Donald Trump’s words can move markets, and that’s exactly what happened on Friday morning when the president warned China it would face “a massive increase of tariffs” if it followed through on its plot to expand export controls on rare earth minerals. Bitcoin saw a precipitous 2.53% drop on the news, and stocks also slid into the red.

“They want to impose Export Controls on each and every element of production having to do with Rare Earths,” Trump wrote, before explaining how his administration plans to counter China’s move. “One of the Policies that we are calculating at this moment is a massive increase of Tariffs on Chinese products coming into the United States of America.”

China quietly announced an expansion of its rare earths export controls on Thursday, just weeks before the country’s president, Xi Jinping, is set to meet with Trump in South Korea for the Asia-Pacific Economic Cooperation (APEC) summit, which kicks off at the end of October. Many see China’s move as a strategic play to gain leverage before the meeting.

The East Asian nation is the world’s largest producer of rare earths, boasting 90% of global production. The minerals in question are used in a wide variety of key products such as electric vehicles, smartphones, and medical devices. Export controls require companies to first receive government permission before selling goods containing rare earths outside of China. Thursday’s announcement by the country’s Ministry of Commerce applied those controls to five more minerals.

But now, with Trump fuming over the announcement, the long-awaited meeting in South Korea may not take place, and Trump’s tariff threat, if actually implemented, may have negative ramifications on the economy and on bitcoin.

“I never thought it would come to this but perhaps, as with all things, the time has come,” Trump said. “Ultimately, though potentially painful, it will be a very good thing, in the end, for the U.S.A.”

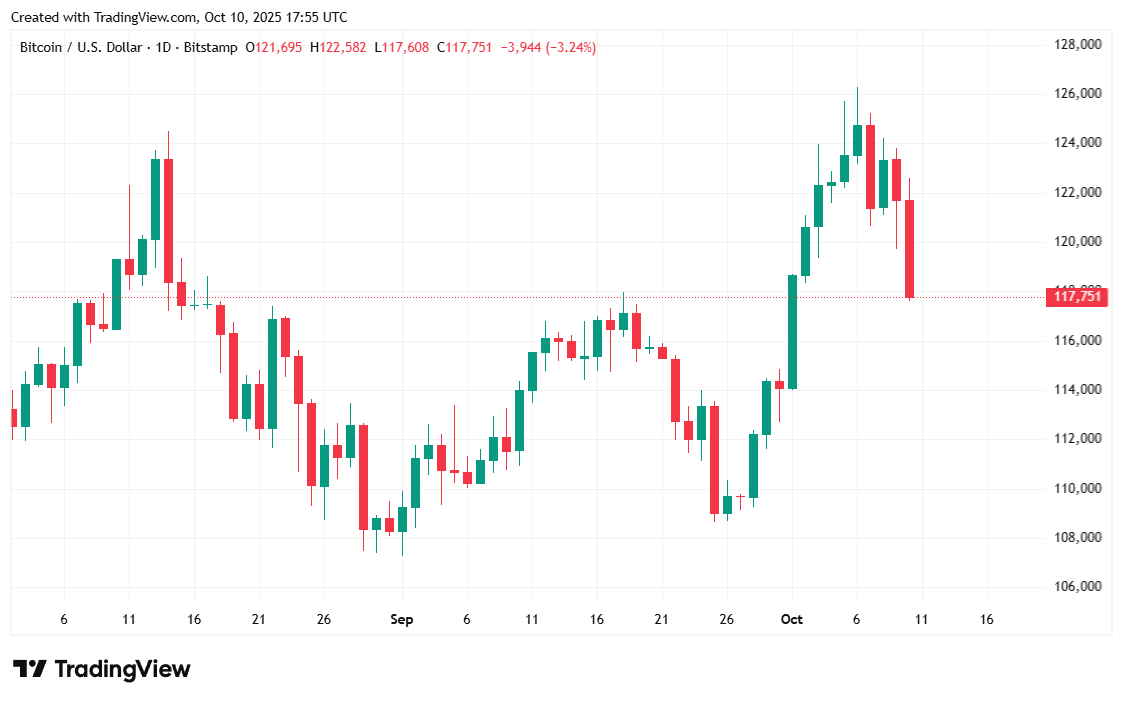

Bitcoin was down 2.53% at $117,655.04 at the time of writing, according to Coinmarketcap data. The cryptocurrency was also down 3.61% over seven days and has been fluctuating between $117,624.44 and $122,509.66 since Thursday.

( BTC price / Trading View)

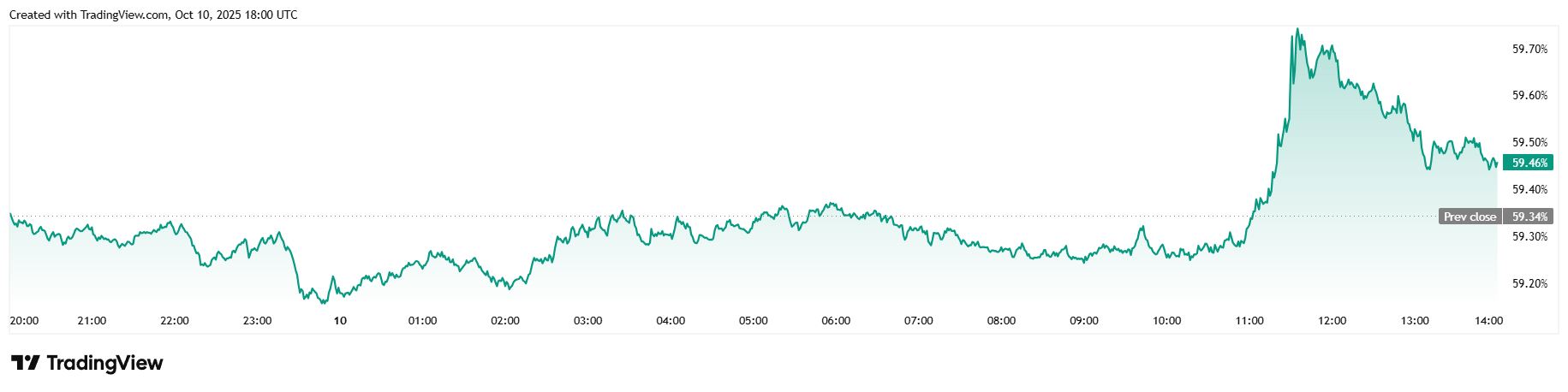

Twenty-four-hour trading volume rose 6.48% to $77.09 billion, and market capitalization fell 2% to $2.35 trillion. Bitcoin dominance, however, climbed 0.17% to 59.46% at the time of reporting.

( BTC dominance / Trading View)

Total bitcoin futures open interest dropped 2.76% to $87.02 billion based on data from Coinglass. Bitcoin liquidations rose to a total of $180.98 million, with longs taking a $140.20 million hit due to Friday morning’s sudden sell-off. Short sellers made up the remaining portion of liquidations, losing a smaller but still significant $40.78 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。