Written by: Glendon, Techub News

On September 15, the week-long Hyperliquid stablecoin USDH competition came to a conclusion, with Native Markets announcing via Twitter that it had won the Hyperliquid USDH stablecoin bid and had been granted the USDH code on Hyperliquid. At first glance, Native Markets, as a startup team, seemed inconspicuous among many strong competitors. However, its eventual victory was somewhat anticipated. Prior to this, the prediction market Polymarket indicated that Native Markets had a winning probability of 97%, essentially locking in the outcome in advance.

It is important to note that compared to established competitors like Paxos, Frax, Agora, and Ethena Labs (which later announced their withdrawal), Native Markets appeared to be at a disadvantage. Although the proposals from competitors varied, their core goals were highly aligned, engaging in fierce competition over how to maximize user benefits. They all promised to share 95% or even 100% of their stablecoin profits with Hyperliquid through the Hyperliquid assistance fund (for repurchasing HYPE tokens), ecosystem development plans, or direct buybacks. For example, Paxos committed to using 95% of USDH reserve interest for repurchasing HYPE tokens and distributing them to the ecosystem; Ethena Labs planned to allocate 95% of net income to the Hyperliquid community; Agora and Frax even promised to return 100% of net income to the Hyperliquid community or use it for HYPE buybacks. However, aside from its deep engagement in the Hyper ecosystem, Native Markets did not showcase any unique advantages in its proposal.

As a result, Native Markets, which had maintained a winning probability of over 90% in the prediction market, found itself embroiled in a whirlwind of public opinion regarding "pre-selection" and "backroom dealings."

Community Controversy Continues, Deep in "Pre-selection" Doubts

This accusation is not without basis. On September 5, shortly after Hyperliquid released the bidding announcement, Native Markets quickly submitted its proposal within just one hour. Coupled with allegations of biased voting behavior among some validators, this controversy escalated.

On September 10, Haseeb Qureshi, a partner at crypto investment firm Dragonfly, bluntly stated, "Initially, I thought the USDH Request for Proposal (RFP) was a bit of a farce. From multiple bidding parties, I learned that, aside from Native Markets, other validators showed no interest in other projects. It wasn't even a serious discussion; it felt like some backroom deal had already been struck."

He emphasized that Native Markets' proposal was almost immediately published after the USDH RFP was announced, suggesting they likely received internal notification in advance, while other competitors scrambled to organize their proposals over the weekend. Thus, the entire USDH RFP seemed essentially tailored for Native Markets. Furthermore, the community appeared to unanimously believe that the best proposals came from established companies like Ethena, Paxos, and Agora, rather than the startup Native Markets. "Polymarket's data corroborated this; once Ethena's proposal was announced, its winning probability skyrocketed, making it the most likely to win. However, when everyone realized that the validators were uninterested, within two hours, the winning probability plummeted to rock bottom."

Akh1 l, co-founder of Stronghold, also pointed out harshly that there was no visible advantage in Native Markets. He specifically mentioned that the on-chain issuance service provider Bridge designated in Native Markets' USDH stablecoin issuance proposal is essentially Stripe, which has a long history of extracting funds from clients. (Note: Bridge was previously acquired by Stripe.)

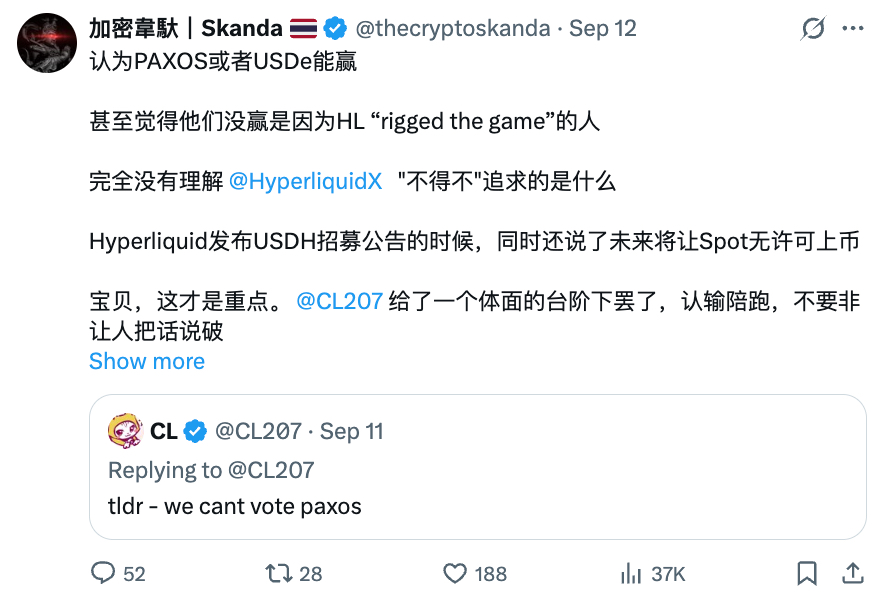

However, in response to Haseeb Qureshi's accusations, some validators stepped up to refute them. An anonymous trader CL (whose controlled validator Hypurrscan holds 15% of Hyperliquid's total voting power and is a core participant in platform governance) commented on his tweet in support of Native Markets, stating that the Native Markets team focuses on long-term development. He also pointed out that validators would seriously consider other newly announced proposals.

Another anonymous trader "aaalex.hl" directed the questioning towards Qureshi's position, claiming he publicly praised Agora as "the best proposal ever" while concealing his status as an investor in Agora and Rain Cope, which raises doubts about his impartiality.

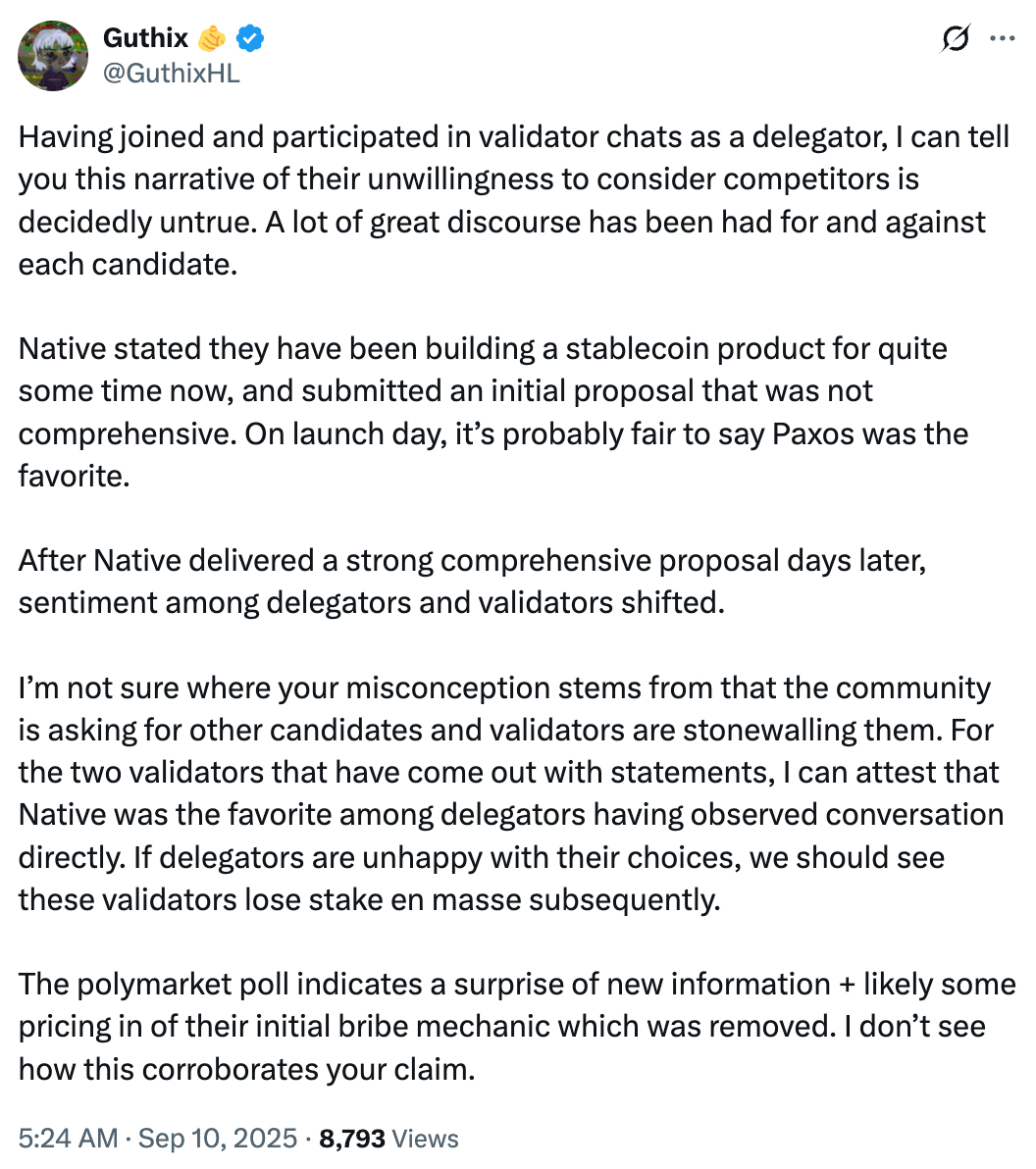

Additionally, crypto KOL "Guthix" calmly responded, "I joined as a delegator and participated in validator chats, and I can clearly state that the claim that validators are unwilling to consider competitors is absolutely false. There have been many exciting discussions regarding each candidate, both in favor and against. The Native Markets team stated that they had been building the stablecoin product for some time, and the initial submission was just a preliminary proposal that was not comprehensive. On the release day, most validators leaned towards Paxos. However, a few days later, Native submitted a highly persuasive comprehensive proposal, which shifted the attitudes of delegators and validators. I can attest that Native is the most popular among delegators, as I directly observed their conversations."

The controversy surrounding Native Markets has persisted to this day, but regardless of whether there was "pre-selection," it is now a foregone conclusion that Native Markets is the final winner.

As mentioned earlier, Native Markets' deep engagement in the Hyper ecosystem is its greatest advantage, which may also be the most valued characteristic by Hyperliquid and its community and validators.

In this regard, KOL "Crypto Veda" straightforwardly analyzed the deeper logic behind this matter: "If Hyperliquid wants to compete with Binance Alpha, Solana Pump, or even Gate, it must fight for the pricing power of token listings. History has repeatedly proven that whoever has pricing power can dominate the market. The prosperity of BSC was due to BUSD printing; once it detached from BUSD, Paxos was just an ordinary issuer. Therefore, Native Market's victory is actually an inevitable choice."

Details and Impact of the USDH Proposal

So, what are the specific details of the Native Markets proposal, and what will the team do after winning the bid?

Native Markets was co-founded by @fiege_max and his team. The core idea proposed by the team is that USDH will be natively issued on Hyperliquid's HyperEVM network, with reserves managed through a combination of off-chain and on-chain assets. Additionally, the team has developed a detailed plan to reasonably allocate reserve profits, with part used for HYPE buybacks and another part to expand the issuance scale of USDH.

Specifically, 50% of the reserve profit will flow directly and unchangeably to the Hyperliquid Foundation, providing solid financial support for the foundation's development; the other 50% will be invested in the growth of USDH, helping USDH continuously expand its market presence. This profit distribution model emulates past Hyperliquid fee-sharing precedents (HIP - 3, deployer fees). Moreover, Native Markets promises that USDH will comply with U.S. GENIUS regulatory standards, fully backed by cash and U.S. Treasury equivalents to ensure its stability and safety. The off-chain reserves will initially be managed by asset management giant BlackRock, while the on-chain reserves will be managed by Superstate through Bridge (under Stripe).

Furthermore, Native Markets has developed the CoreRouter smart contract, a pioneering smart contract that enables atomic minting of USDH on HyperEVM and cross-chain transfer of USDH to HyperCore.

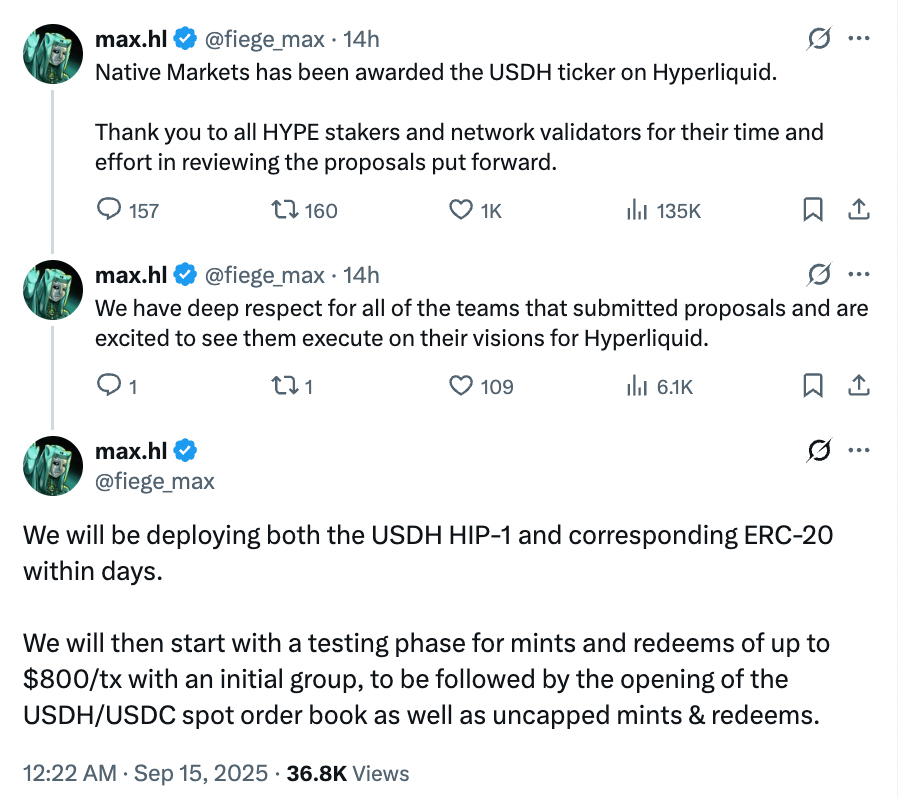

Today, Native Markets tweeted that its USDH stablecoin plan will immediately enter a phased implementation stage: in the coming days, the team will release the first Hyperliquid improvement proposal (HIP) and simultaneously launch an Ethereum-based ERC-20 token. After that, the team will conduct small-scale tests for minting and redeeming with the first batch of users, with a single minting and redeeming limit of $800, and it will only be open to select users. Once the testing stabilizes, the USDH/USDC spot trading pair will officially launch, and unlimited minting and redeeming will be opened, further enhancing the liquidity and usability of USDH.

Finally, it is worth mentioning what impact the launch of USDH will have on the Hyperliquid platform and USDC.

As of September 2025, the USDC reserve amount on the Hyperliquid platform is approximately $5.6 billion, accounting for 95% of its total stablecoin supply, which means Hyperliquid needs to pay Circle about $220 million in reserve interest each year. The launch of USDH can redistribute this portion of revenue back to the platform ecosystem, for example, through repurchasing HYPE tokens or subsidizing users. At the same time, USDH will effectively diversify Hyperliquid's liquidity dependence on a single stablecoin, breaking the liquidity monopoly of USDC on the platform.

The launch of USDH undoubtedly represents a new competitive force for USDC. In the short term, USDH may attract some users to migrate with promotional strategies such as zero fees and revenue sharing, thereby diverting some liquidity and causing a certain market impact on USDC. In the long run, USDC, with its years of accumulated compliance advantages, influence, and vast ecosystem coverage, still possesses a solid moat, making it difficult for USDH to surpass it overnight. However, as USDH continues to gain support from Hyperliquid, it may gradually erode USDC's dominance on Hyperliquid, subtly changing the market landscape like "boiling a frog in warm water."

Additionally, it is particularly noteworthy that Circle's business model, which relies on reserve interest, may face challenges due to the emergence of USDH. In the stablecoin sector, the future competitive focus is quietly shifting from reserve size to distribution channels. As mentioned earlier, stablecoin issuers are willing to forgo almost all profits to gain distribution opportunities on Hyperliquid in exchange for broader market applications and user recognition. Therefore, the Hyperliquid bidding may just be the beginning of this shift, and in the future, we are likely to see more trading platforms and brands following Hyperliquid's lead to issue their own stablecoins, redirecting profits back to the community, ecosystem, and users.

This also means that "monetary sovereignty" will gradually become a new consensus in the stablecoin industry, which will inevitably have a profound impact on USDC's market position. From this perspective, the stablecoin USDH competition launched by Hyperliquid may have already become a key to unlocking a new era for stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。