🧐 USDE Decoupling Event: A 56-Minute System Phase Transition | When stablecoins are no longer stable, the entire market shifts from "solid" to "gas" in an instant, much like the physical world.

Introduction: Every time there is a crash, it reminds us that risk is never external, but within the trust chain. What you see is not just a decoupling of coin prices, but the liquidity of human nature:

When everyone wants to retreat at the same time, the system ceases to exist.

This morning, I saw a recap by Shen Yu, and @bitfish1 wrote a comprehensive analysis with deep reflections, which is very worth studying—

1) USDE Decoupling Event:

On October 11, 2025, from 05:20 to 06:16 (approximately 56 minutes), USDE dropped from $1.00 to a low of $0.65 in the Binance trading pair, and then slowly recovered;

2) Essence:

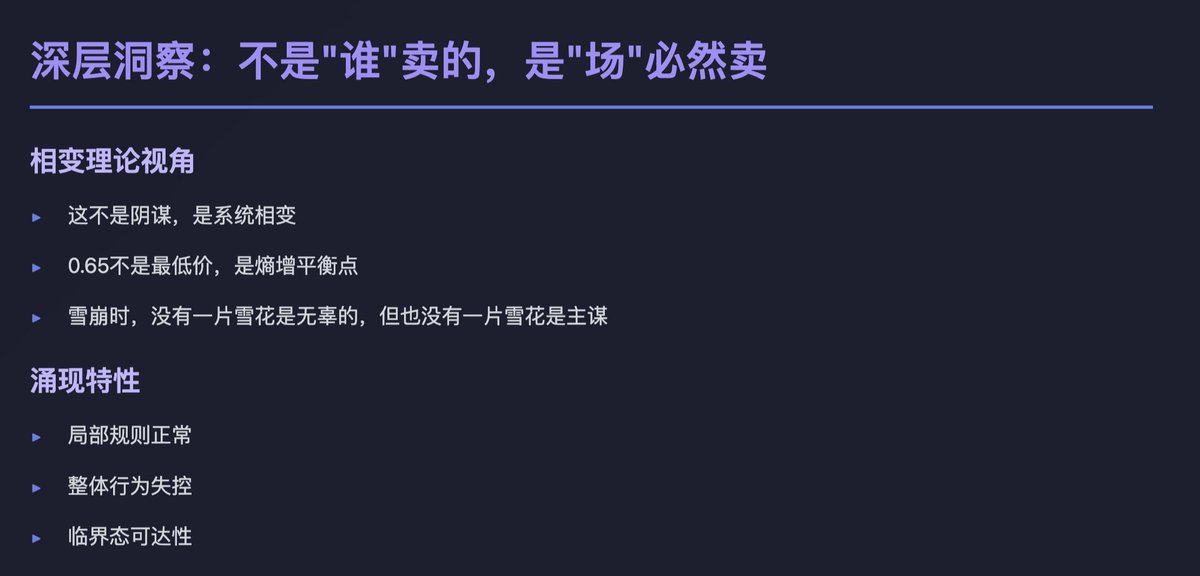

A synchronous collapse of a "three-layer interconnected leverage system": an experimental "phase transition" of the crypto financial system: a system that has been accelerated by leverage and incentives suddenly loses balance and collapses layer by layer.

3) Keywords:

Leverage resonance, staking homogenization, feedback failure, arbitrage channel blockage

1️⃣ Surface Cause: Market Flash Crash + Liquidation Wave

On the surface, the cause seems simple:

Mainstream coins like BTC/ETH suddenly flash crashed;

Long positions in contracts were triggered for liquidation;

The liquidation engine sold USDE as collateral;

Market panic spread, and USDE fell below $1.

But what truly turned this event into a system-level decoupling was not this "needle," but the fact that the entire system was already in a "supersaturated" critical state.

2️⃣ Deep Structure: Three-Layer Self-Reinforcing Leverage Tower

The annualized yield of 12% for USDE is very attractive. To be honest, I also hold a large amount of WBETH and have considered circular lending, because under the activity incentives and high yields on Binance, we easily built a three-layer interdependent leverage system driven by returns:

1) First Layer: Margin Pool:

Using USDE, WBETH, and other LST assets as collateral, with an annualized yield of about 12%.

2) Second Layer: Circular Lending:

Pledging USDE to borrow stablecoins, then exchanging back for USDE, and re-pledging.

This is equivalent to repeatedly leveraging the same asset (leverage ×5).

3) Third Layer: Long Contracts:

Using borrowed funds to continue opening long contract positions (leverage ×10 to 50).

The collateral remains USDE.

Result—

From top to bottom, the collateral, lending assets, and margin of the entire system are all the same thing: USDE.

This means:

As long as USDE wavers even slightly, the three-layer tower will collapse simultaneously.

3️⃣ Fatal Moment: Feedback Mechanism "Failure"

At 05:20, BTC/ETH simultaneously flash crashed.

The liquidation engine began to sell USDE collateral, and the price dropped from $1.00 to $0.95.

Theoretically, arbitrageurs should immediately buy USDE → redeem → arbitrage → restore the peg.

But this "negative feedback mechanism" completely failed in reality:

On-chain gas surged, transactions lagged;

Withdrawal from Binance was delayed by over 30 minutes;

Market makers withdrew liquidity.

Thus, arbitrageurs could not enter, and the feedback broke.

The price continued to drop to $0.91—just at the strong liquidation threshold designed by the system.

4️⃣ Second Phase Transition: Chain Liquidation and Self-Collapse:

When USDE fell below $0.91,

The LTV (Loan-to-Value) of the circular lending layer triggered mass liquidation.

The five-layer circular structure collapsed instantly, with the liquidation volume being 10 times that of the initial stage.

Billions of dollars in selling pressure poured out like an avalanche,

The system bottomed out at $0.65 before 05:58.

At this point, the three-layer leverage tower completed its physical transition from "stable structure" to "collapsed structure."

5️⃣ Self-Stabilization and Re-Solidification

After 05:58, market makers and arbitrageurs returned,

The price gradually recovered to around $0.98.

The system re-"solidified," but the internal structure was damaged.

6️⃣ What have we learned from this event?

The 56-minute decoupling of USDE resembles a "physical experiment of decentralized finance."

It tells us:

All stability is a temporary energy balance;

All collapses occur at the moment when feedback channels are blocked.

The significance of stablecoins is not only to peg to the dollar but also to anchor the trust of the system.

So throughout this piece, I believe the seventh point is the most important. We understand the cause and effect of the event, and we know that this decoupling event was not accidental, but an inevitable result of systemic fragility.

So what insights can we gain?

7️⃣ My Summary and Insights:

1) Do not be misled by "yields"; first, check if the structure is stable.

A 12% annualized yield does not come without reason; it often means that there is hidden leverage within the system.

When yields come from circular schemes rather than real productivity, risks accumulate within the system.

2) The more singular the collateral, the more concentrated the risk.

When a system relies on the same asset (USDE) for collateral, lending, and margin,

Any slight fluctuation will be amplified layer by layer.

The seemingly safe "multi-layer yield" is actually the superposition resonance of the same risk.

3) True "stability" lies not in coin prices but in feedback mechanisms.

Withdrawal delays, surging gas fees, and market makers exiting—these "technical details" ultimately become systemic risks.

The essence of stability is not algorithms or collateral ratios, but—

When something goes wrong, are there people, methods, and willingness to take over the system?

4) Do not overestimate the system, and do not underestimate liquidity.

Any decentralized mechanism will revert to the most basic question in extreme moments:

How many people are willing to buy, and how many must sell?

5) The only thing retail investors can do is to stay alert and diversify.

Do not put all your funds into a "seemingly safe" product,

Do not let "activity rewards" or "staking yields" cloud your judgment.

The premise of making money is to survive longer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。