Introduction

Recently, RWA has become the darling of capital markets, with various listed companies in real estate, renewable energy, and innovative pharmaceuticals announcing developments that have led to soaring stock prices, stirring the hearts of investors. What exactly is the magic of RWA, and what opportunities and challenges does it represent?

1. The Development History of RWA

The concept of RWA can be traced back to 2017-2018, during which attempts at issuing security tokens (STO) emerged amid the ICO boom, with some startups issuing tokens representing company equity or fund shares. However, due to a lack of secondary markets and regulatory hurdles, these early attempts had limited impact. After the rise of DeFi in 2019-2020, projects like MakerDAO began to focus on RWA: Maker first introduced off-chain assets (such as commercial paper) as collateral in its DAI stablecoin system in 2020, marking an important milestone for RWA. During the same period, Centrifuge launched the Tinlake protocol, collaborating with Maker to provide on-chain financing for small and medium-sized enterprises' receivables. Entering 2021, the booming crypto market brought a demand for unsecured lending, with Maple and TrueFi launching to provide credit loans to trading institutions, also directing some funds towards off-chain assets. (Although these loans were primarily used in the crypto space at the time, they laid the foundation for future RWA credit.) Starting in 2022, as global macroeconomic conditions saw rising interest rates and declining crypto-native yields, the market's thirst for stable on-chain returns made RWA a new hot topic. Especially after the Federal Reserve raised interest rates, low-risk, high-yield assets like U.S. Treasury bonds regained favor, leading to a surge of projects bringing U.S. Treasuries and government bonds on-chain. The year 2023 has been referred to as the "Year of RWA" in the industry, with traditional financial giants entering the space: for instance, large asset management companies in Germany and the U.S. (such as BlackRock and Franklin Templeton) launched tokenized fund products; payment companies like Visa began researching on-chain government bonds for stablecoin settlement; and regulatory attitudes towards RWA in various countries gradually became clearer. These factors have propelled RWA from concept validation into an expansion phase.

2. The Concept and Asset Classification of RWA

Real World Assets (RWA) typically refer to the conversion of tangible or intangible assets from the real world into tradable digital tokens through blockchain technology, achieving asset digitization and tokenization. RWA covers a wide range, extending from traditional financial assets to various sectors of the real economy. Specifically, it includes debt instruments such as government bonds and corporate bonds, equity assets like stocks, physical assets such as real estate and gold, non-standardized rights like private equity, intellectual property, and supply chain receivables; almost any asset type with value or ownership is being explored for on-chain possibilities.

It is important to note that in a narrow sense, RWA typically does not include tokens pegged to fiat currencies, such as stablecoins: although the reserve mechanisms of stablecoins are also supported by off-chain fiat or bonds, and broadly fall under the RWA category, they are generally classified separately as stablecoins. The RWA discussed in this article will primarily focus on the tokenization of real assets outside of stablecoins, such as government bonds, real estate, private debt, private equity, receivables, and artworks.

Based on asset nature, the current on-chain RWA can be mainly divided into the following categories:

- Government Bonds and Public Bonds: Highly standardized bond assets are the preferred targets for RWA, with U.S. Treasury bonds being the most prominent. U.S. Treasuries theoretically have no default risk and strong liquidity, with a clear and mature legal structure for tokenization, such as meeting regulatory requirements through offshore funds and token packaging. In addition to U.S. Treasuries, sovereign bonds and corporate bonds from Europe and Asia are also beginning to explore on-chain possibilities, such as issuing tokenized notes through BVI funds or Luxembourg SICAV structures.

- Private Credit (Private Debt): This includes loans to small and medium-sized enterprises, trade receivables financing, consumer finance debt, and real estate mortgages. Tokenizing these assets can provide real yield sources for DeFi funds, but due to the diverse qualifications of underlying borrowers, the risks are relatively high. Typically, a Special Purpose Vehicle (SPV) is established to hold the underlying assets, with DeFi protocols providing liquidity, allowing investors to earn on-chain interest. Representative projects include Maple, Centrifuge, Goldfinch, Credix, and Clearpool, which aim to connect real assets like off-chain SME loans and property loans, enhancing data credibility through Chainlink's asset proof mechanism.

- Commodities and Bulk Assets: This mainly refers to the tokenization of bulk commodities such as gold, carbon credits, and oil. Gold, due to its stable value and clear reserve logic, is the most common commodity RWA, with typical examples like Paxos Gold (PAXG) and Tether Gold (XAUT), which are issued with a 1:1 physical gold reserve. Carbon credits and energy assets like crude oil face higher regulatory hurdles and are currently mostly in pilot stages.

- Equity and Fund Shares: This includes the on-chain issuance of unlisted equity, publicly traded company stocks, and various private fund shares. Representative platforms include Securitize, ADDX, and Swarm, which compliantly convert corporate equity or fund beneficiary certificates into on-chain tokens for circulation. These assets are subject to significant securities regulation, with secondary trading requiring strict KYC whitelisting; some projects choose permissioned chains to limit circulation scope. The scale of equity RWA is currently very small (as of the end of June 2025, the market value is about $362 million, accounting for less than 2% of RWA) and lacks liquidity, a result of both regulatory and market factors.

- Real Estate: Real estate is characterized by high value and low liquidity, with traditional transactions often having high thresholds and long cycles. RWA provides a fragmented new path for real estate investment, such as holding real estate through an SPV and issuing tokenized rights, allowing small investors to proportionally share rental income or property appreciation. However, tokenizing real estate faces challenges of complex rights confirmation and legal integration: how to synchronize on-chain token transfers with off-chain property title transfers remains unclear. There was a case where a real estate project in Singapore had an NFT become an "orphaned asset" due to delays in reflecting off-chain property changes, exposing the risk of off-chain information lag. Therefore, current real estate RWA mainly focuses on rights tokens (such as rental income rights), where holders do not directly own the property but receive income distribution based on their token holdings.

- Alternative Collectibles and Artworks: This includes the tokenization of non-traditional assets such as artworks, collectible cards, fine wines, and luxury watches. These assets often lack active public market pricing, and the main purpose of going on-chain is to lower investment thresholds and improve circulation efficiency. For example, early platforms issued NFT fragments of famous paintings, allowing multiple people to share ownership. However, due to the strong subjectivity in art valuation and extremely low liquidity, RWA in this area remains a niche attempt with limited scale and influence. However, with the popularization of one-click issuance capabilities on platforms like BenFen, the tokenization threshold for artworks and collectibles is expected to significantly decrease in the future.

3. Overview of Mainstream RWA Projects

In recent years, various models of projects have emerged in the RWA space. Below are the main representative projects categorized by asset type, along with a brief description of their core mechanisms:

Government bond RWA projects: Typical representatives include Ondo Finance, Superstate, and Backed Finance.

* Ondo is a platform focused on bringing traditional financial assets on-chain, having pioneered the short-term U.S. Treasury ETF token OUSG, which holds real bond assets through a Special Purpose Vehicle (SPV) and issues corresponding ERC-20 tokens pegged 1:1 to the underlying ETF value, with daily automatic interest settlement.

- Superstate, initiated by the founder of Compound, follows a fully compliant fund path—its product USTB directly invests in U.S. short-term Treasury bonds, issuing on-chain shares through a registered fund, with a management fee of only 0.15%. USTB is only open for subscription to qualified investors as defined by U.S. regulations, allowing investors to either self-custody their token shares or store them through custodial banks like Anchorage and BitGo.

- Backed Finance provides the xStocks framework to tokenize U.S. and European stocks. For example, the TSLAx token issued by Backed is pegged 1:1 to Tesla stock, with real stocks held by a regulated custodian, supporting 1:1 redemption of tokens at any time. Backed's tokens support 24/7 trading, breaking the traditional stock market time zone limitations, with dividends distributed to token holders through airdropped additional tokens; the only issue is that its settlement model is semi-closed synthetix, meaning users' profits cannot be settled 24/7.

Overall, the common characteristic of government bond and securities RWA projects is a strong emphasis on compliance, typically ensuring a solid and clear legal relationship between tokens and underlying assets through the establishment of offshore SPVs or regulated funds.

- Credit Loan RWA Projects: This field has seen the emergence of protocols such as Maple Finance, Goldfinch, TrueFi, Centrifuge, Credix, and Clearpool.

- * Maple Finance positions itself as a multi-chain institutional lending platform, primarily serving institutional borrowers such as hedge funds, trading firms, and DAOs. Maple achieves automated matching of unsecured/low-collateral loans on-chain by introducing off-chain due diligence and borrower credit scoring. Its product line has also expanded to include tokenized U.S. Treasuries and trade receivables pools, with the platform's managed assets exceeding $2.4 billion as of June 2025.

- Goldfinch focuses on credit lending in emerging markets by allowing crypto investors to provide loan funds to fintech institutions in developing countries in exchange for high-yield interest. Goldfinch employs a dual-pool model: retail funds enter a senior pool to earn stable returns (historically around 7-10% annualized), while a community-selected backup pool provides some funds to take on higher risks for higher interest returns. This model utilizes community consensus and token incentives for risk pricing, partially achieving unsecured loans.

- TrueFi initially focused on unsecured lending for crypto institutions but is now transitioning to serve institutional-level RWA, gradually introducing on-chain financing channels for traditional assets.

- Centrifuge positions itself as an RWA infrastructure provider, minting real-world assets (receivables, mortgages, etc.) into NFTs through its Tinlake protocol, which are then split into priority DROP and subordinate TIN tokens for investors to subscribe, becoming a leading platform for on-chain receivables financing.

Overall, credit RWA projects introduce assets like SME loans into DeFi through an off-chain SPV + on-chain fund pool structure. On these platforms, investors receive relatively high interest rates (typically annualized between 8% and 18%), but they must bear higher credit risks and rely on off-chain audits and legal measures to ensure investment safety.

Other Category RWA Projects: In the commodities sector, projects like Paxos Gold (PAXG) and Tether Gold (XAUT) issue tokens backed by physical gold held in custody.

* Each PAXG token corresponds to 1 ounce of London gold, held by top institutions like Brink’s, and allows holders to redeem physical gold for a certain fee. Gold tokens like PAXG enable investors to gain exposure to gold without incurring physical custody costs, while also allowing for 24/7 trading on-chain or use as collateral in DeFi lending.

- In the direction of institutional funds and equity tokenization, in addition to the aforementioned Securitize and Backed, emerging projects like Swarm Markets are introducing European securities on-chain, and ADDX is providing a platform for private fund token subscriptions in Singapore. These platforms are limited by regulations and are mostly open only to qualified investors.

Overall, the currently operational and somewhat scaled RWA projects are still primarily focused on bonds and credit, while other categories are mostly in the exploratory stage. Notably, beyond specific projects, the evolution of underlying public chain infrastructure is also crucial. For example, BenFen's upgrade in 2025 has taken the lead in supporting one-click issuance of RWA, providing a standardized framework for the on-chaining of various assets like bonds, equity, and real estate, forming a complementary relationship with these application layer projects.

4. Blue Ocean or Red Ocean, How Far Can RWA Go?

Although the scale of on-chain RWA assets has shown explosive growth in the past two years, how far can it realistically go in the future? According to data from Binance Research and RWA.xyz, the total on-chain RWA was less than $200 million in 2020, but by the end of 2023, it had exceeded $1 billion; by mid-2024, it is expected to surpass $12 billion (excluding stablecoins). Entering 2025, with institutional funds pouring in, the scale continues to soar. In the first half of 2025, the total value of global on-chain RWA assets has exceeded $23.3 billion, an increase of nearly 380% compared to early 2024.

As of August 2025, the market value of RWA is approximately $25.22 billion. Among these, tokenized U.S. Treasuries represent the largest single category, with a market value of about $6.8 billion, accounting for around 27% of the total RWA. If calculated more broadly, including stablecoins in the RWA category, the on-chain RWA market value would also include $25.68 billion in stablecoins; however, as mentioned earlier, we primarily focus on non-stablecoin assets. Besides U.S. Treasuries, the second largest segment in RWA is private credit, which includes various on-chain loan pools, and its scale is continuously increasing.

For instance, the combined scale of loan pools managed by Maple, Goldfinch, and Centrifuge has reached several hundred million dollars. However, due to the longer duration and lower liquidity of credit assets, this portion still accounts for a limited share of the overall RWA market value (about 10%). Other categories, such as tokenized stocks and commodities, currently have very small volumes: the total value of on-chain stock tokens is only about $360 million; the circulating market value of commodity tokens like gold is also only in the hundreds of millions. It is evident that in the RWA landscape outside of stablecoins, U.S. Treasuries and credit are the dual engines: U.S. Treasury RWA serves as the "yield base" for DeFi due to its low-risk rates, while private credit RWA attracts risk-tolerant funds with higher returns. Both have driven the rapid increase in on-chain RWA scale over the past year.

In this context, breakthroughs at the infrastructure layer are particularly critical. The stablecoin payment public chain BenFen announced a major upgrade, officially supporting one-click issuance and on-chaining of RWA, maintaining a unified framework with one-click stablecoin issuance. With mechanisms like one-click stablecoin issuance and gas fee payment, BenFen is upgrading to become a one-stop issuance center for stablecoins and RWA, as well as an entry point for global payments and asset circulation.

It is foreseeable that as technology matures and regulations improve, RWA is expected to grow into another pillar track in the crypto space following stablecoins. Logically, asset categories that originally belonged to a red ocean will be encapsulated through blockchain into a new blue ocean, and this tool is bound to become a new financial darling. Public chains like BenFen, which possess both one-click issuance capabilities for stablecoins and RWA, will play a key role in this process.

(Source: blocktempo.com)

(Source material from the internet, please delete if infringing)

5. Regulatory Attitudes and Compliance Frameworks in Major Jurisdictions

RWA involves the on-chaining of traditional financial assets, inevitably facing the constraints of securities and financial regulations in various countries. The regulatory attitudes towards RWA and its tokenization vary significantly across jurisdictions, summarized as follows:

- United States: The U.S. takes a cautious overall stance towards RWA, with the regulatory framework based on existing securities laws. Project parties typically operate through a model of SPV isolation + compliance with private securities offerings. Additionally, token issuance must comply with SEC regulations, such as following Reg D (private offerings to qualified investors) or Reg S (offshore offerings) paths to exempt from public registration requirements. This means that issuing RWA tokens in the U.S. is mostly limited to qualified investors, making it difficult for ordinary retail investors to participate directly. Overall, U.S. regulatory agencies (SEC, CFTC, etc.) have a conservative attitude towards RWA, requiring such tokens to be essentially equivalent to securities and to comply with information disclosure and investor protection rules. This has led to RWA innovation in the U.S. being primarily concentrated in the institutional market, with many projects choosing to pilot overseas before introducing them to the U.S. (After all, Trump has already filled his plate with crypto-stock linkage and mining, there’s no need to dig new pits for himself.)

- European Union: The EU is relatively proactive in RWA regulation, with the MiCA regulation (regulating the crypto asset market) passed in 2023 directly addressing RWA, defining tokens pegged to real assets as "Asset-Referenced Tokens (ART)" and bringing them under regulation. In the EU, RWA projects often adopt trust or EU-recognized SPV structures, establishing a variable capital investment company (SICAV) as an SPV to hold underlying assets and issue tokens. MiCA compliance requirements state that issuers must disclose the custody methods of underlying assets, rules for rights distribution, etc. Overall, the EU tends to incorporate RWA into the existing financial regulatory framework, reducing legal uncertainties through unified rules.

- Singapore: The Monetary Authority of Singapore (MAS) launched the Project Guardian in 2022, collaborating with multiple financial institutions to test on-chain settlement and tokenization of government bonds and foreign exchange transactions. In the digital asset framework released by MAS, stablecoins and security tokens are included in a regulatory sandbox, encouraging experimentation with RWA applications in a compliant environment. Overall, the Singapore government maintains a relatively lenient regulatory stance and provides policy support (e.g., tax incentives, regulatory sandboxes).

- Hong Kong: Currently, Hong Kong has allowed licensed brokers to apply for pilot programs for tokenized securities issuance and trading, limited to professional investors. Overall, Hong Kong has a very positive attitude towards RWA, attracting relevant projects to land through government endorsement, emphasizing compliance first, innovation closely following.

- United Arab Emirates: The Virtual Assets Regulatory Authority (VARA) established in Dubai has launched the world's first comprehensive regulatory framework for RWA tokenization, covering token issuance, custody, trading, and other aspects, providing legal certainty for tokenized assets. Although VARA rules have not yet covered all asset types, they demonstrate Dubai's determination to become an RWA hub. Additionally, Abu Dhabi's financial center ADGM also launched a tokenization pilot sandbox in 2023, inviting fintech companies to test RWA products, including debt and fund shares. In terms of applications, the Dubai Land Department has announced plans to explore real estate tokenization, aiming to combine property registration with blockchain; the UAE's carbon exchange is also considering introducing blockchain to expand carbon credit trading. Overall, the UAE adopts a public-private partnership and regulatory sandbox approach, encouraging domestic and foreign institutions to conduct RWA business locally, with its lenient tax policies and clear crypto regulations attracting many project teams. It is foreseeable that as laws gradually improve, Dubai and Abu Dhabi are likely to become the RWA issuance and trading centers in the Middle East.

6. Comparison of On-Chain Issuance Costs and Returns by Country and Asset Type

The economic model of RWA projects involves multiple costs and benefits, including the yield of underlying assets, custody and audit costs, protocol fees, and investor return levels. The regulatory environment in different countries and various asset classes can impact issuance costs and returns. Below, we will compare based on major asset categories, incorporating data and case studies:

- Government Bonds and Treasury Securities: The yield of these RWA underlying assets depends on macro interest rates. Taking U.S. Treasuries as an example, the current one-year Treasury yield is around 5%. Therefore, tokenized U.S. Treasuries (such as Ondo's OUSG and Superstate's USTB) can provide a nearly 5% annualized risk-free rate, becoming the "interest rate anchor" for on-chain funds. The costs of issuing such products mainly lie in fund management fees and compliance expenses. For instance, Ondo's OUSG uses an ETF cross-chain packaging structure, charging an annual management fee of about 0.15%–0.3% to cover operational costs, including custody banks, legal compliance, and other fees. Superstate's USTB, being a registered fund, has a lower management fee of only 0.15%, plus custody fees paid to custodians like Anchorage. By directly holding Treasuries instead of using a nested ETF, it reduces the double fee layer. In terms of compliance costs, issuing such products in the U.S. requires regulatory exemptions, leading to high legal service fees; however, issuing Treasury tokens in places like Switzerland and Singapore, where regulatory acceptance is high, has a relatively simplified approval process. Overall, the yield center for Treasury RWA is low but stable, with management fees making up a small portion of the cost structure.

- Private Credit: On-chain private loan assets typically offer yields higher than traditional rates to compensate for greater credit and liquidity risks. For example, Maple and Goldfinch target SMEs or emerging markets for lending, with historical annualized interest rates ranging from about 8% to 15%. Specific yields vary based on the borrower's qualifications: high-quality borrowers (such as businesses with collateral or stable cash flows) may have loan rates around 8–10%, while higher-risk loans (like unsecured loans to startups) can reach 15% or even higher. Investors in these loan pools can earn corresponding interest returns but must bear default risks and longer lock-up periods. To enhance investment attractiveness, many platforms adopt a tiered yield mechanism: for instance, Goldfinch's senior pool investors receive a fixed rate, while junior participants earn the remaining high yield but take on initial losses. The costs of issuing such assets mainly reflect due diligence and risk management. Borrowing projects typically require hiring third-party auditors and lawyers for off-chain due diligence. The platform also takes a percentage of the borrowing interest as a protocol fee: Maple charges a 0.5%–2% service fee for each loan. These fees are partially passed on to borrowers and partially reflected in the discount on investor returns. Compared to traditional finance, on-chain credit has reduced matchmaking and management costs (smart contracts automatically execute repayments and profit sharing), but credit assessment and collection still require human and legal intervention, so overall costs are not low. Additionally, different jurisdictions' compliance requirements for on-chain lending have a significant impact: in the U.S., public-facing lending is likely to be considered a security or investment product, requiring registration or exemption (high compliance costs); whereas in places like Singapore, tokenized debt issued by licensed entities with limited participation can be conducted within a sandbox, simplifying procedures. Therefore, some projects choose to establish funds in friendly jurisdictions like Singapore and Switzerland to issue loan certificates and then raise funds globally to reduce regulatory friction.

- Real Estate and Other Physical Assets: Real estate tokens typically correspond to rental income or property rights, with their yields influenced by local real estate rental and sales markets. Generally, high-quality properties in developed markets yield rental returns of 3%–5%, while developing markets may exceed 8%. If property rights are fragmented and put on-chain, the basic income for investors is the rent minus property management and tax expenses. This portion of income is relatively stable but far lower than credit assets. However, considering potential property appreciation, total long-term returns may be higher. The main costs of issuing property rights on-chain lie in legal structure setup and ongoing management. Fees for appraisers, custody banks, and notarizing legal documents must be paid. In places like Hong Kong and Singapore, governments are exploring ways to reduce these costs: for example, in the digital green bond project supported by the Hong Kong Monetary Authority, blockchain has simplified the settlement process, saving some intermediary fees. Similarly, the returns from RWA assets like art and collectibles come more from asset appreciation rather than ongoing income. The price discovery for these assets is challenging, and the lack of transparency in valuation leads to significant buy-sell price spreads. Issuers typically charge custody, insurance, and transaction commissions. For instance, some art platforms charge token holders a 2% custody fee annually. In contrast, commodity tokens like gold, while having no interest, exhibit higher liquidity and trading activity than other RWA categories because the gold market is globally accessible and has high price transparency. Statistics show that the monthly on-chain trading volume of gold tokens like PAXG and XAUT far exceeds that of most credit or equity tokens. Thus, different RWA assets exhibit a trade-off between yield and liquidity: high-yield assets often have poor liquidity, while liquid assets (like gold) yield low or even zero returns, necessitating the use of DeFi composite strategies to enhance returns.

- Regional Differences and Cost Comparisons: From a national perspective, the regulatory environment directly impacts RWA issuance costs and return pricing. In the U.S., stringent compliance requirements drive up legal and operational costs, leading many projects to issue only to high-net-worth clients, resulting in limited liquidity and relatively higher financing costs (borrowers must pay higher rates to attract limited funds). Conversely, in RWA-friendly jurisdictions like Singapore and Switzerland, compliance costs are lower, allowing issuers to reach global investors at lower costs, thus having the flexibility to finance at lower rates or pass more returns to investors. This is also why some RWA products cannot be offered to retail investors in the U.S. but can be indirectly introduced through overseas issuance for U.S. institutions to purchase.

Overall, the on-chain issuance costs of RWA include technical costs + compliance costs: at the technical level, blockchain is playing a role in leveraging scale effects to reduce labor and time costs, while compliance costs depend on the regulatory friendliness of the jurisdiction.

7. Core Issues Facing the Current RWA Market

Despite high expectations for RWA, it still faces a series of challenges in practice that require joint efforts from the industry and regulators to resolve:

- Legal Compliance Challenges: The on-chaining of real assets involves complex legal relationships. The current legal framework lags behind technological development, and many key issues lack case law support. For example, how do on-chain tokens correspond to off-chain asset ownership? How are token holders' rights recognized in court? As mentioned earlier, under the SPV structure, tokens are viewed as SPV equity certificates, but the legal gap remains that on-chain transfer does not equate to off-chain transfer. Different jurisdictions may classify the same RWA token differently, leading to a lack of legal protection for cross-border transactions. This legal uncertainty poses compliance risks for RWA projects, with some lawyers pointing out that many RWA tokens currently resemble "self-proving legal digital IOUs."

- Authenticity of Off-Chain Assets and Credit Risk: The value foundation of RWA lies off-chain, making the verification of off-chain asset authenticity and credit status crucial. The industry currently relies on third-party institutions (such as accounting firms and appraisers) to provide proof, which is then uploaded to the chain via oracles. However, intermediaries themselves may make errors or commit fraud, requiring on-chain investors to still "trust" them. For example, a certain RWA lending project exposed issues with a borrowing company providing false financial reports, which the due diligence party failed to detect in time, resulting in investor losses. Additionally, assets like real estate involve challenges in updating and synchronizing: if the status of the underlying asset changes (e.g., collateral loss, property transfer), there is still no perfect mechanism to quickly reflect this on-chain. Although solutions like Chainlink's Proof of Reserve have been introduced to periodically verify asset reserves, the credit risks of complex assets cannot be solved solely by technology; off-chain legal measures such as guarantees, insurance, and default handling arrangements are still needed. These will increase the operational difficulty and costs of projects.

- Insufficient Market Liquidity: RWA assets generally face liquidity shortages. The reasons primarily lie in the limited range of investors: many RWA tokens can only be sold to qualified investors or whitelisted addresses, naturally shrinking the secondary market size. Secondly, the lack of active trading venues and market makers means that most tokens trade quietly on decentralized exchanges, with large bid-ask spreads and low transaction frequencies. Research shows that most RWA tokens have long holding periods, with extremely low turnover rates, and most investors adopt a "buy and hold long-term" strategy. While this reflects a medium to long-term investment preference for RWA, it also means that liquidity is insufficient to support active trading. When investors need to liquidate, they may face issues of no buyers or the necessity to sell at significant discounts. The lack of liquidity also leads to pricing difficulties: due to the absence of continuous trading, the fair value of assets is opaque, further dampening potential trading willingness. To alleviate these issues, the market is beginning to explore the introduction of professional market makers and incentive mechanisms. For example, some platforms offer additional token incentives to liquidity providers (LPs) or seek centralized brokers to facilitate RWA token trading. However, overall, until RWA can attract a larger scale of investors (including ordinary individuals), liquidity bottlenecks will likely persist in the short term.

- Valuation Pricing and Oracle Issues: Many traditional financial assets do not have real-time prices, such as unlisted equity and real estate valuations, which are often lagging and lack unified standards. When these assets are put on-chain, how to price the tokens becomes a challenge. The current main approach is for issuers to periodically announce net asset values (NAV) or reference appraised values, which are then fed onto the chain by oracles. However, there is uncertainty regarding the data sources and frequency of oracles, making it difficult for investors to verify the accuracy of prices. Some assets, due to their uniqueness, have subjective valuation models, leading to significant price expectation differences between buyers and sellers, making transactions difficult. Even for transparent market assets like U.S. Treasuries, there are technical risks of oracle delays or failures. If oracle pricing becomes inaccurate (e.g., due to attacks or data source disconnections), it could lead to market chaos or even liquidation risks. Additionally, the rise of derivatives and composite strategies (such as using RWA tokens as collateral to borrow stablecoins and then participating in other DeFi) places higher demands on price accuracy. If valuation deviations accumulate, it could lead to systemic risks.

- Institutional Participation Still Needs Improvement: Institutional investors are seen as a crucial driving force in the RWA market, but their current level of participation still needs to increase. Even though pioneers like Franklin Templeton have issued on-chain funds, most mainstream asset management companies are still in the experimental phase and have not yet moved core assets onto the chain. On the other hand, some crypto-native institutions (such as DAOs and crypto funds) also have concerns about RWAs: they worry about the lack of transparency of off-chain assets and the need to trust intermediaries, which contradicts the spirit of decentralization. Even MakerDAO, which has allocated a significant amount of U.S. Treasuries as reserves, underwent lengthy internal governance discussions and risk control designs to persuade token holders to agree to the introduction of RWA collateral. Overall, institutional interest in RWA is rising: since 2023, major Wall Street banks have begun developing tokenization platforms, Visa has released RWA reports, and government funds in various countries are attempting small investments in RWA projects. This indicates that institutions have recognized the potential of RWA, but to translate this into large-scale deployment, a complete infrastructure and supporting services (such as custody, clearing, and legal support) as well as successful case studies are needed to enhance confidence.

8. Introduction to the One-Click RWA Issuance Capability of BenFen Chain

As an exploratory solution to address the aforementioned challenges, BenFen Chain has recently launched the "One-Click RWA Issuance" feature to simplify the process of putting real assets on-chain. Originally positioned as a stablecoin payment public chain, BenFen emphasizes high performance and low-cost transactions. In a major version upgrade in August 2025, the official announcement stated that it officially supports one-click issuance and on-chaining of RWAs (real-world assets), upgrading its positioning to a "stablecoin + RWA infrastructure public chain." This feature maintains consistency with the existing one-click stablecoin issuance framework, allowing issuers to conveniently issue compliant RWA tokens through standardized processes.

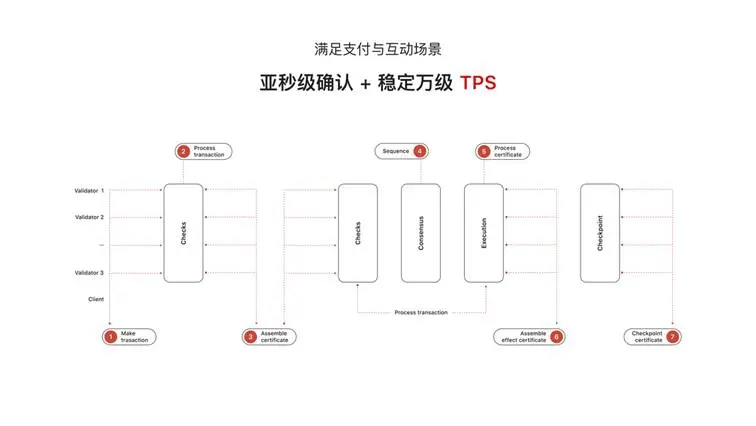

In terms of technical pathways, BenFen Chain has optimized the underlying Move virtual machine and cross-chain engine, providing underlying support for asset on-chaining and compliant custody while maintaining a throughput of tens of thousands of TPS and sub-second confirmation speeds. The chain has built-in smart contract templates and standard business processes: issuers only need to submit asset information and compliance materials according to the guidelines to map real assets (such as real estate, bonds, stocks, etc.) to on-chain tokens with one click. The system automatically integrates custody, auditing, KYC, and other aspects to ensure the secure and reliable mapping of off-chain assets to on-chain tokens. For example, if a user wants to issue a commercial real estate bond token on BenFen Chain, they only need to upload property appraisal reports, custody bank certificates, and other materials. The smart contract will lock these document hashes and generate tokens, which can only be subscribed and traded by qualified investor addresses that have passed KYC, thereby strictly enforcing regulatory requirements on-chain. The entire process is highly automated, significantly simplifying what used to be a months-long asset securitization process—official claims that the previously high-threshold and cumbersome RWA on-chaining can now be completed with simple operations. This means that issuers can greatly reduce technical difficulties and time costs, quickly gaining on-chain liquidity and global settlement capabilities.

In terms of potential advantages, BenFen Chain aims to create a "stablecoin financial operating system," with its one-click RWA issuance sharing the same underlying infrastructure as one-click stablecoin issuance. The chain supports direct payment of Gas fees using stablecoins and even introduces a Gas fee sponsorship mechanism, further reducing the cost for users to utilize the public chain. For issuers, not only is the work of developing smart contracts and building KYC systems eliminated, but BenFen Chain also provides compliant custody solutions: it can connect with licensed custodians to safeguard underlying assets and record custody certificates on-chain, enhancing regulatory transparency. Additionally, leveraging high TPS and cross-chain capabilities, RWA tokens on BenFen Chain can be easily bridged to other mainstream networks, expanding the potential investor base. These designs make BenFen Chain adaptable to various asset types, including real estate, bonds, equity, commodities, etc. As long as legal and compliant asset proof can be provided, they can be mapped to issue on-chain tokens. For example, a real estate company can issue project revenue bonds with one click through BenFen Chain, allowing global investors to conveniently subscribe after completing KYC; at the same time, the distribution of proceeds and subsequent rental income is automatically executed by on-chain contracts, reducing the risk of human error.

Conclusion

The narrative of RWA is grand and exciting, but its path is not without challenges. It stands at the crossroads of "blue ocean" and "red ocean," with a vast market ahead filled with both opportunities and legal, risk, and liquidity pitfalls. The core issues currently facing the RWA market include legal compliance, asset authenticity verification, and insufficient liquidity, among many other challenges.

The "One-Click RWA Issuance" feature launched by BenFen Chain is an important exploratory solution to address these challenges, providing practical and feasible pathways through standardized processes and compliant custody features. As a significant explorer of RWA infrastructure, BenFen Chain is laying a solid technical foundation for putting real assets on-chain, driving RWA from concept to large-scale application. In the future, as technological solutions continue to mature and the regulatory environment gradually improves, infrastructure providers like BenFen Chain will help RWA truly become an important bridge connecting traditional finance and the crypto world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。