Standard Chartered Warns: Bitcoin Treasury Companies Face Collapse

The crypto market faced a major shock after Standard Chartered Bank issued a warning about the financial health of Digital Asset Treasury (DAT) companies. The report pointed out that the market net asset value (mNAV) of many DATs has collapsed, creating serious risks for smaller firms. This sudden development has hit market sentiment, leading to a price dip in Bitcoin, Ethereum, and Solana.

Source: X

Source: X

Why Standard Chartered Warned About DAT Companies

Digital Asset Treasury firms are companies that mainly hold cryptocurrencies like BTC, ETH, and SOL as their core business model. The health of these firms is often measured by mNAV, which compares their enterprise value to the value of their crypto holdings.

-

When mNAV is above 1, companies can issue shares and buy more crypto.

-

When it falls below 1, expansion becomes difficult, and risks rise.

According to Standard Chartered, several well-known DATs have slipped below this critical level, cutting off their ability to accumulate more assets. The bank said this could lead to differentiation and consolidation in the industry. Big players such as Strategy (MSTR) and Bitmine (BMNR), which enjoy low-cost funding and staking revenue, are likely to survive and even acquire smaller firms.

The report also noted that mNAV pressure has been building since June due to saturation, investor caution, and unsustainable business models. Strategy’s early success in Bitcoin buying inspired nearly 89 imitators, many of whom now face survival challenges.

Ethereum and Solana DATs May Have an Edge

Standard Chartered’s Head of Global Digital Assets Research, Geoffrey Kendrick, highlighted that Ethereum DAT companies are better positioned than Bitcoin treasury companies . This is because Ethereum offers staking yields, which provide an additional income stream.

-

DAT companies currently hold 4% of all Bitcoin, 3.1% of Ethereum, and 0.8% of Solana.

-

BitMine Immersion, the largest ETH treasury firm, already holds over 2 million ETH, giving it a strong base.

Kendrick believes the future of DATs will depend on three factors: financing capability, scale, and yield. Among these, Ethereum treasuries appear more resilient.

Crypto Prices React and Market Dissipates Market Sentiment

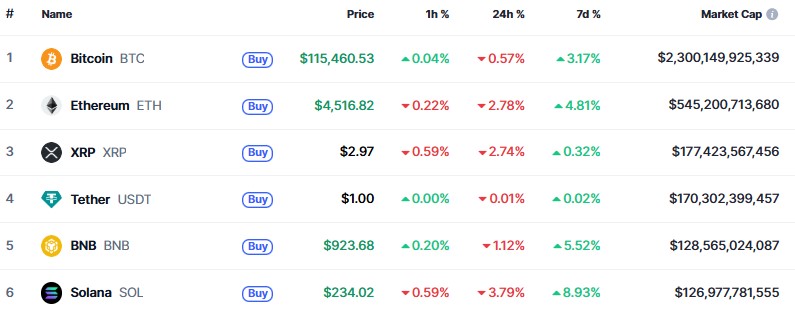

The warning definitely had that uncanny effect on crypto prices. After a whole week's worth of profiting, the markets now turned red on Thursday:

Source: CoinMarketCap

Source: CoinMarketCap

Bitcoin (BTC): down 0.6% in one day, presently trading at $115,344.79, with a market cap of $2.29T.

Ethereum (ETH): down for more than 3%, trading at $4,514.73, market cap $544.95B.

Solana (SOL): down 3.57% for the day, coming in at $234.50, market cap $127.23B.

Analysts say the Standard Chartered report is not the only reason behind the decline. The upcoming U.S. Federal Reserve meeting on September 17 , along with uncertainty around interest rate decisions, has also hurt investor confidence.

Peter Schiff Issues Harsh Warning

Adding fuel to the negative sentiment, Peter Schiff , Chief Economist and Global Strategist, repeated his long-standing criticism of Bitcoin treasury firms. Schiff called them “Ponzis built on a pyramid.”

Source: X

Source: X

He pointed out that $NAKA, one such DAT company, recently crashed 55% in a single day and is now down 96% since May, proving the risks he had warned about.

Conclusion

Collapse of mNAV in Digital Asset Treasury companies created new challenges for the crypto industry. Larger, staking-enabled players may survive, or even better still, be strengthened via consolidation, but smaller firms may face a death spiral. In the short term, the investors may witness more volatility. Meanwhile, their long-terms, experts view the sector as potentially more healthy if handled well by managing the risks.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

Also read: What is the primary use of a private key? Ari wallet daily quiz免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。