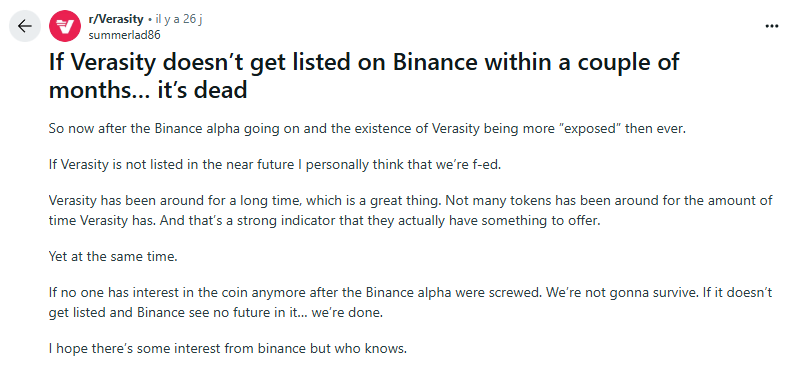

Another important point that many seem to misunderstand: launching on Binance Alpha does not guarantee a listing on Binance's spot market. Many projects accept to launch on Binance Alpha essentially to vie for a chance to get onto the spot market, only to end up "losing both the lady and the soldiers."

The team behind Verasity once said: "If they can't get onto the Binance spot market, they are basically dead." Clearly, their only reason for launching on Binance Alpha was the hope of getting onto the Binance spot market.

Final Thoughts

Ultimately, whether to launch on Binance Alpha or similar products from other exchanges is a choice for the project teams.

However, I do not believe that Binance Alpha is beneficial for the long-term development of projects, as it often means that project teams choose short-term hype over walking alongside the community. If a project is loyal to its community, it should gradually build and create heat and market hype over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。