The best crypto growth strategy is a balance between data and intuition.

Author: Maggie Hsu

Compiled by: Deep Tide TechFlow

How do you assess the success and growth of a crypto protocol or product? In Web2, marketers have various strategies to measure success. In the crypto space, especially in the realms of L1, L2, and protocols, marketing strategies are still being developed. Some metrics are not yet available, some are less important, and many need to be rethought for blockchain.

I have spoken with many growth and marketing leaders, each with different dashboards, which is normal because the definition of growth for L1 or L2 is not the same as for DeFi protocols, wallets, or games. Let’s explore these differences more broadly:

Growth of L1 and L2 is closely related to the user and developer community. We can measure their success by looking at the Monthly Active Addresses (MAA) of L1 and L2 and the number of applications built on them. If MAA is growing but application growth is not significant, it may simply indicate the presence of a few popular or junk applications; ideally, both should grow in sync. In this case, the role of the Chief Marketing Officer (CMO) is more like a marketing engine for the community, in addition to promoting the protocol itself.

The fundamental growth metrics for protocols are the number of users, transaction volume, and Total Value Locked (TVL)—the total value of assets deposited in the protocol's smart contracts, or Total Value Secured (TVS)—the total value of assets secured by the protocol. Although TVL is a controversial metric, when combined with the other metrics discussed below, it can provide a rough understanding of the protocol's growth. One founder shared that they also calculate the "capital cost" of "active TVL," which is the ratio of the amount of rewards they need to provide to achieve a certain locked value versus the fees or locked value generated.

The growth of infrastructure and other Software as a Service (SaaS) is usually related to the growth of individual products. For example, the developer platform Alchemy focuses on customer and revenue growth within each product line, similar to what we see in traditional SaaS companies. More specifically, focusing on the recurring revenue percentage of existing customer retention or Gross Revenue Retention (GRR) indicates that the product is sticky and the customer base is stable, which is crucial for measuring recurring revenue. Net Revenue Retention (NRR) also considers upselling and reflects the ability to increase revenue from the existing customer base.

The growth of wallets and games also appears more traditional (similar to the SaaS example above). But here, it focuses on measuring overall usage and revenue using the following metrics:

Daily Active Addresses (DAA), the number of unique addresses active on the network each day

Daily Transaction Users (DTU), the number of unique addresses conducting revenue-generating transactions on the network (a subset of DAA)

Average Revenue Per User (ARPU), the revenue generated from users or customers over a specific period

However, if tokens are involved, then token price and holder distribution will be affected, but even these metrics depend on your goals. For example, do you want a large number of small token holders or a few whales? It depends on the category, stage, and strategy of your product or service, and you need to choose the appropriate metrics.

So, how do you build a company-specific metrics dashboard? Here are some potential metric suggestions, along with more insights into their position in the marketing funnel. Ultimately, you need to decide what to measure, how to weigh the importance of each metric, and how to take action based on the data…

Core Metrics: What Matters?

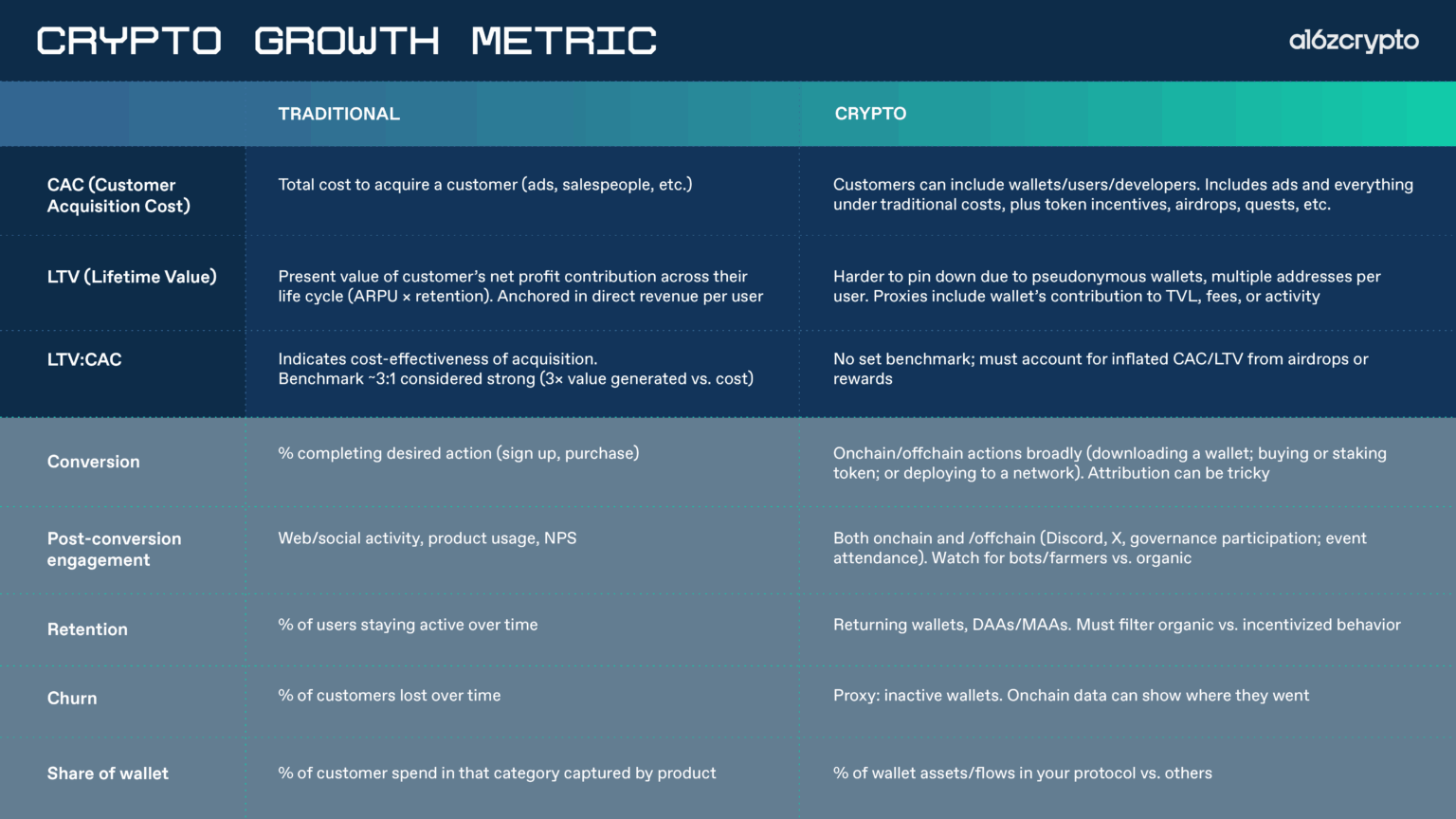

Metrics such as Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Average Revenue Per User (ARPU) are central to understanding the success and efficiency of customer acquisition efforts (we will define these metrics below).

While these concepts are widely recognized in traditional SaaS, they need some adjustment in the crypto space because here "customers" often refer to "wallets," and the form of value creation is different. We will redefine these metrics below and explore their unique nuances in the crypto space.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) refers to the total cost of acquiring a customer, which can be measured in several different ways:

Broadly speaking, blended CAC is calculated by dividing the total customer acquisition cost by the total number of new customers. It tells you the average price paid for each new customer across all channels—not only including acquisition costs but also natural growth costs (which makes it hard to see which specific growth strategies are driving performance).

On the other hand, paid CAC focuses only on customers acquired through paid marketing. Many times, teams "aimlessly" invest in paid marketing without measuring the effectiveness. Paid CAC can reflect the cost of acquiring these customers and whether specific marketing campaigns are truly effective. In the cryptocurrency space, measuring this is particularly important, as we have seen many teams distracted by paid incentives early on without figuring out what their product is actually doing.**

What counts as "cost"? When calculating CAC, costs may include advertising spend, sponsorships, marketing collateral development, task token incentives (on platforms like Galaxe, Layer3, or Coinbase Quests), and airdrops to target wallets.

Who counts as a "customer"? In this case, "customer" may refer to "users" or "developers"; for example, a brand new wallet conducting transactions on a protocol can be seen as a customer of that protocol.

Lifetime Value (LTV) and Average Revenue Per User (ARPU)

Lifetime Value (LTV) represents the present value of future net profits from a customer over the duration of the customer relationship. LTV essentially measures the return a customer provides after becoming a customer, including the amount they spend on the product.

LTV itself is a complex calculation and concept. In the cryptocurrency space, this concept does not always translate directly because "users" do not always behave like "customers" in the traditional sense. For example, they may be anonymous wallets, and one user may hold multiple different wallets. Therefore, LTV may reflect the contribution of a single wallet to the Total Value Locked (TVL), which refers to the total dollar value of assets held in the protocol's smart contracts, as we mentioned earlier.

For DeFi protocols, TVL can provide a snapshot of the "current total assets," while LTV can help answer the question of "what value a specific wallet brings to the protocol over its lifecycle."

LTV:CAC Ratio

Lifetime Value (LTV) is often used to evaluate the initial Customer Acquisition Cost (CAC) and the "value" of that customer over a period of time. The LTV :CAC ratio provides insights into the cost-effectiveness of acquiring new customers by comparing the value brought by customers to the cost of acquiring new customers.

For traditional SaaS products, a 3:1 ratio is considered reasonable, as it means the value created from customers is three times the cost of acquiring them, with the remaining profit available for reinvestment in growth. In the cryptocurrency space, we have not yet established such a benchmark.

When evaluating the LTV:CAC ratio in the cryptocurrency space, it is also important to consider other acquisition incentives, such as airdrops or points, as these measures may distort the metrics. Ideally, such incentives can help attract users to use the product and help them get started, but when users like the product enough, it can continue to grow even without incentives—in this case, CAC decreases while LTV increases, improving the LTV:CAC ratio.

Here is a brief summary of the key metrics outlined in the article and how to think about them in the crypto space:

Overall, these metrics provide a foundation for measuring the effectiveness of your growth marketing efforts in attracting users at different stages of the marketing funnel, while considering the costs of these efforts.

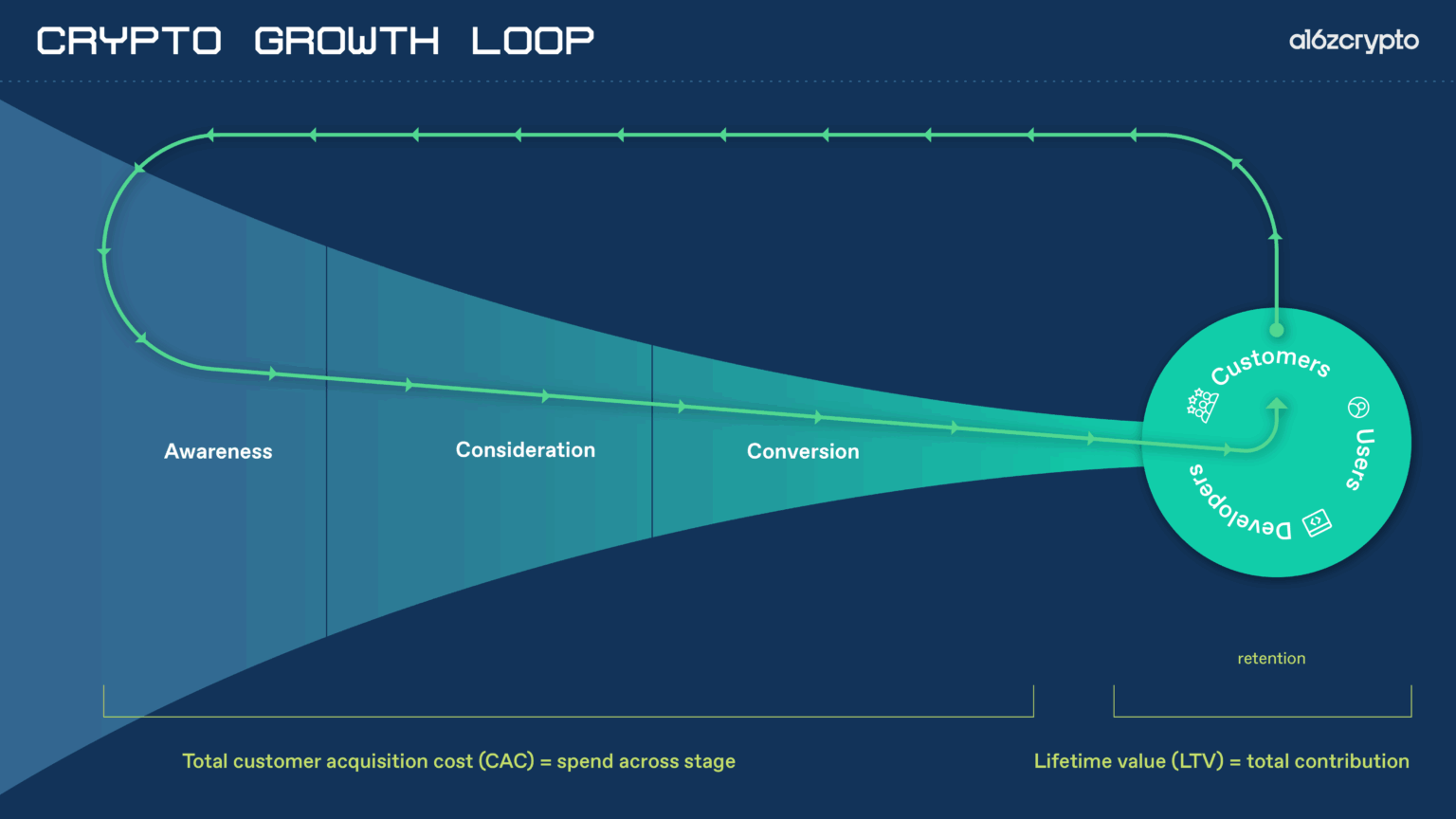

Analyzing the Growth Funnel in the Crypto Space

After identifying the core metrics, the next step is to map them from top to bottom onto the marketing funnel. It is important to note that while the growth marketing funnel in the crypto space differs from the traditional Web2 funnel, the differences mainly lie in the unique marketing strategies, behavioral characteristics, and unique opportunities at each stage, such as on-chain behavior, token incentives, and community-driven dynamics.

Next, we will explore each stage of the funnel one by one, analyzing key strategies and metrics, as well as their differences in the crypto space compared to Web2…

Awareness/Lead Generation

Whether through traditional channels or cryptocurrency, the first stage of the marketing funnel is to raise brand awareness. Even in the crypto space, increasing brand awareness is a prerequisite for everything that follows.

At this stage, you will also begin to measure Customer Acquisition Cost (CAC). "Reach" (the number of unique individuals who see your content) should also be one of the core metrics. Reach is particularly important when evaluating the success of mass marketing channels such as news, media, and public relations. The challenge at this stage is to distinguish between short-term spikes in attention and genuine "sticky" interest: Are users just curious, or are they truly interested in using the product?

In addition to core acquisition metrics, the channels you use to find new users each have their advantages, risks, and unique nuances in the crypto space:

Key Opinion Leaders (KOLs) and Influencers

Paying random influencers or KOLs with large audiences may seem like a reliable way to increase visibility, but this approach often fails to generate meaningful engagement, especially when the influencer has no real connection to the project, and their audience does not resonate.

However, collaborating with influencers who align with the project's vision is valuable, as they can share their excitement in a credible way. Consider "micro-influencers," who are more niche, targeted, and trusted voices; or even local influencers, such as experts within the team who have already established strong personal influence. Claire Kart, the Chief Marketing Officer of privacy-focused L2 company Aztec, is a typical example; she is not only an internal influencer but also actively seeks out emerging influencers, building organic connections with them and bringing them into the Aztec ecosystem.

Advertising

In the crypto space, advertising faces a range of challenges. For example, due to ambiguous and constantly changing policies regarding crypto advertising, many crypto companies cannot run ad campaigns on traditional platforms like Google or Meta. Additionally, the crypto community is somewhat wary of traditional advertising, as similar ad formats are sometimes used by scammers to lure users to malicious sites.

Crypto marketers have found more success promoting specific applications on X (formerly Twitter), LinkedIn, Reddit, TikTok, or the Apple App Store. They can also consider alternatives such as Brave browser ads, Spindl ads within the Coinbase/Base app, or MiniApps and sponsored posts on Farcaster, and even optimize for prompts to integrate into AI search answers.

Referral and Affiliate Marketing

The concept behind referral programs is the same as traditional marketing: you get rewarded when others sign up through your referral. The difference in cryptocurrency is that rewards can be sent instantly and verified directly on-chain, coordinating incentives and making the entire process smoother. Projects like Blackbird demonstrate how on-chain referrals can develop into compound network effects through ongoing loyalty programs and community engagement, rather than just one-off customer acquisition activities.

Word-of-mouth is one of the most powerful growth drivers in the crypto space: for consumer-facing products, adoption is often driven by referrals, as users recommend the product to others because they enjoy the experience and see the value. For infrastructure projects, referrals typically come from existing customers and developers.

Measuring word-of-mouth growth can be done by simply tracking the Net Promoter Score (NPS) or directly surveying new users on whether they were referred and who referred them after signing up or completing onboarding.

In this sense, referrals act like an inverted, bottom-up marketing funnel: users do not just stay at the conversion stage but reintroduce new potential users back to the top of the funnel. Early users become advocates, bringing more people into the network (and potentially earning rewards for their contributions), thus driving the growth flywheel.

Note on Accuracy: Accurately measuring the growth of real users/customers versus bot users is a challenge faced across industries, especially in social media. The crypto space has some unique identity primitives we can use, such as verifying "proof of human" through World ID, or verifying identity through zero-knowledge proofs (via zkPassport), which can distinguish real users from bot users or airdrop hunters. Growth teams can leverage these primitives not only to build anti-sybil attack capabilities for community growth mechanisms like airdrops but also to better understand actual users and help plan product retention.

The Power of a Growing Network

Finally, one of the unique growth drivers in cryptocurrency is tokens, which are often the best way to attract users, developers, and liquidity into markets that traditionally face difficult cold start problems. However, this is not purely speculative: more importantly, when token prices rise, they can attract new users who want to participate in a movement or something that is developing. Developers also take notice, as rising prices can indicate an active community and real demand, making the platform more attractive.

Consideration/Interest

The next stage of the traditional marketing funnel is consideration, where potential customers develop a positive interest in the product and evaluate it against other products.

This is particularly important in the crypto space, as every decision—from purchasing tokens to ordering hardware wallets—often requires a significant amount of education, given that cryptocurrency is still a relatively emerging (and often complex) industry for users and developers. Providing users with the right information to help them make decisions and weigh competing products or platforms can have a huge impact. For this reason, many companies, from Coinbase to Alchemy, invest in educational content aimed at consumers and developers.

Effective educational content not only details the features and benefits of the product but also explains how the product works (e.g., security, custody, community and treasury governance, token economic models, etc.). Developers may need in-depth technical documentation and tutorials, while consumers typically require explanatory content (e.g., before transferring real funds between wallets or blockchains).

User education through email during key processes (such as product registration or purchase), in-product prompts and tooltips, interactive onboarding, and setting up product trials or "testnets" to demonstrate and experience features before committing to transferring assets are standard tools. Companies are also beginning to optimize their educational content to accommodate large language models (LLMs), so that when someone asks a question, the company's content can be retrieved.

Successful teams measure interest not only through clicks or downloads but also by demonstrating trust and intent through intermediate actions taken by users (such as joining a wallet waitlist or adding small funds to test features). However, understanding whether these efforts are successful depends on the chosen channels, as each channel has its own set of metrics. Ultimately, you need to map these metrics to some form of conversion, which we will discuss below.

Conversion

Conversion is the stage in the marketing funnel where users complete the desired action. At this stage, users have been attracted, engaged, and informed, ultimately taking the action you want them to complete.

As a metric, "conversion rate" is a broad term: in traditional marketing, it may refer to the number of customers purchasing a product, users registering for a demo, or the number of people requesting to speak with the sales team. In the crypto space, conversion may also include downloading a wallet, purchasing tokens, or even deploying code on a platform. The specific form of conversion defined depends on the product and goals, but precisely defining conversion metrics is crucial for developing the best measurement methods.

Tracking conversions through marketing channels (e.g., the number of wallet downloads driven by offline events) is essential. Understanding which sources drive results can help teams optimize budget allocation, messaging, and more.

Accurately measuring conversions also relies on attribution mechanisms, which are particularly complex in the crypto space, especially when it comes to accurately tracking users' journeys between traditional websites, social networks, and on-chain behavior (e.g., from off-chain to on-chain behavior or vice versa).

Web tracking tools like Google Tag Manager can track website conversions, while new tools for wallet users (like Addressable) can bridge the gap between off-chain ads and on-chain behavior, allowing teams to track from website or Web2 ads to on-chain actions. However, user journeys are often not linear; for example, a user may first see a post on X, attend an offline event, and then make their first transaction.

Despite the historical challenges of attribution tracking in the crypto space, teams can gain a more comprehensive understanding of growth with the improvement of analytical tools. While many individuals have multiple wallets, advancements in analytics technology have enhanced the ability to match multiple wallets to a single user, allowing on-chain behavior to be associated with specific users. As privacy regulations (such as GDPR, cookie restrictions, etc.) make Web2 attribution more difficult, the transparency of on-chain data provides an advantage while also protecting user identities.

Post-Conversion Engagement

In the traditional marketing funnel, the engagement/interest stage typically measures product interactions prior to purchase. These interactions are a way for users to better understand the product and brand and are a key stage in converting initial interest into loyal engagement.

In the crypto marketing funnel, post-conversion user engagement is equally important, encompassing both online and offline, on-chain and off-chain behaviors. This not only helps teams gain insights into how to retain users but also understand how to maintain the overall health of the community, regardless of where users are located.

For example, online engagement (which we also discussed in our social media guide) can include the following metrics:

Engagement on Discord or other forums/chat platforms

Activity on X (formerly Twitter)

Sentiment analysis on social channels

User participation in governance or voting

Although many crypto marketers still rely on traditional social listening tools, these conventional methods need to be adjusted for the crypto space. For instance, sentiment tracking can directionally understand how the community feels about a project, but it should not be the sole basis for decision-making. Sentiment tracking can help teams identify active contributors, key influencers, and assess the effectiveness of messaging. However, the crypto community is dispersed across multiple platforms, with varying quality and depth of metrics, and a few highly active accounts may have an outsized impact, leading to significant data noise.

In addition to sentiment tracking tools, some teams also use other social media monitoring tools (like Fedica) to track and reward user engagement. For example, identifying contributors who amplify content, create memes, participate in discussions, or inject energy into the community. However, it is worth noting that incentive-based activities can be easily manipulated: certain incentives may attract those more focused on rewards than the project itself, potentially leading to short-term community activity but lacking sustainability in the long run.

Marketing in the crypto space can still achieve meaningful organic growth through non-incentive or non-paid methods. For example, by interweaving different types of content strategies. The stablecoin liquidity layer Eco adopted an organic content strategy based on the "4-1-1 principle": publishing 4 pieces of educational content about its market opportunities; publishing 1 piece of "soft sell" content (e.g., third-party endorsements); and publishing 1 piece of "hard sell" content (e.g., "use our product"); and repeating this cycle every few hours over 7 days. Through this organic publishing strategy and leveraging significant product announcements and co-marketing activities, Eco increased its total monthly exposure by nearly 600%.

Offline Engagement (such as attending conferences or events) also plays a crucial role in helping users engage through deeper connections. Traditionally, the way to measure these events was to collect email addresses to expand mailing lists (e.g., by scanning attendees' QR codes). More refined tools include using NFC chip tags on giveaways (e.g., through IYK) and running various activities to encourage users to click or scan them. Online platforms (like Discord or Towns) provide exclusive spaces for ongoing interaction and relationship building, where teams can track the number of interactions users have over a certain period (posts, likes, replies) and conduct quality and sentiment analysis on these interactions.

Retention

Retention rate answers a key question: "Who is sticking around?" Retention can be measured as the percentage of users who complete on-chain actions after a set period, or more broadly, as the level of ongoing user activity. The method for calculating retention rate is to divide the number of existing users at the end of a period by the number of users at the beginning of that period. If you are measuring email list subscribers or wallet downloads, tracking retention is not about initial registration but about measuring users who remain active after a period of time. Common retention metrics include: returning users, or the number of daily active addresses over a period.

In the cryptocurrency space, retention metrics must consider the tension between "long-term" and "short-term" behaviors, as they involve powerful token mechanisms and behaviors. For example, a surge of airdrop hunters at launch may appear as growth, but once the rewards stop, many will leave. This is why it is important to define your "ideal" user and measure retention relative to that group, rather than just the raw total user count. This is also why measuring product metrics (inherent metrics of the product and natural interest in the product) is crucial, so as not to confuse what is effective and what is ineffective, especially if your product has not yet achieved product-market fit. Otherwise, you may think you have found product-market fit when you actually have not; that is, people's interest is not genuinely in your product but rather in the rewards.

Retention rates naturally drive customer lifetime value (LTV), as the longer users stay, the more they spend or trade. This not only increases their LTV but also makes the LTV:CAC ratio more favorable.

Churn

Churn is the opposite of retention, measuring how many users are lost during their lifecycle and when they are lost. The churn rate is calculated by dividing the number of users lost at the end of a period by the total number of users at the beginning of that period, expressed as a percentage. In the crypto space, an alternative metric for churn (though not fully mappable to traditional churn metrics) is the proportion of inactive wallets after a certain period. For example, users may register wallets through a marketing campaign or cycle but then never use them again. Some of these users may re-engage at some point in the future, but the key to calculating churn is identifying active users, frequently engaged users, and returning users, rather than those who have only executed a single on-chain operation as "dormant" users.

There are tools available to monitor user interactions with decentralized applications (dApps) (such as Safary), helping to identify friction points that lead to user churn, such as high transaction fees, complex user experiences, or the need to complete multiple onboarding steps. For example, when Solana released the Seeker phone, some users wanted pre-funded wallets (similar to early Saga phones) to reduce barriers to initial use, as needing to manually fund to transact could delay product adoption. Although Solana has shifted to conducting dApp reward activities after users receive the phone, reducing friction in the onboarding process remains crucial.

To reduce churn, funnel tracking and user cohort targeting platforms can be used, which support crypto-specific user engagement (such as Absolute Labs' "wallet relationship management"). These tools allow teams to create custom user segments and re-engage users through Web2 channels and crypto-native strategies (like targeted airdrops). Additionally, sending messages directly to wallets through secure decentralized messaging tools (like XMTP) can provide timely, personalized prompts to encourage users to return and continue engaging.

Wallet Share

Another way to track churn and retention is to observe "wallet share": the proportion of total spending in a category allocated to your product or service. In the crypto space, this concept can be applied very intuitively. By analyzing the composition of wallets, teams can see the types and amounts of assets held and the direction of activity. If users stop interacting with your protocol, on-chain data can reveal whether they have turned to competitors. Of course, as the complexity of protocol products and services increases, the reasons for user migration may become harder to determine. But if you observe user behavior shifting towards a competitor or other products with unique features, this may reveal important insights.

Similarly, if many of your token holders also hold tokens from a related project, this may present opportunities for co-marketing—such as collaborating with that project to host joint events or offering your tokens to its token holders. General analytics tools like the crypto data center Dune can facilitate this analysis, while more specialized platforms can provide in-depth insights for specific tokens. Given that most users have multiple wallets, linking them to a single end-user identity is also important; on-chain analytics tools (like Nansen) can provide wallet tagging across multiple chains for more accurate wallet share analysis.

Measuring growth in the crypto space is not simply about replicating Web2 methods but rather adapting effective strategies, discarding ineffective ones, and building new frameworks around the unique advantages of blockchain. Given the diversity of crypto products, from L1 to gaming, each team's growth dashboard will differ.

But data does not tell the whole story. Ultimately, quantitative metrics are just part of the narrative: a deep understanding of your audience and qualitative insights about users are equally irreplaceable. Conversations within the community (whether discussions about the project or simple memes and vibes), the energy felt at events, and even intuitions about what works and what doesn't all play significant roles in guiding growth strategies. In the early stages, the behaviors of a few core users may be more valuable than those of other users. These qualitative signals are often the earliest indicators of product-market fit. The best crypto growth strategies balance data with intuition, combining short-term tactics to spark excitement with long-term strategies to build a stronger community.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。