Source: Galaxy Digital

Author: Will Owens

Translation and Compilation: BitpushNews

Introduction

Meme coins have become a pillar of the cryptocurrency market, but they often carry a negative stigma and are fraught with controversy. Skeptics argue that they are worthless, as most meme coins tend to go to zero over time or are outright scams. Fairly speaking, most indeed are.

Like all trading, the meme coin market is ultimately a zero-sum game: one trader's profit comes from another trader's loss.

However, unlike assets with underlying cash flows or utility, meme coins have little to offer beyond cultural value, making losses more common and often more severe. We outline these dynamics in our 2024 Galaxy Research report and argue that meme coins should not be entirely dismissed. A year from now, this space will only become more complex and significant.

While joke tokens have existed since the early days of crypto (Dogecoin launched in 2013, and the long-forgotten Coinye West followed the next year), the modern meme coin era began with the surge of DOGE in 2017. This was followed by Shiba Inu, then BONK and dogwifhat on the Solana blockchain, and finally Pump.fun in early 2024. This launch platform has spawned MOODENG, Pnut, TROLL, and millions of other meme coins.

Pump.fun changed everything. It lowered the barrier to entry for launching meme coins to nearly zero.

With just a few dollars and no coding skills, anyone can create a token that is immediately tradable, liquid, and deployed via bonding curves. This marks a structural shift in meme coins. The volume of token creation has surged, and launch platforms have become the new norm.

Homepage of Pump.fun, a microcosm of "Degen"

Unlike altcoins that typically claim some form of "utility" (governance rights, fee income, access to services), meme coins are, by definition, devoid of any utility. They serve no purpose other than as cultural tokens, vessels of ideas, symbols of friendship, and collective identity.

Trading meme coins is less about fundamentals and more about what can be described as "cultural arbitrage": predicting or getting ahead of cycles, such as buying tokens related to viral TikTok trends before the market catches on.

In the long run, the vast majority of market participants will lose money trading meme coins, and in many ways, this is purely gambling. But dismissing this space entirely is lazy and ignores its significance.

The ecosystem faces challenges, especially on Solana, which dominates the total trading volume of meme coins.

Snipers and "bundlers" capture most of the supply in the initial moments of token launches, creating future sell pressure. The median holding time for meme coins is measured in seconds, as traders mine new trading pairs for quick profits.

However, meme coins will continue to exist. In an increasingly digital world, the existence of purely cultural assets makes sense. Crucially, meme coins also serve as an entry point into the crypto space: they draw new retail participants who would not otherwise use these products into wallets and decentralized exchanges. For many, meme coins are their first step into the crypto-native infrastructure, opening the door to deeper participation in DeFi.

Key Points

* Meme coins currently account for about ~30% of Solana's DEX trading volume, down from 60% in January.

* Of the approximately 12.8 million Pump.fun tokens, only 12 tokens (0.00009%) account for >55% of the platform's total fully diluted market cap.

* The total fully diluted market cap of Pump.fun tokens exceeds $4.8 billion.

* This is more than 85% of the total fully diluted market cap of Solana launch platform tokens. No other platform can compare.

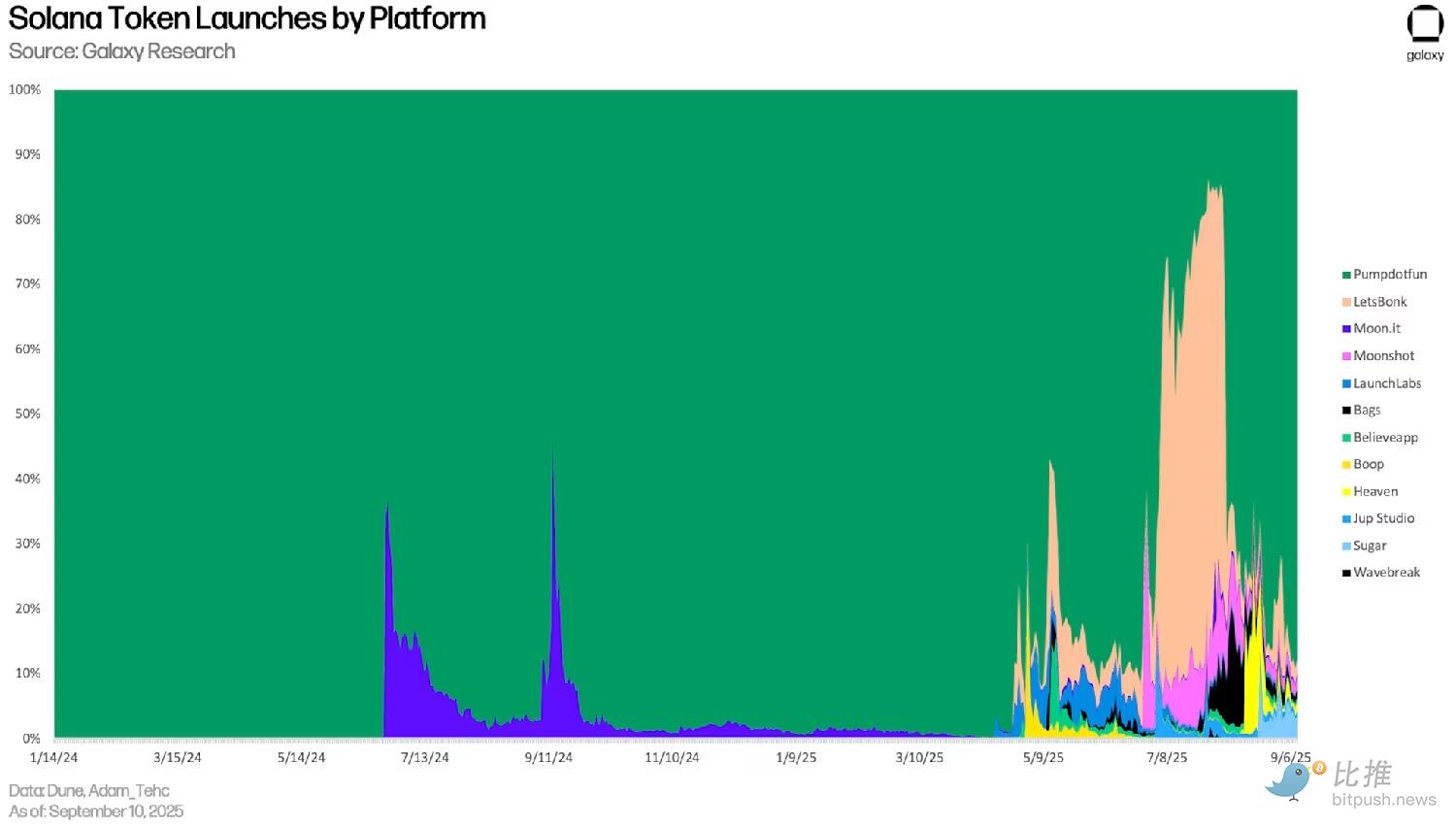

* Since its launch, Pump.fun has captured the vast majority of the Solana launch platform market share. It has only been surpassed by another launch platform twice, and each time for a very short duration.

* The most recent temporary competitor to surpass Pump was Bonk.fun this summer.

* The median holding time for tokens on Solana is about ~100 seconds, down from ~300 seconds previously.

* This behavior highlights the increasingly scalp-like and PvP nature of trading.

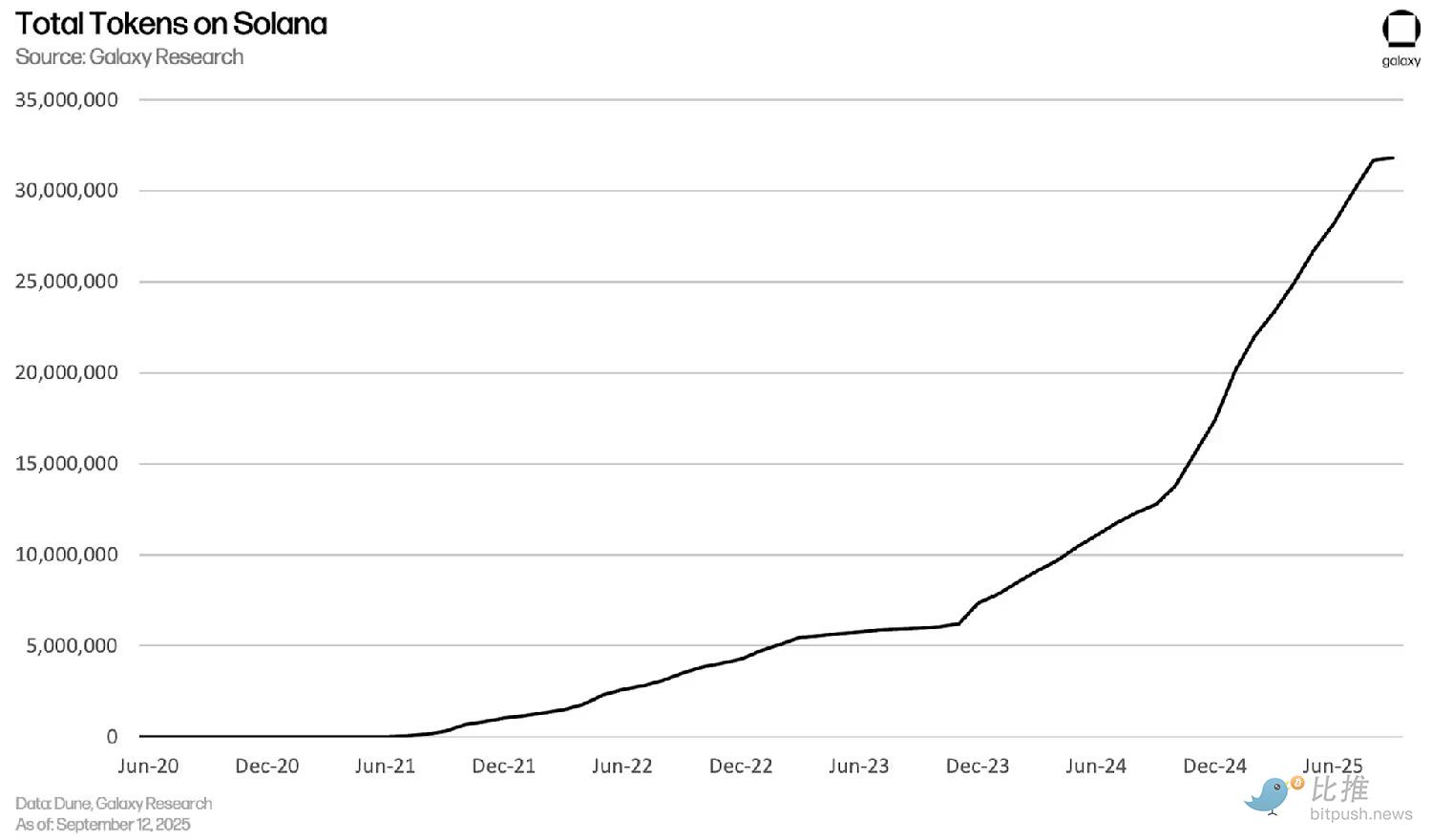

* There are now over 32 million tokens on Solana, up from less than 8 million before Pump.fun launched in January 2024.

* This represents a growth of over 300% in less than two years.

* Meme coins are a powerful entry point into the crypto space, bringing new users into wallets and DEX.

* The ecosystem exhibits a power-law distribution, with a few tokens capturing the majority of the value.

Market Size and Activity

Since the beginning of 2024, the meme coin market has expanded at an astonishing rate. Over 32 million different tokens have been created on Solana alone. This scale was unimaginable before the launch of Pump.fun. A simple change in user experience—removing the technical expertise required to launch tokens—has fundamentally reshaped the ecosystem. Previously, launching tokens required manual management of liquidity pools and significant capital investment. Now, anyone with an internet connection can deploy tradable tokens at a negligible cost.

Solana's high throughput and low fees make it a natural breeding ground for token creation, dwarfing other chains in terms of launch numbers. However, the BNB Smart Chain captures most of the meme coin spot trading volume, thanks to launch platforms like four.meme. Recently, the explosive token generation event on Aster DEX catalyzed broader interest in the BSC ecosystem.

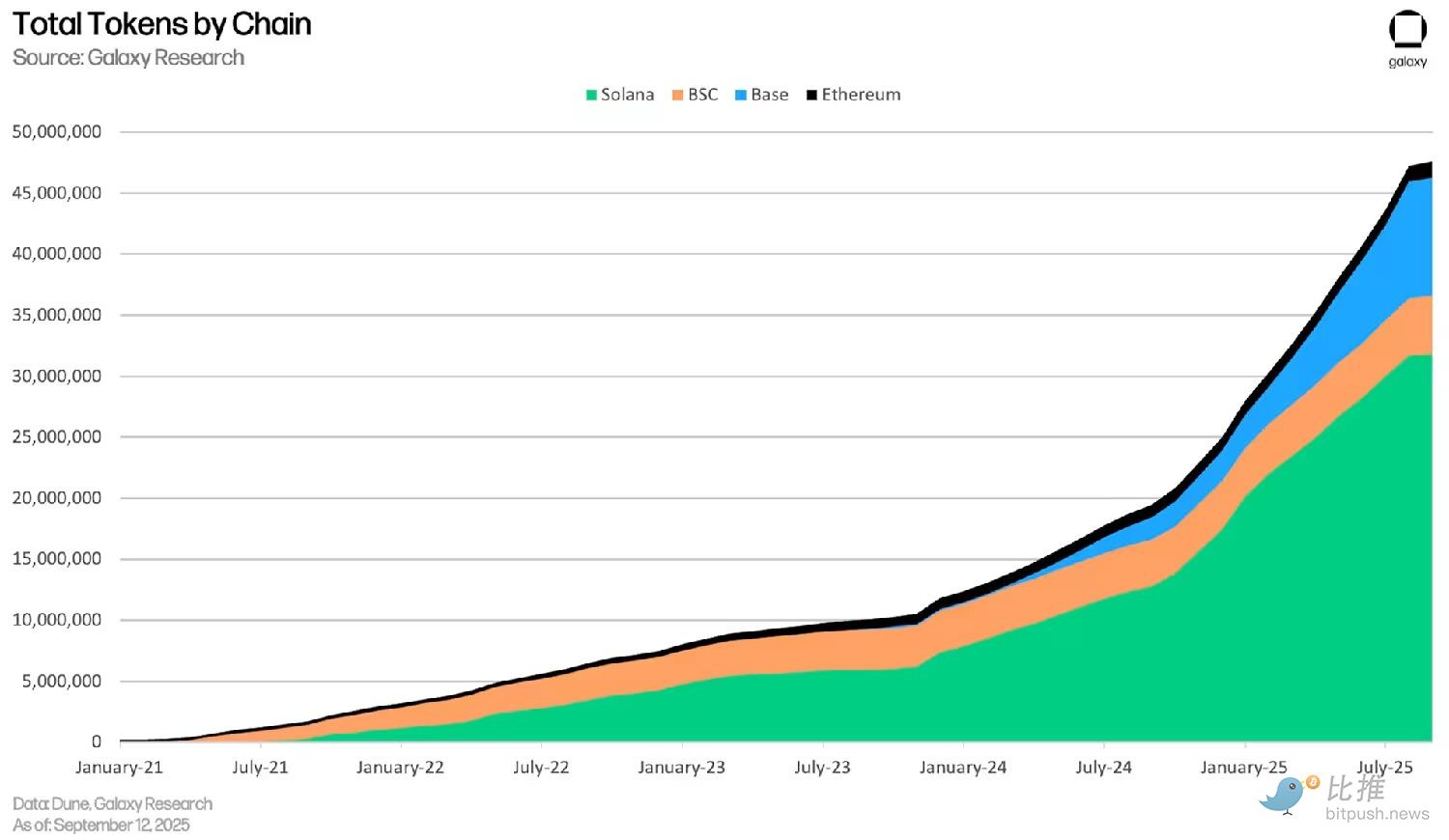

Total number of tokens on Solana

Even when we broaden our view to include Ethereum, Coinbase's Base, and BSC, this trend remains consistent. These chains collectively created over 57 million tokens, with Solana dominating (56%). Ethereum is home to more traditional/cult-like meme coins, such as PEPE, MOG, and SPX6900. Base continues to grow, especially with SocialFi-style meme coins like Zora. In short, Solana is the preferred platform for the hottest meme coins and cultural trends, Ethereum is home to more mature meme coins, and Base performs better in capturing niche launch platform markets, particularly in AI (Virtuals) and social (Zora) verticals.

Notably, the Base team recently announced they are building a bridge from their Ethereum L2 to Solana, which will allow liquidity to flow between chains.

Total number of tokens across chains

Now let's analyze the different meme coin launch platforms. After briefly losing market share to Bonk.fun in the summer, Pump.fun has reestablished its complete dominance in the Solana token launch market. The launch platform space is highly competitive, with shiny new entrants constantly trying to differentiate themselves through incentive adjustments or branding. However, these competitions are often short-lived.

Sometimes, new entrants manage to attract attention briefly by introducing niche innovations. For example, Heaven DEX experimented with novel token economics, quickly attracting liquidity and users, but its market share evaporated just as quickly. This is the norm in the crypto space. Traders quickly rotate to the next "runner," with everyone racing to be the fastest actor.

Despite the TikTok-like brevity of Solana traders' attention spans, Pump.fun's entrenched position has proven resilient. For now, token launch platforms seem to be a winner-takes-most market.

Solana token launches by platform

Solana token launches by platform

Of the approximately 32 million Solana tokens, about 12.9 million originate from Pump.fun. This platform has industrialized the production of tokens on Solana. No other platform can compare, as its launch share is larger than the total of all competing launch platforms combined.

Readers may recall celebrity launch projects, such as Kanye West's $YZY or Donald Trump's $TRUMP. The launch teams did not use typical launch platforms for these highly publicized tokens. Instead, they collaborated directly with Meteora, a Solana-based DeFi protocol that serves as dynamic liquidity infrastructure. It allows them to manually configure liquidity pools and manage token distribution. This gives the team more control and reduces the risk of bots or snipers acquiring large amounts of tokens early at "cheap" prices.

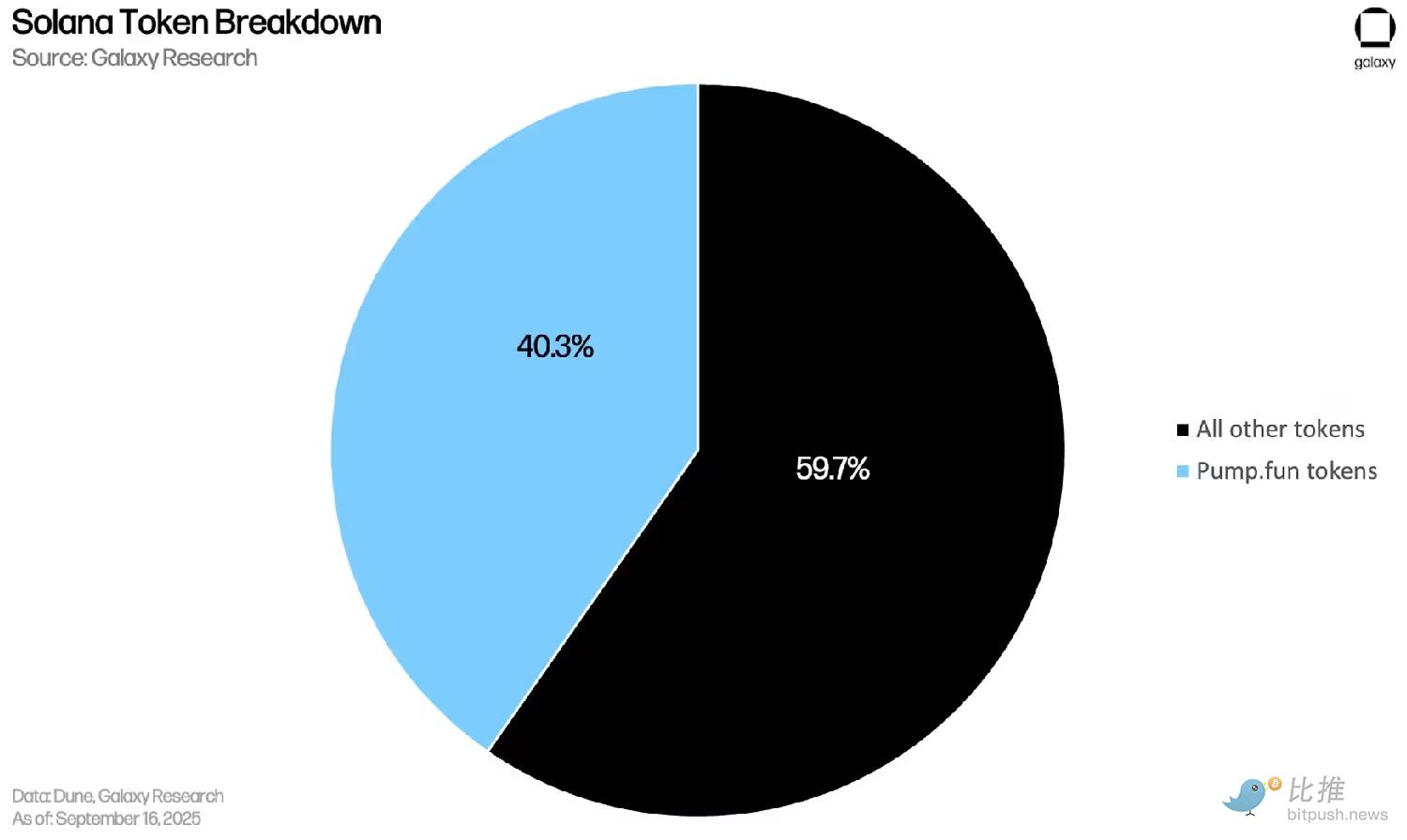

Solana token breakdown

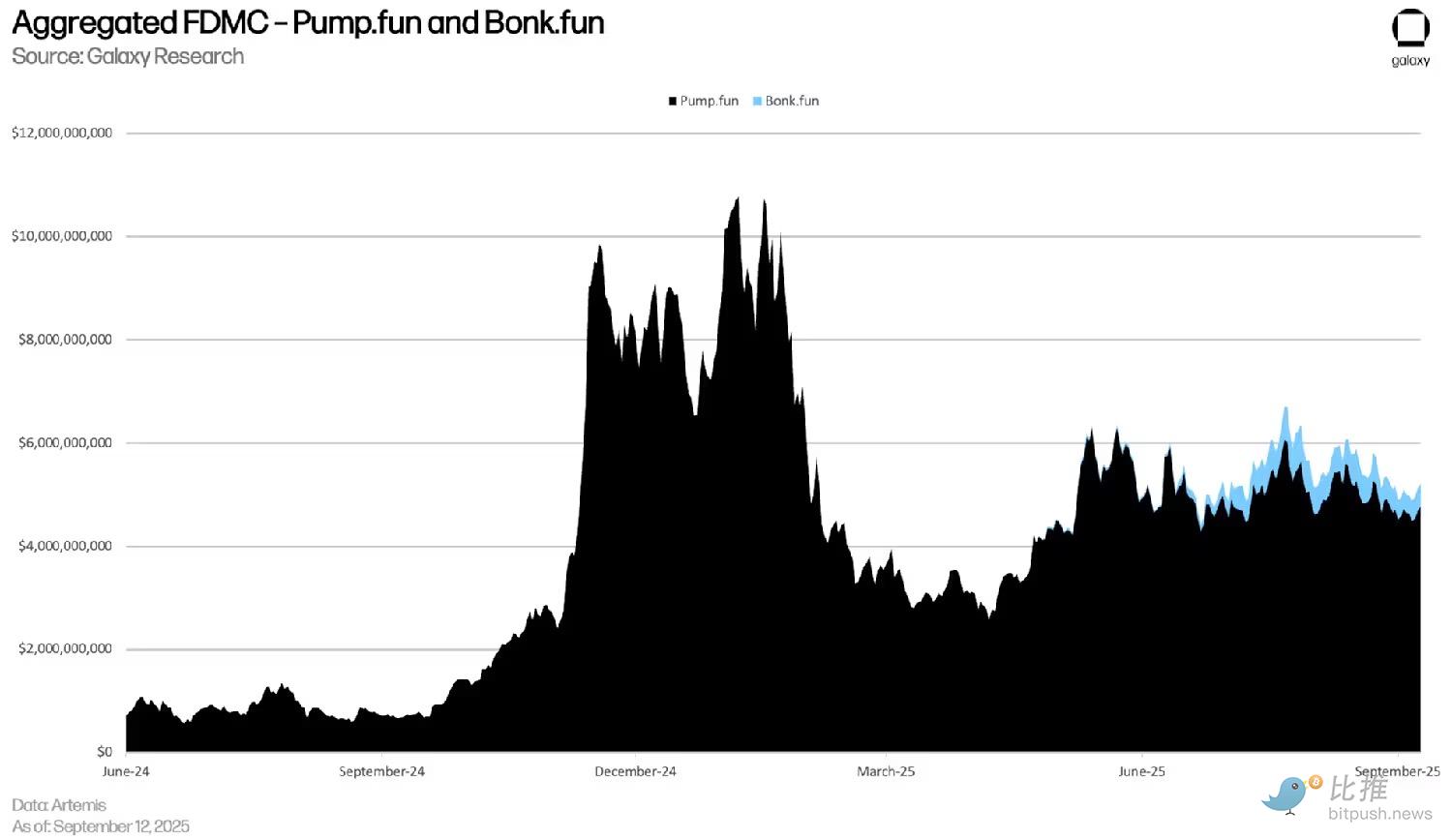

The value distribution is similar. The total fully diluted market cap of Pump.fun tokens now exceeds $4.8 billion, several orders of magnitude higher than its closest competitor. In the chart below, Pump.fun's total FDMC is shown in black, while bonk.fun's FDMC is shown in blue. The former peaked in January, surpassing $10 billion.

Total FDMC of Pump and Bonk.fun

The scale of this market reveals two points. First, meme coins have reached a scale that cannot be ignored: tens of millions of tokens and billions of dollars in value. Second, the field is characterized by centralization. Solana dominates over other chains; Pump.fun dominates Solana; and within Pump.fun tokens, a tiny fraction of tokens accounts for the majority of the value.

While the DEX trading volume on Solana this cycle is impressive, it is also interesting to look at the specific percentage of that volume coming from meme coins. Data from Blockworks shows that the percentage of meme coin trading volume relative to total DEX trading volume has been declining over the past year, but there was a sharp spike when President Trump launched $TRUMP.

Solana DEX Trading Volume: Meme Coins vs Others

Looking at the 100% stacked area chart below, meme coins typically accounted for over 50% of all Solana DEX trading volume in Q4 2024, but this has since dropped to only 20% to 30%. This means that SOL/USDC, stablecoin swaps, and other DEX swaps have begun to surpass meme coin activity. While Pump.Fun has made launching meme coins easy for everyone, it has also, in a sense, accelerated the "maturation" of the meme coin market. The endless launches have led to liquidity fragmentation and competition, making it harder for individual tokens to enjoy the parabolic price appreciation seen by the best-performing meme coins from late 2023 to early 2024. This, combined with the emergence of competitive on-chain trading applications, particularly Hyperliquid's perpetual futures products, has contributed to the overall decrease in trading volume.

Solana DEX Trading Volume: Meme Coins vs Others (Stacked Chart)

On-Chain Dynamics

The market size shows us how large the meme coin system has become. Users' on-chain activity helps us understand how these assets behave. Most notably, the short-term, scalp-like, and power-law-driven nature of trading behavior.

The first metric is holding period. The median holding time for Solana meme coins (for wallets that buy and fully sell within seven days) has collapsed to about 100 seconds, down from nearly 300 seconds a year ago. This means that the average participant does not "hold" tokens for hours, let alone days. Instead, they are rapidly rotating, scalping a few percentage points of profit to compete against other traders, which is essentially a PvP trading game.

Solana "Trench"

The underlying infrastructure reinforces this behavior pattern. Axiom is a platform that offers a feature called instant trading, allowing traders to execute orders with the click of a button. It is easy to execute trades on a one-second K-line, leading to an ultra-scalping environment. Especially when you consider human nature—most market participants are more likely to panic sell at the bottom rather than take profits after a surge—the expected value of this game is deeply negative for almost everyone (except token deployers, insiders, and "KOLs"—more on this later).

Median Holding Time for Solana Meme Coins (Seconds)

The next chart is a snapshot of median holding times over the past year, segmented by daily transaction counts. Addresses with fewer than one transaction per day show holding times exceeding 200 seconds. As transaction counts increase, the median holding time sharply compresses to the range of 80-120 seconds. Only for the most active wallets (>50 transactions) does the holding time extend slightly.

Overall, addresses holding tokens at various levels only do so for a few seconds.

Median Holding Time by Transaction Count

The power-law distribution of Pump.fun token values is striking. Of the nearly 12.9 million tokens launched on the platform, only 12 account for more than half of the total fully diluted market cap. These dozen tokens collectively represent $2.69 billion, accounting for 56% of the total $4.8 billion FDMC, while the remaining 44% is distributed among the millions of other tokens.

In other words, 0.00009% of Pump.fun tokens control the majority of the value.

The structure of this ecosystem is almost like a lottery. Almost every new launch project is destined to collapse within hours, while a very few manage to attract enough attention to break through. For the vast majority of traders, meme coins are structurally a negative expected value game, but the existence of these outliers continues to fuel speculation and "gambling at the casino."

Top 12 Pump Tokens vs Remaining Tokens

While most meme coin traders are losing money, the infrastructure owners are capturing significant value. The chart below compares the revenues of Pump.fun (launch platform), Axiom (trading platform), and Hyperliquid (perpetual futures exchange, non-meme coin but included for comparison). Notably, Axiom is operated by a small team (fewer than ten people) and has scaled to monthly revenues in the millions by charging meme coin traders fees.

Daily Revenue

Value does not accumulate in the tokens themselves but rather in the platforms and tools that support their creation and trading.

Meme Coin Stack

The meme coin ecosystem is best understood as a layered "stack." Each layer builds upon the next.

Underlying Blockchain

Most meme coin activity is concentrated on Solana, where low fees, high throughput, and a culture suited for ultra-speculative gambling make it the dominant chain for PvP trading.

Base and BSC also host significant activity, while Ethereum carries larger tokens and a less competitive culture.

Launch Platforms

Pump.fun has lowered the barrier to entry, allowing anyone to easily create tradable tokens. Its bonding curve model ensures liquidity at launch.

Competitors like Bonk.fun, Believe, and HeavenDEX have emerged, but none have been able to maintain significant market share. Data shows that launch platforms are a winner-takes-most market.

DEX Aggregators / AMM

Once launched, tokens trade on automated market makers. Pump.fun operates its own internal AMM, PumpSwap, to retain liquidity, while broader price discovery occurs through Jupiter, Raydium, Orca, and others.

This layer ensures that tokens can be traded instantly by anyone, anywhere.

Trading Bots and Automation

Execution speed dominates meme coin trading. Bots like Axiom, BONKbot, and Trojan help users snipe newly launched tokens (buying them the moment they become tradable) and trade instantly.

This infrastructure has led to a reduction in median holding times and transformed the market into an ultra-PvP environment, making it nearly impossible for new traders to profit meaningfully.

Community

X (formerly Twitter) communities and Telegram groups amplify memes and coordinate pump activities. Communities are motivated to drive up the price of their tokens, with collective belief replacing fundamentals.

This layer distinguishes PvP "lottery" tokens from PvE-style meme coins (like SPX 6900, MOG, TROLL, FARTCOIN, etc.) that can evolve into lasting cults or cultural movements.

KOLs are an important part of this layer…

Because KOLs (Key Opinion Leaders) play an outsized role in amplifying or stifling meme coins, I have compiled a non-exhaustive list of the most influential and active accounts driving narratives on Twitter:

Note: CT stands for Crypto Twitter KOL List (Condensed Version)

'Creator Capital Market'

One of the recent meta-narratives/narratives surrounding meme coins is the rise of the so-called creator capital market. Pump.fun's latest initiative, Project Ascend, launched in September, views tokens as a direct monetization channel for content creators. This system will replace the usual fixed creator fees paid to token developers with a dynamic sliding scale model linked to the token's market cap. Low market cap tokens pay creators a higher percentage of trading fees, providing additional resources for growth to new projects, while larger market cap assets pay less. For example, a token with a market cap below $300,000 pays significantly more in fees to creators than a $20 million token.

Meanwhile, a new phenomenon of Pump.fun streamers has emerged. These content creators link token launches directly to their live streams on the platform, creating interactive experiences around trading. This brings three obvious benefits:

Early live stream participants are rewarded. Viewers who enter promising live stream tokens early can see immediate gains as the streamer gains attention.

Built-in viral sharing incentives. Holders are directly motivated to share the live stream and bring in new attention, as price performance is tied to broader awareness. Sometimes they resort to extreme measures.

Changes in the creator economy. The income streamers earn from token trading fees can far exceed what they make from traditional platforms like Twitch or Kick, making tokenized live streaming a powerful alternative to traditional advertising or subscription monetization.

Whether this model is sustainable remains to be seen. Linking live streaming to token speculation could go wrong quickly, as traders may only care about the tokens and not the live stream. However, in the short term, the alignment of incentives between creators and traders makes Pump.fun appear to be a native financial platform of the attention economy.

Risks

Meme coins come with a unique set of risks that distinguish them from other assets in the crypto space. Ultimately, these risks reinforce why most market participants tend to steer clear of meme coins.

Many tokens launched outside standardized launch platforms face fundamental smart contract risks. The most common is the honeypot trap: a token that can be bought but not sold. On price charts, honeypots present a series of stair-step green candlesticks, giving ordinary traders the illusion of explosive gains until they realize they cannot exit their positions. Once developers extract enough value, the price collapses.

Example of a honeypot scam chart. New buyers can push up the price but cannot sell.

Another ongoing danger is the rug pull scam. Even seemingly reputable tokens often collapse after the initial hype fades. Developers and insiders typically hold a large portion of the supply (often in hidden "side wallets") and can sell to retail liquidity. Similarly, for tokens with manually controlled liquidity pools, providers may suddenly withdraw liquidity. This means that even small sell-offs can destroy the chart. Traders sometimes find out too late when the liquidity for a trading pair is drained, showing only a few dollars or less in actual liquidity.

What a trading pair looks like on Dexscreener when liquidity is drained. Practically untradeable. Note: This token is not related to Tesla.

Meme coins are also susceptible to "vampire attacks." This refers to a copycat token surpassing the original token by capturing more attention, often with the help of internal small groups or paid KOLs promoting it. For example, a token like "67" may successfully launch on Bonk.fun but later be surpassed by a nearly identical version on Pump.fun with stronger support. Even if a good trader enters early and correctly predicts the trend, they may end up buying the wrong "version" of the token.

Finally, regulatory risks loom. While U.S. regulators have mostly ignored meme coins recently (aside from stating they are not securities), the fine line between "harmless gambling" and "retail exploitation" makes them an easy political target. A crackdown could sharply reduce trading volume. A good example is the $LIBRA token, which was promoted on social media by Argentine President Javier Milei but collapsed shortly after launch. Traders lost millions, while insiders, including Hayden Davis, netted millions. Cases like this fuel similar narratives.

Outlook

Meme coins are not just a fleeting trend. They are a lasting fixture in the crypto attention economy. Their significance lies more in the culture they create and the financial infrastructure they support.

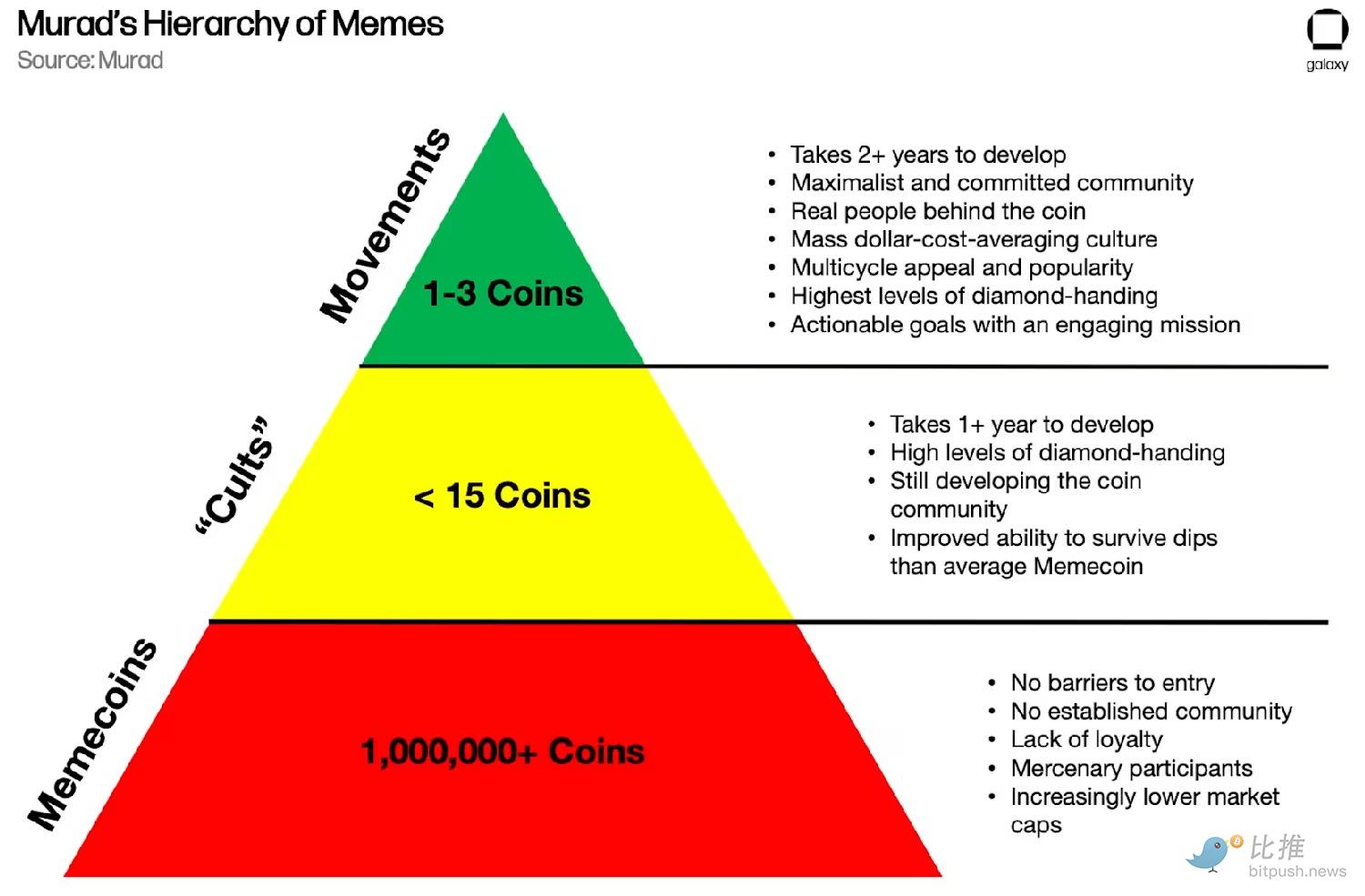

As the influencer known as Murad pointed out, the ecosystem resembles a pyramid of attention and persistence. At the base are millions of one-off tokens. These are PvP gambling chips, with lifespans measured in minutes or hours, dominated by bots and scalpers. In the middle are dozens of "cult" tokens, like TROLL and MOODENG, which maintain sticky communities and can survive for months or years. At the top are a few tokens that transcend trading to become cultural movements or "quasi-religious." These tokens achieve multi-cycle persistence, including DOGE, PEPE, SPX 6900, and possibly MOG.

Murad's meme hierarchy

Each cycle brings some cross-border listings that attract mainstream capital and legitimize the space. These events reset the meme stack: imitators flood in, fees soar, and new power-law winners emerge. Celebrity and political tokens (YZY and TRUMP) will remain cyclical, with high variance and massive media amplification effects.

Daily meme coin trading remains a negative expected value for most participants. The advantage lies with the distribution owners. Owning the casino is better than being addicted to gambling in it. For example, Axiom's cumulative revenue has surpassed $200 million, with a team of fewer than ten people. For institutions, a clearer risk exposure is to the infrastructure and a few cult assets with multi-cycle persistence, rather than the long tail of newly launched tokens.

However, meme coins also play a broader role in the evolution of the digital asset market. Many users' first interaction with blockchain is purchasing meme coins on DEXs. From there, they gradually evolve to bridging assets, swapping stablecoins, and even experimenting with lending protocols. Meme coins lower the "psychological friction" of crypto by making speculation feel social and approachable.

Additionally, meme coins serve as a stress test for blockchain infrastructure. Few use cases can test a blockchain as intensely as the meme coin frenzy. For instance, during the $TRUMP token launch, the trading platform Jupiter recorded over 42 million failed transactions in a single weekend.

The bottom line is that the meme coin space is a flywheel supported by infrastructure for user acquisition and cultural speculation. Expect more noise, faster rotations, and a small group of platforms to steadily emerge and achieve compounding growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。