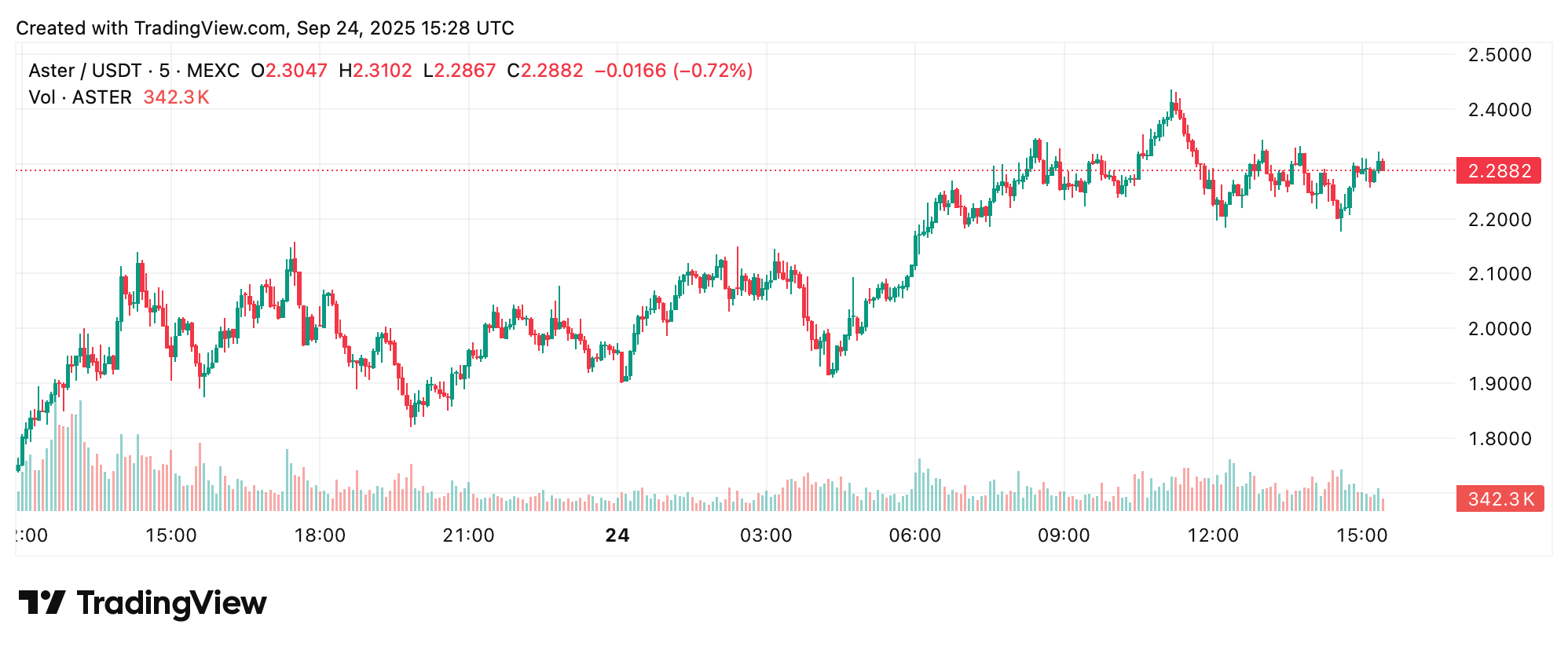

On Wednesday, the newly listed aster (ASTER) token rocketed to a new all-time high of $2.41, putting its name on every trader’s watchlist. As the native asset of Aster — a decentralized exchange (DEX) for perpetual futures — ASTER powers governance votes, fuels incentive schemes, and greases the wheels of its liquidity programs.

This week, ASTER ripped from sub-$1 obscurity into fresh highs, tearing through a 7-day range of $0.562 to $2.41. Liquidity and activity ballooned almost overnight, with aggregation sites flashing multi-billion-dollar daily turnover and headlines crowning Aster as a rising dex star. Onchain sleuths even spotted hundreds of millions in whale-sized buys since launch, giving the token a solid bid under price.

ASTER price on Sept. 24.

Looking ahead, the big test is whether these peaks hold or turn into cliffs. Keep an eye on ASTER’s daily bands and breakout zones, plus the dex’s share and revenue updates that could feed more momentum. Incentive drops or fresh listings might pour gasoline on the fire, but traders should mind the risk: after parabolic runs, fading volume can make pullbacks feel like trapdoors.

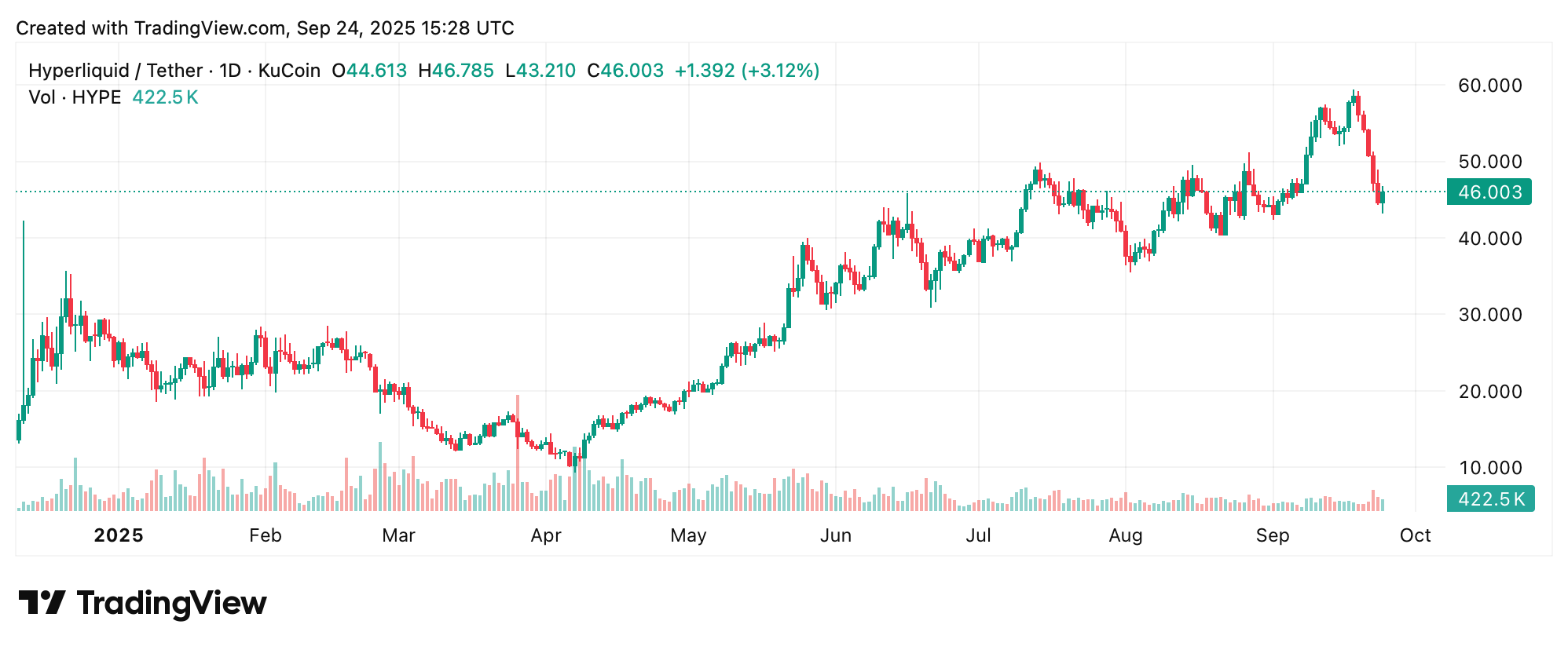

Another hot ticket on the radar is Hyperliquid’s hype (HYPE) token. Much like ASTER, HYPE is the lifeblood of Hyperliquid’s perps-driven dex and trading-first blockchain, pulling duty across governance, staking, and reward programs. HYPE took a breather after tagging its $59.30 all-time high on Sept. 18, sliding into a 7-day range of $43.6–$59.1 and hovering in the mid-$40s today. The rotation spotlight has tilted toward ASTER, while traders eye HYPE’s looming supply calendar.

HYPE price on Sept. 24.

HYPE is off 1.6% today and more than 15% over the past week, leaving it 22.6% under its Sept. 24 peak. Adding to the unease, one chart spoiler is the hefty unlock path. On X, Maelstrom Fund reminded followers that despite Hyperliquid’s breakout growth and monster volumes, a flood of tokens is on deck. Starting Nov. 29, 237.8 million HYPE will vest linearly over two years—roughly $11.9 billion at $50 each—dripping nearly $500 million a month into circulation.

Looking forward, the market will measure how emissions stack up against organic demand. Keep tabs on unlock cadence, treasury maneuvers, and any repurchase tweaks, as these levers will decide whether HYPE sinks or swims. Hyperliquid’s perps dominance gives it muscle, but rivals are circling like sharks. A clean reclaim of $50–$52 could recharge momentum, while slipping from the mid-$40s risks another trip to the $43–$45 support zone.

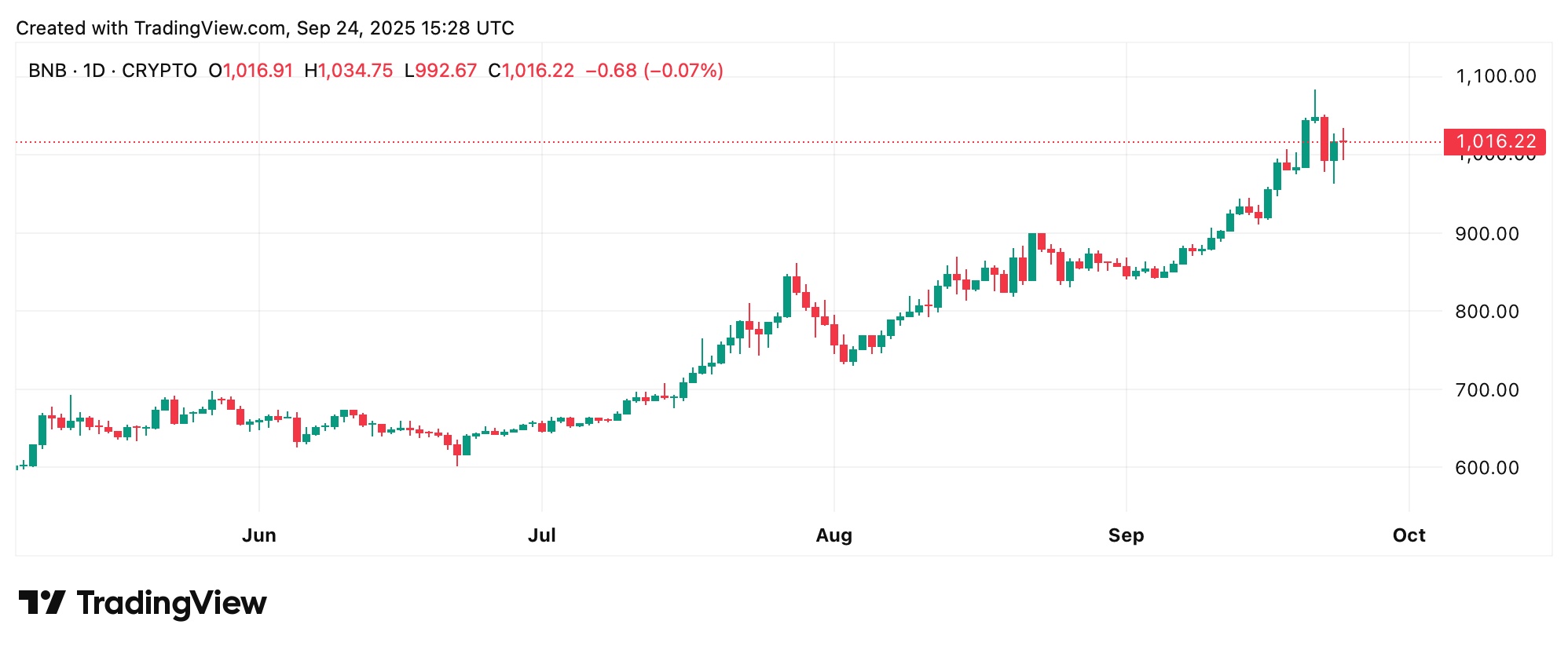

BNB remains a headline heavyweight, serving as the native asset of the BNB Chain and Binance ecosystem, where it covers gas fees, powers staking, and props up a wide range of onchain apps. Like ASTER, BNB hit a fresh all-time high at $1,079 on Sept. 21 before easing back, now consolidating around $1,000–$1,030 inside a 7-day range of $949–$1,076.

BNB price on Sept. 24.

BNB‘s momentum has held up well against major peers, with analysts flagging relative strength as a bullish marker. Adding fuel, Franklin Templeton just tapped BNB Chain for its Benji tokenization platform, bolstering institutional interest. Looking ahead, traders will want BNBBurn updates on the calendar—auto-burn projections and any spike in fee revenue could give BNB another leg up.

Still, after tagging new highs, the token may cool off in step with ASTER and HYPE’s recent drawdown. Short-term consolidation isn’t out of the question, but the ecosystem’s breadth keeps it firmly in the spotlight.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。