Author: Zhao Qirui

Editor: Zhao Yidan

In recent years, a phenomenon known as "Digital Asset Treasury" (DAT) has rapidly evolved from the forefront of the crypto world into an unavoidable strategic topic in global corporate boardrooms. The essence of DAT is not merely "companies buying coins" or speculative behavior, but rather a proactive, systematic financial management transformation. It signifies that companies are beginning to strategically integrate digital assets into their balance sheets, viewing them as tools that serve the dual functions of capital preservation and strategic positioning. The emergence of this model indicates that a institutional bridge is being established between traditional corporate finance and the decentralized digital economy.

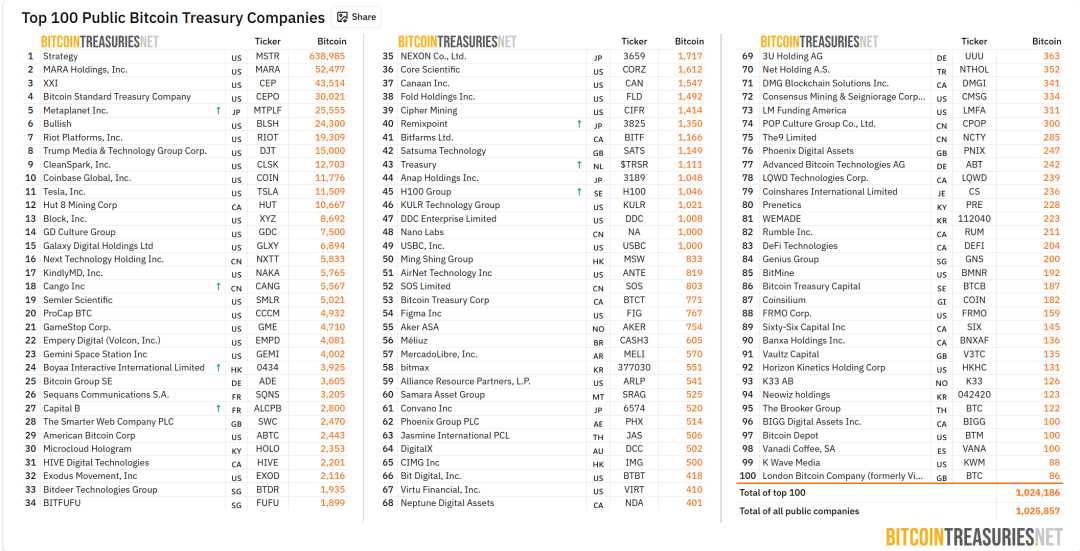

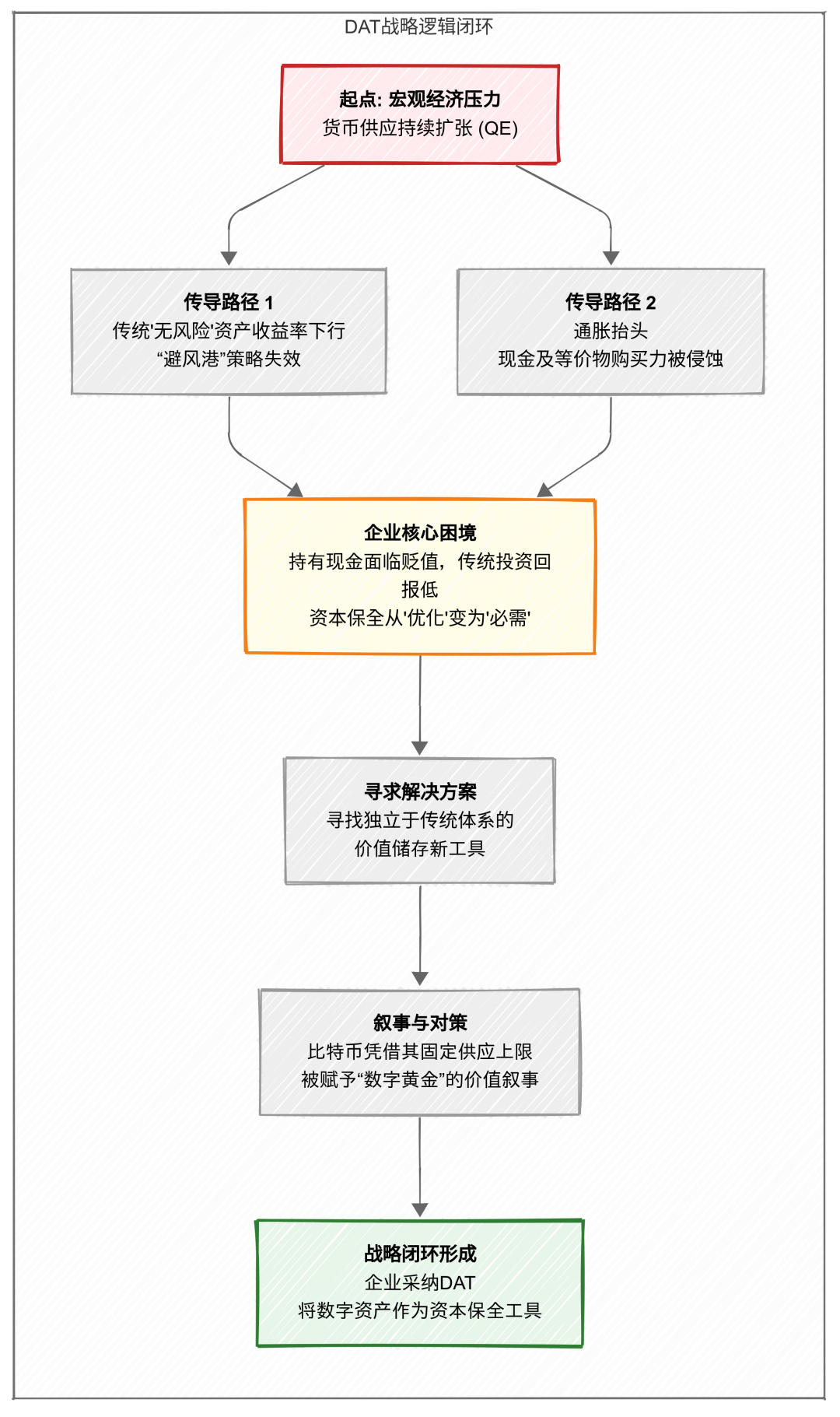

The rise of DAT is a direct response to the macroeconomic pressures of the post-pandemic era. Since the 2008 financial crisis, major central banks around the world, particularly the Federal Reserve, have implemented multiple rounds of large-scale quantitative easing (QE) policies. While these policies stabilized financial markets, they also led to a dramatic expansion of the money supply, with global M2 money supply experiencing explosive growth, raising widespread concerns about the long-term erosion of the purchasing power of fiat currencies. Against this backdrop, the value of traditional cash and low-yield bonds in corporate treasuries is facing continuous erosion. It was in this macro narrative that pioneers, represented by MicroStrategy (now renamed Strategy Inc.), took groundbreaking actions in 2020 to establish Bitcoin as their primary reserve asset. This move aimed to hedge against inflation and seek a means of storing value that is independent of the traditional system.

MicroStrategy's transformation turned an abstract macro anxiety into a concrete strategic choice that companies cannot avoid, igniting a core question: Are digital assets a prudent hedge to protect shareholder value, or a high-risk speculative leap?

This article aims to provide corporate decision-makers, institutional investors, and researchers with a comprehensive analytical framework to systematically dissect this emerging paradigm of DAT. We will delve into the macro and technological forces driving the rise of DAT, analyzing the differing strategies adopted by various companies—from pure value storage to deep ecological integration. By comparing it with traditional capital allocation strategies, this article will reveal the uniqueness of DAT and comprehensively assess its potential empowerment and accompanying profound risks. Ultimately, this article seeks to discern the nature of DAT: Is it a rational financial revolution driven by macroeconomic pressures, or a fleeting bubble spawned by technological fervor and market speculation? The answer to this core contradiction will provide strategic decision-making guidance for all parties navigating this new financial ocean filled with uncertainty.

Part One: The Origin of the Wave

1.1 When Traditional Safe Havens Fail

Many attribute the rise of Digital Asset Treasury (DAT) to a technological phenomenon; however, if we combine the emergence of DAT with the direction of macroeconomics, we can see that DAT is actually a strategic response from companies to the dramatic changes in the global macroeconomic paradigm in the post-pandemic era. The decision-making logic of corporate finance departments has undergone a profound evolution under a new type of systemic pressure. The narrative of this evolution should actually trace back to the era of large-scale quantitative easing (QE) led by central banks around the world after the 2008 global financial crisis.

The core mechanism of QE—central banks injecting massive liquidity into the financial system by purchasing securities—has fundamentally reshaped the operational environment of corporate treasury management. Taking the Federal Reserve as an example, between 2008 and 2014, three rounds of QE caused its balance sheet to balloon from less than $1 trillion to $4.5 trillion, leading to a significant increase in global M2 money supply. The long-term consequence of this policy has placed corporate treasurers in a dilemma. On one hand, the influx of new liquidity into capital markets has driven a "V"-shaped rebound and continued rise in asset prices such as stocks and real estate, making it increasingly difficult to obtain safe returns through traditional investments. On the other hand, and more insidiously, the hundreds of millions in cash reserves on corporate balance sheets are losing purchasing power at a subtle yet undeniable pace under the framework of monetary quantity theory.

Accompanying the expansion of the money supply is the systemic decline in the yields of traditional "risk-free" assets. To stimulate the economy, major global central banks have kept benchmark interest rates at historically low levels for an extended period, even pushing them into negative territory.

In the past, short-term, highly liquid assets such as government bonds and money market funds served as "safe havens" for companies to park idle cash and obtain stable, albeit modest, returns. However, in a global environment of low and even negative interest rates, the returns on these traditional tools have plummeted, rendering the "safe haven" completely ineffective. For example, in Europe and Japan, long-term government bond yields once plunged into negative territory, meaning that holding these assets not only failed to generate returns but also implied that holding government bonds could even mean paying the government a "custody fee." Traditional cash management strategies have evolved from a low-risk yield optimization tool into a financial trap that slowly consumes capital.

Corporate treasury departments find themselves in a dilemma: either accept the continuous devaluation of cash purchasing power or be forced to look towards the unknown realms further along the risk-return curve in search of the possibility of positive returns.

The overproduction of money and the low-interest-rate environment have created a breeding ground for rising inflation, while the global supply chain restructuring and rising commodity prices in the post-pandemic era have jointly ignited the fuse. Persistent inflationary pressures pose the most direct and urgent threat to corporate treasuries, transforming the need to hedge against cash devaluation from an "optimization allocation" into a "survival necessity."

The essence of inflation is an invisible tax on cash holders, directly undermining a company's operating capital and future investment capacity. When the officially published Consumer Price Index (CPI) continues to rise, the "asset inflation" that companies actually experience—the speed at which prices for quality assets (such as prime real estate and high-growth company equity) increase—often escalates even more sharply. Under this dual inflationary pressure, leaving large amounts of cash idle on the balance sheet is tantamount to watching shareholder value evaporate continuously.

At this point, the strategic logic of DAT is fully formed. Faced with a macro environment characterized by continuous expansion of the money supply, the failure of traditional safe havens, and inflation continually eroding capital, the goal of corporate financial strategy is no longer simply to preserve and increase value, but to ensure that assets can be preserved amid structural changes in the economy. It is against this backdrop that Bitcoin, with its fixed supply cap of 21 million coins and decentralized network structure, has been endowed with the narrative of "digital gold," precisely responding to companies' core demand for value storage in an era of monetary overproduction. The decision for companies to turn to digital assets raises the question of whether this is a proactive, rational choice based on profound insights or an emergency response to a high-risk alternative after all traditional paths have failed. This core question runs through the entire process of DAT's rise.

1.2 The Catalysis of Industry Pioneers

If macroeconomic pressures create the "necessity" for the emergence of DAT, then the actions of industry pioneers provide the "possibility." A theoretical strategic concept, without a clear framework and replicable operational path, will ultimately remain as sporadic attempts. The rapid evolution of DAT into a far-reaching movement hinges on the thought architects represented by MicroStrategy and the legitimacy catalysts represented by Tesla and Block, who together completed the transmission from theoretical construction to mainstream acceptance.

In this movement, MicroStrategy and its founder Michael Saylor's role goes far beyond being the "first to eat crabs"; he is the "thought architect" of the entire strategy. He provided the business community with a complete, replicable framework and operational manual.

Saylor's theoretical system is thoroughly articulated in the open letters he issued to shareholders, the financial reports submitted to the U.S. Securities and Exchange Commission (SEC) (10-K, 10-Q), and the "Bitcoin for Corporations" series of conferences.

He does not simply view Bitcoin as a speculative investment but elevates it to a strategic "Primary Treasury Reserve Asset." His logical chain is tight and disruptive:

Diagnosis of the Macro Environment: Saylor's starting point is closely linked to macroeconomic catalysts. He repeatedly emphasizes that global quantitative easing is causing the purchasing power of fiat currencies (especially the U.S. dollar) to depreciate at a non-negligible rate each year. For companies holding large cash reserves, this is akin to an invisible erosion of value, which he refers to as the "melting" of capital.

Critique of Traditional Assets: He argues that in a low-interest-rate environment, traditional safe-haven assets such as government bonds and gold can no longer effectively fulfill their value-preserving function. Government bond yields are meager or even negative, while gold, though scarce, faces issues of low storage, verification, and transfer efficiency in the digital age.

Redefinition of Bitcoin: Based on this, Saylor redefines Bitcoin as a superior value storage tool in the digital world—"digital gold." He draws an analogy from the physics concept of "energy," asserting that Bitcoin is a closed currency network, guaranteed by code to maintain its scarcity (with a cap of 21 million coins), capable of most effectively preserving "monetary energy" and preventing its dissipation over time. This narrative provides a philosophical foundation for companies to allocate Bitcoin, positioning it as a rational financial strategy aimed at achieving long-term capital preservation.

This theoretical framework is not a castle in the air but is realized through a series of bold and transparent financial engineering practices. Through various documents submitted to the SEC, the market can clearly see the specific path by which it deeply binds corporate balance sheets to Bitcoin: since 2020, MicroStrategy has not only relied on its own cash but has actively borrowed to accelerate Bitcoin accumulation through diversified financing tools such as issuing low-interest convertible bonds and issuing additional stock. This series of operations has formed a powerful positive feedback loop, or "financial flywheel": purchasing Bitcoin reinforces the market's perception of its "Bitcoin proxy stock," driving its stock price to significantly trade at a premium relative to its net asset value (NAV) of held Bitcoin. Before the approval of Bitcoin spot ETFs, this allowed its stock to effectively act as a de facto proxy ETF. The company then utilized this premium to finance the purchase of more Bitcoin at a lower cost, further solidifying market perception.

By publicly sharing rigorous theoretical arguments and detailed operational paths, MicroStrategy has provided the entire business community with a "open-source playbook" that greatly lowers the threshold for other companies to explore DAT strategies. However, the stability of this highly leveraged model is inherently tied to continuously rising asset prices and market confidence, which raises profound reflections on its replicability and risk exposure for traditional companies with stable core businesses and lacking technological allure.

However, no matter how comprehensive an operational manual may be, it requires validation from the mainstream world to transcend niche categories. It is at this critical juncture that the entry of tech giants plays the role of a "strategic legitimacy catalyst," pushing DAT from a relatively marginal financial topic into the spotlight of the mainstream business world.

Tesla's entry is a powerful market signal. In early 2021, Tesla disclosed in its 10-K filing with the SEC that it had purchased $1.5 billion worth of Bitcoin and briefly announced that it would accept Bitcoin as a payment method for car purchases. Although its subsequent actions—such as selling part of its holdings at a high point to realize profits and pausing Bitcoin payments due to environmental concerns—revealed a significant opportunistic aspect of its strategy, the initial action of one of the most innovative companies in the world created a tremendous shock globally, proving that digital assets are a serious topic worthy of consideration for top tech companies' balance sheets.

In contrast, Block (formerly Square), led by Jack Dorsey, demonstrated a more strategically profound "ecological synergy" model. In October 2020, Block announced a $50 million investment in Bitcoin, explicitly stating in public documents that this move aimed to support Bitcoin in becoming a more empowering global monetary system, which aligns closely with the inclusive financial goals of its businesses like Cash App. Block not only holds Bitcoin but also actively invests in the development of Bitcoin open-source technology through its departments like TBD and Spiral, committed to building decentralized financial infrastructure. This strategy deeply binds the holding of Bitcoin (DAT) with the company's core business vision, positioning it as "an investment ticket to future business models," rather than merely a financial hedge.

Overall, Tesla's participation brought explosive mainstream media attention and cultural crossover effects to DAT, while Block showcased how DAT can create synergistic value with business ecosystems as part of a company's long-term strategy. The "endorsement" from these two tech giants significantly enhanced the legitimacy of the DAT strategy, demonstrating to the market that this is not an isolated action by a single company, but an emerging corporate strategy worthy of serious discussion. However, the sustainability of such decisions, driven strongly by the personal beliefs of founders, is also closely related to changes in market cycles and the focus of leadership. When the macro environment reverses or the founder's interest shifts, whether this powerful demonstration effect can continue remains an open question.

Ultimately, it is the combination of MicroStrategy's profound theoretical construction and the high-profile mainstream endorsement from tech giants that has formed a powerful demonstration effect. The former provides a detailed blueprint for "why to do" and "how to do," while the latter offers critical trust in the "feasibility" and "forward-looking" nature of this blueprint. This process significantly reduced the cognitive and practical barriers for subsequent corporate decision-makers to adopt DAT, paving the way for a broader wave of corporate "coin hoarding" after 2021.

1.3 From the "Wild West" to "Wall Street"

While macroeconomic pressures have created a strong "demand" for companies to adopt Digital Asset Treasury (DAT), mere demand is insufficient to foster a lasting strategic wave. If the holding and management of assets remain in a personalized, high-risk "Wild West" model, the large-scale entry of corporate funds would be out of the question. The explosion of the DAT wave is directly predicated on transforming the management of digital assets from a realm filled with operational risks and compliance fog into a "Wall Street"-style ecosystem that is rule-based and risk-controlled. The key to this transformation lies in the maturity of three foundational infrastructure pillars: institutional-grade custody, compliance audit pathways, and financial derivatives, which together build a crucial "trust bridge" for the entry of corporate funds.

First Barrier: The "Black Hole" Risk of Custody and the Emergence of Professional "Gatekeepers"

For any company, the primary technical and operational risk of adopting a DAT strategy crystallizes in a saying from the crypto community: "Not your keys, not your coins." The essence of cryptocurrencies like Bitcoin is that they are digital bearer assets, with ownership defined and proven by the possession of private keys. This means that if a company chooses "self-custody," it must bear the full responsibility for protecting these private keys. This not only requires extremely high technical capabilities to guard against cyberattacks, hacking, and malware but also imposes extreme demands on the company's internal controls to prevent internal fraud or operational errors that could lead to the loss of private keys. Once a private key is permanently lost, the corresponding asset becomes irretrievable, creating an unbridgeable "black hole" on the company's balance sheet. This extreme risk is an obstacle that the vast majority of companies, especially traditional non-tech firms, cannot and do not wish to bear.

To address this core pain point, professional institutional-grade custody solutions have emerged, playing the role of "gatekeepers" and transforming the significant burden of asset security into a purchasable, trustworthy external professional service. Institutional custody service providers like Coinbase Prime, Fidelity Digital Assets, and BitGo have successfully mitigated the risks of self-custody by offering a complete set of solutions designed specifically for institutional clients. Their core value proposition is built on three pillars:

Cutting-edge Security Architecture: These custodians generally employ multi-signature, multi-party computation (MPC), and store the vast majority of assets in offline "cold storage" as part of a layered defense strategy. These measures significantly reduce the risks of single points of failure and cyberattacks, ensuring that private keys are not easily stolen or misused.

Comprehensive Insurance Coverage: To further hedge against risks, top custodians typically purchase substantial commercial crime insurance from well-known insurance groups like Lloyd's of London. These policies cover asset losses due to third-party hacking, internal employee theft, and other causes, providing companies with a familiar financial safety net from the traditional financial world.

Strict Compliance and Audit Certification: To establish institutional trust, these custodians proactively undergo SOC 1 and SOC 2 audits. These certification reports, issued by independent third-party accounting firms (such as the "Big Four"), demonstrate that the custodians have sound internal control systems in areas such as financial reporting, security, availability, and confidentiality, meeting the compliance review requirements of publicly traded companies.

Second Barrier: The "Fog" of Accounting and Compliance and the Guidance of Professional "Navigators"

After addressing asset security issues, publicly listed companies face a second major obstacle: how to disclose and account for their digital asset holdings in compliance with financial reporting standards. According to U.S. GAAP, cryptocurrencies like Bitcoin were classified as "indefinite-lived intangible assets" at the time. This accounting treatment is highly unfavorable for companies: when the market price of the asset declines, the company must recognize impairment losses, impacting current profits; however, when the market price rebounds, it cannot revalue the asset upwards to recognize gains. This means that financial reports can only reflect losses and cannot show appreciation, severely distorting the company's true financial condition and potentially negatively impacting stock prices.

In the face of this accounting and compliance "fog," the "Big Four" accounting firms—PwC, Deloitte, EY, and KPMG—have played the role of "navigators." They have published a series of white papers and industry guidelines on the accounting treatment and auditing of digital assets, providing the market with a clear but imperfect operational path. The value of the work done by these professional service firms lies in:

Establishing Audit Standards: They provide methodologies for auditing the existence, ownership, and valuation of digital assets, enabling external auditors to issue audit opinions on companies' DAT holdings.

Providing Disclosure Examples: They assist companies in clearly disclosing the quantity, cost basis, fair value, and associated risks of their digital assets in financial statement notes, enhancing the transparency of financial reporting.

Although the accounting standards for "intangible assets" have inherent flaws (the FASB has released updates in 2023 to allow for fair value measurement), the work of the "Big Four" ensures that the disclosure process for companies is compliant and auditable. This resolves the critical compliance barriers faced by publicly listed companies, allowing them to legally incorporate DAT into their audited financial statements.

Third Barrier: The "Roller Coaster" of Volatility and the "Seatbelt" of Risk Management

Even with asset security and compliance in place, the extreme price volatility of digital assets, especially Bitcoin, remains a significant financial risk that corporate treasury departments cannot ignore. With annualized volatility reaching 75% or higher, the value of assets can fluctuate dramatically in a short period, posing a severe challenge to companies seeking capital preservation and financial stability. Without effective risk management tools, a DAT strategy would be akin to pure price gambling.

In this context, the development of regulated financial derivatives markets provides the necessary "seatbelt" for companies to manage this volatility risk. Among these, the Bitcoin futures and options products launched by the Chicago Mercantile Exchange (CME Group) represent a key milestone. As one of the most respected derivatives exchanges globally, CME's products offer institutional investors:

Hedging Tools: Companies can hedge against the price decline risk of their spot holdings by selling Bitcoin futures or buying put options.

Liquidity Management: The high liquidity of the futures market allows companies to quickly adjust their risk exposure without directly selling spot assets.

At the same time, traditional financial giants like BlackRock and Fidelity successfully launched Bitcoin spot ETFs in 2024, further providing mainstream capital with compliant and convenient investment channels, significantly enhancing the legitimacy and market depth of Bitcoin as an asset class. These regulated derivatives and ETF products enable companies to upgrade DAT from a "pure holding" passive strategy to an actively managed strategic allocation that can be integrated into modern corporate risk management frameworks.

In summary, it is the gradual maturity of the three foundational infrastructure pillars—institutional-grade custody, compliance audit pathways, and financial derivatives—that has collectively transformed digital asset investment from a daunting "Wild West" into a "Wall Street" ecosystem where corporate funds can navigate safely. However, this professionalized and centralized infrastructure, while reducing technical risks, also introduces new dimensions of risk. The collapse of FTX has devastatingly challenged the narrative of "professional = safe," exposing that even seemingly compliant centralized trading counterparts may harbor fatal internal risks. Companies' reliance on these centralized services, to some extent, diverges from the core value of Bitcoin's decentralization, reintroducing scrutiny and single-point failure risks. Compared to traditional financial markets, the depth of digital asset infrastructure (such as the liquidity of the derivatives market) is still in its early stages, and whether it can support the truly large-scale entry and exit of corporate funds without triggering market shocks remains a critical unresolved question.

Part Two: Strategic Divisions

2.1 The Motivation Map for Corporate DAT

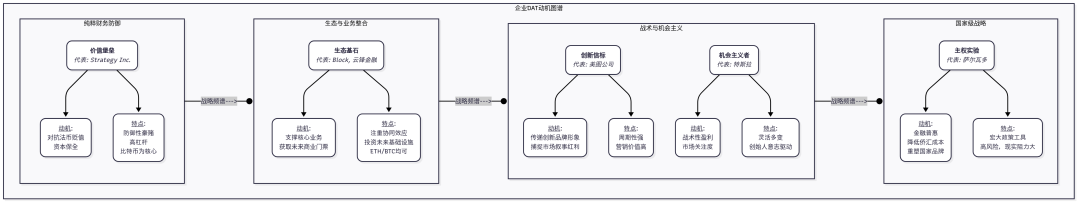

As Digital Asset Treasury (DAT) moves from the margins of innovation to mainstream visibility, the corporate world has not formed a unified adoption paradigm but instead presents a diverse "motivation map." Different companies, based on their industry position, strategic goals, and risk preferences, have chosen distinctly different paths. By deconstructing key cases, we can outline a continuum from pure financial defense to deep ecological integration, and then to more tactical opportunistic motivations.

At the purest end of this continuum is the "Value Fortress" prototype, whose sole mission is to transform the company's treasury into the ultimate bastion against macroeconomic uncertainty. The pioneer and most extreme practitioner of this strategy is undoubtedly Strategy Inc. Since announcing in August 2020 that it would make Bitcoin its "primary reserve asset," Strategy's strategic logic has remained consistent: **to combat the long-term devaluation of **fiat currency.

Saylor has repeatedly emphasized in his letters to shareholders and various public speeches that holding cash in a world of continuous quantitative easing and high inflation expectations is tantamount to watching shareholder value erode. To this end, the company not only continuously converts operating cash flow into Bitcoin but also innovatively uses financial engineering methods such as issuing low-interest convertible bonds and market-based stock offerings to actively incur debt to accelerate accumulation. This "stock-debt-coin" linkage model forms a powerful "financial flywheel," but its success is inherently tied to the continuous rise in Bitcoin prices and the recognition of capital markets. This highly leveraged model, while bringing excess returns, also exposes the company to extreme market volatility, unfavorable accounting standards, and potential repayment pressures; it is essentially a defensive gamble. First, there is the risk of extreme market volatility; a significant drop in Bitcoin prices would directly lead to substantial impairment losses on the balance sheet and a decline in stock prices. Second, there is the risk of accounting standards; before the update of U.S. GAAP, the unfavorable "intangible asset" impairment rules severely distorted its financial performance. Third, there is leverage risk; heavy reliance on debt financing theoretically creates repayment pressure in extreme bear markets, although Saylor insists that its debt structure prevents it from facing liquidation risk. Although Strategy's strategy is essentially defensive, its aggressive execution and the resulting massive market attention also inevitably imbue it with a strong "innovation beacon" character.

However, not all companies view their treasury from such a purely financial perspective. For companies in the middle of the map, digital assets are not an endpoint but rather an "ecological cornerstone" leading to broader strategic goals.

Block (formerly Square)'s DAT strategy is deeply tied to its core mission of "economic empowerment." Its Cash App has long provided convenient Bitcoin buying and selling services to tens of millions of users. Therefore, Block's holding of Bitcoin is not just a financial investment but also a strategic support and demonstration of its belief in its payment ecosystem. Additionally, its departments like TBD and Spiral are dedicated to developing decentralized open-source technologies and identity systems (Web5), aiming to build a more open financial future. Here, DAT is an organic component of its push for future inclusive finance and decentralized business models.

Hong Kong-listed Yunfeng Financial, indirectly owned by Jack Ma, showcases another ecological synergy model. The company announced in September 2025 that it had purchased 10,000 Ethereum, explicitly stating that this move aimed to provide "key infrastructure support" for its real-world asset (RWA) tokenization activities and explore its application scenarios in core businesses like insurance. Shortly thereafter, its subsidiary completed the first pilot of RWA tokenization for a fund of funds (FOF). Here, holding ETH is not merely a bet on its price but a means to master the core capabilities for asset issuance, settlement, and smart contract interaction on the Ethereum ecosystem, serving as strategic "ammunition" for its transition to Web3 and RWA tokenization.

The success criteria for such strategies are not the appreciation of the assets themselves but their synergistic effects on the core business; the risk lies in the fact that if strategic synergy fails or the chosen track does not develop as expected, DAT may become an isolated high-risk investment.

Continuing along the map, we see some more flexible strategies, where the narrative value and marketing effects in the short term may even surpass pure financial returns. Hong Kong-listed Meitu is a typical "innovation beacon." As an imaging application company, it announced in 2021 that it had purchased Bitcoin and Ethereum, clearly stating in its announcement that this was not only asset allocation but also a demonstration of its "long-term vision to enter the blockchain industry." This move successfully conveyed its embrace of the future brand image to the market and young users, quickly becoming a media focus. However, this strategy also has a high degree of cyclicality. As the market cooled and the company's strategic focus shifted to AIGC, Meitu liquidated its holdings for profit in 2024, indicating that its DAT strategy was more about capturing "innovation dividends" within specific market cycles rather than permanent value storage. If the market narrative fails to effectively translate into business advantages, such behavior may be viewed as a "speculative risk of being sidetracked."

Tesla has taken this flexibility to the extreme of being an "opportunist." The success of opportunistic strategies lies in tactical profitability and gaining market attention. However, the risks are also evident: the capriciousness of the strategy may damage the company's reputation, causing it to be seen as a speculator rather than a strategist. This model, strongly driven by the personal will of the founder, is highly dependent on the founder's continued focus and the alignment of market conditions, lacking institutional resilience.

Finally, when DAT strategies are scaled to the national level, they form the "sovereign experiment" prototype. At this point, digital assets are no longer merely tools for corporate treasuries but policy instruments serving grand national strategies (such as financial inclusion, reducing remittance costs, attracting foreign investment, and reshaping national branding).

In September 2021, El Salvador became the first country in the world to establish Bitcoin as legal tender and launched the official digital wallet Chivo, airdropping $30 worth of Bitcoin to every citizen to encourage usage. Its strategic goals are diverse: first, to significantly reduce remittance costs, which account for about 20% of the country's GDP, by bypassing traditional banking networks; second, to provide financial services to the 70% of the population without bank accounts; third, to utilize geothermal energy from volcanoes for "green" Bitcoin mining, attracting global crypto capital and talent, and reshaping the national brand.

However, this grand experiment has encountered significant resistance in reality. Independent research shows that the Chivo wallet has low user engagement due to frequent technical failures and security vulnerabilities, with the vast majority of users stopping usage after claiming the subsidy. The proportion of remittances processed through Bitcoin is also far below expectations, accounting for only 1.3% of the total in 2023. Meanwhile, the extreme price volatility of Bitcoin poses significant risks to the national treasury, triggering serious warnings from international institutions like the International Monetary Fund (IMF) and directly affecting the country's international financing capabilities. Ultimately, to secure IMF loans, El Salvador was forced to announce in early 2025 the cancellation of the legal requirement to accept Bitcoin, marking a significant setback for this experiment. The case of El Salvador provides a profound lesson for the world: embedding high-volatility digital assets directly into the national monetary system is far more complex and risky than anticipated, and without mature infrastructure, widespread public education, and robust risk hedging mechanisms, such grand experiments are prone to difficulties.

2.2 Path Dependence of DAT Strategies

A company's Digital Asset Treasury (DAT) strategy does not form in a vacuum but is profoundly shaped by its "soil" (regulatory environment and market culture) and its intrinsic "beliefs" (judgments about the future of digital assets). By cross-examining the key cases from the previous chapter along two core analytical axes—geography and regulatory environment (U.S. vs. Asia) and asset philosophy (Bitcoin vs. Ethereum)—we can reveal the strategic logic and path dependence hidden behind corporate DAT choices.

Lens One: Geography and Regulation Axis

Comparing the DAT models represented by U.S. listed companies with those represented by Asian (especially Hong Kong) listed companies reveals essential differences in "game rules" and "player mentality."

- Information Disclosure: U.S. Standardized Transparency vs. Asian Flexibility in Announcements

The U.S. capital market is known for its strict and standardized information disclosure requirements, which are vividly reflected in the practices of DAT companies. For example, Strategy Inc. (formerly MicroStrategy) and Tesla must provide detailed disclosures of their digital asset holdings through mandatory documents submitted to the U.S. Securities and Exchange Commission (SEC), such as 10-K (annual report), 10-Q (quarterly report), and 8-K (major event report). These documents not only require disclosure of the quantity purchased, cost basis, and fair value but also necessitate the confirmation of impairment losses according to U.S. GAAP, allowing the market to accurately track changes in their balance sheets. This high degree of standardized transparency provides investors (especially institutional investors) with quantifiable, auditable data, but it also imposes significant accounting burdens on companies, particularly under unfavorable "intangible asset" standards.

In contrast, Hong Kong-listed companies like Meitu and Yunfeng Financial primarily disclose information through the Hong Kong Stock Exchange's announcement system. While still regulated, their announcement format is more flexible in content and structure, focusing on the disclosure of significant transactions rather than conducting continuous, standardized financial impact analyses like SEC filings. This difference reflects the distinct regulatory styles of the two capital markets: the U.S. market emphasizes protecting investors through rules-driven, systematic information symmetry, while the Hong Kong market allows companies greater autonomy and flexibility in information release while adhering to principles.

- Regulatory Path: "Regulation by Enforcement" vs. "Guided by Framework"

The regulatory path for crypto assets in the U.S. is often summarized by the industry as "regulation by enforcement." Agencies like the SEC and the Commodity Futures Trading Commission (CFTC) tend to apply existing securities and commodity laws to digital assets, delineating regulatory red lines through a series of high-profile enforcement actions and lawsuits. For example, the SEC uses the "Howey Test" to classify a large number of tokens as "investment contracts," thereby placing them under securities regulation, which brings significant compliance uncertainty and legal risks to issuers and trading platforms. This confrontational regulatory environment forces companies to conduct extremely cautious legal assessments when adopting DAT, but precisely because Bitcoin and Ethereum have been explicitly excluded from being classified as "securities" by the SEC, DAT strategies centered on these two assets have gained a relatively secure legal foundation.

In contrast, financial centers in Asia, such as Hong Kong, are actively constructing a forward-looking "framework" regulatory path. For example, the licensing system for Virtual Asset Service Providers (VASP) introduced by the Hong Kong Securities and Futures Commission (SFC) provides clear operational licenses and compliance guidelines for core infrastructure such as cryptocurrency exchanges and custodians. The approval for Yunfeng Financial's wholly-owned subsidiary to upgrade its license to provide virtual asset trading services was achieved within this framework. This "legislate first, regulate later" framework path, while bringing new compliance costs, offers companies greater predictability, enabling them to innovate and allocate assets within clear rules.

- Market Response: U.S. Institutional Premium vs. Asian Retail Frenzy

The two different regulatory and market cultures have also shaped distinct market responses. In the U.S., the rise of DAT is closely tied to the deep participation of institutional investors. The success of Strategy Inc. in operating its "financial flywheel" hinges on its ability to attract a large number of institutional investors (such as pension funds and endowments) that cannot hold cryptocurrencies directly to buy its stock, thereby creating and maintaining a significant premium relative to its Bitcoin net asset value (NAV). This institutionally driven "innovation premium" is the core driving force behind the U.S. stock market DAT model.

In the Asian market, although institutional interest is growing, the sentiment and behavior of retail investors still play a more significant role. After Meitu announced its purchase of Bitcoin and Ethereum in 2021, the volatility of its stock price reflected more the speculative enthusiasm of retail investors and their pursuit of market hotspots rather than the long-term pricing of its strategic value by institutions. This market response pattern makes the stock prices of Asian DAT companies more closely linked to the short-term sentiment of the crypto market, but also more susceptible to shocks from reversals in market sentiment.

Lens Two: Philosophical Axis of Asset Choice

The choice between allocating Bitcoin (BTC) or Ethereum (ETH) reflects fundamentally different philosophical judgments about the future of digital assets.

- Bitcoin (BTC): Defensive Value Preservation Battle of "Digital Gold"

Companies that choose Bitcoin as their primary reserve asset, such as Strategy Inc. and Block, have decision-making logic closely tied to the macroeconomic drivers discussed in the first part. In their public statements and investment discussions, these companies generally position Bitcoin as "digital gold" to combat the devaluation of fiat currency and hedge against inflation. Strategy's founder, Michael Saylor, repeatedly emphasizes that in an era of global quantitative easing, holding cash equates to a continuous loss of value, while Bitcoin, with its fixed supply cap of 21 million coins and decentralized nature, becomes a superior long-term value storage tool.

Thus, choosing Bitcoin is essentially a "vote" by the company on the future of the existing monetary system. This is a defensive value preservation battle, with the core goal of finding a solid "value fortress" for shareholder capital independent of the traditional financial system in an environment of increasing macro uncertainty. This strategy does not seek short-term trading profits but focuses on long-term value preservation and appreciation over decades.

- Ethereum (ETH): Offensive Ecological Layout Battle of "Programmable Economy"

In contrast, companies that allocate Ethereum, such as Meitu and Yunfeng Financial, have more "offensive" strategic intentions. The core value proposition of Ethereum is not merely value storage but its immense potential as the infrastructure for a "world computer" and "programmable economy." The smart contract functionality of Ethereum makes it the underlying platform for decentralized finance (DeFi), real-world asset (RWA) tokenization, and various Web3 applications.

Yunfeng Financial explicitly states in its announcements that the purchase of ETH is to "provide key infrastructure support for its RWA tokenization activities" and to explore its applications in core businesses like insurance. Meitu also emphasized its optimism about the future of the blockchain industry when investing in ETH, viewing it as a ticket to enter new fields. Therefore, choosing Ethereum is essentially a strategic investment by the company in future business infrastructure. This is an offensive ecological layout battle, with the goal not simply to preserve value but to gain "tickets," technical capabilities, and business synergy advantages in the next generation of the internet and financial systems. The staking yield characteristic of ETH makes it a "productive asset" that can generate continuous cash flow, further reinforcing its strategic value as an ecological cornerstone.

These two analytical axes are not independent but profoundly interact with each other. The tendency of Asian markets, such as Hong Kong, to allocate ETH is partly due to their regulatory framework (such as the VASP license) encouraging application innovation and compliant business implementation, which naturally aligns with the application attributes of ETH. Conversely, the mature capital markets in the U.S., the rich financial derivative tools (such as CME futures), and the large pool of institutional investors provide an ideal execution environment for Strategy's macro-hedging strategy based on Bitcoin's grand narrative.

Looking ahead, as global regulatory frameworks (such as the Financial Stability Board (FSB) and the International Organization of Securities Commissions (IOSCO) guidelines) gradually coordinate and the digital asset market (such as the popularity of Bitcoin spot ETFs) matures, the differences in geography and asset choice may converge but will not completely disappear.

On one hand, unified global regulatory standards will lower compliance barriers across markets, making DAT models easier to replicate. On the other hand, the "digital gold" narrative of Bitcoin and the "programmable economy" narrative of Ethereum represent two fundamentally different value propositions that will continue to attract companies with different strategic goals.

Therefore, the future DAT market may present a "bimodal coexistence" pattern: on one end, a "value-type DAT" centered on Bitcoin, focusing on macro hedging and value storage; on the other end, a "growth/production-type DAT" centered on Ethereum and other application-oriented public chain assets, focusing on ecological synergy and cash flow generation.

Ultimately, a company's choice will continue to be a profound reflection of its worldview about the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。