India Crypto Regulation Crisis: Stablecoins to Break UPI, Ban Coming?

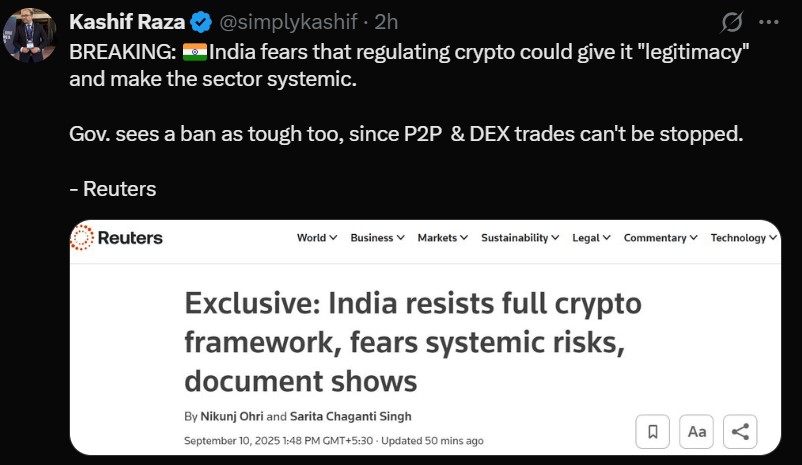

The debate over India Crypto regulation has reached a new turning point. A new government paper reveals deep concerns that giving digital assets official recognition could backfire.

Instead of solving risks, regulation might actually make them systemic—spreading threats from individual investors to the entire economy.

Source: Kashif Raza , Founder of Bitinning

At the same time, India crypto ban news is gaining traction, since peer-to-peer transfers and decentralised exchanges remain unstoppable. This double-edged situation has left the government facing one of its toughest financial dilemmas yet.

Why Govt. is Fearing Indian Crypto Regulation Could Backfire: 2 Reasons

The official India crypto discussion paper outlines two key reasons behind hesitation on Indian crypto policy :

-

Stablecoins Could Harm UPI: Country’s fast digital payment backbone is a global success story. If pegged cryptocurrency becomes popular, it could weaken Unified Payments Interface by dividing payments between UPI and private tokens. In simple words, Stablecoins risks UPI payments.

-

Systemic Risk: Once regulation is introduced, banks, companies, and households may adopt it more widely. A market crash in such a scenario could hit not just traders but the entire financial system.

These 2 points show why the government thinks this act could give legitimacy, but also increase risks for the whole economy.

Stablecoins vs UPI: A Threat to Indian Payment System

Latest news in cryptocurrency highlights one of the biggest alarms in the asset regulation: The risk of stablecoins fragmenting UPI.

The Unified Payments Interface powers trade, salaries, and everyday household transactions. If stablecoins dominate, people may bypass UPIs, leading to divided usage and loss of regulatory control.

This could weaken innovation, reduce trust, and even increase illegal activities like fraud or tax evasion. The report underlines this as a direct threat to our digital payments system.

Ban Cryptocurrency or Regulate It? Both Paths Look Risky

In the India cryptocurrency ban discussion vs regulation, the government says it has two tough choices right now:

-

A ban may sound like an easy fix, but it cannot stop peer-to-peer trades or decentralised exchanges.

-

India crypto regulation would make assets look trusted . But this could push more people to use it, which may create bigger risks for the whole system.

This is why the country has so far avoided a final stance. In 2021, a draft bill to ban private cryptocurrencies was never passed into law.

Then, while serving in the G20 presidency in 2023, they were intent on gaining acceptance of a global framework, while delaying their own decision. Today, the country is still cautiously balancing between control and risk.

Conclusion: Is It Too Late to Stop Digital Assets?

Even after high taxes and many warnings, Indians have already put about $4.5 billion into cryptocurrencies. This is not a big danger for the economy yet, but it clearly shows strong public interest in India crypto news today .

If the government tries banning digital assets, people may still trade them secretly, outside official control. For now, the latest India crypto regulation step has been to wait and watch until there is more global clarity.

But as more people start using digital assets, the risks will also grow. This raises an important question—is it already too late to stop this rising momentum?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。