Original Title: pump.fun's Sapijiju: First-Ever Discussion on Building the Future of Social Trading

Original Source: Delphi Digital

Original Translation: Ismay, BlockBeats

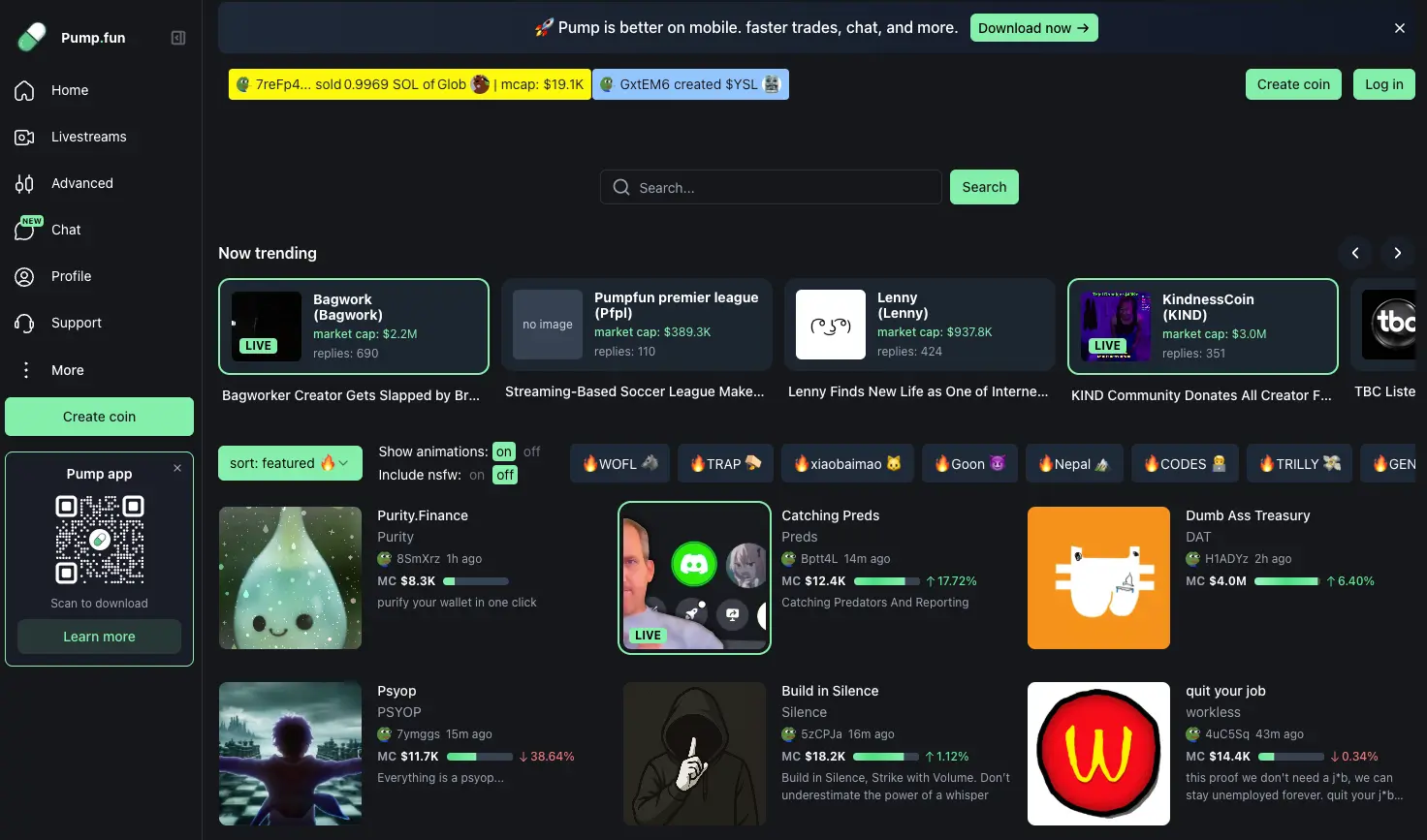

On September 11, Pump.Fun's native token PUMP was launched on the South Korean exchange Upbit, bringing renewed attention to this once rapidly growing crypto company. The meme craze is clearly not as vibrant as it was last year, but the competition in the space where Pump.Fun operates has been fierce over the past year.

It is in this environment of "decreased hype and increased competition" that Pump.Fun's product and capital strategies have become more distinctive. This episode features Noah, one of the anonymous co-founders of Pump.Fun, marking his first public appearance in a podcast format. He aims to address external questions regarding Pump.Fun's token launch, buyback mechanisms, and other strategic moves, while also signaling a shift in the team's communication strategy. He hopes to showcase Pump's internal perspective and long-term vision through more direct dialogue, helping the community and potential users understand that the company is not content with being labeled merely as a "meme launch platform," but is attempting to open up a larger imaginative space through a product-driven approach.

01 Nine Startups Led to Pump.Fun, Coinbase is a Failed Company

Delphi Digital: Hello everyone, it's great to have you here. Today we have a special guest—Noah (@sapijiju), one of the co-founders of Pump Fun.

Pump launched last year and quickly swept the market, with data performance being quite remarkable. By the fourth quarter, they had a highly anticipated token issuance. Earlier this year, they raised a significant amount of funding, with the token initially surging before retreating, currently priced about 10% above its ICO level. From a market share perspective, they were once the absolute leading launch platform, briefly overshadowed by Bonk, but have since regained their share.

According to the latest data, their revenue over the past month is around $50 million, almost entirely used for token buybacks on the order book. This trend continues, which is a core reason for attracting attention. In a market environment where no one would describe it as "prosperous," they are still able to achieve such a scale of buybacks, amounting to an annualized buyback volume of $600 million. So everyone is eager to see what they will do next. They have substantial funds and long-term plans; the key is to understand how they intend to deploy this capital and expand the platform.

Friends on Crypto Twitter should know Alon, but conversing with Noah has helped us better understand Pump's role in the crypto industry, not only in terms of its internal growth but also how it drives the development of the entire crypto sector. So, Noah, I’m really looking forward to starting with your background. How did you ultimately invest your life into Pump?

Noah: I think some people might know me more from the investment side, which is my primary role, so I tend to keep a low profile.

However, we feel that now is a suitable time to talk more openly about the product and bring some different internal perspectives. Because when many people think of Pump, the first image that comes to mind is Alon on Twitter and our corporate account. That account does quite well, sharing our plans and so on, but its audience is limited. What I want to discuss today is that Pump's future is not just a part of the current "Trench" ecosystem; we genuinely hope to develop this company into something much larger.

Many people think of Pump as a small team with not many people behind it. But in fact, the situation is completely different now. We have three co-founders: myself, Dylan, and Alon. Currently, the team working directly or indirectly on the Pump platform is close to 70 people. We are quite a large team and are still hiring, hoping to advance further in competition.

Regarding my background, to be honest, I have almost no formal background. Alon, Dylan, and I are all very young. I started a company related to Pump when I was 19. Before that, I basically just went to high school and spent about six months in college. Since I was 16 or 17, the only thing I did was related to cryptocurrency.

Initially, I got into mining, and at that time, my dorm room was heated to 35 degrees by four GPUs. With about $10 a day from mining, I gradually entered this field. My first job was actually as a moderator for a Discord community. I wanted to quickly find a way to connect with users and investors, so I soon joined a project called SoJava NFT Pub, which aimed to create an NFT futures exchange.

I remember you might know Joe; we discussed this project back then. I was about 18 or 19, and it was during that time that I started collaborating with Alon. I even suggested to Joe to bring Alon on board. Joe is a great person, and he is still an angel investor on our platform, interestingly witnessing the project's inception.

After that, I maintained the mindset of "finding something that can be done." I met some people through business development and built a network at conferences. Later, I decided to leave NFT Pub and start new attempts. Initially, it was still in the NFT space, where our idea was to create a product truly aimed at consumers. That was over two years ago. We tried many things, but the infrastructure at that time was a complete mess, with almost nothing being genuinely utilized.

Of course, there were exceptions. For example, Daniella's MIM, although many people later rated it poorly, at least what he created was used, and MIM was widely used for leveraged trading. Another example is Terra Luna; despite the tragic ending for many, UST was indeed used by millions at that time. For me, the inspiration from these cases is that if we are going to do something, it must be a product that can be used by thousands or even millions of users, rather than relying on some false narratives or endorsements from prestigious schools or VCs to fool everyone.

Our goal has always been to create a product that can be widely used. If we can truly achieve this, I even hope to completely exit this industry in the future. Because from the current situation, the crypto world is not doing well; it needs real change to develop to a scale that can alter the industry landscape.

Delphi Digital: I’m actually quite curious about why you ultimately chose to create the Pump product, as its initial positioning was to prevent "rug pull projects," providing a service to the market. It quickly found its product-market fit, not only within the crypto circle but also outside of it. I want to ask how you got to this point? Why did you determine that Pump was the "killer product"? What insights did you gain during this process, including before and after the token issuance? Because in our advisory work, we often see that once a token is issued, it can turn into a whole new "beast." It can serve as fuel to ignite flames or become a disruptive factor at some stage. So I’m really interested in hearing your thoughts on the different stages of the product before and after the token issuance, as well as the changes throughout its lifecycle.

Noah: In fact, many people do not understand this. We have told this story several times, but I think people really need to understand how difficult it is to achieve PMF (Product-Market Fit). Looking at the top 100 tokens by market cap now, there are probably only about fifteen that have truly achieved PMF; the rest are basically somewhat fraudulent.

Our journey to today has actually been built on one failure after another. Since founding the company that operates Pump, we have tried eight or nine different ideas. For example, we created an NFT Launchpad, which had a mechanism somewhat similar to Pump's current logic; my co-founder also worked on an NFT AMM; we even tried a financing model for content creators—where a TikTok creator could sell 5% of their future income in advance and tokenize it, but that model failed. We also tried a revenue-sharing mechanism for crypto auditors, somewhat like professional poker players selling part of their shares to reduce volatility, but that didn’t work either.

Later, we even tried to fork FriendTech, conducted "vampire attacks" on FriendTech, and even experimented with meme coin mechanics. These projects came one after another, but at that time, we didn’t raise much money, unlike other companies that could secure millions in funding. We only had a few very loyal angel investors supporting us. So we had to keep trying over and over again, and the process was very tough. You spend months working on a product, launch it to the community, and no one pays attention. You post a tweet, and people glance at it and think, "What is this? Not interested," and then scroll away. That feeling of defeat is really heavy.

It wasn't until the ninth attempt that we successfully "hit" the market with Pump.

Looking back, it’s quite interesting because we still have some old project prototypes. If you compare them, you will find that Pump is like a "collage" of all our failed products. The UI design of the NFT AMM is quite similar to Pump's current UI, and the logic of financing content creators has also been carried over to Pump. You could say that Pump was born from blending past failures together. So the biggest takeaway is the repeated failures until we found the right thing. We still maintain this mindset when developing products.

This way of thinking is about constant experimentation. Over the past year and a half, we have tried many different directions. And to be honest, not to boast, but if you really look at what has happened in the crypto industry, you will find that almost no one is truly innovating.

Think about it, what has really been done in the crypto industry over the years? Besides recreating a PerpDEX or launching a stablecoin with slightly altered mechanics? We have done live streaming, created chat features, developed social functionalities, and even launched a mobile application that now has hundreds of thousands of users.

Indeed, these features are not unique in the world of centralized exchanges, but if you look back at the entire crypto industry— in my view, there hasn't been a truly successful crypto company to date. For example, Coinbase, I really don't think it's a good company. What has Brian Armstrong really done? Essentially, he was just the first to productize a Bitcoin wallet, and as a result, he was pushed along by the times.

Many people need to realize that most of the so-called innovations in the crypto industry are actually outdated, lacking real breakthroughs, and have failed to drive the future we expect. What we aim to do with Pump is to continuously take big risks and try things that can expand market share—not just within the crypto industry but also reaching beyond it.

Looking at the leading companies in the crypto space, I think Tether is indeed an impressive business. But what about the others? Their ceiling is only a few hundred billion dollars. On a global scale, these companies can actually be considered failures.

In contrast, Facebook/Meta has a market cap of $2.5 trillion, or Saudi Aramco and Tesla—these companies have truly made an impact globally. Over the past decade, crypto companies have basically not done anything that genuinely changes the world. In my view, most large crypto companies have grown primarily due to Bitcoin itself, rather than their products.

If Coinbase had simply used all the funds raised to buy Bitcoin back in the day, the cash on their balance sheet today might not be much less than what they actually operate with. Sure, you could say they made Bitcoin more accessible, which could be seen as promoting democratization, but the fact is, many crypto businesses are just "tied to the index," benefiting from the overall market rise. So what we really want to do is break out of this "crypto matrix" and try to do things that no one has done before.

02 The Creator Economy of Pump.Fun

Delphi Digital: Speaking of your recent moves to realize this vision, you just launched a streaming feature, specifically enhancing the creator fee mechanism. The most significant change is that you increased the initial binding curve and the fee ratio in the early stages of market capitalization. But these new fees are not taken by you; they are all given to the creators.**

From the trader's perspective, this 1% fee has almost no impact in an environment where the token can fluctuate 10% every few minutes, and it won't hinder their operations. But for creators, this is a considerable income. You previously showcased some examples where, under the new fee mechanism, creators' income can be 10 to 20 times higher than before. The data is also impressive; on the first day of the new mechanism, $2.4 million in fees were directly allocated to creators.

So, there are not only impressive total figures but also a grassroots story: some small creators who previously had no viewers can now earn a considerable income even if only a few people are watching. I would like to hear your thoughts on this and your future plans.

Noah: I want to say first that everyone has already seen some results in the creator segment; this is just a very good start. But for those who think Pump is just a meme coin issuance platform or only focuses on meme coins, I hope you can take a step back and really see what this product is being used for and who is using it.

I want to emphasize that many of Pump's users are young people. My observation is that the crypto world is actually divided into two market segments: one is people over 30 who have made a lot of money through Bitcoin, Ethereum, or projects like Polkadot; the other is a new generation of users, roughly aged 16 to 24, who are entering the crypto world, and they are precisely the driving force behind Pump.

We never intended to create a "meme coin platform"; that was never the goal from the beginning. What we want to create is a platform where all content can be traded—short videos, live streams, YouTube-style video content, tweets, and so on.

Imagine a world where every piece of content on the internet can be invested in, traded, and shared. We found that the core feature of Pump is that it is essentially a social product. When you issue a token on the platform or discuss a token, that token will rise due to the discussion. Similarly, any content that is talked about will attract more people. Initially, we thought it was enough for creators to have their own tokens, but they must sell tokens (for example, selling part of their YouTube video tokens) to make money, which is clearly not the ideal path.

In this world, especially in the fast-paced tech startup field, a product must be 10 times or even 100 times better than the competition to truly win. Our plan to challenge those large social media companies is that if you live stream on TikTok or Instagram, even if you have 5,000 followers, your monthly income might only be $10, $20, or $50, which is far from enough to live on. But on Pump, we set up mechanisms from the beginning to allow content creators to earn 100 times more than traditional social media. Besides the token logic, the recently launched creator fee mechanism has completely exceeded my expectations.

I think we might be approaching a "escape velocity PMF moment" in the creator space. Just last night, I saw a streamer on Pump with only 20 viewers, who had been live for just 8 minutes, and it was his first time streaming on Pump, but he had already earned $300 in fees. This shocked me, but at the same time, it was also expected because this is exactly the result we designed from the beginning.

If you compare it to a streamer on Twitch who is live for the first time with only 20 viewers, they might only earn $0.50 or $1 in a month. But on Pump, the same 20 viewers can bring in $300 in income. This means our product directly provides a 100x, 300x, or even 600x increase in earnings. What do creators on TikTok, Instagram, Twitter, and other platforms care about the most? Of course, they care about their audience, but the core concern is still economic incentives. The world we want to build is one where creators on Pump can not only make money but also leverage network effects to reach a larger audience, thereby attracting more quality content creators to join.

This is our plan in this direction. The current new creator fee mechanism is just an early version; we will continue to iterate and optimize it to make it more suitable for the general user. Once this adjustment is completed, it will release very unique value. We have now launched a mobile application, which will allow the product to spread faster. At the same time, we have also implemented a built-in direct messaging feature (DMS)—I haven't seen any crypto company directly add private messaging in their product interface.

From the beginning, our thinking has been about how to incorporate social attributes into the product. Why? Because if you look at OKX, Binance, Bitget, Coinbase, MEXC, KuCoin, they are all essentially cut from the same mold; their UI is just a re-skinned version of the 2017 CZ model, with no differences in the product, and everyone is just competing on marketing.

To truly succeed, you must carve out a completely different path. Apple's slogan is "Be different, not better." If the reason users come to the platform is not because of some influencer's recommendation or an advertisement, but because friends are chatting here, the people you follow are creating content here, and you can interact with the content and make money, that creates a whole new moat. That is what we truly want to do. The first time I saw the "live streaming screen + real-time price curve" interaction on Pump, I realized this is a brand new content form, and I genuinely believe it will sweep the globe.

So back to your question, what we want to create is actually a hybrid, blending TikTok, Robinhood, Twitch, and Pump.Fun into a super app that allows Gen Z users to trade while creating and consuming content.

Because if you talk to people from my generation, many, especially those not completely consumed by work, spend an extraordinary amount of time on TikTok. Many people spend up to eight hours a day scrolling through TikTok. I think just that number is quite shocking, even a bit hard to believe. But once you layer a financial aspect on top of that—meaning you’re not just spending eight hours watching content, but you can also trade that content and even invest financially in each piece of content—then I think something very special will emerge.

Twitch itself is not even a profitable company, which is quite crazy. This large company has a global valuation of about $48 billion to $50 billion, according to market estimates, and of course, it was acquired by Amazon. But if you really look deeper, it might just be a way to help AWS bill clients, with very little real value.

Kick is similar; it doesn't make money and is essentially just a way to funnel funds to Stake. So when you really look at the world, you find it quite distorted; many companies haven't made much money. This is also why I think Pump is cool, because it genuinely makes money, and the profit margins are very high.

Delphi Digital: I think this is particularly worth discussing in depth. For example, during the ICO boom, many people focused on the fact that these teams had about $2 billion in cash, and then they were going to target the streaming industry. But hearing you say this makes it quite interesting because your goal isn't even Twitch or Kick, right? They themselves are not profitable companies worth chasing.**

What intrigues me more is that you don't seem to be spending a lot of money to sign big streamers like Kai Cenat or Aiden Ross, spending a large sum with almost no return on investment. Instead, your focus is on the other end—those lesser-known creators and streamers, giving them the opportunity to gain an audience and earn money. How do you see streaming fitting into your strategy? For instance, in your goal to take down big platforms like Facebook, TikTok, and Twitch, what role does it play? And now that your token has been launched, what will be the most important strategic focus in the near future?

Noah: First, I want to emphasize that the best products will always win. Take the story of Airbnb, for example. Brian Chesky founded Airbnb, but around 2007, it gradually expanded into Europe. At that time, there were three brothers (I can't remember their names) who created a "copy" of Airbnb, and as a result, they had a larger market share in Europe than Airbnb itself. Chesky started to panic and called his friends to discuss whether they should acquire the competitors or take some measures. It is said that he even called Mark Zuckerberg, and the advice he received was to ignore them; the best products will always win.

I think this is the pattern. If your product is clearly superior to your competitors, users will eventually turn to you. Therefore, I believe the primary task is to build Pump into a "product-driven" company. We must be extremely focused on what users are doing, continuously collect feedback, communicate with users, understand their pain points and concerns, and then quickly iterate based on that feedback. Only in this way can we make the live streaming part of the business truly operate independently.

Regarding big streamers, we are certainly considering that as well, but many people may not know that we recently spent about $500,000 to procure a batch of "streamer starter kits." These kits include cameras, monitors, keyboards, mice, and other equipment to help newcomers start live streaming. If you contact us, we will send these kits to you after screening. We don't want to spend a lot of money hiring established big streamers to create content—what's really crucial is whether the product can achieve PMF (Product-Market Fit).

Looking back at the most successful products in history, Netflix, Amazon, and even Twitch, they were not built through advertising but through word-of-mouth—friends telling friends. So our current focus is to support the first batch of content creators, providing them with tools and opportunities to produce their own content. This is how we can truly establish the initial user base.

Our current logic is that if streamers can earn significantly more money on Pump than on other platforms, the first step is that they will be attracted here to start creating content. Then these creators, who already have followers or friends on Instagram, Twitter, or other social platforms, will naturally bring those people to Pump to consume content, and that's when the network effect begins to kick in. It doesn't matter whether they are small or big streamers; as long as they find the product better, they will gradually bring people over, and the scale will expand.

For Pump, the goal is clear: as more and more people accumulate followers and create more content, the logic remains the same—more content will generate more tokens; more tokens will lead to more trading volume because more high-quality tokens will appear in the market. This way, these streamers can not only bring in new streamers and creators but also a whole new audience—something that other crypto companies have never been able to reach. For example, I've never seen anyone watch Kai Cenat's live stream because of Coinbase.

Another point is that users spend very little time on financial apps. For instance, on Bybit, you might check your positions and casually scroll through, but the average duration isn't long, making it hard to achieve real monetization. In contrast, people spend hours scrolling on Facebook or Instagram. But on Coinbase, you might just open it to take a quick look.

So our real focus is still on PMF—first getting the streamers in, then driving more content creators, creating a continuously growing cycle. Even if only 10% or 5% of the audience eventually converts into traders, it will expand the entire market. Many of these people may not have known what cryptocurrency was before, but they come in because of the content, use the product, and find it very useful, gradually sticking around.

Delphi Digital: I find it interesting that you emphasize content so much. This is actually a topic that is often discussed internally at Delphi. For example, many of our colleagues are optimistic about Zora; their goals are quite similar to yours, but their approach is almost completely opposite. Zora starts with content and then attaches tokens to it, while you start with tokens and then generate content around them.

So I'm curious about how you view your own model compared to Zora's model. Personally, the longer I think about it, the more I feel this idea makes sense. Because now we can easily control our diet, like what to eat and how to pair it, but "information diet" is the hardest to control. When I scroll through my Twitter timeline, if I can find one or two pieces of valuable content, I have to endure hundreds of boring posts and junk information. I think things like Pump or Zora might actually help filter out more valuable and relevant content for me.

Noah: Yes, because money ultimately points to things that are truly valuable, whether it's because they are "blockbuster" enough or because of the inherent value of the information itself. I have actually deleted all social media from my phone because I really don't like those things. They drain your energy. Those who endlessly scroll are, in my view, in the worst state. If you really have to do that, you might as well make it at least bring some economic return instead of purely wasting your life.

As for Zora, I think their team is great; they know what they are doing and are exploring a different niche. I don't think we are in competition. But one point I always emphasize is that you must focus on current users, not future users. We have made similar mistakes in our product development process. When Pump first launched, we initially wanted to directly impact the social media level but skipped many necessary steps. Now we have strategically adjusted to focus more on existing users and gradually bring them into the next phase.

If you look at the most successful products in the world, like Instagram, WhatsApp, Signal, or even Google, you will find that there hasn't been much change since their inception. WhatsApp has been almost the same product for over a decade, with only very minor changes. But it is these small changes that have allowed it to break through the "escape velocity" of users, from ten million to one hundred million, and then to one billion. For example, supporting multiple languages and expanding the group chat limit to thousands of people—these seemingly trivial updates can lead to significant leaps for the product.

So our approach to Pump is the same: serve existing users well and continuously make small, precise improvements. For instance, the "creator rewards" we just launched today instantly increased the number of live streams on the platform fivefold. Because this minor optimization immediately produced a huge effect.

Many people look up to Instagram and think they are impressive. But in fact, most of what they do is copy—copying Snapchat's story feature, copying its direct messaging, and copying TikTok's short videos. It seems pieced together, but the underlying product architecture has never changed, only slightly updated. Ultimately, this is the best path. The same goes for us; small changes can lead to huge ripple effects.

Twitch is currently valued at about $50 billion, and their concurrent viewers at any given time range from about 70,000 to 90,000, based on the data I've seen over the past four months. Meanwhile, Pump's live streaming peak, even now, can achieve 3% to 5% of their user base. If you do some "napkin math" and combine the valuation with growth potential, it becomes very interesting.

That said, I still adhere to the "product first" philosophy. You need to continuously iterate and grow slowly, rather than trying to leap ahead in one go. You want users and viewers to grow alongside the product, not the other way around.

Delphi Digital: I'm curious about the behavior patterns of those streamers who have migrated over. What do you expect them to do? For example, will they just issue one token and make it attractive? Or will they try different themes?

Noah: Let me interrupt here; this point is important. We will not force user behavior. Just like if Elon really acquired Twitch, he wouldn't require everyone to post content about elections or upload certain types of videos, right?

The beauty of social platforms is that you need to give creators complete freedom of choice. It’s more like a sandbox where everyone can express themselves freely, create, and innovate. That’s the most magical part because no one knows what it will ultimately develop into. It’s very similar to the early story of YouTube; it has a kind of magic. Pump itself also has similar qualities; for example, I remember a user came over with a paper plate under their chin—this completely unique content doesn't exist on other platforms but can give rise to a whole new niche and use case.

So our logic is to build the "sandbox" and let it grow on its own. Then we observe how people use it, what they need, and we will invest more resources to support their goals.

For example, many people may not know that we developed the live streaming feature because we were particularly focused on users. At that time, we found that users were watching developers' live streams together in Telegram voice channels. So why not integrate this scenario directly into the product? This way, we can enhance social connections within the platform.

Think about it: what app does everyone in the crypto industry use? Telegram. Its usage frequency is even higher than Binance. If we can find an effective monetization method based on Telegram habits, we can combine trading with social networking.

This should resonate with you VCs or LPs, right? Whether you're discussing big or small deals, you're actually communicating on Telegram, right? Twitter feels more like a "public square" where people chat and collide with ideas; but real friends, partners, and business relationships are all on Telegram. So, if we can build a more native experience for crypto users on Telegram, it would be very exciting.

For instance, the bots currently on Telegram are mostly quite rough and not user-friendly. But what if we could create some truly tailored features for traders and crypto users? For example, a dedicated application to help VCs invest in larger projects or participate more conveniently in small-cap investments, combining this social experience with trading experience—now that would be interesting.

03 Why Are There So Many Participating Institutions in Pump.Fun's ICO?

Noah: Additionally, I want to briefly discuss Pump.Fun's ICO. Many people ask why Pump is collaborating with so many different partners. Why are certain large institutions involved? There are actually complete considerations and processes behind this…

What we want to do now is create a truly "decentralized" issuance platform, breaking the current single structure in the market. Right now, if you want to issue a token, your options are limited, and most rely on those large token issuance platforms. But in the future, we will definitely invest more effort in building a platform that allows you to issue tokens or do ICOs simultaneously in ten different places, making the whole process as simple and user-friendly as a one-click permission delegation. This way, we can compete with giants like Coinbase in this area, which I find very interesting.

I may have digressed a bit, but speaking of Pump's development direction, if you look at the current product form, you will find that as long as users are active on our interface, we can generate huge revenue and accumulate substantial funds to support various experiments, and that is the exciting part.

Many people may not know that Pump.Fun has locked over $1.6 billion worth of Solana in LP pools, and these funds can never be withdrawn because they have all been sent to the mainnet's burn address. This means that even if all tokens on Pump were to go to zero (which is obviously impossible), there would still be about $1.5 billion worth of Solana permanently locked in these pools. This clearly provides significant support for the price of Solana.

This is a very interesting fact. Moreover, if you look at the trading volume of these tokens on Pump, whether they are small-cap tokens or large-cap tokens that have "graduated" to larger platforms, the daily trading volume is generally between $700 million and $1 billion.

Now let's shift our perspective to the stablecoin market. The daily trading volumes of USDT and USDC are indeed very large and are truly widely used base currencies. But looking further down, for example, DAI, I don't even consider it a stablecoin because it has no trading volume; it is essentially a leveraged product.

So theoretically, if we were to create our own stablecoin in the future—which might take at least a year—it could very well enter the top three stablecoins in global trading volume. Because trading volume means usage, and usage means growth. When you have an ecosystem that is being used by hundreds of thousands or millions of users simultaneously, you can build a series of new products on that foundation, and these products often perform exceptionally well.

To be honest, I am still quite young, and others on the team are too; I am only 21. So what can I do in the next twenty years? Our platform has indeed made a lot of money, but the more important question is what I want to create in the next twenty years. I feel that our plan is to build something that can have a long-term, global impact; that is the direction our company truly wants to optimize and pursue.

Delphi Digital: There are many rumors out there that you might be looking to create your own L1 or something similar. I'm curious about your mention of stablecoins; while this isn't an immediate core goal, it could serve as a direction or new product to expand upon in the future. I would like to know what other ideas your team has seriously considered. Can you share some thoughts that you think could be communicated to the market? Of course, I understand there are many copycats out there, so you might hold back some details.

Noah: Of course, I can share. I think we might be a bit blunt about this, but the overall vision is that Pump wants to become the most interesting place in the crypto world. At the same time, we basically want to take over the entire world; that is the plan. So everything you just mentioned, whether it's discussions or speculations, is indeed within our consideration, and some of it is even already in development.

Our goal is to completely scale this thing up and swallow all products in the crypto space and beyond. Absorb, acquire, crush—take it all. That is the long-term plan for this product.

Delphi Digital: Another point of interest is that you have a considerable amount of funds on your balance sheet. What specific directions do you plan to spend it on? For example, you previously mentioned investing in creators and even set up a small fund specifically to buy back some tokens, possibly to incentivize users and drive activities. I also want to know what your considerations are regarding mergers and acquisitions. Are you more inclined to acquire certain types of companies or fields rather than building from scratch?

Noah: That's right. I think the key question is—having money is certainly good; many companies indeed have large amounts of capital. But spending money is easy; spending it effectively is the hardest part. The companies that can truly win in the long term are those that can achieve "money making money."

It may sound a bit silly, but that is the most fundamental issue. For example, if you spend $100 on an incentive activity and it brings in $120 in revenue, that is a truly effective investment. This is also the part that is most difficult to execute in detail; it requires a step-by-step approach.

Don't forget that the platforms and competitors we are benchmarking against are giants like Binance, Coinbase, Hyperliquid, and USDT. They have not $2 billion but $100 billion or $200 billion at their disposal, ready to wipe you off the map at any time. So cash, for us, is essentially a strategic resource that must be used to solidify our position and then gradually expand our influence.

I believe there are many ways to achieve this goal. For example, through acquisitions, it doesn't necessarily have to be particularly large projects, but rather those products that you believe can have a substantial impact on the business after acquisition.

Or you could take a route similar to Facebook, which had a large amount of cash. Although Facebook's main business at the time wasn't making a lot of money, it used the funds raised from its IPO to see the rise of WhatsApp and the potential of Instagram, and was willing to pay a high price to acquire them. The result was that it captured the next wave of consumer trends, converting more users into its ecosystem and driving product growth.

So we are always looking for those "small but critical" things that could have a huge impact, even if they might be independent products, but ultimately can be integrated into our larger product family. At the same time, we are also constantly experimenting, such as spending money on various incentive measures, live streaming incentives, professional trading incentives—almost everything you can think of has been tried.

But the key is to conduct detailed A/B testing, and this scale is often at the level of millions of dollars in A/B testing, to verify which ones are truly effective and which are not. Then once we find hotspots or potential solutions, we invest a large amount of capital to scale it into exponential growth. This is the complete logic behind us.

But again, the most important takeaway is that capital is a weapon; you must use it wisely. Blindly spending money does not equal growth; spending money wisely is key. Only in this way can you truly aim for a market cap target of $500 billion or even $1 trillion.

Delphi Digital: In the past two or three months, you must have had investors reaching out to you every week, right? Have you seriously considered this internally?

Noah: We have indeed considered it. I don't want to say too much right now, but I can confirm that this matter is indeed within the discussion scope; that's the simplest way to put it.

04 Discussing a16z's Rejection of Investing in Pump.Fun

Delphi Digital: Great. Back to the topic of buybacks, you have done about $50 million in buybacks over the past 30 days, mainly because the initial ICO allocation ratio was later adjusted to use almost 100% of daily revenue for token buybacks. Previously, there were rumors in the market that you would commit to using 25% of your revenue for buybacks, but that changed a few months later, and now it resembles Hyperliquid's model, which is about 97%. How will you arrange your buyback strategy in the future? Are there any plans you can share?

Noah: Currently, the total amount of Pump buybacks is about $71 million, and so far, we have bought back over 5.3% of the circulating supply. Initially, the platform was buying back at a rate of 25% of revenue, if I remember correctly. Recently, it has changed to using almost 100% of revenue for buybacks.

I think by looking at the successful cases of this cycle, we can infer the future performance of crypto companies. For example, Hyperliquid, which used nearly 100% of its revenue for buybacks, pushed its token valuation into the range of $40 billion to $50 billion.

Another example is Binance in its early days; it also used 50% of its revenue directly to burn BNB, though I can't recall the specific mechanism. For our Pump team, we will learn from the most successful platforms in the industry; their strategies have been proven effective, and we know what works and what doesn't.

When we were looking for investors early on, I tried many times to reach out to Marc Andreessen. Through various friends, sending DMs, and even trying to connect with various angel investors, I just wanted to have a conversation with him or find someone like Andrew Horowitz at a16z. At that time, we thought they were "holy grail" investors, believing that if we could get their money, it would make a decisive difference for us. But it turned out that this was completely the wrong idea.

By the way, here's a piece of advice for all entrepreneurs: money is just money. Except for a very few unique investors, the brand of a VC will almost never have any impact on your business outcomes. If you are pursuing them just because of a VC's reputation or trying to label yourself with them, it is completely unnecessary; just ignore it. This is the first lesson I learned. We tried to reach out, but they directly rejected us, unwilling to talk, citing the reason that "you are making meme coins."

But this is also quite interesting. On one hand, many traditional VCs, older investors, simply do not understand what young people are doing. If you ask those in their fifties or forties, "What are your kids doing? What is my nephew doing? What are my interns doing?" they really have no clue. But if you actually go into the office and ask these young people what they are doing in the crypto space, at least half of them will tell you they are trading meme coins.

So I think it's time to change the perspective: this may no longer be a simple "meme coin phenomenon," but rather a larger cultural shift.

When we approached Andreessen, they rejected us, showing no interest, citing the reason that "meme coins have no value." But ironically, if you look at some so-called hot projects, like Story Protocol—this, in my view, is one of the biggest scams I've ever seen. I was truly dumbfounded and couldn't believe it.

But this kind of thing is now packaged as "the most sought-after project," with a whole bunch of so-called top investors backing it, like a16z and Horowitz, and the result is just blatant "money grabbing" in broad daylight.

I really, strongly detest this aspect of the crypto industry, where some people create products but pretend they are something revolutionary, pretending they can change the world, pretending they can attract millions of users, when in fact no one is using them.

It's just a few wealthy individuals coming together, throwing money in, inflating the token prices, possibly accompanied by market manipulation, fraud, and various other malicious behaviors, and then systematically squeezing money out of retail investors, harvesting from ordinary people and young people who want to enter the market.

This perfectly illustrates why Pump will succeed. Why do people want to use Pump? Why are they willing to trade with fun image tokens? It's simply because they are utterly disappointed with everything else—those things are just garbage.

This situation shocks me. Because when you buy any coin on Pump, you won't be deceived; you know what it is—it's just a coin, purely for fun. Unlike some projects that tout "interstellar interoperability" or other crazy concepts, which are actually just blatant scams. The scary part is that people are still attracted by these flashy narratives, like "interoperability" and "zero-knowledge proofs." But do you know anyone who has actually used ZKSync? To me, that is truly terrifying.

This scam has been ongoing in the industry for many years. They tout the slogan of "changing the world," tricking community members and investors into buying these tokens, but what’s the result? Not a single real user is using their products. So can you blame people for trading tokens on Pump? Essentially, buying ZKSync and buying a Pump coin is the same thing.

Moreover, the fact is that if these Pump coins are large enough and the projects are profitable enough, they can also create products, which are not fundamentally different from so-called infrastructure projects. The phrase "let's believe this will moon" is no different from "let's believe this will create a new interoperable chain"; both are essentially slogans for raising money. The only difference is that the latter comes with a bunch of strange lock-up terms and dark, complex financial engineering that transfers money from retail users to the pockets of VCs.

Then you see those big institutional investors come out, talking about "the future of finance," while what they are really doing is cashing in to buy luxury homes, shifting the burden onto the young people who are truly driving this industry—in my view, the ones creating interesting things are the generation in their 20s to 30s.

I think if we take a step back—sorry, I digressed a bit—but from a global perspective, there hasn't been any truly groundbreaking innovation in the past twenty years.

The last product that truly changed a generation was something like Facebook, which indeed had a global impact. Of course, TikTok, Bitcoin, and ChatGPT are also significant breakthroughs, and you could say they are impressive. But ultimately, it might just be a better Google. Well, it is indeed more advanced, but to what extent has it really changed our lives?

This is the first question worth asking: the world hasn't changed that much. If you look closely, you'll find it quite frightening. Then you might ask, where are the young entrepreneurs and talents? They are either working on various AI-wrapped applications (the so-called ChatGPT shells) or in the crypto space.

This is also one of the reasons I eventually entered the crypto field—because the young people I know, those under 25, even under 22, whom I believe will change the world in the future, are either in crypto or in AI. And I can almost guarantee that AI is largely being hyped. For this reason, crypto feels more real to me.

This has also changed the way I see the world. If you look back at Silicon Valley back in the day, like Elon Musk, Peter Thiel, and a group of Silicon Valley entrepreneurs, what were they doing twenty years ago? It was actually quite similar to what we are doing today. They were trading stocks, speculating on concept stocks during the internet bubble, constantly telling stories and pumping prices, just like today's "token issuance." But if you extend the timeline by 25 or 30 years, the companies these people built became the ones that truly changed the world and achieved great success.

One more point I want to add is that some of the most successful and wealthiest people I have met spend a lot of time with young people. This is not a strange thing; they know where the talent of the future lies. If you want to know where the world will go in the next 20 or 30 years, you must look at what young people are doing now; that is the real "Alpha."

Delphi Digital: Exactly, I completely agree. There are indeed many points worth expanding on. In the past two or three years, when chatting with some "outsiders," I have increasingly felt this. Even when I tell them, "As long as you hold a basket of top assets like Bitcoin, Ethereum, and Solana for the long term, it will definitely rise," their feedback is often, "But Bitcoin has already missed a hundredfold increase."—even though they believe in Bitcoin's long-term value.

Noah: People are always thinking about "doubling their money again," but how can you sustain a tenfold increase? It's impossible, right? I think every generation creates a brand new market, a brand new financial stage. For example, you might be ten years older than me and have been very successful in the crypto space. But why did you enter crypto back then instead of staying in traditional finance? Because the previous generation of "baby boomers" had already made a fortune by speculating on Apple stocks and similar assets. Once they inflated the market cap of those assets to the size of an African country, what could you do? You could only look for the next layer of new things. Thus, Bitcoin, Ethereum, Polkadot, Cardano, and others were pushed up, allowing people aged 25 to 35 to make money a few years ago.

But now, when these assets are trading at extremely high valuation levels, you need to create something new to give young people a chance to "get on board." Looking back at history, this pattern has never changed. In the 1980s, investment banks were the stage for "wealth creation"; then it was the internet, where everyone flocked, creating the giants of that era; and then came crypto, and now it's AI.

Everything is essentially "skin deep"; what you see today is not fundamentally different from the cycles of 20 years ago. Think about it carefully; it's quite frightening because it reflects the essence of human nature—repeating the same patterns over and over again. Speculating on my AI stocks and speculating on pets.com back in the day, what’s the difference? They are essentially the same garbage, just wrapped in the clothing of a different era.

Delphi Digital: Interestingly, you know that when we first started Delphi, we were a fundamental research institution, so I was indeed late to the meme game and took quite a few detours along the way. Later, one of our good friends, Anson from Delphi, was the first to clearly explain this logic. His point is that the older generation plays the lottery, with a one in a million chance of winning, yet the lottery has become one of the largest industries in the world. Meanwhile, Generation Z plays the "meme coin lottery." The difference is that they can increase their odds from one in a million to one in a thousand by integrating into culture, scrolling through TikTok, and catching trends. This is the essence of meme coins—a "lottery" that is more in touch with culture.

Noah: Exactly, and the odds in crypto are much better than in other places in the world; this is not just talk, but there are reasons for it. Because more and more people are coming in, this industry naturally attracts them. After all, this is one of the few places in the world where you can still carve out your own path.

In other industries, everything is highly solidified. For example, some of my high school classmates who are my age now work in investment banks, but their lives are like slaves, working for shareholder value until they are 40. That’s terrible.

The appeal of crypto, on the surface, is the narrative of decentralization, but I think the deeper reason is that it gives you an opportunity to create something different for yourself, to truly create unique value. Of course, people can label crypto with various "new tags," like "decentralized finance," but I think most of that is noise. What really matters is that crypto has captured the hearts of the younger generation. And that is key. Because the reality is that the world in the next 20 or 30 years will ultimately be built by the younger generation.

05 What Does the Future Hold for Pump.Fun?

Delphi Digital: Now there’s another tricky issue, which is that social media constantly reinforces the idea that you have no other way out; the only way to turn things around is to "gamble." This narrative makes people feel like this is the only path. Returning to the planning for the next few months, will live streaming be a major focus for you?

When people first saw the prototype of your live streaming feature, many immediately thought of an episode of "Black Mirror," where people do various extreme things to make money through live streaming, like pulling out their nails. Although your mechanism is completely different, that’s the question I initially wanted to ask. It’s not about what you will control, but rather what content you will observe as popular and then support those ideas. So I’m curious about how you see the development in the coming months.

Noah: First, I want to ask everyone listening to take out their phones and download the Pump mobile app; that’s the first thing I hope you do. Because all our future focuses will be "mobile-first." Why focus on mobile? The reason is simple: everyone has a phone in their pocket.

If I like TikTok or other apps, sharing on mobile is much easier than on desktop. Applications that are purely desktop-based, like Polymarket, are harder to spread. But with mobile, it can achieve viral distribution more easily. And when I say "viral," I don’t mean 2 million users or 5 million users; I mean a billion-level user base.

The benefit of software is that even a small change, like increasing the share rate by 5%, can lead to changes in hundreds of millions of users. So we will firmly pursue a mobile-first approach to make the product easier to break out. At the same time, we need to integrate with social media so that every interaction, every post, and every transaction can be seen by more people, thereby amplifying the impact.

Another interesting point is that Pump's revenue is already relatively stable, and user retention is strong, which gives me a lot of confidence. The current question is how to expand the market? How do we transform it from a business that "earns $2 million a day" to one that "earns $200 million a day"? The answer is to find something that can drive growth faster.

Delphi Digital: I’m quite curious. We’ve seen a lot of feedback on Crypto Twitter, especially around the time of your token launch, where people felt the communication was lacking. But recently, we’ve also noticed a significant shift—you’ve started to actively communicate while focusing on your work. For example, your willingness to come on this podcast and your interest in appearing on other shows is an important step in itself.

So I want to know, what can token holders and the broader crypto community expect from Pump and your team? Whether it’s short-term or plans before the end of this year?

Noah: Well, to be honest, the whole "Long" situation could have been handled much better; that was indeed our oversight. But we have learned from it, and that’s one of the reasons I’m here doing this podcast—we are making significant adjustments to our communication strategy, which is very important.

My Twitter DMs are open, and Alon’s Twitter DMs are also open. If you have questions about our future plans, feel free to reach out to us directly. I promise to take the time to chat with you, whether you have ideas or solutions; just DM me, and I will explain our thoughts and direction. I think that’s our responsibility. Look at those big companies, like Robinhood; a large part of their work is constantly communicating their vision to the world, and that’s what we need to do now.

Even now, I hope that those listening to this podcast can feel some different perspectives and see what differences there might be in the way Alon and I think. Our direction is aligned; it’s just the way we express it that differs. Ultimately, this is about more honest communication. Also, I’m not sure if I mentioned this before, but this is actually a two-part podcast series; this is the first part, mainly discussing the future of crypto; the second part will focus on how to truly go mainstream.

Click to learn about job openings at ChainCatcher

Recommended reading:

Pantera Capital Deep Dive: The Value Creation Logic of Digital Asset Treasury DATs

Backroom: Information Tokenization, a Solution to Data Overload in the AI Era? | CryptoSeed

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。