SEC Reviews Grayscale Crypto ETF Filings on Altcoins

Grayscale Crypto ETF Filings for Bitcoin Cash, Hedera, Litecoin

Grayscale has taken another formal step toward launching a Litecoin exchange-traded fund. On September 9, 2025 the firm filed a Form S-3 registration statement with the U.S. Securities and Exchange Commission for a Litecoin ETF, and also filed registration documents related to Bitcoin Cash and Hedera products. These filings include a prospectus that gives investors clearer information about how the proposed fund would work.

Source : X

SEC Delays Decisions on Grayscale's Hedera and Bitcoin Cash ETFs

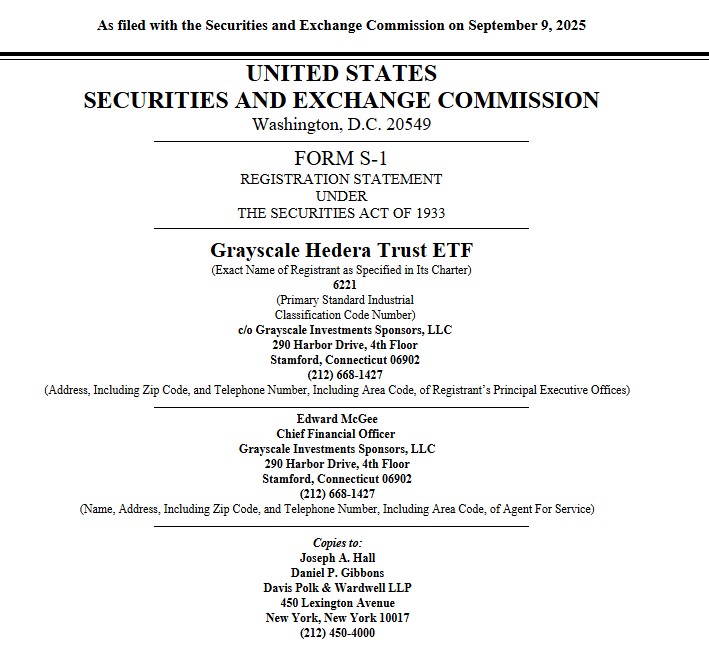

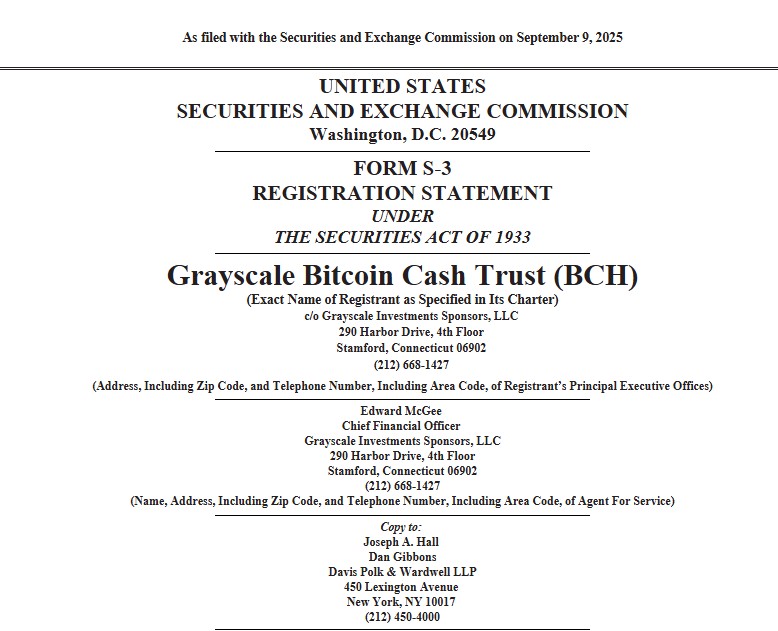

The company also filed an S-1 for a Hedera product and S-3 form for a Bitcoin Cash product, signaling broad interest in converting or expanding trust offerings into ETF formats. None of the filings are effective yet they remain subject to SEC review and possible amendments.

Source : Website

Strategic Move in the Crypto ETF Market

Grayscale’s move comes as several firms push the SEC for crypto-linked ETFs. The market has already seen major activity around BTC and Ethereum ETFs; now it’s time to switch to other well-known tokens. Regulators have been cautious because the commission has also delayed decisions on several altcoin ETF proposals including action pushed out for proposals tied to Hedera and Dogecoin

If Approved, Market Implications and Investor Outlook

If the SEC accepts and clears the registration statements, Grayscale would be able to list the fund on a national exchange, assuming related listing rules are met. If the SEC rejects or delays, Grayscale may amend the filings and try again. Market news and investor interest will likely shape how fast any final decision occurs.

Grayscale’s new filings mark a clear push to expand crypto ETFs beyond bitcoin and ether. For investors who want regulated exposure to Litecoin and Hydra, these documents are an important early step but approval is not guaranteed.

Why investors care: liquidity and price alignment

If the SEC approves these conversions, ordinary investors could buy regulated exposure to altcoins like Litecoin or Bitcoin Cash through their brokerage accounts, just like they buy stocks. That could increase liquidity in the tokens and make price movements which closely mirror the token’s market price. The move gives institutional traders a simpler, regulated route to add or trim crypto positions

History matters: why Grayscale’s legal fight helped shape the market

The firm's earlier legal battles with the commission over converting its BTC trust were a turning point. That appeal played a key role in the pathway regulators used when they later allowed spot BTC and Ethereum ETFs to trade in the U.S. Now the firm is trying a similar playbook for other tokens but whether regulators will follow the same path is still an open question.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。