Core Indicators (Hong Kong Time September 8, 16:00 to September 15, 16:00)

- BTC/USD rose 3.8% (from $111,300 to $115,500), ETH/USD rose 7.2% (from $4,290 to $4,600)

- The spot performance of BTC aligns with our gradually evolving view: the upward process that began in September 2024 has basically completed and is entering an adjustment phase. It is expected that this will mainly be sideways, with the market brewing a test of previous highs (or even breaking historical highs), followed by a larger downward correction. This adjustment may break through the support level of $101,000, leading the price back into the high volatility range of $88,000–$92,000, and ultimately triggering a three-wave structural adjustment lasting several months (or even the whole year), targeting the range of $60,000–$75,000. The upper resistance levels are at $118,000 and $120,000, and breaking through these may challenge historical highs; so far, the support at $112,000–$113,000 remains relatively solid.

Market Themes

- Last week, the market focused on U.S. economic data and corporate earnings reports. Against the backdrop of weak non-farm employment data, market expectations for a rate cut by the Federal Reserve in September have been high, and the weak University of Michigan Consumer Sentiment Index and PPI data further reinforced the rate cut expectations — even before the CPI was released, the interest rate market had begun pricing in a complete cycle of six rate cuts by the end of 2026. Although the core CPI monthly rate of 0.346% reached its highest since January this year, the market quickly digested this impact due to the Federal Reserve's recent statements and employment data concerns, allowing U.S. stocks to continue their upward trend into the weekend.

- Cryptocurrencies benefited from a warming risk appetite: BTC filled the gap formed after the Jackson Hole meeting at $116,000–$110,000. After several months of sluggish performance, market confidence is gradually recovering, and ETF inflows have significantly rebounded after the "summer lull." The collapse of the net asset value premium rate of DATs (Bitcoin Trust) has instead boosted overall sentiment, as the price of coins has decoupled from the price of DAT shares again. In addition, Galaxy Digital announced it would lead a $1.65 billion investment to build the Solana ecosystem treasury, pushing the price of SOL close to $250.

BTC Implied Volatility

- Actual volatility significantly fell back to the 20%-25% range last week, with ETF funds returning to support spot prices, but there has been a large amount of selling pressure every time there is an increase, limiting upward volatility. As prices gradually approach the psychological resistance zone of $120,000–$124,000, the liquidity of sell orders may gradually thin out, and the trend of actual volatility needs to be closely monitored.

- The sluggish actual volatility has dragged down implied volatility (especially for short terms), but with the FOMC meeting scheduled for this Wednesday and the coin price continuously testing the upper range, short-term volatility has naturally rebounded. It is possible that we will see bullish spreads re-entering the market, betting that BTC will catch up with the rate cut trends that have already appeared in other markets, providing support for options contracts expiring after September.

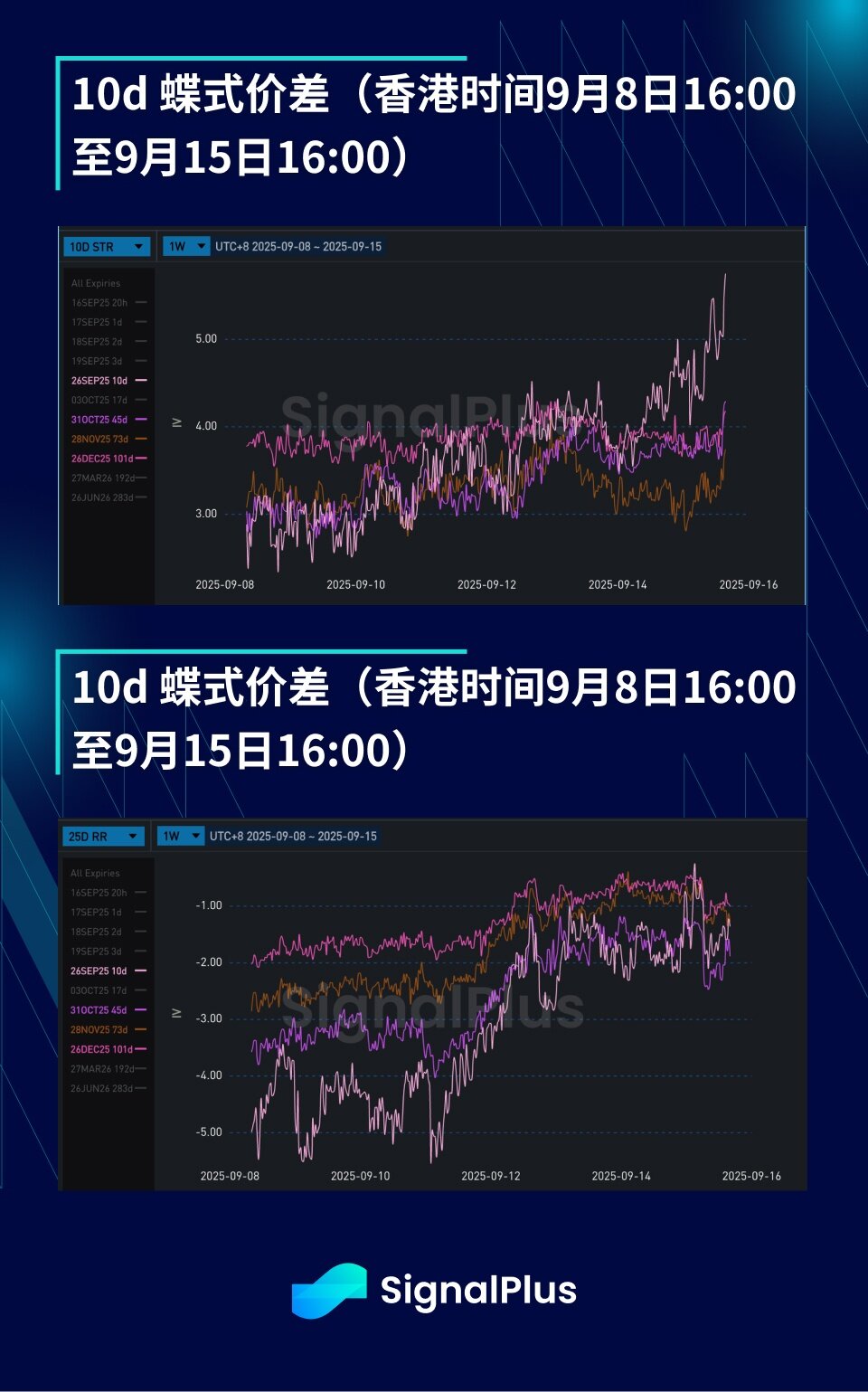

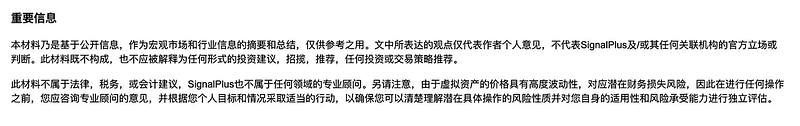

BTC USD Skew/Kurtosis

- The skew indicator shows that the premium for put options continues to narrow: ETF inflows have suppressed the actual volatility below, and the risk appetite environment has helped spot prices break through the initial resistance of $113,000–$114,000. However, compared to past cycles, structural bullish demand still appears insufficient, and given that volatility is at a low level, long-term cash investors are still buying downside protection during the uptrend.

- Kurtosis rose before the weekend: Historically, September has shown weak performance for BTC, and (other) markets have fully priced in the Federal Reserve's data risk appetite, leading investors to continuously seek wing-side protection. Previously, demand was mainly concentrated on the put side (skew continued to lean downward), but the recent rebound in coin prices has brought bullish options above historical highs into view, pushing kurtosis higher (while put skew narrows) — indicating a strong market desire to avoid holding too few options positions before breaking previous highs.

Wishing you a successful trading week ahead!

You can use the SignalPlus trading trend indicator feature for free https://t.signalplus.com/crypto-news/all, integrating market information through AI, making market sentiment clear at a glance.

If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: Logicrw), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。