Why Crypto Is Down Today: Tariffs, Fed Cuts, and Whale Liquidations

Why crypto is down today is the biggest question for traders as the global market cap plunged to $3.99 trillion, down 3.9% in 24 hours. Trading volume hit $161 billion, while Bitcoin dominance rose to 56.4% and Ethereum’s fell to 12.7%. Every major coin—BTC, ETH, XRP, SOL—is bleeding red.

At the same time, the U.S. shocked markets with record tariff revenue of $30 billion in August 2025, yet the deficit soared to $345 billion. That’s 11x larger than tariff income, exposing deep fiscal stress. With annualized tariff revenue now at $350 billion, a 355% jump since 2024, fear is spreading across global markets.

Whales Trigger $1.7B Liquidation as Bitcoin Dives Overnight

Another major reason why crypto is down today is whale-driven liquidation. In just 20 minutes, $1 billion in Bitcoin longs were wiped out during a low-liquidity Sunday night session. Bitcoin slipped to $112,811, down 2.5% intraday, while Ethereum crashed 11% overnight, trading at $4,212.

Whale addresses played the volatility smartly. After the crash, wallet 0x50dE deposited $15M USDC into Hyperliquid, immediately going long on BTC, SOL, HYPE, and PUMP, according to LookonChain data . Still, liquidation carnage totaled $1.70B in 24 hours, hitting 405,141 traders. ETH alone saw $309.7M liquidated, while BTC lost $214.4M.

Source: CoinGlass

Source: CoinGlass

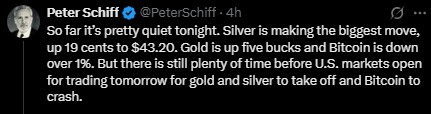

Peter Schiff’s Tariff Warning Echoes as Fed Cuts Rates

Economist Peter Schiff had warned tariffs and rate cuts would backfire. His prediction seems to be unfolding. After the Fed’s 25 bps rate cut, the 10-year yield rose to 4.14%, up from 4.02% just a day before. Schiff believes yields could climb to 5%, forcing the Fed to restart QE.

Source: X

Source: X

Meanwhile, Trump insists the U.S. has the “hottest economy.” Schiff retorts it’s hot only because “it’s burning down.” Gold climbed to $43.20 and silver gained 19 cents, while Bitcoin extended its losses—another key factor behind why crypto is down today.

Fear and Greed Index Shows Investors Turning Fearful

For weeks, sentiment stayed neutral or greedy. But today, the Fear and Greed Index dropped to 45 (Fear), signaling a sharp shift. With whales dictating price moves, tariff shocks shaking global trade, and the Fed pushing confusing signals, investors are now cautious.

Source: Fear and Greed Index

Source: Fear and Greed Index

What’s Next: Busy Week With Key U.S. Data and Powell Speech

Why crypto is down today may not be the end. The crypto market faces a pivotal week as investors brace for key U.S. economic events that could shape its next move. Attention is on Federal Reserve Chair Powell’s speech on Tuesday, which may influence interest rate expectations. Midweek, housing and manufacturing data, including New Home Sales and Durable Goods Orders, will provide insight into economic strength.

Thursday brings Q2 2025 GDP figures and Existing Home Sales, while Friday’s PCE Inflation report could impact inflation outlook. These developments are likely to trigger volatility, and crypto traders will be closely watching to gauge whether the recent downturn is a correction or the start of a broader trend.

Conclusion

The answer to why crypto is down today lies in a deadly mix of tariffs, Fed policy confusion, whale liquidations, and shifting sentiment. With $1.7B wiped in 24 hours, the road ahead depends on Powell’s words and key U.S. economic data. Investors should expect turbulence but prepare for opportunity.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。