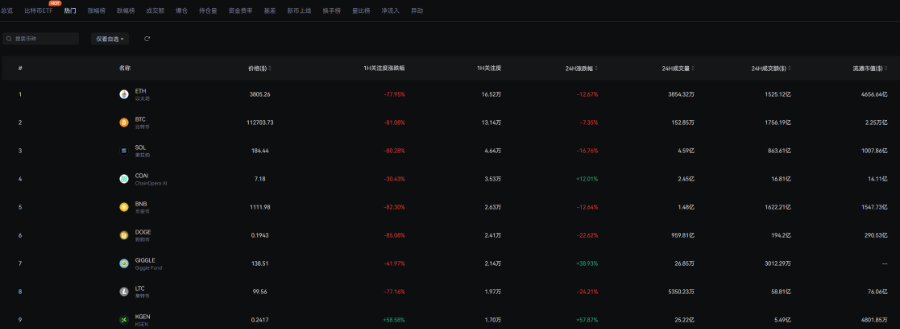

In the early hours of October 11, 2025, the cryptocurrency market experienced severe turbulence, with Bitcoin (BTC) plummeting 10% from $122,000 to $107,000, while mainstream coins like Ethereum (ETH), Solana (SOL), and XRP saw declines of 15%-30%. The main trigger for this round of flash crash was U.S. President Trump's announcement of a 100% tariff on China and the implementation of a new round of export controls, reigniting concerns over the U.S.-China trade war, leading to a collective decline in global risk assets.

In such a market environment, retail investor sentiment is panicked, with high-risk small coins and meme coins being the hardest hit, while blue-chip mainstream coins show relative resilience. Historical experience indicates that bear markets or periods of correction often present a golden window for positioning in quality assets.

Coin

Price (USD)

24h Change (%)

Market Cap (USD)

24h Trading Volume (USD)

BTC

112,463.91

-7.22%

2.242T

175.198B

ETH

3,799.94

-12.48%

465.013B

151.96B

SOL

184.50

-16.41%

100.819B

85.353B

BNB

1,130.76

-10.74%

157.387B

160.276B

XRP

2.44

-13.48%

146.195B

20.982B

DOT

2.98

-27.07%

4.47B

1.155B

AVAX

22.01

-22.45%

9.279B

5.609B

LINK

17.54

-21.49%

11.526B

41.161B

SHIB

0.000010

-14.55%

6.057B

0.537B

LTC

98.97

-22.76%

7.561B

6.137B

BCH

534.36

-9.20%

10.654B

1.462B

HBAR

0.17

-20.50%

7.177B

2.962B

XLM

0.33

-14.47%

10.164B

3.092B

Data Source: AiCoin official website, statistics as of 3 PM - Overview of the latest market data for mainstream coins

I. Coins to Watch Amidst the Plunge

Attention should return to the "first-tier" blue chips — BTC, ETH, SOL, BNB, these top four giants by market cap, as well as the top 10 mainstream altcoins like XRP, DOT, AVAX, LINK, SHIB, LTC, BCH, HBAR, XLM. These coins have solid fundamentals, high institutional interest, and significant potential for capital inflow.

● First-tier blue chips: BTC, ETH, SOL, BNB, these top four giants are suitable for conservative investors.

● Mainstream altcoins: XRP, DOT, AVAX, LINK, SHIB, LTC, BCH, HBAR, XLM, provide leveraged opportunities, requiring selective positioning: oversold lows offer short-term arbitrage opportunities, utilizing volatility tools to capture rapid rebounds.

Coin

Consensus / Platform Positioning

Supply / Holding / Staking

Main Use Cases

Advantages (Catalysts)

Main Risks

ETF / Institutional Interest

XRP

Ripple Ledger, focused on cross-border payments and bank-level settlements (non-traditional EVM chain).

Total supply of about 100 billion XRP (long-term distribution and custody release mechanism); high liquidity.

Cross-border remittances, interbank net settlement, bridging assets.

Significant regulatory benefits obtained (progress in U.S. ownership/regulatory events), high liquidity and institutional interest, suitable for "payment-type" token positioning.

Controversy remains over centralized issuance and Ripple's control over the token; any reversal in regulation/judiciary could amplify pullbacks.

High institutional interest (multiple documents listed as candidate assets), benefiting once institutional product windows open.

DOT (Polkadot)

Nominated PoS, multi-chain / parallel chain ecosystem (cross-chain hub positioning).

Recent adjustments to circulation and total supply mechanism (Polkadot DAO has passed a proposal for a supply cap of about 2.1B), high staking rate.

Cross-chain relay, parallel chain custody/coordinating, DeFi, infrastructure.

Strong scalability, parallel chain ecosystem brings long-term value, staking rewards attract long-term holders.

Competition (other cross-chain/Layer 1), the speed and feasibility of parallel chain project implementation determine value.

Listed in multiple institutional/ETF watchlists (medium to long-term institutional potential).

AVAX (Avalanche)

Avalanche consensus, EVM compatible, multi-subnet model (high TPS, low latency).

Maximum supply of 720M, some already issued, the remainder distributed through staking rewards; part of transaction fees burned to offset inflation.

Smart contracts, DeFi, asset tokenization, subnet enterprise chains.

High performance, subnetting attractive for enterprises/tokenization; active capital inflow.

Intense ecosystem competition (Solana, Sui, Aptos), user stickiness challenges.

Listed as one of the potential altcoin targets in multiple product applications.

LINK (Chainlink)

Decentralized oracle network, non-L1 but infrastructure-level.

Hundreds of millions of LINK in circulation; staking/protocol revenue buyback mechanism to be implemented from 2025.

Feeding real-world data onto the chain (prices, data services, DeFi pricing).

Strong network effects, foundational infrastructure for DeFi; has real protocol revenue.

Value depends on contract call volume; if DeFi demand weakens, volatility may increase.

Regarded as an institutional-grade infrastructure asset, commonly found in ETF watchlists.

SHIB (Shiba Inu)

Meme coin, community-driven; revolves around Shibarium (L2), burning mechanisms, and governance.

Initial supply in the quadrillion range, continuous burning and reduction in circulation; has ecological tokens (LEASH, BONE).

Community/social speculation, NFTs, limited L2 applications.

Strong community and marketing power, potential value if L2 ecosystem matures.

Insufficient practicality, highly speculative price, significant risk of capital outflow.

Low probability of institutionalization, classified as a high-risk, high-volatility asset.

LTC (Litecoin)

PoW, "the silver to Bitcoin," fast transfers and low fees.

Maximum supply of 84 million, periodic halving (most recent in 2023).

Store of value / payment / medium of exchange.

High historical recognition, strong stability, widely supported.

Weak technical differentiation, slow ecosystem expansion.

A candidate for established alternative assets, with some ETF/fund holdings.

BCH (Bitcoin Cash)

Bitcoin fork, larger blocks, low-fee payment-oriented.

Maximum supply of 21 million, halving mechanism similar to Bitcoin.

Micro payments, peer-to-peer transactions.

Clear payment scenarios, low transaction fees.

Weak development vitality, high probability of being replaced by new L1/L2.

Low institutional interest, limited probability of ETF inclusion.

HBAR (Hedera)

Hashgraph architecture + council governance, enterprise-grade DLT.

Total supply of 50 billion, custodial distribution; supports staking incentives.

Enterprise DLT services, Token/Consensus services, identity and IoT.

Enterprise council (Google, IBM, etc.) enhances credibility; high performance and low energy consumption.

Centralized governance, limited number of ecosystem developers.

Listed as a compliance-oriented observation asset by institutions/ETFs.

XLM (Stellar)

Focused on cross-border payments and stablecoin bridging.

Total supply of about 50 billion, circulating about 32 billion.

Fiat-crypto bridging, payments, asset tokenization.

Collaborates extensively with financial institutions, mature payment use cases.

Overlaps with XRP's track; requires continuous commercial cooperation to drive growth.

Appears in ETF watchlists (priority lower than XRP).

SOL (Solana)

High-performance PoH+PoS public chain, emphasizing speed and low fees.

Maximum supply of about 550 million SOL; approximately 60% issued; high staking participation rate.

Smart contracts, DeFi, NFTs, RWA, social applications.

Extremely high TPS (>4,000), low fees, explosive ecosystem (DeFi+Meme+GameFi), active institutional traders.

Frequent network stability issues; inflation pressure and VC concentration.

One of the hottest altcoins for ETFs, with multiple institutions having filed for SOL ETFs.

Source: AiCoin compilation, basic information on the top ten mainstream altcoins

II. Altcoin ETFs and Subsequent Speculative Opportunities

1. Rebound Opportunities from Oversold Signals

Using AiCoin's volatility monitoring tool, you can easily capture golden windows for short-term trading. Simply go to the homepage → Popular Rankings → Volatility to track coins that have fluctuated more than 3% or 5% within 5 minutes in real-time. This feature accurately captures abnormal fluctuations in cryptocurrency spot and contract funds, presenting core indicators such as the first volatility moment of the altcoin, the latest volatility time, and the current market price. In a market environment of severe turbulence, this real-time volatility alert will become your tool for seizing short-term opportunities.

Here are the lowest points for the top ten mainstream altcoins at 5 PM on the 11th, with the lowest points representing good investment value levels.

● XRP (Ripple) - Daily low: 1.25 USD

● DOT - Daily low: 0.633 USD

● AVAX - Daily low: 8.52

● LINK - Daily low: 7.9

● SHIB - Daily low: 0.00000678

● LTC - Daily low: 52.71

● BCH - Daily low: 482

● HBAR - Daily low: 0.0725

● XLM - Daily low: 0.16

2. Investment Opportunities from the Fundamentals of Mainstream Altcoins

● XRP, benefiting from RippleNet's cross-border payment ecosystem and regulatory clarity, is poised for institutional capital inflow and potential ETF approval, suitable for medium to long-term holders seeking stable growth;

● AVAX stands out with its high-throughput quantum network architecture, supporting DeFi and gaming innovations, showcasing high growth potential;

● LINK, as a leader in the oracle space, provides reliable data feeds, and its cross-chain compatibility enhances its core position in the RWA field, with institutional adoption rates continuing to rise.

In contrast,

● SHIB, while active in the community and enhancing utility through Shibarium L2, remains fundamentally meme-driven with strong speculative attributes, suitable only for risk-tolerant short-term speculation;

● Coins with strong interoperability like DOT and LINK are relatively stable;

● Payment-oriented projects like LTC and BCH rely on BTC's influence;

● HBAR and XLM are poised for enterprise-level adoption.

Project

Fundamental Highlights

XRP (Ripple)

Focused on cross-border payments through the RippleNet network, which has partnered with multiple banks; in 2025, the price is expected to break the $2.50 resistance level, driven by ETF inflows and institutional demand expanding the ecosystem.

Clear regulatory environment (SEC lawsuit largely resolved) enhances compliance appeal.

DOT (Polkadot)

Multi-chain interoperability architecture supporting parallel chain auctions, attracting a Web3 project ecosystem; in 2025, its core position is solid, with expected growth in users and developers.

Led by Gavin Wood, the team frequently upgrades technology.

AVAX (Avalanche)

High-throughput subnet technology supporting DeFi and gaming; in 2025, institutional interest is rising, revealing ETF potential.

The ecosystem is active, with partners including financial institutions.

LINK (Chainlink)

Leading oracle network providing reliable data feeds, supporting DeFi and RWA; Q2 2025 reports show upgrades in the CRE environment, enhancing trade execution efficiency.

Strong cross-chain compatibility and high institutional adoption rates.

SHIB (Shiba Inu)

Meme coin transitioning to an ecological platform, with Shibarium L2 improving transaction efficiency; community-driven, with a token burning mechanism reducing supply.

2025 will see ecosystem expansion (such as NFTs and gaming).

LTC (Litecoin)

"The silver to Bitcoin," enabling fast, low-fee transactions; institutional interest increases post-2025 halving, serving as a payment tool.

Historically stable and compatible with the BTC ecosystem.

BCH (Bitcoin Cash)

A large block fork focused on everyday payments; 2025 price predictions reflect payment adoption potential.

Strong community support and low transaction fees.

HBAR (Hedera)

Hashgraph consensus with enterprise-level adoption (e.g., Google, IBM); in 2025, strong growth vectors in RWA and enterprise.

Regulatory friendly with high TPS.

XLM (Stellar)

Cross-border payment network enabling low-cost remittances; in 2025, adoption is growing, similar to Ripple but more decentralized.

Partners include financial institutions.

Source: AiCoin compilation - Fundamental highlights of the top ten mainstream altcoins

III. First-Tier Blue Chip Coin Analysis

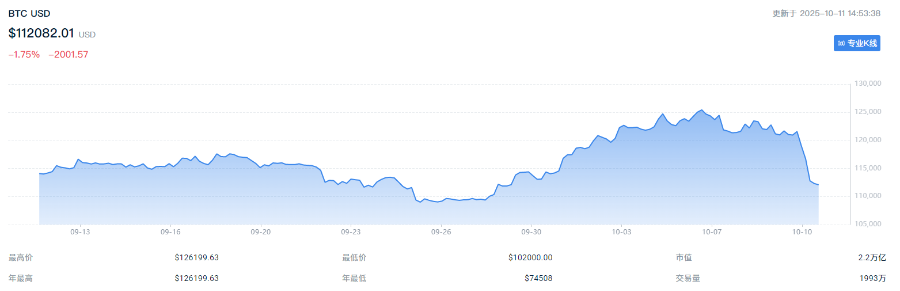

1. Bitcoin (BTC): The Safe Haven of Digital Gold

● Pros and Cons

Pros

Cons

Strongest network effects and liquidity

Slow transaction speed (about 7 TPS)

Halving mechanism controls supply

High energy consumption, especially during mining

Outstanding anti-inflation properties

Significant risk due to short-term price volatility

Excellent performance in macroeconomic environments

Significantly affected by geopolitical and regulatory policies

● Fundamentals: In the first half of 2025, BTC's market cap surpassed $2.4 trillion, with over 10 million active addresses on-chain and a hash rate reaching 650 EH/s, a historical high. Recent Ordinals protocol and Layer 2 solutions (like Stacks) have enhanced its DeFi applications, accounting for over 50% of the total network transaction volume.

● Capital Flow: Institutional adoption rate reached 86%, with ETF assets under management exceeding $65 billion, and giants like BlackRock and Fidelity increasing their holdings by over 420,000 BTC.

● Risks: Regulatory uncertainties (such as the SEC's review of ETFs) and geopolitical events (like trade wars) could trigger further liquidations; if the price falls below the $100,000 support level, it may test the $90,000 low.

2. Ethereum (ETH): The King of Smart Contracts, Growth Driven by Upgrades

● Pros and Cons

Pros

Cons

Most diverse ecosystem: Supports over 5,000 DApps

Gas fees significantly spike during mainnet congestion

Strong EVM compatibility: Promotes multi-chain interaction

Facing competitors capturing market share, such as Solana (SOL)

Layer 2 scaling solutions: Reduce gas fees and enhance performance

Mainnet scalability challenges: Requires continuous technical upgrades

● Fundamentals: In 2025, ETH staking volume reached 36.2 million, with TVL exceeding $150 billion. The Fusaka upgrade (in December) will increase TPS to 100,000. Its dominant position in the DeFi and NFT markets remains solid, with protocol revenue exceeding $5 billion annually.

● Capital Flow: Grayscale is staking 857,600 ETH (valued at $3.83 billion), with institutional demand driving $5.14 billion inflows in Q4. Standard Chartered Bank raised its 2025 target price to $7,500, with record ETF purchases.

● Risks: Layer 2 fragmentation may divert liquidity; if the Federal Reserve raises interest rates, ETH, as a risk asset, may be impacted, with a support level at $3,700.

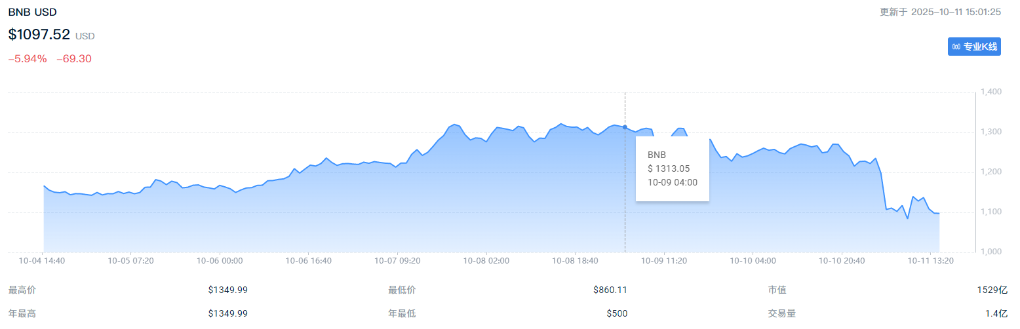

3. BNB: The Core of the Binance Ecosystem, Driven by Utility

● Pros and Cons

Pros

Cons

Over 5 million daily active users (BNB Smart Chain)

Centralized risk due to Binance's dominance

Low transaction gas fees, clear cost advantages

Facing significant regulatory pressure, affecting market stability

Strong cross-chain bridge support, aiding multi-chain ecosystem development

Operational and policy risks may suppress growth

● Fundamentals: In 2025, BNB Chain DEX trading volume reached $108 billion, with 5.1 million addresses. The Hard Fork upgrade reduced gas fees by 50%. The ecosystem includes Launchpad and NFT markets.

● Capital Flow: Institutional holdings exceed 10%, with BNB Chain leading a $1 billion builder fund, expecting a 129% increase in 2025.

● Risks: Regulatory events surrounding Binance (such as CFTC fines) could have repercussions; support level at $1,000.

IV. Comparative Summary: Blue Chip Coins vs. Mainstream Altcoins

In the market flash crash triggered by the escalation of the U.S.-China trade war, crypto assets collectively declined, with high-risk meme coins experiencing particularly severe crashes, while blue-chip projects demonstrated significant resilience. Correction periods often present golden windows for positioning in quality assets, and investors should return to first-tier and mainstream altcoins, prioritizing stable allocations.

● First-tier blue chips are more suitable for conservative investors:

● Bitcoin, as digital gold, has extremely high network effects and institutional adoption rates, with outstanding anti-inflation properties, making it suitable for long-term hedging.

● Ethereum has a rich ecosystem, with a solid dominant position in smart contracts, and significant growth potential driven by upgrades.

● BNB, relying on the Binance ecosystem, has strong utility and active cross-chain support.

● Mainstream altcoins provide leveraged opportunities:

● Mainstream altcoins require selective positioning: oversold lows offer short-term arbitrage opportunities, utilizing volatility tools to capture rapid rebounds.

● The fundamentals favor XRP's cross-border payment ecosystem, AVAX's DeFi gaming innovations, and LINK's leadership in oracles, with strong institutional demand, making them suitable for medium to long-term holding.

● SHIB is community-driven but highly speculative, primarily for short-term arbitrage;

● DOT, LTC, and BCH are relatively stable, relying on linkage effects;

● HBAR and XLM are poised for enterprise-level adoption, with clear incremental layout potential.

Dimension

First Tier (BTC/ETH/BNB)

Mainstream Altcoins (XRP/DOT, etc.)

Fundamental Strength

High (mature ecosystem)

Medium (niche applications)

Institutional Attention

Extremely high (ETF-driven)

Medium-high (enterprise cooperation)

Capital Inflow

Stable (trillion-level)

Volatile (billion-level)

Risk Level

Medium (macro-sensitive)

High (intense competition)

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。