I have never been interested in this book because its Chinese title is too much like "airport bookstore style," called "The Navalmanack." This name reminds me of clickbait titles like "If You Don't Understand Management, You'll Work Yourself to Death!" Additionally, I felt that the author's secular achievements in Silicon Valley were not top-tier, which led to my preconceived bias. Recently, due to a recommendation from a good friend, I read it on a plane and found it quite interesting. The author actually spends the first half discussing "how to make money," while the latter half focuses more on the wisdom he learned about how to attain happiness from figures like the Buddha, Jiddu Krishnamurti, and Charlie Munger. The first half is about worldly matters, while the second half points directly to the true self. Here, I will share the main points from the first half about how to make money.

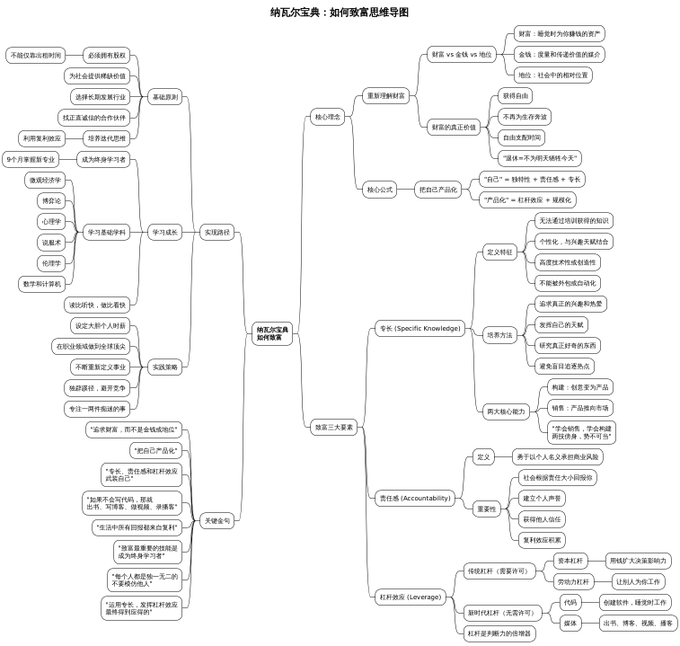

I believe the core ideas boil down to three points: 1. How to increase income; 2. How to invest your surplus income for compound growth; 3. How to manage desires and expenditures.

1. How to Increase Income: Productize Yourself and Leverage

There are four types of leverage: Capital leverage: make money work for you (investing). Human leverage: lead a team and have others work for you. Code leverage. Media leverage.

Among these, code and media are permissionless leverage. They are key to the "new wealthy class." You can create software and content that work for you even while you sleep.

How to choose these levers? Be yourself. No one can compete with you on being you. If you are good at fundraising and investing, then specializing in investment and asset management may be suitable. If you are good at programming, you are likely already wealthy. But media is a lever that anyone can use: from Ray Dalio in the investment industry to Perplexity in coding, every KOL should operate like the e-commerce of the past, DTC, which means direct to your customer, direct to your audience. Look at Satoshi Nakamoto: a one-person company, Code + Media, created the most efficient human productivity in business history—a single person created a project worth $2 trillion.

A gentleman hides his tools and waits for the right time: have patience. Believe that when the world needs a unique skill, you are that one-of-a-kind person. In the meantime, you can build a personal brand on Twitter/YouTube/WeChat Video Accounts/Little Red Book and enhance your visibility by providing free value.

How to choose a profession? Choose a job that you enjoy. Interest will drive you to be more engaged than others.

What are the most essential roles? Essentially, you can either sell or create. Just these two things.

Avoid merely "renting time": simply selling time (working for others) makes it hard to accumulate real wealth; you must find ways to "exchange money directly without time."

Manage your energy, not your time: knowledge workers are like athletes—training and sprinting, then resting and reviewing; they are also like lions—either hunting or resting and sleeping.

2. How to Invest Long-Term and Achieve Compound Growth

Don't rush to buy stocks or cryptocurrencies; instead, enhance your skills and judgment. You can't earn money beyond your understanding. I will share more about how to learn and what to learn when the opportunity arises.

Don't over-diversify: "The more you know, the less you will diversify." Only when you have unique knowledge and judgment should you dare to concentrate your investments.

Understand rather than follow: don't buy just because others are buying. Only invest when you truly understand an asset.

Trade less: excessive trading consumes time and attention. True wealth often comes from holding quality assets for the long term. Of course, if you are one of the very few in the human population, like a second Soros, it means your fate and destiny are suited for making money through trading/leverage/long and short positions, but 99.999% of people are not.

Recommended assets: 1. Stocks: hold quality companies (especially tech companies) for the long term; avoid short-term speculation. 2. Startups/Equity: the author is a well-known angel investor (having invested in Uber, Twitter, etc.), but he also warns that this carries significant risks for ordinary people, requiring insider resources and judgment. 3. Cryptocurrencies: he invested in Bitcoin and Ethereum early on, believing that cryptocurrencies are a new type of capital and financial infrastructure, but one must be sober about their risks and volatility.

3. How to Manage Desires and Expenditures to Achieve Financial Freedom

You earn money to solve financial and material problems. The best way to distance yourself from an obsession with money is not to continuously upgrade your lifestyle while making money. As income increases, it is easy for people to "upgrade their lifestyle." If you can keep your lifestyle relatively unchanged and preferably earn a large sum of money in a "centralized" manner rather than gradually, there will be fewer opportunities to upgrade your lifestyle. This way, you may go further and have a better chance of truly achieving financial freedom. Those whose living standards are significantly below their economic capabilities often enjoy a freedom that those busy upgrading their lifestyles can hardly imagine.

There is a commonly used international standard for measuring "financial freedom": if your investable assets reach 25 times your annual living expenses (25x), you have achieved financial freedom. So the less you spend, the lower the threshold for financial freedom. It's that simple.

Author's Biography: Naval Ravikant's main achievements in business include founding AngelList (a platform connecting startups with angel investors, revolutionizing early-stage financing); making early investments in several tech startups (such as Uber, Twitter, Stack Overflow), demonstrating a keen ability to "discover potential companies"; managing venture capital funds (like Hit Forge) and engaging in cryptocurrency hedge fund MetaStable Capital; in addition, he initiated the Spearhead investment program to support entrepreneurs in becoming investors, thereby expanding their influence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。