Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The current global financial market is exhibiting characteristics similar to the 1999 internet bubble period, where liquidity-driven factors have replaced fundamentals as the dominant market logic. Goldman Sachs traders point out that although Moody's model indicates a 48% probability of economic recession in the next 12 months, market participants have shifted towards chasing liquidity, adjusting positions, and following price trends, forming a general sentiment of "currency devaluation is less than consumption." This shift in sentiment has pushed the U.S. stock market into a speculative phase, with consumer spending willingness resonating with high exposure in the stock market, combined with the Federal Reserve's interest rate cut cycle and fiscal stimulus policies, collectively driving the market from "fear to FOMO." They note that in the next three to six months, the economy and market may experience a significant surge.

It is noteworthy that the recessionary pressures in cyclical industries and the expansion in technology and AI sectors signal economic contradictions, while the deadlock between the two parties in the U.S. over government spending proposals has exacerbated policy uncertainty. The risk of a federal government shutdown and disagreements over healthcare policies may become short-term disruptive factors. Against this backdrop, the liquidity easing expectations brought by the Federal Reserve's "preventive interest rate cuts" are forming external demand pull for export-oriented economies like China through overseas capital expenditure channels. Positive signals such as the domestic PPI turning positive month-on-month also support economic recovery. This week, the market will closely monitor the upcoming PCE inflation data and speeches from Federal Reserve officials, as these macro factors are expected to increase market volatility.

In the cryptocurrency market, Bitcoin has continued to decline since the interest rate decision meeting on September 18. Analyst CrypNuevo expects the price to test the liquidity pool range of $119,600 to $123,600, with secondary support at $114,200. A slight pullback may touch $112,000, and he suggests increasing long orders at key price levels. Donald Dean points out that if the trendline support holds, the target price will successively look towards $123,000 and the Fibonacci level of $131,000. Crypto Seth notes that there is $670 million in short liquidations at $120,000 for Bitcoin, and he believes the market may first retest $114,000. On the other hand, some analysts are cautious; Jason Pizzino observes that the price has dropped after forming a double top pattern, with bulls currently focusing on the support level of $112,000 to $113,000. If it breaks below, bears may push the price further down to the range of $107,000 to $110,000. Analyst Ted further points out that there is over $2 billion in long liquidation pressure in the range of $106,000 to $108,000, and the market may initiate a significant rise after clearing this area.

Ethereum has dropped 10 days after approaching $4,800 on September 13. Although there was a slight increase in the days leading up to the interest rate decision meeting on September 18, it has now fallen below $4,300. Donald Dean believes that if the support level of $4,200 holds, it may rebound to $5,766. If it breaks, $4,070 will become the next support level. Analyst Ted has given an extremely optimistic long-term forecast, believing that the global M2 supply is sufficient to support Ethereum reaching $18,000 to $20,000 at the peak of this cycle, but in the short term, it may first sweep through the liquidity at $4,000. Analyst Krugman warns of an extreme bearish scenario, suggesting a potential 15% pullback to the first major support level of $3,500, with a full retracement possibly reaching a decline of 45%. Notably, on-chain dynamics show that an address associated with Trend Research recently redeemed 16,800 ETH from Aave and deposited it into Binance.

In the altcoin market, ASTER reached $2 after several days of continuous rise but has now pulled back to $1.45. The AVNT from the Base ecosystem also saw a certain decline after hitting a historical high of $2.6. This pullback sentiment has also transmitted to the on-chain contract concept sector, with tokens like SUN, DRIFT, and PERP all experiencing price declines. Additionally, BNB saw a strong increase last week, rising 13% over the week and breaking through $1,083 to set a new high over the weekend. However, tokens within its ecosystem, such as CAKE and THENA, did not strengthen in tandem and instead experienced collective declines when BNB's price pulled back today.

2. Key Data (as of September 22, 14:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $112,500 (YTD +20.4%), daily spot trading volume $26.32 billion

Ethereum: $4,114 (YTD +24.37%), daily spot trading volume $23.93 billion

Fear and Greed Index: 44 (Neutral)

Average GAS: BTC: 1.11 sat/vB, ETH: 0.19 Gwei

Market share: BTC 58.19%, ETH 13.35%

Upbit 24-hour trading volume ranking: SUN, AVNT, WLFI, XRP, ETH

24-hour BTC long-short ratio: 45.26%/54.74%

Sector performance: Meme sector down 13.2%, AI sector down 12.5%

24-hour liquidation data: A total of 402,447 people were liquidated globally, with a total liquidation amount of $1.663 billion, including $280 million in BTC liquidations, $470 million in ETH liquidations, and $93.24 million in SOL liquidations.

BTC medium to long-term trend channel: upper line ($116,170.70), lower line ($113,870.29)

ETH medium to long-term trend channel: upper line ($4,533.24), lower line ($4,443.47)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of September 19)

Bitcoin ETF: +$223 million, with only BlackRock ETF IBIT achieving net inflow

Ethereum ETF: +$47.75 million, with only BlackRock ETF ETHA achieving net inflow

4. Today's Outlook

Korea Blockchain Week 2025 will be held from September 22 to 28

DeAgentAI Genesis airdrop has started distribution, main staking activity will begin on September 22

Binance HODLer airdrop launches 0G (0G), spot trading will go live on September 22

Ethereum Fusaka mainnet will undergo Sepolia fork on September 22

Binance Alpha and Binance Futures will launch Bless (BLESS) on September 23

Binance will delist ALPHAUSDT perpetual contract on September 23

Yala announces recovery plan: will destroy illegally minted YU tokens on September 23

Kaito Al will launch community sale of Novastro token XNL on Capital Launchpad on September 22

SPACE ID (ID) will unlock 72.65 million tokens on September 22, worth approximately $13 million

SOON (SOON) will unlock approximately 15.21 million tokens on September 23, with a circulation ratio of 4.74%, worth approximately $5.3 million

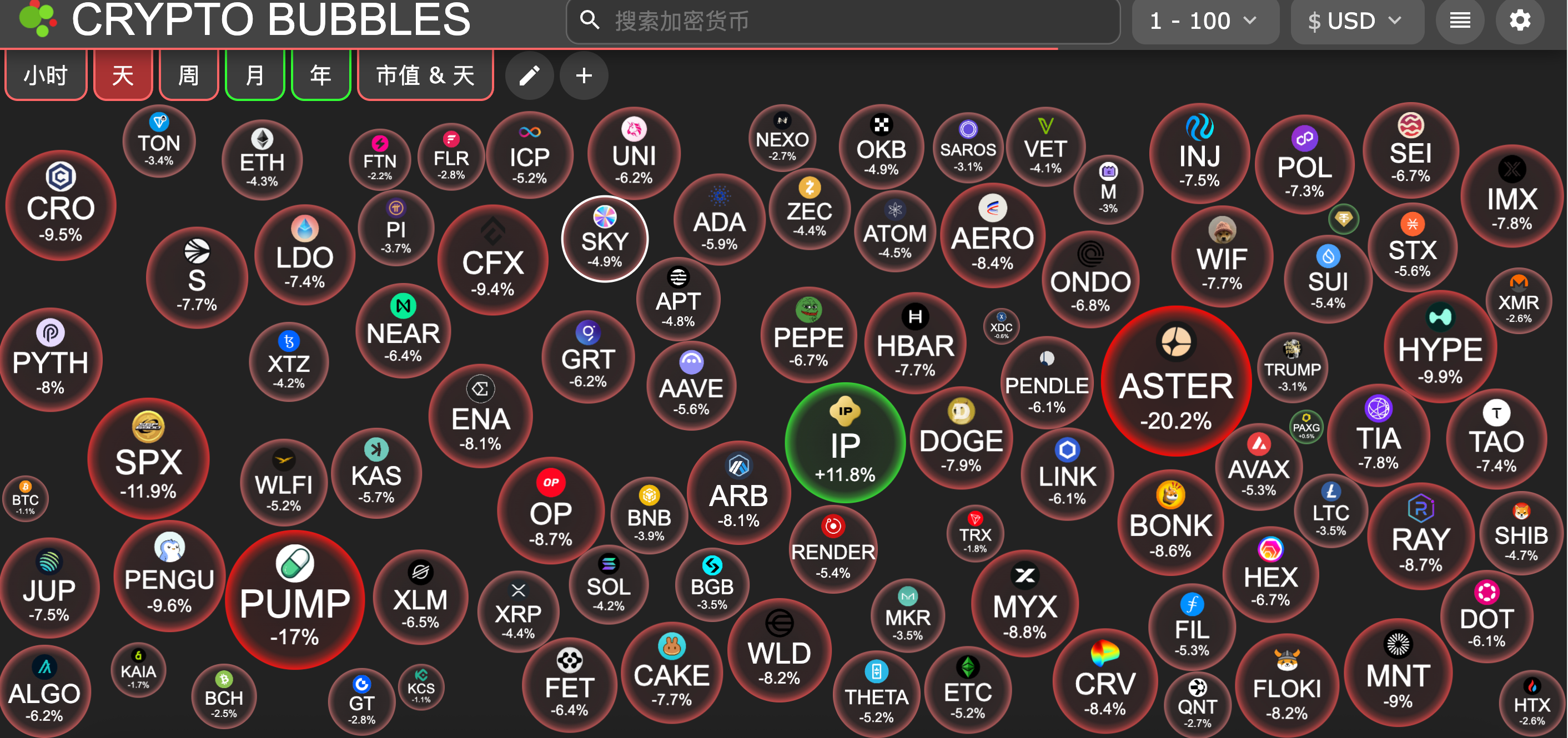

The largest declines among the top 100 cryptocurrencies today: Aster down 20.2%, Pump.fun down 17%, SPX6900 down 17.8%, Sonic (formerly FTM) down 17.2%, Conflux down 16.9%.

5. Hot News

Arthur Hayes suspected of selling 96,600 HYPE, worth $5.1 million

Data: BNB Chain has generated over $350 million in fee revenue in Q3 this year

Ronin Treasury plans to initiate RON token buyback on September 29

Trend Research transferred all NEIROETH to exchanges for liquidation in the past 20 minutes

Arca suspected of buying ENA and IMX, totaling approximately $10.7 million

Faraday Future plans to invest $41 million in Qualigen through PIPE for cryptocurrency business

Matrixport associated address transferred over 88,000 ETH to Binance

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。