Written by: Luke, Mars Finance

A storm about "definition" is quietly gathering on the horizon of the crypto world. Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC) and known as the "crypto godmother," made a seemingly casual remark that could become the last straw for many existing Layer 2 (L2) architectures. She pointed out that any L2 relying on centralized sequencers could have its core functions classified by the SEC as "exchanges." This is not alarmism, but a life-and-death compliance test. When regulatory scrutiny pierces through marketing jargon and strikes at the core of technical architecture, a race for "decentralization" in the L2 space has already begun.

The SEC's "Gaze": Function, Not Name, Determines Everything

To understand the core of this storm, we must first grasp the SEC's regulatory logic in recent years. Under the leadership of SEC Chairman Gary Gensler, the core idea has become clear: "What it is doesn't matter; what it looks like does." Regulators are not concerned with whether a project calls itself a "decentralized protocol" or a "liquidity solution"; they only care about its operational substance.

This logic has been repeatedly emphasized in the SEC's charges against leading platforms like Coinbase and Kraken. The SEC believes that as long as a platform provides the function of "aggregating buy and sell orders and using established, non-discretionary methods to make these orders interact," it constitutes a de facto exchange. Now, compare this description with the working principle of centralized sequencers in L2.

Sequencers, the heart of the L2 network, have the core responsibility of receiving massive amounts of transactions from users and then sorting and packaging them using "established, non-discretionary methods"—typically based on a "first-come, first-served" (FCFS) principle—before ultimately submitting them to the Layer 1 main chain. If we view the transactions submitted by users as buy and sell orders, then the sorting process, fully controlled by a single entity (such as Offchain Labs behind Arbitrum, OP Labs behind Optimism, or Coinbase behind Base), is functionally very similar to the "matching engine" of a traditional exchange.

This is precisely where the SEC may strike. From the regulator's perspective, when an entity can unilaterally decide the final order of transactions worth hundreds of millions or even billions of dollars, it wields immense power and creates a clear point of accountability. As Hester Peirce has long advocated with her "safe harbor" proposal, only when a network achieves "functional decentralization," meaning the founding team can no longer unilaterally control the network's operation, can it truly escape the risk of being classified as a security or regulated financial entity.

Once formally recognized as an "unregistered exchange," the consequences would be catastrophic. The SEC's past enforcement actions have provided the answer: not only would they face fines of up to billions of dollars (such as the $4.47 billion settlement against Terraform Labs), but they could also be required to forfeit all "ill-gotten gains" and be subject to permanent injunctions, leading to a complete business shutdown. For L2 protocols that pursue speed and efficiency, this would undoubtedly be a disaster.

L2's "Heart Bypass Surgery": From Efficiency First to Survival First

In the past few years, the narrative around L2 development has always revolved around efficiency and user experience. To stand out in fierce market competition, the vast majority of L2 projects have chosen the "shortcut" of centralized sequencers. The benefits of this approach are obvious: extremely low transaction latency, predictable transaction costs, and effective suppression of maximum extractable value (MEV) issues, such as preventing the "sandwich attacks" prevalent on the Ethereum mainnet. This has significantly contributed to the early prosperity of the L2 ecosystem.

However, this "devilish deal" made at the expense of decentralization is now causing L2 projects to lose sleep. The sword of Damocles of regulation hangs high, and the once-technical advantages could overnight turn into the most fatal compliance vulnerabilities. A profound paradigm shift is occurring: the competitive focus of L2 is shifting from mere performance comparison to a "heart bypass surgery" concerning architectural security and future survival rights.

The core of this surgery is to dismantle the single point of control of sequencers. This is no easy task; decentralized sequencers face a series of complex technical challenges, almost replaying the "blockchain trilemma" at the L2 level. A decentralized sequencer network needs to ensure high performance (low latency, high throughput) while designing a fair incentive mechanism to encourage honest nodes and establishing an efficient consensus mechanism to address potential malicious behaviors. Any misstep in any link could lead to a decline in network performance or even reintroduce MEV issues, regressing user experience.

Despite the numerous challenges, the instinct for survival is driving the entire L2 sector to accelerate transformation. The strategic layouts and execution speeds of major mainstream L2s clearly outline a picture of a "decentralization race."

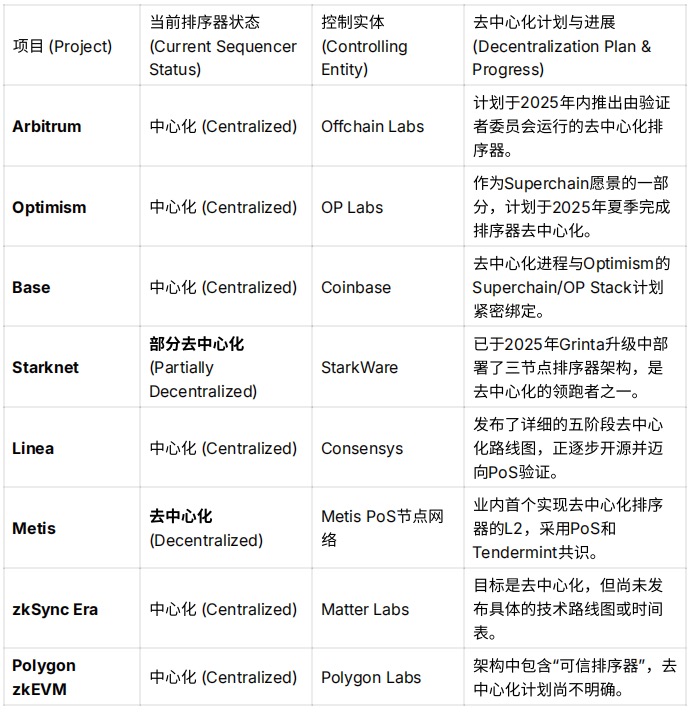

From the table, we can observe clear strategic divisions. The two giants, Arbitrum and Optimism, as the biggest beneficiaries of the "centralization dividend," are now turning the ship around, setting 2025 as a key node for decentralization. Starknet has demonstrated its technological foresight, having already entered the "multi-node" operational phase, seizing the initiative. Meanwhile, Metis has already validated the feasibility of PoS decentralized sequencers for the entire industry as a pioneer. Linea, with its clear roadmap, has conveyed certainty to the market. In contrast, some projects appear relatively vague in their planning on this issue, which may become a limiting factor for their future development.

Towards a Future of "Minimal Trust": Shared Sequencers and New Narratives

In the face of decentralization challenges, beyond each L2 project "reinventing the wheel," a more disruptive solution is emerging—Shared Sequencers. Projects represented by Espresso Systems and Astria are building a neutral, open, high-performance decentralized sorting network.

This idea is very clever. Instead of having each L2 expend enormous effort to build and maintain its own sequencer committee, it is better to outsource the sorting work to a "public infrastructure layer" specifically designed for sorting. L2 projects can plug into this shared network like connecting to the internet, instantly gaining the capabilities of decentralization, censorship resistance, and cross-chain interoperability.

This not only greatly lowers the threshold for L2s to achieve decentralization but could also reshape the entire modular blockchain landscape. A neutral shared sorting layer can naturally provide atomic composability bridges for all L2s connected to it, allowing users to interact seamlessly and at low cost across different L2s. This is undoubtedly a strong response to the current fragmentation issues in the L2 ecosystem.

Conclusion: Farewell to the "Wild West," Moving Towards Maturity

The story of L2 is evolving from a purely technical narrative about "scalability" to a grand chapter about "compliance" and "maturity." The SEC's potential regulation acts as a powerful catalyst, forcing the entire industry to think ahead about fundamental issues that were once overshadowed by growth speed.

The era of centralized sequencers, as a necessary transitional phase, may soon come to an end. Future competition will no longer be merely a contest of TPS (transactions per second) and gas fees, but a comprehensive battle of network resilience, governance robustness, and regulatory foresight. Those who can complete this "heart bypass surgery" first and truly move towards a minimal trust architecture will not only gain the tacit approval of regulators but also earn the ultimate trust of users and developers. This "race against time" ultimately leads to a more decentralized and vibrant crypto future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。