Crypto Market Update Today: Fear and Greed Index 27 Amid Trump Tariffs

Global Cryptocurrency Market Update

-

Total cap: $3.86 trillion (down 9.1% in 24h)

-

24h trading volume: $451 billion

-

Bitcoin dominance: 58.4%, Ethereum: 12.1%

-

Total tracked cryptocurrencies: 19,155

-

Top-performing ecosystems: Polkadot and XRP Ledger

-

No Crypto Events Today

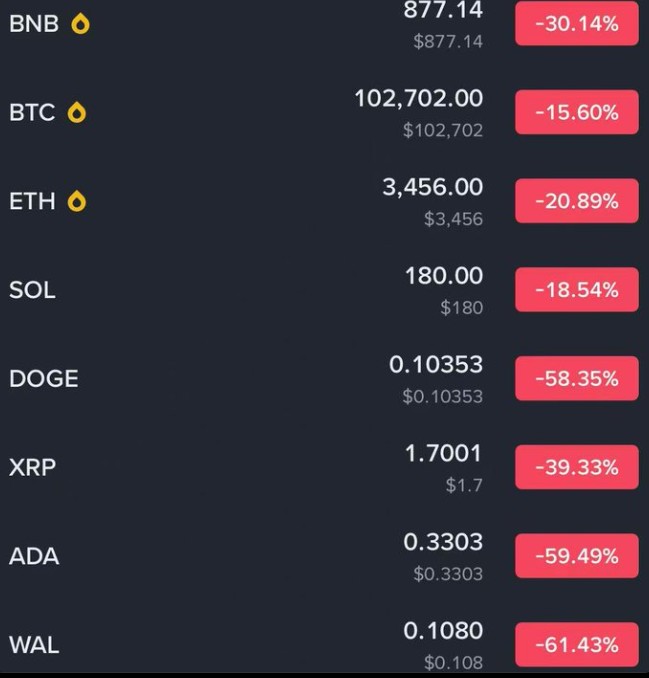

Crypto Market Update: Biggest Crash in History Today – October 11, 2025

Historic Altcoin Liquidation: Today’s crypto market experienced the largest altcoin liquidation event in history, with over $19.13 billion liquidated and 1.6 million traders affected, according to Coinglass data. Assets like AVAX (-61%) and XRP (-62%) saw catastrophic price collapses.

Trigger Event: The crash was triggered by President Trump’s announcement of 100% tariffs on China, which led to Bitcoin dropping below $105,000 and Ethereum under $4,000. Thin order books and synchronized sell-offs amplified altcoin volatility .

Source: X

Major Exchanges Impacted: Platforms like Hyperliquid recorded the largest share of liquidations, totaling $10.28 billion, including $9.3 billion in long positions. The HLP Vault’s profit surged from $80M to $120M within 24 hours.

Regainers Amid Chaos: Despite the downturn, some altcoins like TRX, SUN, and JST appeared on today’s top gainers list, showing how quickly markets can rebound in small segments.

DeFi Volatility Highlighted: World Liberty Financial (WLFI) , a Trump-linked DeFi token, spent $10M to buy 55.68M tokens at $0.18, only to see prices crash to $0.07 before rebounding to $0.12—a 30% loss in minutes, highlighting extreme volatility even with large buybacks.

Lessons from the crash: Leveraged long positions in altcoins are extremely risky during such events.

Recent Liquidations: In just the past hour, $460 million in long positions were liquidated, showing continued market instability.

24 Hour Latest Crypto Market Update

Latest Bitcoin & Ethereum Update

-

Bitcoin (BTC): $112,741 (-7.5%), Market Cap: $2.24T, 24h Volume: $159.7B

-

Ethereum (ETH): $3,844.61 (-12.4%), Market Cap: $465B, 24h Volume: $95.1B

Top 5 Trending Coins Today

-

SX Network (SX) priced at $0.08207, decreases 10.7% with TV $215K

-

Undeads Games (UDS) price today $2.31, down by 0.2% with TV $1.1M

-

Adrena (ADX) price $0.05511, dips 14.4% with TV $2.03M

-

Sui (SUI) priced at $2.63, down 23.9% with TV $3.61B

-

Aster (ASTER) coin price today $1.29, steeply declined by 25.7% with a TV $ of $3.12B

Top 3 Gainers Today

-

Pomato (POMATO) priced $0.0529 soars 57.9% with trading volume $ of $4.2M

-

Infinit (IN) priced $0.1747 surged 51.1% with trading volume $ of $157M

-

Dacxi (DXI) priced $0.0009564, up by 41.7% trading volume $ of $472K

Top 3 Losers Today

-

4 (4) at $0.07692 price, decreases 52.5% trades with $153M

-

Kava (KAVA) price $0.1668 dips 50.3% trades with $88M

-

BinanceLife price $0.1286, down 49.2% with volume $146M

Stablecoins & DeFi Market

-

Stablecoins: Market cap $309B, down -0.3% (24h), 24h Volume: $348.4B

-

DeFi: Cap shrank to $135B (-17.4%), 24h Volume: $23.9B, 3.6% dominance

Fear and Greed Index Today

Source: Alternative Me

The Bitcoin Fear & Greed Index, which currently stands at 27 (Fear), indicates negative market sentiment. Just yesterday, it was at 64 (Greed), while last week it was even higher at 71 (Greed). A month ago, the index reflected neutral sentiment at 54. The sudden drop signals rising fear and caution among investors.

Latest Market News Today

President Trump Tariffs reignite US-China trade war, announcing 100% tariffs on Chinese imports and export controls on key US-made software starting on November 1. The move follows China’s tighter rare earth export restrictions, sending global markets tumbling, tech stocks plunging, and raising doubts over a planned Trump-Xi meeting.

Google has launched the Agent Payments Protocol (AP2) with Coinbase, Mastercard, Polygon, and 60+ partners. Announced on September 16, 2025, AP2 enables AI agents to make payments using cards, banks, or crypto, ensuring secure, real-time transactions and bridging traditional finance with Web3 for AI-driven commerce.

Ten major global banks , including Bank of America, Goldman Sachs, Deutsche Bank, and Citi, are teaming up to launch a joint stablecoin pegged to G7 currencies. Aimed at boosting cross-border payments and liquidity, the project could challenge Tether’s dominance and mark rising institutional adoption of digital assets.

Binance and Coinbase reported degraded transaction performance on October 10, 2025, as surging volumes followed $9.5 billion in crypto liquidations after Trump’s tariff announcement. The outages highlight exchange infrastructure limits, echoing past incidents in 2021 and 2023, when similar spikes caused temporary trading slowdowns.

Russia’s central bank has announced that domestic banks can now conduct limited crypto activities under strict rules. Exposure will be capped at 1% of capital, with full rollout in 2026. The move follows earlier cross-border crypto use, signaling Russia’s shift toward regulated integration despite global sanction concerns.

Coin Gabbar Opinion

Market Status: Down, but recovery potential is strong.

Today’s crypto market crash is a mixed signal. Today’s crash is an opportunity in disguise. While volatility is high and short-term fear dominates, historical trends suggest quick rebounds for strong assets. Investors should not panic sell in the downward trend, as it will come and go. Patience is the key to opening opportunities in the cryptocurrency sphere.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。