The weekly opening saw a sharp drop as news emerged that the U.S. federal government is facing a shutdown risk. According to data from the prediction market Kalshi, the probability of a government shutdown occurring in 2025 has surged to 70%, a record high. This figure reflects the deadlock between the two parties in Congress over budget negotiations. If an agreement is not reached by September 30, the federal government will begin a partial shutdown at midnight on October 1. This is one of the most severe budget crises since the 35-day shutdown during Trump's first term from 2018 to 2019.

Historically, the Republicans shut down the government for 16 days in 2013 to block Obamacare and for 35 days in 2018-2019 over the border wall. So what is the situation this time? There is about a week left, so we will just have to wait, but the three major U.S. stock indices are not significantly affected, with many individual stocks declining.

Bitcoin

Before the interest rate cut, Bitcoin's weekly Bollinger Bands middle line rebounded, and today's rapid decline is testing the BOLL again. If the middle line breaks, there is a chance it could drop to the lower line, which is around 100,000. If it does not break 107,000, we will continue to look for a rebound. The MACD divergence has not yet been resolved. Previously, the three-day line indicated that there was a chance for a rebound when it first dropped. However, the rebound has not broken through the 0.618 level, indicating it is still not strong. Currently, it continues to break below the Bollinger middle line and the daily line has broken below MA20, now testing the support around 110,000 from the previous four-hour head and shoulders bottom.

The daily line has formed a descending channel, directly breaking below MA20 and MA60, and piercing MA120. If the body breaks below MA120, we still need to pay attention to the risk of further decline.

Support: 107,000 to 110,000

Resistance: 118,000 to 121,000

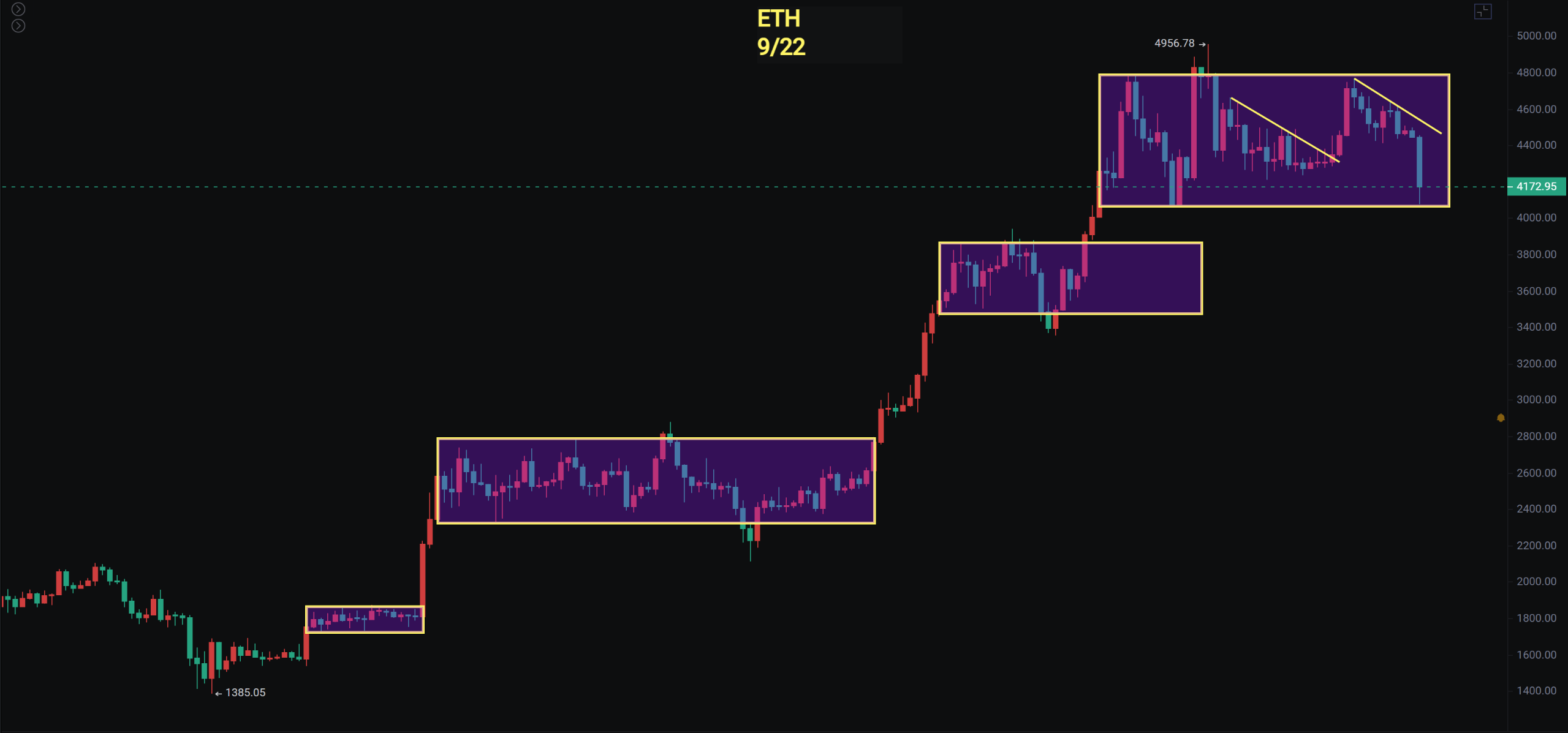

Ethereum

Ethereum has directly dropped to the bottom of the range, piercing 4077, with the previous bottom at 4060. There is short-term support, so I have previously mentioned that it is unclear how long Ethereum will oscillate. However, we still believe there is a chance to break below the range and return, but the premise is that Bitcoin cannot continue to plummet. In the current market, if Bitcoin can maintain above 107,000, there is a possibility for Ethereum. If Bitcoin drops to 100,000, Ethereum will also be affected.

Support: 3850 to 3060

Resistance: 4788 to 4956

If you like my views, please like, comment, and share. Let's navigate through the bull and bear markets together!!!

This article is time-sensitive and for reference only, with real-time updates.

Focusing on K-line technical research, sharing global investment opportunities. Public account: BTC Trading Prince Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。