Yesterday we mentioned that it would be best for the market to close with a small bullish candle, and as we expected, it did close with a small bullish candle. However, our hoped target of breaking above 116,000 was not achieved, as both bulls and bears have completed their objectives here. Therefore, whether the market will be dominated by bulls or bears in the future depends entirely on the intentions of the market makers next week. So let's welcome the judgment of the market makers next week.

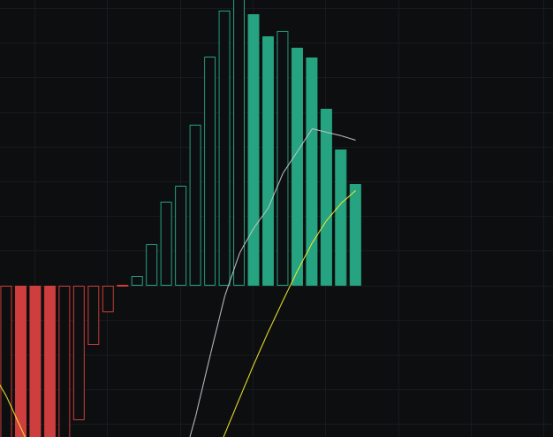

From the MACD perspective, the energy bars continue to decline, and the fast line has also turned downward, which is not good for the bulls. We will continue to observe the market.

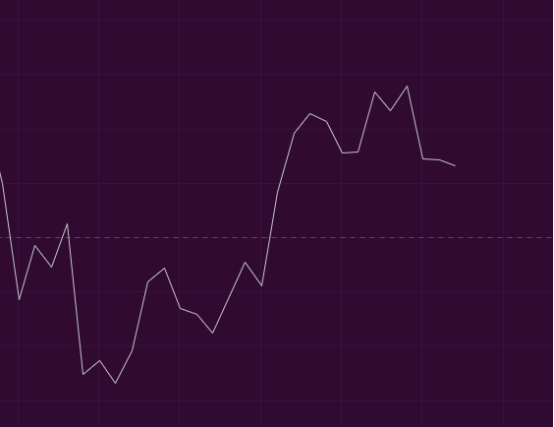

Looking at the CCI, there hasn't been much change in the past two days; it is still hovering above 20, and it could go either way. Ultimately, we will have to see how it moves next week.

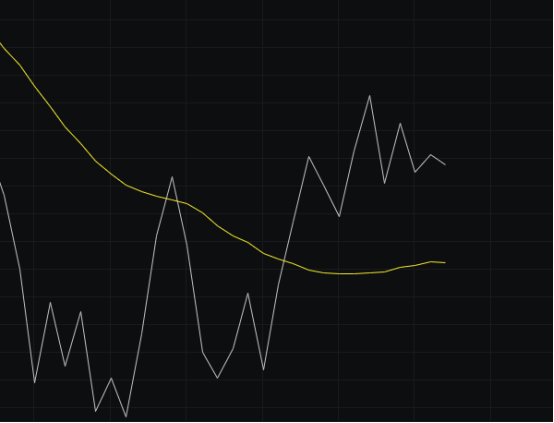

From the OBV perspective, after two days of sideways movement, the slow line has now flattened out, but the fast line is still above the slow line, indicating a continued bullish pattern.

Regarding the KDJ, yesterday we said that ideally, we would see a small bullish candle based on the KDJ pattern, and indeed, we got a small bullish candle, which aligns with our expectations for the KDJ. Today, the KDJ continues to move downward, and it would still be better for the bulls to see another small bullish candle; we will look at the closing situation tomorrow.

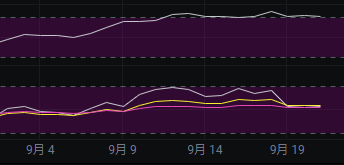

In terms of MFI and RSI, the MFI is still in the overbought zone, indicating that the bulls have not given up, while the RSI has returned to the neutral range, where it could go either way. The best trend will depend on next week's choices.

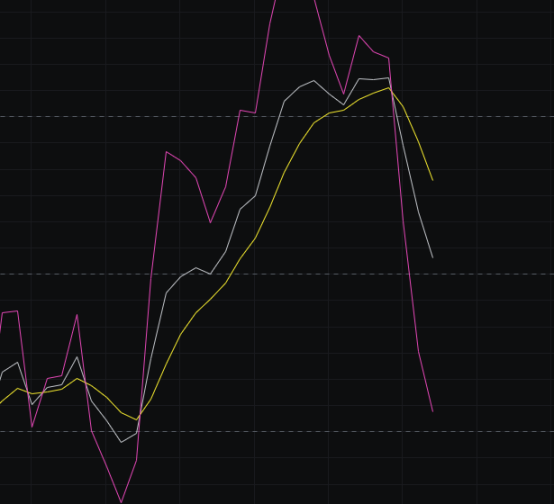

Looking at the moving averages, several moving averages are almost flat, indicating that another trend change is imminent, and it is highly likely that a direction will be determined next week.

From the Bollinger Bands perspective, the movement aligns with our expectations for the Bollinger Bands yesterday, still closing with a small bullish candle, while the lower band is rising. If the price drops, it will accelerate the closing action, but as bulls, we prefer to see a small bullish candle. To maintain a wide trading range, it would be best to also close with a small bullish candle today, allowing the lower band to continue rising, making the trend change next week more logical.

In summary: The overall trend of Bitcoin is within our judgment, and we predict that a direction will be determined next week. As for whether the market makers will judge in favor of the bulls or the bears, we will wait and see. Our target for the bulls is to close with a bullish candle today, ideally with the price breaking above 116,000. The support below Bitcoin is at 115,200-114,000, and the resistance above is at 117,000-118,500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。