Original: Odaily Planet Daily

Author: Azuma

Following 312 and 519, 1011 is destined to be a day written in the history of cryptocurrency.

Last night, influenced by Trump's sudden tariff remarks, global financial markets plummeted, and the cryptocurrency market also suffered a severe blow — BTC once dropped to 101,500 USDT, ETH fell to 3,373.67 USDT, SOL dipped to 144.82 USDT, and BNB fell to 860 USDT.

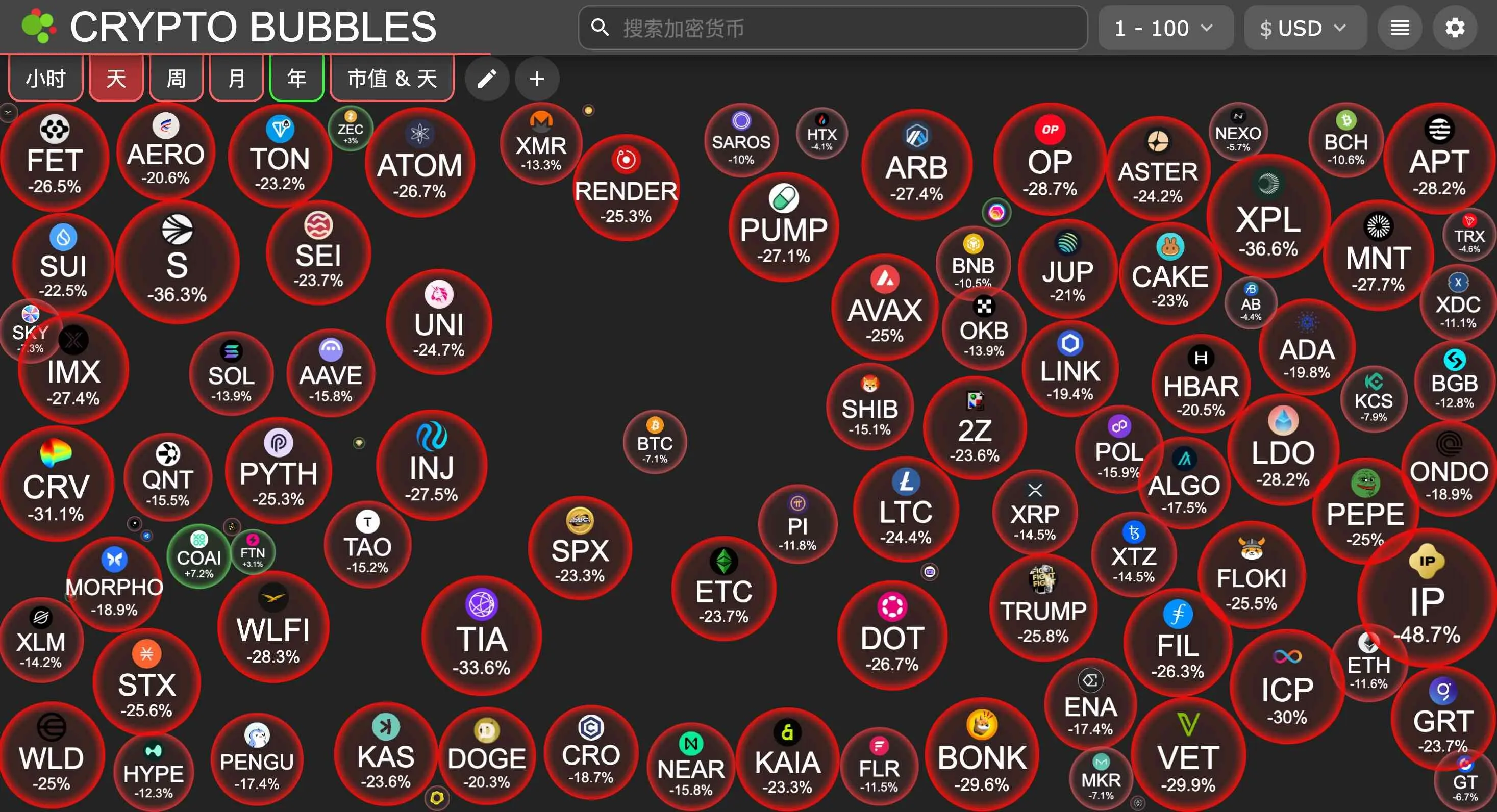

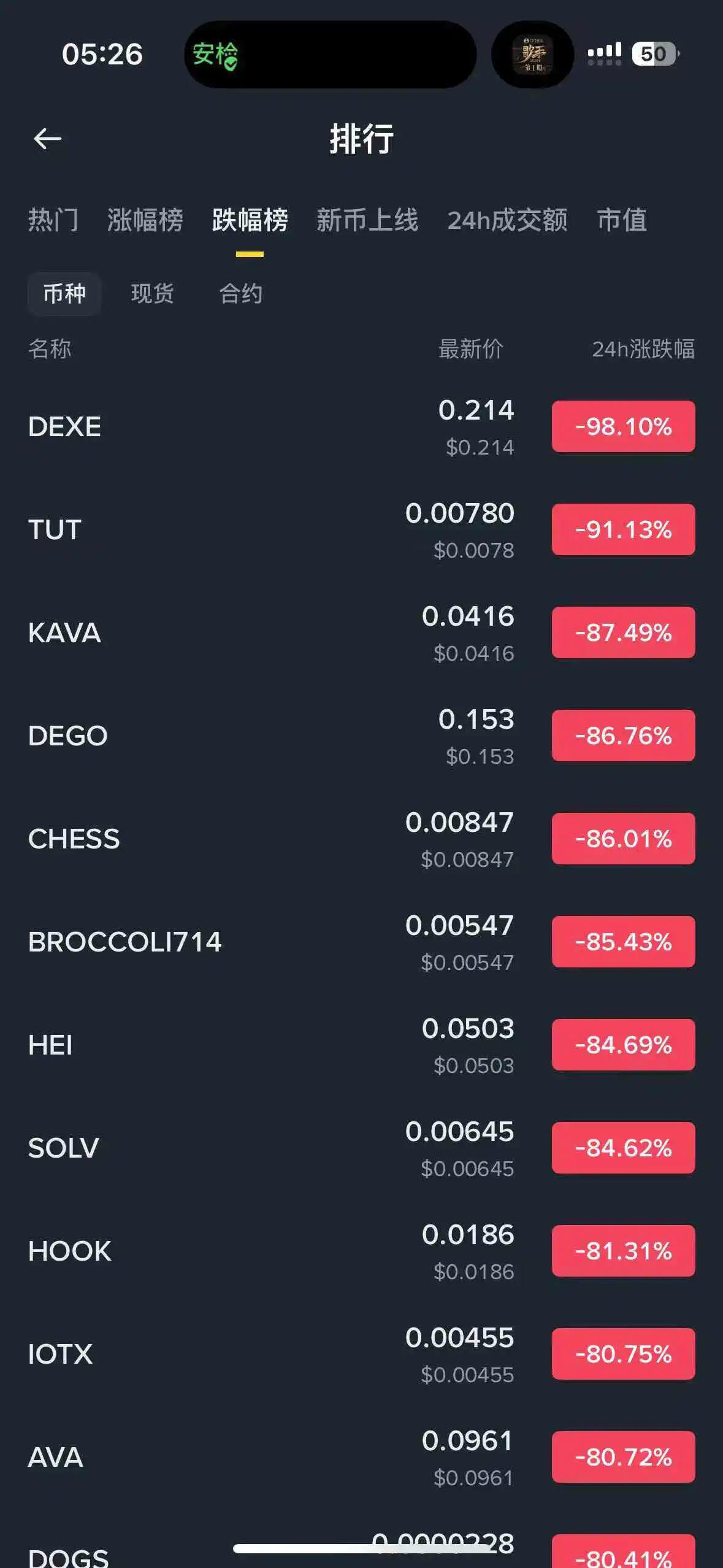

Even more exaggerated were the smaller market cap altcoins, which, affected by a series of market liquidations, saw multiple altcoins drop over 80% or even 90% in a short time. Having experienced 312 and 519, I have never seen altcoins collectively exhibit such exaggerated single-day declines.

Odaily Note: A screenshot of Binance's decline leaderboard from this morning, and this is not even the lowest point of the decline.

Coinglass data shows that as of around 7:40 this morning, the total liquidation amount across the network in the past 24 hours was 19.133 billion US dollars, with as many as 1,618,240 people liquidated. The largest single liquidation was a long position of ETH worth 203 million US dollars on the Hyperliquid platform.

In extreme market conditions, although the vast majority of users' positions were severely impacted (for example, some experienced multiple liquidations overnight), there were also those who "picked up the chips" and seized the opportunity to get rich in extreme conditions.

Opportunity to Get Rich 1: Direct Short Selling

The simplest opportunity to get rich is, of course, to directly short sell, which does not need further elaboration.

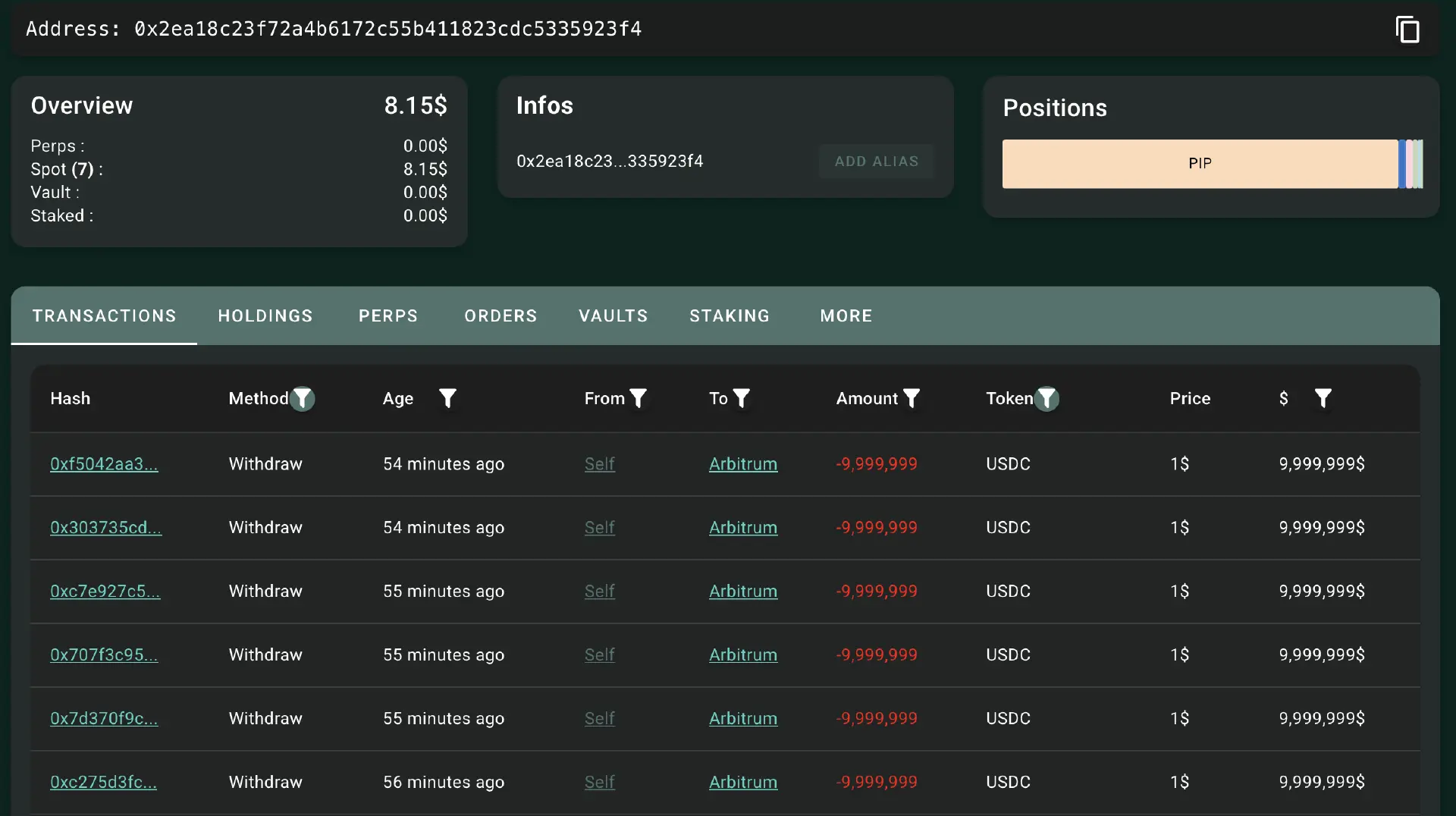

For example, Hypurrsan data shows that a whale address starting with 0x2ea18 made a profit of 72.33 million US dollars in the past 24 hours by shorting BTC and ETH. This whale has withdrawn 60 million US dollars in USDC back to Arbitrum, securing the profits.

Opportunity to Get Rich 2: Bottom Fishing

Compared to contract players, the biggest opportunity for spot users is naturally bottom fishing — if you had orders placed at low prices last night or stayed up all night, you would have had the chance to buy:

XRP at 1.25 US dollars;

DOGE at 0.095 US dollars;

SUI at 0.55 US dollars;

IP at 1 US dollar;

XPL at 0.25 US dollars (this was 2.7 US dollars just a few days ago);

ARB at 0.1 US dollars;

AAVE at 79 US dollars;

PENDLE at 1.65 US dollars;

JUP at 0.05 US dollars;

ENA at 0.13 US dollars;

UNI at 2 US dollars;

TRUMP at 1.5 US dollars;

ATOM at 0.001 US dollars (yes, you read that right!);

IOTX at 0.00000 US dollars (yes, you still read that right! See the image below ↓)……

Aside from small-cap altcoins, mainstream coins like ETH and SOL, although they seem to have smaller declines, also presented excellent bottom fishing opportunities — due to liquidity constraints, the prices of some liquidity derivative tokens experienced significant fluctuations, with WBETH once dropping to 430 US dollars and BNSOL to 34.9 US dollars — who would have dared to think they could see ETH at 400 and SOL at 30 before going to bed last night……

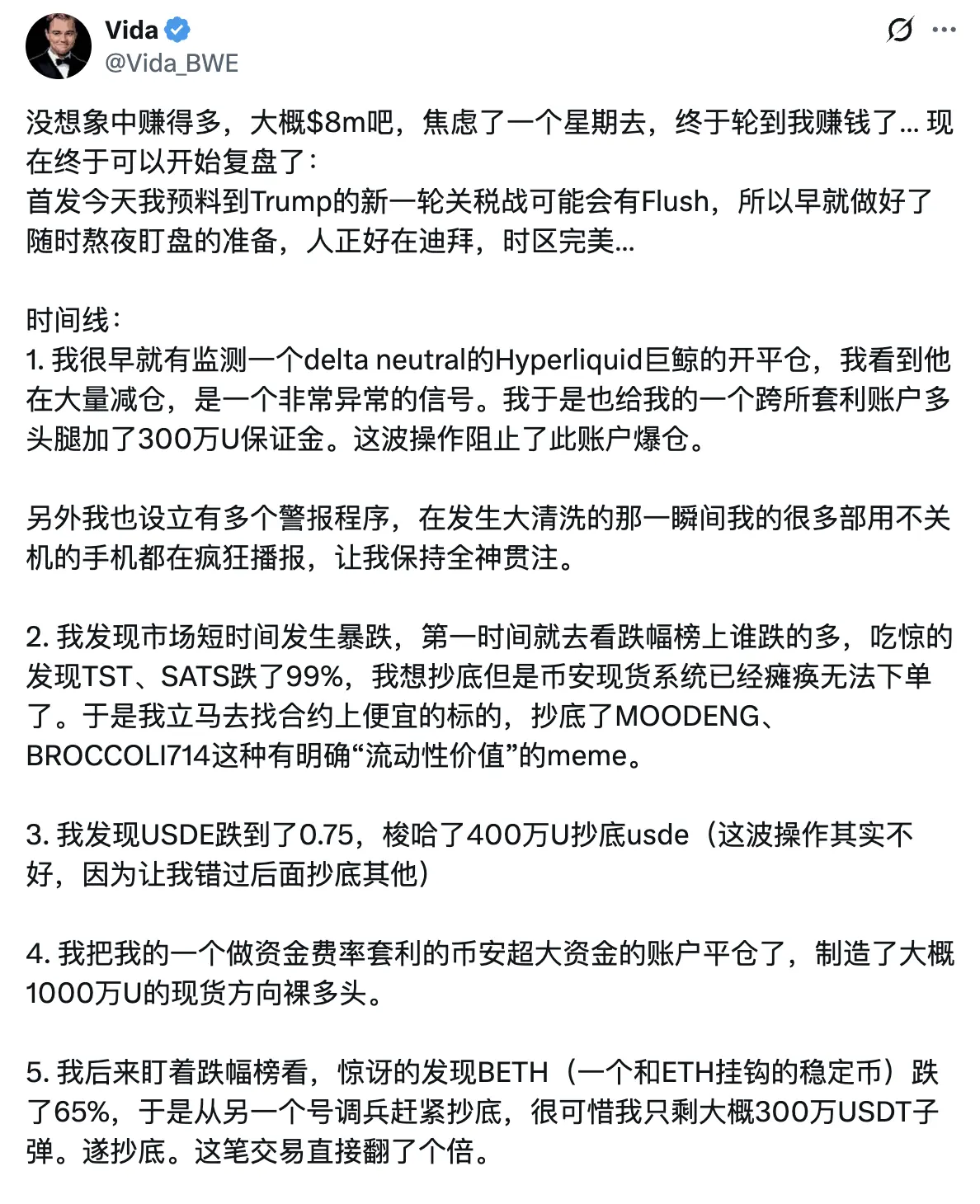

After the market somewhat recovered, many KOLs began to share their profit situations on X, such as Vida (@Vida_BWE), who directly disclosed a profit of about 8 million US dollars overnight.

Opportunity to Get Rich 3: Stablecoin Decoupling

Aside from altcoins that still have some uncertainty, the short-term decoupling of USDe was also a major bottom fishing opportunity last night.

Due to market liquidity issues (some users needed to convert USDe back to USDT to supplement their margin), USDe once decoupled last night, dropping to 0.6268 US dollars amid panic and a series of liquidations. Some users seized this opportunity to bottom fish and made a fortune after the peg was restored.

Afterward, Ethena officially stated on X that USDe is safe and sound, and even the protocol made some extra money due to the extreme market conditions — "Due to market turbulence and large-scale liquidations, the secondary market price of USDe experienced fluctuations. We can confirm that the minting and redemption functions of USDe have always been operational without any downtime, and USDe remains over-collateralized. Due to the impact of liquidations, the market's contract trading prices have consistently been lower than spot prices. Since Ethena holds spot and shorts contracts, this unexpectedly generated more additional income for USDe. Therefore, due to the sudden events, the over-collateralization rate of USDe will be higher than yesterday."

No need to worry, only a few profited, and those who missed out are just victims of fate.

For those who missed last night's market (including myself), watching the above opportunities slip away may evoke some envy or anxiety, but the reality is that only about 1% of users could get rich from this, while over 99% of users woke up to face losses in their accounts.

In one night, nearly 20 billion US dollars vanished in the contract market; it was a night of significant wealth transfer in the market and a night when many users lost everything… In such extreme market fluctuations, all we can do is reduce risks and preserve our capital — after all, only by staying in the game can we play until the end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。