Original Title: Monthly Outlook: Debunking the Seasonality Myth

Original Authors: David Duong, Global Research Director at Coinbase; Colin Basco, Research Assistant at CoinbaseOriginal Translation: xiaozou, Jinse Finance

Key Points:

We predict a strengthening of the crypto market in early Q4 2025, driven by resilient liquidity, a favorable macro backdrop, and supportive regulatory dynamics, with Bitcoin expected to perform particularly well.

The technical demand for Digital Asset Treasuries (DATs) is expected to continue supporting the crypto market, even as the industry enters a competitive "player versus player" phase.

Our research indicates that historical monthly seasonal patterns (especially the "September Effect") are not significant or reliable predictors of crypto market performance.

1. Overview

We believe the crypto bull market still has room to extend into early Q4 2025, with key drivers including a resilient liquidity environment, favorable macro conditions, and supportive regulatory dynamics. We expect Bitcoin, in particular, to continue exceeding market expectations, as it directly benefits from existing macro tailwinds. In other words, unless there are severe fluctuations in energy prices (or other factors that could negatively impact inflation trends), the immediate risks disrupting the U.S. monetary policy path are actually quite low. Meanwhile, the technical demand for Digital Asset Treasuries (DATs) should continue to provide strong support for the crypto market.

However, seasonal concerns continue to plague the crypto space—historically, Bitcoin has seen a decline against the dollar in September for six consecutive years from 2017 to 2022. While this trend has led many investors to believe that seasonal factors significantly impact crypto market performance, this assumption has been disproven in 2023 and 2024. In fact, our research shows that the small sample size and potentially wide distribution of outcomes limit the statistical significance of such seasonal indicators.

A more critical question for the crypto market is whether we are in the early or late stages of the DAT cycle. As of September 10, public DATs hold over 1 million BTC ($110 billion), 4.9 million ETH ($21.3 billion), and 8.9 million SOL ($1.8 billion), while later entrants have begun targeting alternative tokens further down the risk curve. We believe we are currently in the "player versus player" (PvP) phase of the cycle, which will continue to drive capital towards large crypto assets. However, this may also signal an impending consolidation phase for smaller DAT participants.

2. Outlook Remains Optimistic

Earlier this year, we suggested that the crypto market would bottom out in the first half of 2025 and reach new historical highs in the second half of 2025. This was a view that deviated from market consensus at the time—market participants were concerned about a potential recession, questioning whether price increases indicated irrational exuberance, and worrying about the sustainability of any recovery. However, we found these views to be misleading, so we return to our unique macro outlook perspective.

As we enter Q4, we maintain an optimistic outlook for the crypto market, expecting continued strong liquidity, a favorable macroeconomic environment, and encouraging regulatory progress. In terms of monetary policy, we anticipate that the Federal Reserve will implement interest rate cuts on September 17 and October 29, as the U.S. labor market has provided strong evidence of weakness. We believe this will not create a local peak but will instead activate sidelined capital. In fact, we noted in August that declining interest rates could prompt a significant portion of the $7.4 trillion in money market funds to end their wait-and-see stance.

Nevertheless, a significant shift in the current inflation trajectory (e.g., rising energy prices) would pose risks to this outlook. (Note: We believe the risks posed by tariffs are far lower than some assessments suggest.) However, OPEC+ has recently agreed to increase oil production again, while global oil demand is showing signs of slowing. Nonetheless, the prospect of further sanctions on Russia could also drive up oil prices. Currently, we expect oil prices to remain below the threshold that would push the economic scenario into stagflation territory.

3. The DAT Cycle is Maturing

On the other hand, we believe that the technical demand for Digital Asset Treasuries (DATs) is expected to continue supporting the crypto market. In fact, the DAT phenomenon has reached a critical turning point. We are no longer in the early adoption phase characterized by the past 6-9 months, nor do we believe we are nearing the end of the cycle. In fact, we have entered the so-called "player versus player" (PvP) phase—this is a competitive stage where success increasingly depends on execution, differentiated strategies, and timing, rather than simply replicating MicroStrategy's operational model.

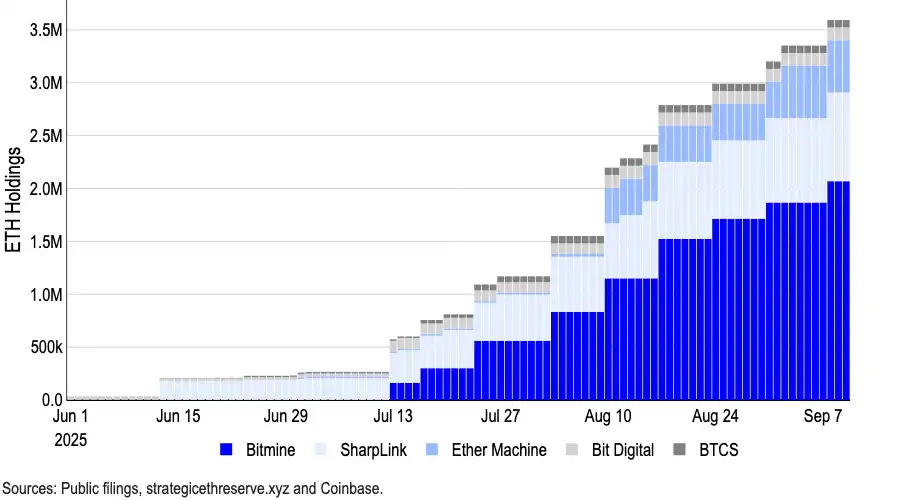

Indeed, early movers like MicroStrategy enjoyed significant premiums over net asset value (NAV), but competitive pressures, execution risks, and regulatory constraints have led to a compression of mNAV (market cap relative to net asset value ratio). We believe the scarcity premium benefiting early adopters has dissipated. Nevertheless, DATs focused on Bitcoin currently hold over 1 million BTC, accounting for about 5% of the circulating supply of that token. Similarly, top DATs focused on ETH collectively hold about 4.9 million ETH ($21.3 billion), representing over 4% of the total circulating supply of ETH.

Figure 1. ETH-focused Digital Asset Treasuries Continue to Accelerate Purchasing Trend

In August, the Financial Times reported that 154 U.S. publicly traded companies had raised about $98.4 billion for crypto asset purchases in 2025, a significant increase from the $33.6 billion raised by the top 10 companies earlier this year (based on Architect Partners data). Capital investment in other tokens is also increasing, particularly in SOL and other alternative tokens. (Forward Industries recently raised $1.65 billion to establish a SOL-based digital asset treasury, supported by Galaxy Digital, Jump Crypto, and Multicoin Capital.)

This growth has triggered stricter scrutiny. In fact, recent reports indicate that Nasdaq is tightening regulations on DATs, requiring specific transactions to be approved by shareholders and advocating for enhanced disclosure. However, Nasdaq clarified that it has not issued any formal press releases regarding new rules targeting DATs.

Currently, we believe the DAT cycle is maturing, but it is neither early nor late. It is certain that, in our view, the era of easy profits and guaranteed mNAV premiums has ended—in this PvP phase, only the most disciplined and strategically positioned participants will thrive. We expect the crypto market to continue benefiting from the unprecedented capital inflow into these vehicles, thereby enhancing return performance.

4. Is Seasonal Risk Real?

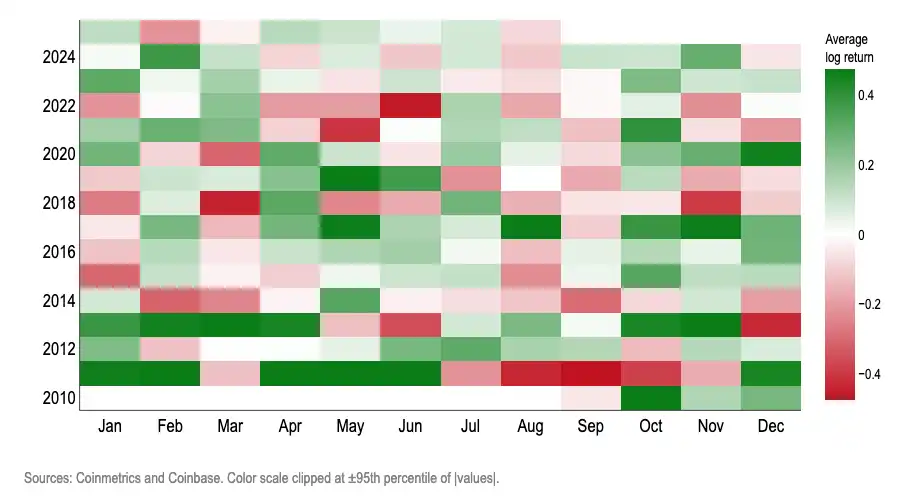

Meanwhile, seasonal fluctuations have been a concern for crypto market participants. Bitcoin has seen a decline against the dollar in September for six consecutive years from 2017 to 2022, with an average negative return of 3% over the past decade. This has left many investors with the impression that seasonal factors severely impact crypto market performance, and that September is generally an unfavorable time to hold risk assets. However, trading based on this assumption would have been disproven in both 2023 and 2024.

In fact, we believe that monthly seasonal fluctuations are not effective trading signals for Bitcoin. Through various methods such as frequency distribution charts, odds ratios, out-of-sample scoring, placebo tests, and control variables, the conclusion is consistent: the annual month is not a statistically reliable predictor of the positive or negative values of BTC's monthly logarithmic returns. (Note: We use logarithmic returns to measure geometric or compound growth, as it better reflects long-term trends and accounts for Bitcoin's high volatility.)

Figure 2. Heatmap of Bitcoin's Monthly Logarithmic Returns

The following tests found that "calendar months" are unreliable for predicting the positive or negative values of Bitcoin's monthly logarithmic returns:

(1) Wilson Confidence Interval

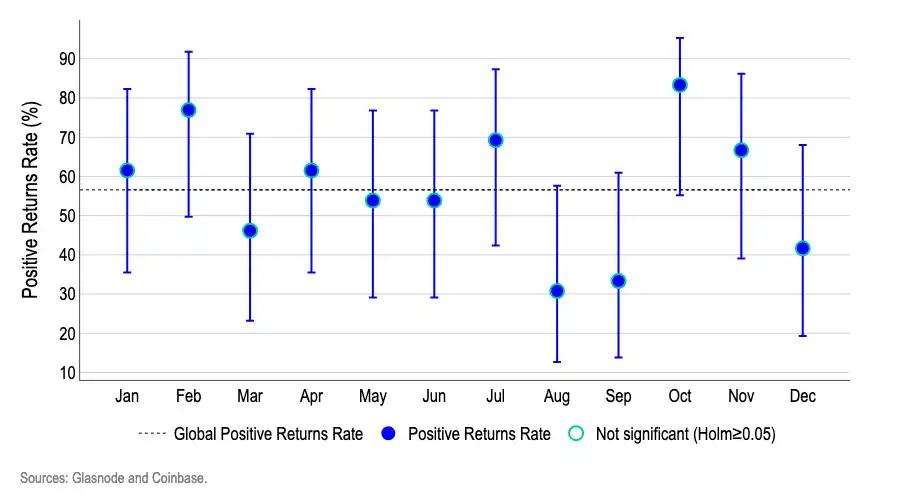

Figure 3 shows that after considering small sample uncertainty, no month breaks through the obvious threshold for predicting seasonality. Those months that appear "high" (February/October) or "low" (August/September) have error ranges that overlap with the overall average and other months, reflecting random variance rather than a persistent calendar effect.

Each dot shows the probability of BTC finishing the month with a gain; the vertical line/bar represents the 95% Wilson confidence interval band—this is an appropriate measure since there are only about 12-13 data points for each month, providing a more accurate uncertainty threshold for small samples.

The dashed line shows the average probability of an overall increase. Since we are examining data for 12 months simultaneously, we apply the Holm multiple testing adjustment to avoid any lucky month masquerading as a regular pattern.

Figure 3. BTC Positive Logarithmic Returns and 95% Wilson Confidence Interval

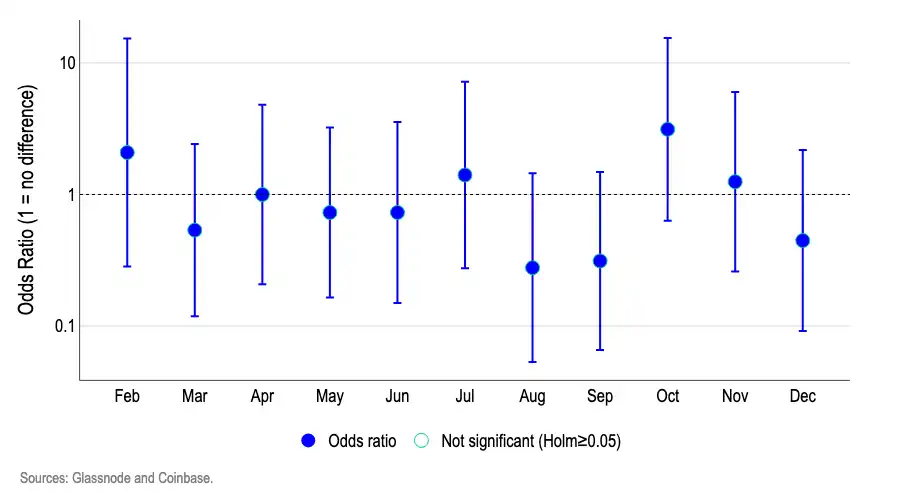

(2) Logistic Regression Analysis

We used a logistic regression model to test the impact of specific months on the probability of Bitcoin's price increase or decrease (with January as the baseline). Figure 4 shows that the odds ratios for most months cluster around 1.0, with the key point being that their 95% confidence intervals cross the 1.0 line.

Values close to 1.0 indicate "the same probability of obtaining positive logarithmic returns as in January," while values above 1.0 indicate "higher probability," and values below 1.0 indicate "lower probability."

For example, an odds ratio of 1.5 means "the probability of an increase in that month is about 50% higher than in January," while 0.7 indicates "the probability is about 30% lower."

Since most confidence intervals cross 1.0 and no month shows significance after Holm multiple testing adjustment, we cannot conclude that calendar months are effective indicators for predicting the positive or negative values of Bitcoin's logarithmic returns.

Figure 4. Logistic Regression—Monthly BTC Logarithmic Return Probability Ratios Relative to January (Baseline)

(3) Out-of-Sample Prediction

In each step, we re-estimated the two models using only the data available up to that month (initially training on half of the dataset):

The baseline model is a logistic model containing only the intercept, which predicts a constant probability (equal to the historical proportion of positive return months to date).

The Month Effect (MoY) model is a logistic regression that includes month dummy variables; it predicts the probability of an increase in the current calendar month based on past performance of that month.

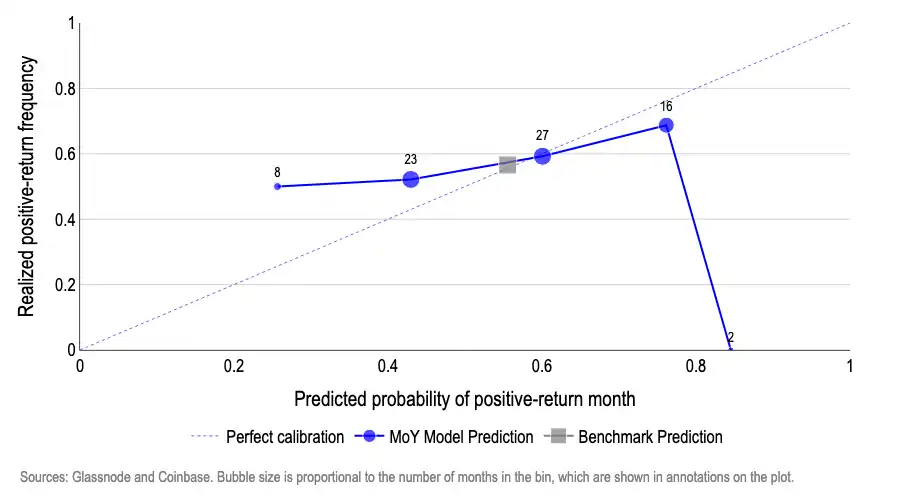

Our results are presented in Figure 5, where the X-axis represents the predicted probability of positive logarithmic return months, and the Y-axis represents the actual proportion of months with positive returns. When plotting the predicted results, perfectly calibrated model data points should align along the 45° line— for example, if a 50% probability of an increase is predicted, the actual proportion of months with increases should also be 50%.

The Month Effect (MoY) model shows significant bias. For instance:

- When predicting an increase probability of about 27%, the actual frequency is around 50% (overly pessimistic);

- It only roughly approaches the target within the 45-60% prediction range;

- In the high probability range, it is overly confident— for example, a prediction of about 75% corresponds to about 70% of the actual value, while an extreme prediction of about 85% results in about 0% realization.

In contrast, the baseline model, which consistently predicts the historical baseline rate (about 55-57% probability of increase), closely follows the 45° line, and given the relatively stable historical probability of positive return months for Bitcoin, this line hardly shifts. In short, this result indicates that calendar months have almost no predictive power in out-of-sample predictions.

Figure 5: Out-of-Sample Prediction Accuracy of the Month Effect (MoY) Logistic Regression Model

(4) Placebo Randomization Test

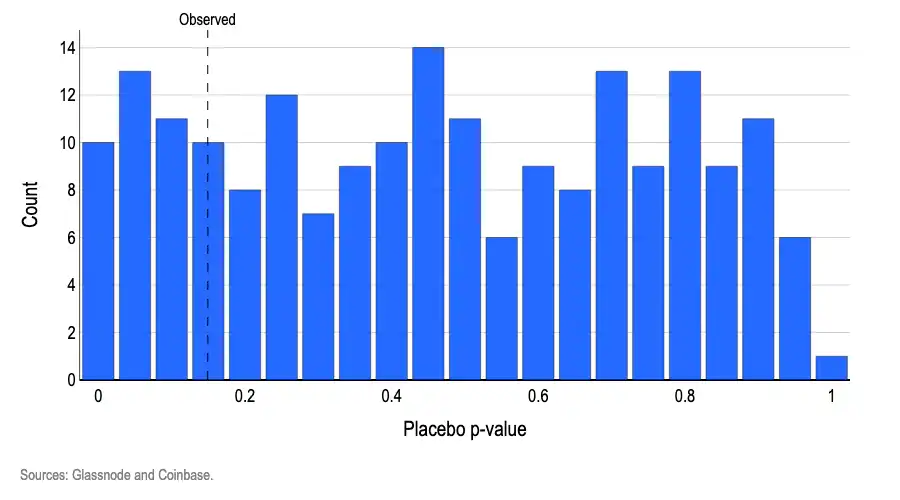

To verify whether "month labels" help predict positive and negative logarithmic returns, we used a simple logistic model with month dummy variables and assessed whether these variables improved the fit compared to a baseline model without month variables (standard likelihood ratio joint test). The observed p-value was 0.15, indicating that even if month factors are irrelevant, the probability of such a significant pattern occurring by chance is about 15%. We then randomly shuffled the month labels thousands of times, each time redoing the same joint test.

The results showed that about 19% of the random shuffling operations produced results less than or equal to the observed p-value (Figure 6).

In short, this result is quite common under purely random conditions, reinforcing the conclusion that "there is no month signal." If month labels had statistical significance, the real data joint test should yield a p-value of 0.05, and the proportion of such small p-values generated in the shuffling operations should be less than 5%.

Figure 6. Distribution of Placebo p-values Generated by Randomly Shuffling "Month" Labels in the Logistic Model

(5) Control Variable Testing

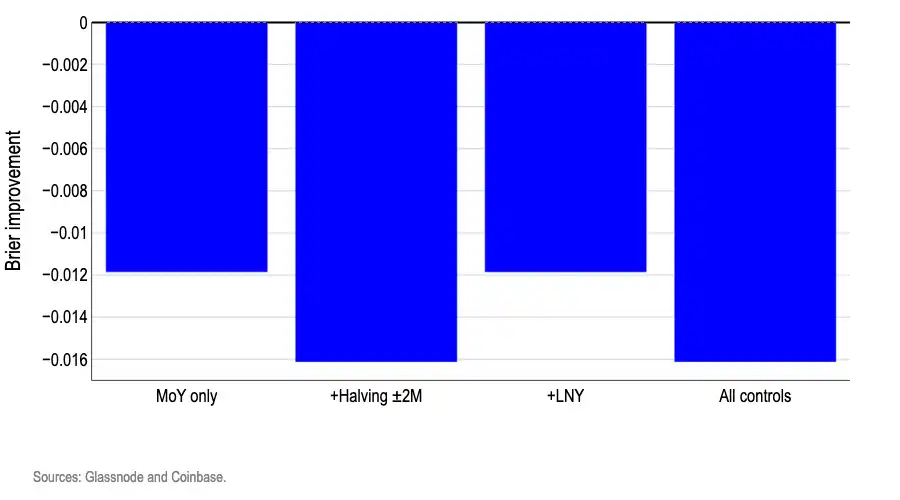

Adding real calendar markers did not unlock any tradable advantage— and often decreased the accuracy of predicting the direction of price movements. We re-estimated the "probability of positive return months" using the same month dummy variables, then added two significant event practice control variables: 1) factors that may affect Bitcoin's logarithmic returns; 2) months that do not occur at fixed times each year— the Lunar New Year and Bitcoin halving window (±2 months). We only used control variables corresponding to different calendar months each year to avoid redundancy in dummy variables leading to unstable model estimates.

This test aims to verify two common concerns: (i) the phenomenon that appears to be a "month effect" may simply be a disguise for periodic events— such as liquidity during the Lunar New Year (LNY) or the Bitcoin halving effect; (ii) even if the original month pattern is weak, considering these driving factors may yield utility. In the initial phase, we trained on half of the dataset and used the other half for testing. We assessed the monthly probability predictions using Brier scores, which reflect the mean squared error between predicted probabilities and actual price movement outcomes (i.e., the degree of deviation between predicted values and reality).

In Figure 7, the bar chart shows the Brier improvement values of each model compared to the simple baseline (which uses a single value of historical increase rate from the training window). All bars are below zero, indicating that the performance of each control variable variant is worse than the constant probability baseline. In short, introducing additional calendar markers based on month labels only adds noise.

Figure 7: Brier Improvement Scores of Logistic Regression Models with Added Control Variables in Out-of-Sample Predictions

4. Conclusion

The concept of market seasonality creates harmful shackles on investor psychology and may form a self-fulfilling prophecy. However, our models indicate that simply assuming the monthly probabilities of increases and decreases are roughly consistent with long-term historical averages outperforms all calendar-based trading strategies. This strongly suggests that calendar patterns do not contain effective information for predicting Bitcoin's monthly direction. Since calendar months cannot reliably predict the positive or negative direction of logarithmic returns, the likelihood of predicting the magnitude of returns is even slimmer. The synchronized declines in past Septembers and the legendary increases of Bitcoin in "October Surges" may have statistical interest, but they lack statistical significance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。