Bitfinex Securities was established in 2021, dedicated to leveraging technological advancements in the digital asset industry to drive the transformation of global capital markets.

Bitfinex Securities is a regulated platform that allows institutions to raise funds through the issuance of tokenized securities. The platform today confirmed that it is applying to the Astana International Financial Centre (AIFC) to transition from the current FintechLab to become an Authorized Investment Exchange.

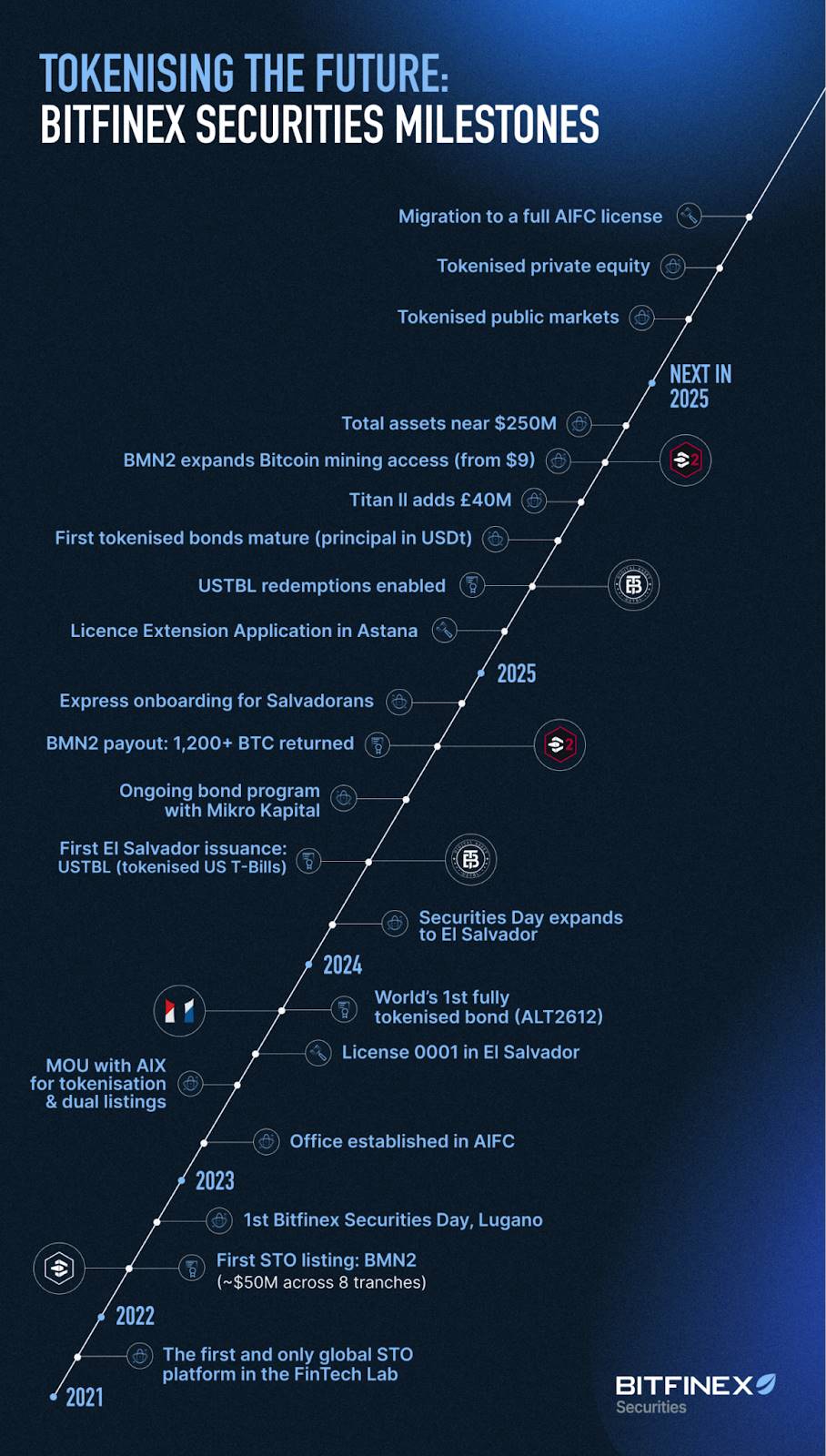

Bitfinex Securities joined the AIFC FintechLab in September 2021, a regulatory sandbox aimed at promoting the development of the financial industry in the region. Since joining, the platform has issued tokenized securities worth $206 million within the sandbox, including Mikro Kapital's conventional tokenized bond program and the first Blockstream Mining Note. Additionally, since April 2023, Bitfinex Securities has also obtained a separate license from the National Digital Assets Commission of El Salvador.

As the platform confirms it is about to reach $250 million in tokenized assets, Bitfinex Securities' licensing extension plan in Astana is also advancing. This progress marks the platform's rapid growth momentum.

Key achievements this year include:

Direct listing of TITAN1 and TITAN2 — Bitfinex Securities' first tokenized stocks, with a total value of £143 million;

Successful full redemption of Mikro Kapital's first tokenized bond, with a total payment of $630,000 in USDt;

Direct listing of Blockstream Mining Note 2 (BMN2) — providing investors with secondary market trading opportunities, starting at a price below $9, based on fair value.

Bitfinex Securities Chief Technology Officer Paolo Ardoino stated:

“We continue to appreciate the support of AIFC, as an innovator in digital asset regulation, they have proven their leadership position. After successfully completing the initial licensing period, we are pleased to confirm that we will apply for an upgrade to a full license in Astana this year. Forward-looking jurisdictions like AIFC create a clear and robust regulatory environment for businesses, which not only helps attract and nurture companies like Bitfinex Securities but also demonstrates the value of regulatory innovation.”

Bitfinex Securities Operations Director Jesse Knutson commented:

“The tokenized assets on our platform are approaching $250 million, which is an important milestone and a sign of the trust we have built with issuers. Given that all our listings rely on the Liquid Network, this also highlights the critical role of the Bitcoin ecosystem in driving the development of the tokenized financial market. As market demand for tokenized securities continues to grow, we look forward to further expanding our listing range, making Bitfinex Securities a leading platform covering all categories of tokenized assets.”

Additionally, Bitfinex Securities is also regulated in El Salvador and has become the world's first international digital asset platform to obtain a license under the country's Digital Asset Issuance Law.

About Bitfinex Securities

Bitfinex Securities was established in 2021, dedicated to leveraging technological advancements in the digital asset industry to drive the transformation of global capital markets. With real-time settlement, 24/7 trading capabilities, global liquidity access, and support for self-custody, Bitfinex Securities aims to create a more efficient, cost-effective, and seamless interaction experience between investors and issuers. Bitfinex Securities is licensed and regulated in both the Astana International Financial Centre (AIFC) in Kazakhstan and El Salvador.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。