Recently, the bidding war for USDH issuance rights initiated by HyperLiquid attracted players like Circle, Paxos, and Frax Finance to openly compete. Some giants even offered $20 million in ecological incentives as bargaining chips. This storm not only showcased the immense allure of DeFi protocol native stablecoins but also provided us a glimpse into the stablecoin logic of the DeFi world.

Taking this opportunity, we hope to re-examine: What are DeFi protocol stablecoins, why are they so valued? And in today's increasingly mature issuance mechanisms, where truly lies the pivot that determines their success or failure?

Source: Paxos

Why are DeFi Stablecoins so Attractive?

Before exploring this question, we must acknowledge a fact: the stablecoin market is currently dominated by stablecoins issued by centralized institutions (such as USDT and USDC). With their strong compliance, liquidity, and first-mover advantages, they have become the most important bridge between the crypto world and the real world.

At the same time, a force pursuing a more pure decentralization, censorship resistance, and transparency has been driving the development of DeFi native stablecoins. For a decentralized protocol with daily trading volumes often reaching tens of billions of dollars, the value of native stablecoins is self-evident.

They are not only the core pricing and settlement unit within the platform, significantly reducing reliance on external stablecoins, but they also firmly lock the value of transactions, lending, and clearing within their own ecosystem. Taking USDH in HyperLiquid as an example, its positioning is not merely to replicate USDT but to become the "heart" of the protocol—operating as collateral, pricing unit, and liquidity hub.

This means that whoever holds the issuance rights of USDH will occupy a crucial strategic high ground in the future landscape of HyperLiquid. This is the fundamental reason why the market responded swiftly after HyperLiquid extended an olive branch, with Paxos and PayPal even offering $20 million in ecological incentives as bargaining chips.

In other words, for DeFi protocols that are extremely reliant on liquidity, stablecoins are not just a "tool," but a "pivot" encompassing on-chain economic activities of trading and value circulation. Whether it is DEX, lending, derivatives protocols, or on-chain payment applications, stablecoins play a core role in the dollarized settlement layer.

Source: imToken Web (web.token.im) DeFi protocol stablecoins

From the perspective of imToken, stablecoins are no longer a tool that can be summarized by a single narrative, but a multidimensional "asset collective"—different users and different needs correspond to different stablecoin choices (Further reading: "Stablecoin Worldview: How to Build a Stablecoin Classification Framework from the User Perspective?").

In this classification, "DeFi protocol stablecoins" (such as DAI, GHO, crvUSD, FRAX, etc.) represent an independent category. Compared to centralized stablecoins, they emphasize decentralization and protocol autonomy more—anchored by the mechanism design of the protocol itself and collateral assets, striving to break free from reliance on a single institution. This is why, even amidst market fluctuations, many protocols continue to experiment.

The "Paradigm War" Initiated by DAI

The evolution of DeFi protocol native stablecoins is essentially a paradigm war centered around scenarios, mechanisms, and efficiency.

1. MakerDAO's DAI (USDS)

As the pioneer of decentralized stablecoins, MakerDAO's DAI established the paradigm of over-collateralized minting, allowing users to deposit collateral such as ETH into the vault to mint DAI, and it has withstood multiple extreme market conditions.

However, less known is that DAI was also one of the first DeFi protocol stablecoins to embrace RWA (real-world assets). As early as 2022, MakerDAO began experimenting with allowing asset originators to convert real-world assets into tokenized loans, attempting to find a larger asset backing and demand scenario for DAI.

With the recent rebranding from MakerDAO to Sky and the launch of USDS as part of its ultimate plan, MakerDAO aims to attract a different user base from DAI based on the new stablecoin, further expanding adoption from DeFi to off-chain scenarios.

2. Aave's GHO

Interestingly, Aave, which is based on lending, has leaned towards MakerDAO by launching the decentralized, collateral-backed, and dollar-pegged DeFi native stablecoin GHO.

Its logic is similar to DAI—it is an over-collateralized stablecoin minted using aTokens as collateral, where users can use assets in Aave V3 as collateral for over-collateralized minting. The only difference is that since all collateral is productive capital, it generates a certain interest (aTokens), which specifically depends on lending demand.

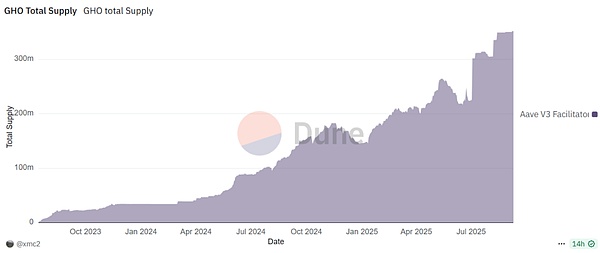

Source: Dune

From an experimental comparison perspective, MakerDAO relies on minting rights to expand its ecosystem, while Aave derives stablecoins from its mature lending scenarios. These two provide different templates for the development of DeFi protocol stablecoins.

As of the time of writing, GHO's minting volume has surpassed 350 million, maintaining a steady growth trend over the past two years, with market recognition and user acceptance steadily increasing.

3. Curve's crvUSD

Since its launch in 2023, crvUSD has successively supported various mainstream assets as collateral, including sfrxETH, wstETH, WBTC, WETH, and ETH, covering major LSD (liquid staking derivatives) categories. Its unique LLAMMA liquidation mechanism also makes it easier for users to understand and use.

As of the time of writing, the minting quantity of crvUSD has surpassed 230 million. Notably, a single asset, wstETH, accounts for about half of the total crvUSD minted, highlighting its deep binding and market advantage in the LSDfi field.

4. Frax Finance's frxUSD

Frax Finance's story is the most dramatic. During the stable crisis in 2022, Frax quickly adjusted its strategy by increasing sufficient reserves to completely transform into a fully collateralized stablecoin, stabilizing its footing.

A more critical step was its precise entry into the LSD track over the past two years, leveraging its ecological product frxETH and accumulated governance resources to create highly attractive yields on platforms like Curve, successfully achieving a second growth curve.

In the latest USDH bidding competition, Frax proposed a "community-first" proposal and plans to peg USDH to frxUSD at a 1:1 ratio, with frxUSD supported by BlackRock's yield-generating on-chain treasury fund, stating that "100% of the underlying treasury yield will be directly distributed to Hyperliquid users through on-chain programmatic means, with Frax charging no fees."

From "Issuance" to "Trading," What is the Pivot?

From the above cases, it can be seen that, to some extent, stablecoins are a necessary path for DeFi protocols to transition from "tools" to "systems."

In fact, as a narrative forgotten after the summer of 2020-2021, DeFi protocol stablecoins have been on a continuously evolving path. From MakerDAO, Aave, Curve to today's HyperLiquid, we find that the focus of this war has quietly changed.

The key is not the ability to issue but the trading and application scenarios. Simply put, whether it is over-collateralization or full reserves, issuing a stablecoin pegged to the dollar is no longer a challenge. The real crux lies in "What can it be used for? Who will use it? Where can it circulate?"

As HyperLiquid emphasized when bidding for USDH issuance rights—serving the HyperLiquid ecosystem first and compliance as the standard—this is where the true pivot of DeFi stablecoins lies:

- First, it is naturally the endogenous scenarios where this stablecoin can be widely deployed, which is also the "base" of the stablecoin. For example— for Aave, it is lending; for Curve, it is trading; for HyperLiquid, it will be derivatives trading (collateral assets). A strong endogenous scenario can provide the most original and loyal demand for stablecoins;

- Secondly, there is liquidity depth. After all, the lifeline of stablecoins lies in their trading pairs with other mainstream assets (such as ETH, WBTC) and other stablecoins (such as USDC, USDT). Having one or more deep liquidity pools is fundamental to maintaining price stability and meeting large-scale trading demands. This is why Curve remains a battleground for all stablecoins;

- Then there is composability and scalability. Whether a stablecoin can be easily integrated by other DeFi protocols as collateral, lending assets, or the underlying asset for yield aggregators determines the ceiling of its value network;

- Finally, there is the "icing on the cake" yield-driven aspect—in the stock game of the DeFi market, yield is the most effective means to attract liquidity. A stablecoin that "makes money for users" is more attractive;

In summary, centralized stablecoins remain the underlying liquidity of DeFi, and for all DeFi protocols, issuing native stablecoins is no longer a simple technical choice but a strategic layout concerning the ecological value closed loop. The true pivot has long shifted from "how to issue" to "how to make it traded and used frequently."

This also means that the DeFi stablecoins that can succeed in the future will undoubtedly be those that can provide their holders with the most solid application scenarios, deepest liquidity, and most sustainable yields—rather than just being a "currency."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。