Author: Nancy, PANews

On September 22, during the peripheral activities of the KBW 2025 summit in South Korea, a special "eSports exhibition match" took place, where contract players showcased a 10-minute live demonstration of leveraging decentralized contract platforms for high-stakes betting. New platforms such as Lighter, edgeX, and GRVT competed on the same stage. On September 23, the founder of Hyperliquid appeared at the KBW venue, a rare public appearance that attracted many fans of Hype.

Currently, the competition in the Perp DEX sector is intense.

The leading Hyperliquid faces potential bearish pressure from a massive token unlock, while new competitors like Aster, Lighter, and edgeX are quickly attracting users through incentive mechanisms and wealth creation effects, reshaping the market landscape. Under the multifaceted game of technology, capital, and attention, the growth space in this sector is being further opened up.

Upcoming Massive Selling Pressure Sparks Community Debate on Supply Reduction Proposal

Hyperliquid's rise is attributed not only to its efficient on-chain trading experience and low-cost advantages but also to its early strategy of leveraging price performance to attract users and capital. This approach has allowed Hyperliquid to dominate the Perps DEX sector for a long time, leading significantly in on-chain trading volume and user stickiness, leaving competitors far behind.

However, the impending massive token unlock has raised market concerns. Over a month ago, BitMEX co-founder Arthur Hayes publicly expressed bullish sentiment on HYPE, stating that the token could achieve a 126-fold increase, with annual revenue potentially reaching $25.8 billion by 2028, while Hyperliquid's revenue was projected at $5.1 billion at that time. Nevertheless, Hayes chose to cash out all his holdings on September 22, citing significant unlock pressure on HYPE. Despite this, he still insists that a 126-fold opportunity exists, as 2028 is still far away.

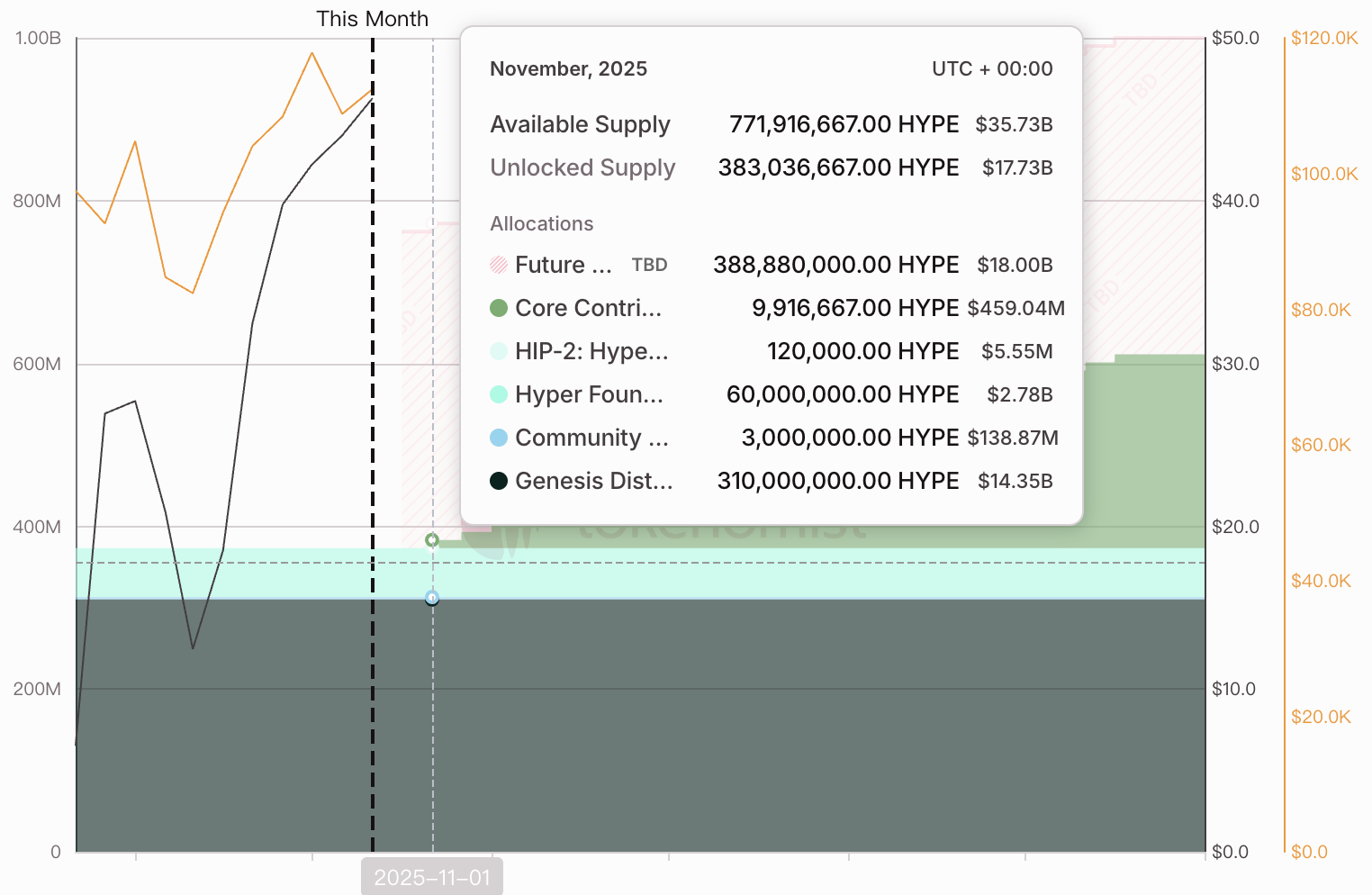

In fact, according to Tokenomist data tracking, starting from November 29, 238 million Hype tokens from core contributors will be unlocked linearly over the next 24 months, currently valued at $10.8 billion, with a potential monthly selling pressure of about $450 million. However, based on the $110 million buyback scale of HYPE in August, it is far from covering the potential selling pressure.

The Hayes family office fund Maelstrom stated that this is Hyperliquid's "first real test," with monthly releases posing a significant risk to HYPE's price stability. "Imagine you are a Hyperliquid developer. You have worked hard for years, and now you are about to receive a life-changing amount of tokens, which can be cashed out with just one click."

The fund also pointed out that even the DAT (crypto treasury company) strategy is far from the future scale of HYPE token unlocks. For example, Nasdaq-listed biotech company Sonnet BioTherapeutics plans to use its $305 million cash holdings to acquire more HYPE tokens.

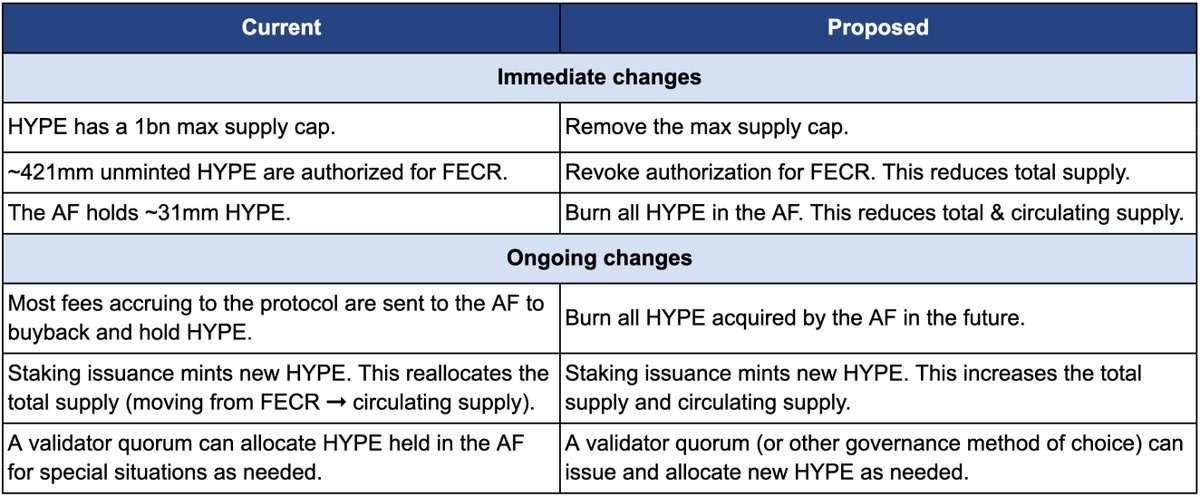

In response to market concerns, DBA co-founder Jon Charbonneau and Flashbots strategy head Hasu proposed reducing the total supply of HYPE by 45%. The proposal indicates that Hyperliquid currently holds a large number of authorized but uncirculated tokens, held by the assistance fund (AF, about 31 million HYPE) and future emissions and community rewards (FECR, about 4.21 million HYPE). It suggests changes to Hyperliquid's economic model, including revoking all unminted HYPE authorized for future emissions and community rewards (FECR), destroying all HYPE currently held and subsequently acquired by the assistance fund (AF), and removing the maximum supply cap of 1 billion HYPE to optimize the protocol's financial structure without affecting the rights of existing token holders or the protocol's funding capabilities.

It is reported that the funds managed by DBA and the two proposers hold significant positions in HYPE, and if the proposal goes to a formal governance vote, all parties plan to vote in support. Currently, the proposal has sparked widespread discussion and attention within the community.

Market Enters Accelerated Differentiation Phase, Incentives Drive Short-term Traffic Surge

In recent days, Aster has attracted users and attention to more emerging platforms through wealth creation effects. As the Perp DEX competition reignites, users flock to seize airdrops, while platforms employ various strategies to compete for liquidity.

Currently, the Perp DEX market shows a highly concentrated yet accelerating differentiation pattern, with signs of slowing growth for the leading platforms, while emerging platforms rapidly rise based on incentive expectations.

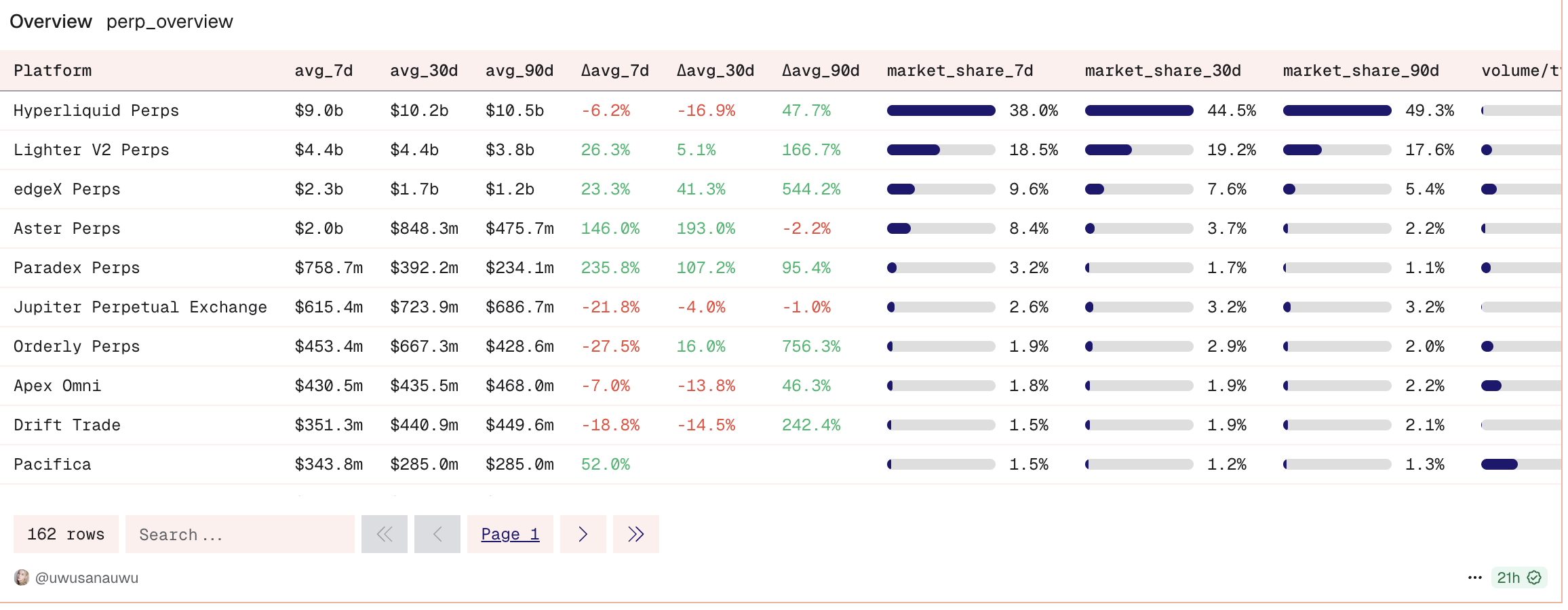

According to Dune data, as of September 23, Hyperliquid leads the Top 10 perpetual contract market with a 38.1% market share; followed by Lighter (16.8%), Aster (14.9%), and edgeX (12.3%). However, further analysis shows that Hyperliquid's market share has declined from 49.3% 90 days ago to 38%, indicating a slight downward trend in the short term. In contrast, emerging platforms have shown significant growth momentum, with Paradex's trading volume surging 235.8% in the last 7 days; Aster growing 146% in the past week; Lighter increasing approximately 166.7% over the last 90 days; and edgeX's trading volume skyrocketing by 544.2% in the past 90 days. This indicates that recent market growth has been largely captured by new platforms.

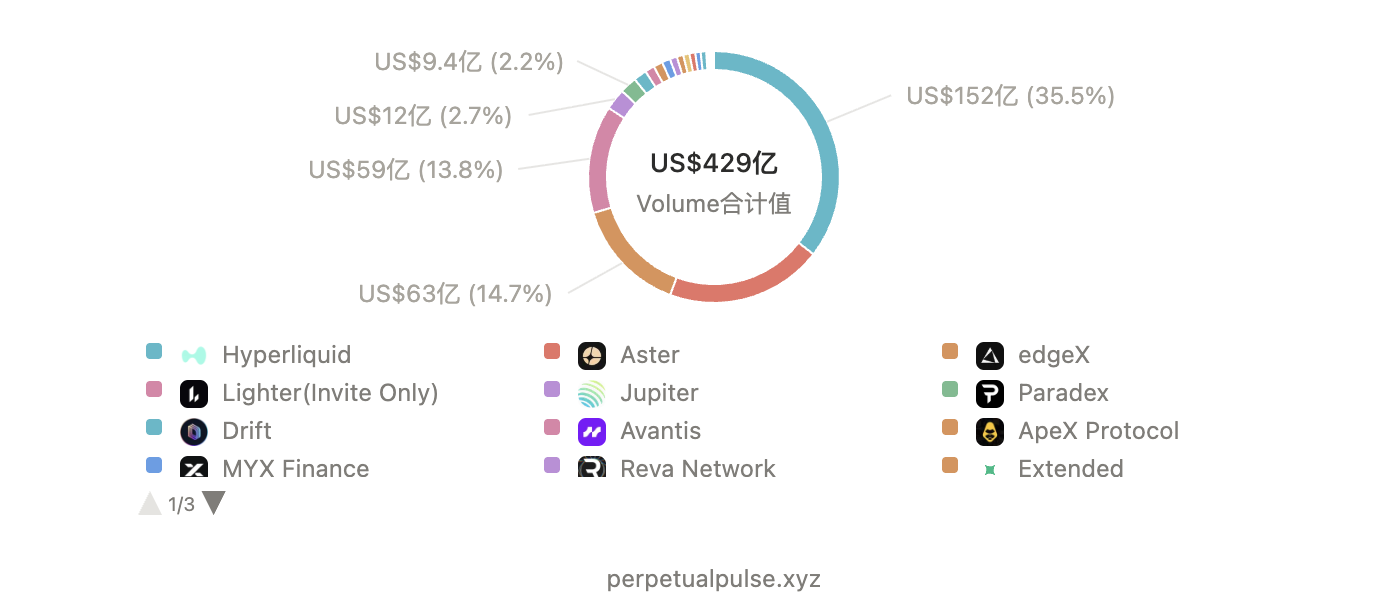

From the perspective of daily trading volume, PerpetualPulse data shows that the total trading volume of mainstream Perp DEXs in the past 24 hours was approximately $42.9 billion, with Hyperliquid contributing $15.2 billion, and Aster, Lighter, and edgeX contributing $8.6 billion, $6.3 billion, and $5.9 billion, respectively. These four platforms account for a total of 84.1%, further confirming that market concentration remains high, but share differentiation is accelerating.

Relying solely on trading volume is insufficient to fully reflect the real market situation; the open interest/volume ratio (OI/Volume) is considered a better measure of user activity and market health. According to statistics from Dragonfly managing partner Haseeb Qureshi (September 22), a high ratio (>100%) indicates that the platform has a large number of real user positions and active leverage usage, reflecting a healthy market, such as Hyperliquid's ratio of 287% and Jupiter's 395%; a medium-low ratio (10–65%) suggests that trading is mostly short-term operations or arbitrage, with limited real user activity, such as Lighter and Orderly both at 29%; an extremely low ratio (20%) indicates wash trading or incentive-driven activity, lacking long-term retention, such as Aster at 12% and Paradex at 13%.

In fact, the recent spikes in trading volume and open interest for these platforms are indeed highly correlated with their incentive mechanisms and market expectations. For instance, Aster's short-term trading volume surged due to wealth creation effects and second-phase airdrops; Lighter and edgeX saw users concentrating on earning points due to Q4 token issuance expectations.

However, the overall market size of Perp DEX is entering a new phase. DeFillama data shows that as of September 23, the daily trading volume of Perp DEX has exceeded $43.21 billion, an increase of approximately 530.7% since the beginning of the year.

Overall, the current competition in Perp DEX is fundamentally a contest for attention and incentives. In the short term, airdrops and token issuance expectations may continue to dominate the traffic competition, driving periodic explosive trading and user migration. But the real key lies in whether the platforms can convert this short-term influx of traffic into genuine retention and long-term trading activity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。