House Republicans Push SEC to Approve Bitcoin in 401(k) for $12.5T

Could Americans soon invest part of their Bitcoin in 401(k) retirement savings ? House Republicans are urging the SEC to act quickly on President Donald Trump’s executive order.

Source: X (formerly Twitter)

If approved, this step would allow millions of Americans to include cryptocurrencies such as Bitcoin and Ethereum in their retirement savings. This is also pushed by the US president Trump to add crypto in this savings plan.

This might be a significant shift for retirement investing, providing new possibilities but also introducing new risks.

Lawmakers Push SEC to Approve Crypto in 401(K)

On September 22, 2025, nine Republican members of the House Financial Services Committee, led by Chairman French Hill, sent a letter to SEC Chair Paul Atkins.

They asked the SEC to move fast on Executive Order 14330, which tells the SEC and Department of Labor to update rules so 401(k) plans can include alternative assets like Bitcoin.

Supporters say this step would give Americans more choices and help “democratize investing,” opening opportunities that were not available before.

Why This Could Matter for Investors

Americans hold around $9 trillion in 401(k) savings. Even a small portion of these funds moving into cryptocurrencies could make a big impact.

-

Even a fraction of these funds going into cryptocurrency could have a significant effect.

-

Analysts predict that if only 3–5% of 401(k) funds flowed into BTC, it might inject $1.37 trillion to $2.29 trillion into the market.

-

This could actually force Bitcoin price higher, although actual markets are more volatile.

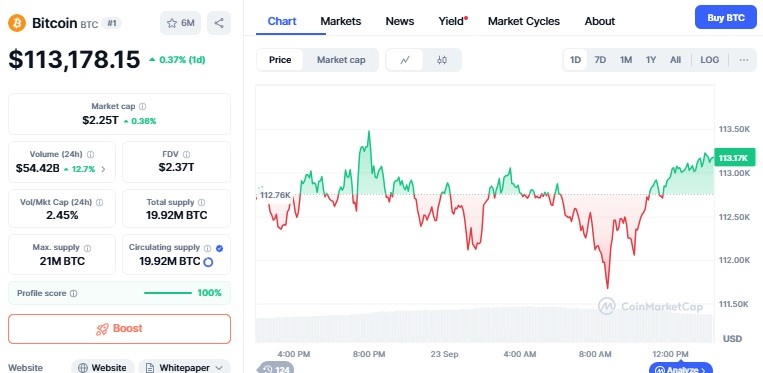

Source: CoinMarketCap

At the time of writing the BTC is at $113,229, up 0.47 in the past 24 hours. The volume has gone up by nearly 18% to $55.78 Billion.

Allowing Bitcoin into 401(k) accounts would have several advantages:

-

Additional Options: Individuals would be able to include crypto in their retirement portfolios, rather than stocks and bonds.

-

Mainstream Confidence: Getting crypto into this means that digital assets are gaining wider acceptance by the financial system.

-

Growth Potential: Bitcoin and Ethereum have demonstrated high returns, providing an opportunity to grow savings quicker.

-

Safety Through Regulation: SEC regulation could make crypto investment safer for regular investors, with fewer chances of fraud or complicated rules.

Risks One Should Know

Even though the idea is exciting, cryptocurrency is very volatile. Prices can fluctuate so much, and that can hit retirement savings.

Critics also fear government intervention would allow larger players to manipulate the market more easily.

What's Next

SEC Chairman Paul Atkins is set to make a speech imminently, and people are waiting eagerly for his announcement.

Investors will have to be cautious and know the risks involved. This is not a sure short way of making money, but it might present new options for individuals looking to diversify their retirement assets.

Conclusion

The push to allow Bitcoin in 401(k) plans is a landmark move for retirement investing and cryptocurrency. It might empower Americans with more control over their funds and digital assets with broader acceptability.

But with the risk and volatility of the markets, anyone who thinks about crypto in savings should exercise caution and be well-informed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。