CoinW研究院

关键要点

全球加密货币总市值为4.01万亿美元,较上周4.46万亿美元,本周内加密货币总市值跌幅为10.09%。截止至发稿,美国比特币现货ETF累计总净流入约627.7亿美元,本周净流入27.1亿美元;美国以太坊现货ETF累计总净流入约149.1亿美元,本周净流入488万美元。

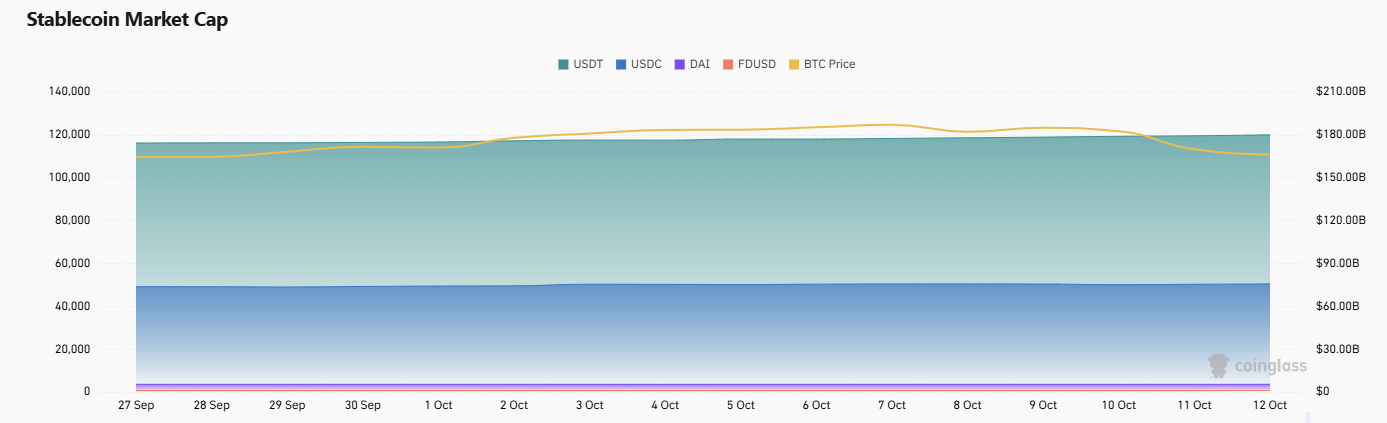

稳定币总市值为3,100亿美元,其中USDT市值为1,794亿美元,占稳定币总市值的57.87%;其次是USDC市值为754亿美元,占稳定币总市值的24.35%;DAI市值为53.6亿美元,占稳定币总市值的1.73%。

据DeFiLlama数据,本周DeFi总TVL为1,574亿美元,较上周1,691亿美元,本周跌幅为6.92%。按公链进行划分,其中TVL最高的三条公链分别是Ethereum链占比67.53%;Solana链占比8.6%;BNBChain占比6.9%。

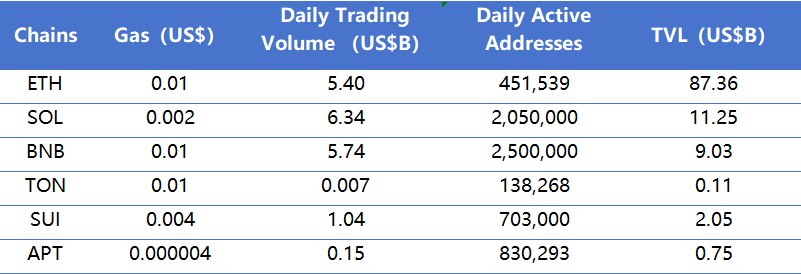

从链上数据看,日成交量中,本周除Aptos下降27.2%之外,其余公链都是上涨的趋势。其中,Ethereum上涨91.15%、Solana上涨58.27%、BNBChain上涨58.12%、Toncoin上涨28.2%、Sui上涨23.2%。交易费用上,Ethereum下降50%、Solana下降50%、BNBChain、Toncoin与Sui维持稳定、Aptos下降33.3%;从日活跃地址上看,Solana上涨13.9%、BNBChain上涨23.2%、Toncoin上涨21.4%、Aptos上涨30.4%;相反,Ethereum下降6.4%、Sui下降16.7%。从TVL上看,本周整体呈下降趋势,仅BNBChain上涨1.9%,同时Ethereum下降8.55%、Solana下降12.52%、Toncoin下降17.3%、Sui下降19.6%、Aptos下降9.6%。

创新项目关注:Aborean是专为Abstract设计的DeFi协议,旨在提升资金效率;XSY 是专注于构建数字合成美元 $UTY 的 DeFi 协议,旨在以结构化、可扩展的方式释放区块链生态中价值潜力;Punk.auction是建立在以太坊上的去中心化协议,旨在通过自动化机制购买并拍卖 CryptoPunks。

目录

关键要点

一.市场概览

1.加密货币总市值/比特币市值占比

2.恐慌指数

3.ETF流入流出数据

4.ETH/BTC和ETH/USD兑换比例

5. Decentralized Finance (DeFi)

6 .链上数据

7. 稳定币市值与增发情况

二.本周热钱动向

1.本周涨幅前五的VC币和Meme币

2.新项目洞察

三.行业新动态

1.本周行业大事件

3.上周重要投融资

四.参考链接

一.市场概览

1.加密货币总市值/比特币市值占比

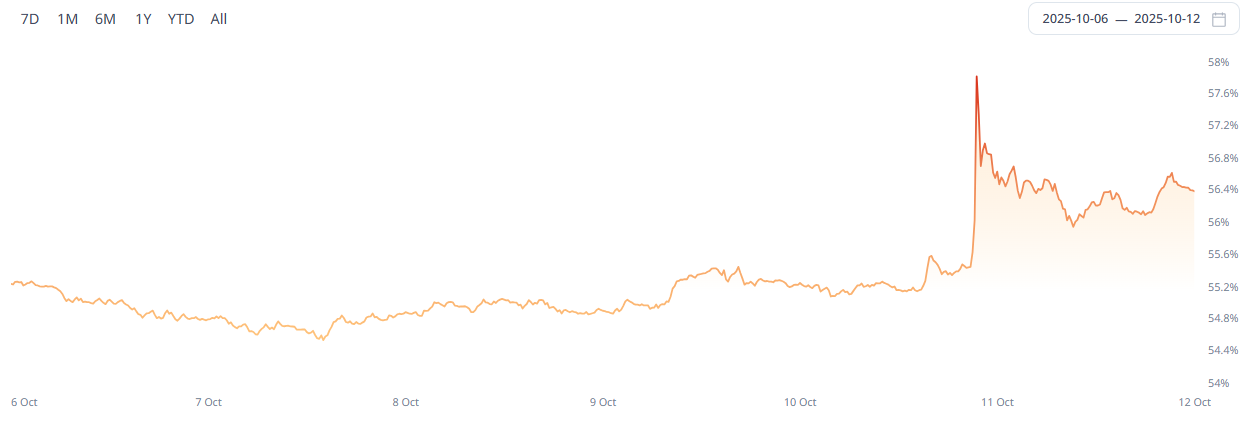

全球加密货币总市值为4.01万亿美元,较上周4.46万亿美元,本周内加密货币总市值跌幅为10.09%。

数据来源:cryptorank

数据截止至2025年10月12日

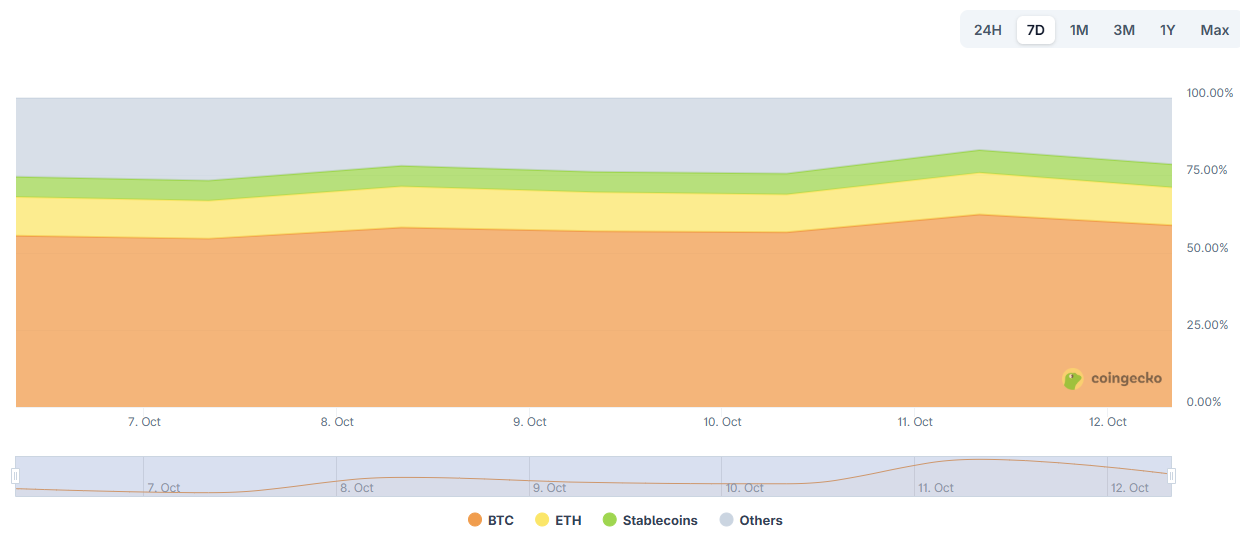

截止至发稿,比特币市值为2.29万亿美元,占加密货币总市值的57.2%。与此同时,稳定币市值为3,100亿美元,占加密货币总市值的7.73%。

数据来源:coingeck

数据截止至2025年10月12日

2.恐慌指数

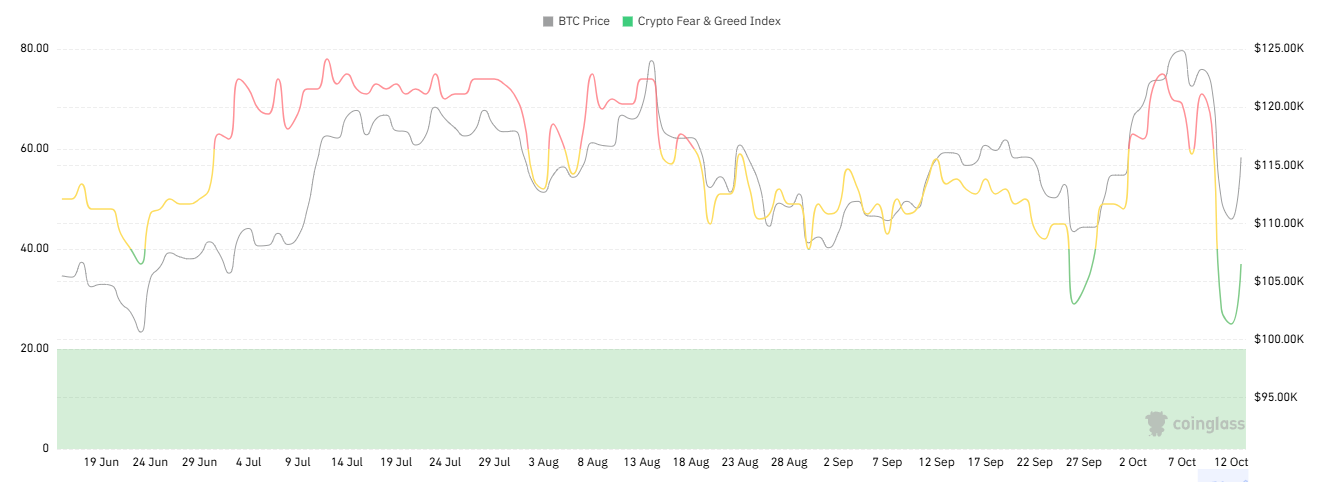

加密货币恐慌指数为37,显示为恐慌。

数据来源:coinglass

数据截止至2025年10月12日

3.ETF流入流出数据

截止至发稿,美国比特币现货ETF累计总净流入约627.7亿美元,本周净流入27.1亿美元;美国以太坊现货ETF累计总净流入约149.1亿美元,本周净流入488万美元。

数据来源:sosovalue

数据截止至2025年10月12日

4.ETH/BTC和ETH/USD兑换比例

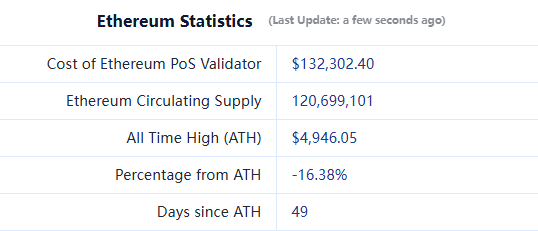

ETHUSD :现价 3,456美元,历史最高价 4,946 美元,距最高价跌幅约16.38%。

ETHBTC :目前为 0.035882,历史最高为0.1238。

数据来源:ratiogang

数据截止至2025年10月12日

5. Decentralized Finance (DeFi)

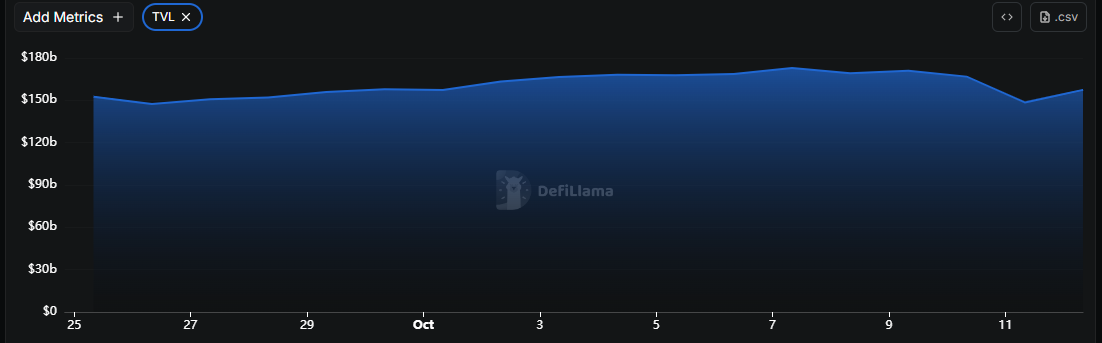

据DeFiLlama的数据,本周DeFi总TVL为1,574亿美元,较上周1,691亿美元,本周跌幅为6.92%。

数据来源:defillama

数据截止至2025年10月12日

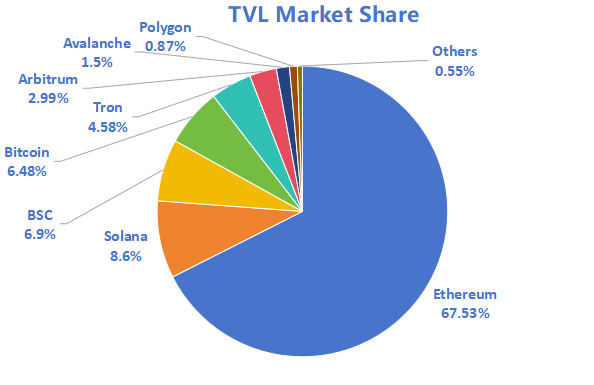

按公链进行划分,其中TVL最高的三条公链分别是Ethereum链占比67.53%;Solana链占比8.6%;BNBChain占比6.9%。

数据来源:CoinW研究院,defillama

数据截止至2025年10月12日

6 .链上数据

Layer 1相关数据

主要从日交易量、日活跃地址、交易费用分析目前主要Layer1含ETH、SOL、BNB、TON、SUI以及APT的相关数据。

数据来源:CoinW研究院,defillama,Nansen

数据截止至2025年10月12日

● 日成交量与交易费用:日成交量和交易费用是衡量公链活跃度和用户体验的核心指标。从日成交量看,本周除Aptos下降27.2%之外,其余公链都是上涨的趋势。其中,Ethereum涨幅最为显著,上涨约91.15%、Solana上涨58.27%、BNBChain上涨58.12%、Toncoin上涨28.2%、Sui上涨23.2%。交易费用上,Ethereum下降50%、Solana下降50%、BNBChain、Toncoin与Sui维持稳定、Aptos下降33.3%。

● 日活跃地址与TVL:日活跃地址反应了公链的生态参与度和用户粘性,TVL反应了用户对平台的信任程度。从日活跃地址上看,本周变化趋势较大。其中Solana上涨13.9%、BNBChain上涨23.2%、Toncoin上涨21.4%、Aptos上涨30.4%;相反,Ethereum下降6.4%、Sui下降16.7%。从TVL上看,本周整体呈下降趋势,仅BNBChain上涨1.9%,同时Ethereum下降8.55%、Solana下降12.52%、Toncoin下降17.3%、Sui下降19.6%、Aptos下降9.6%。

Layer 2相关数据

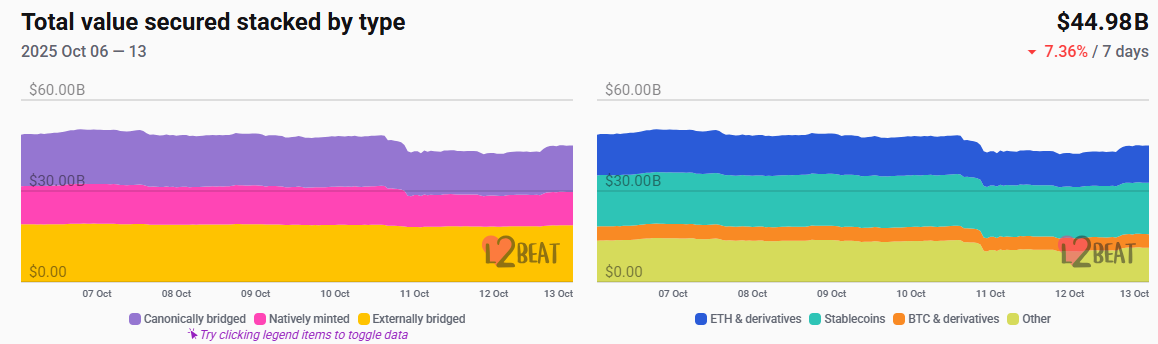

● 据L2Beat数据显示,以太坊Layer2总TVL为449.8亿美元,本周较上周478.8亿美元,整体跌幅为7.36%。

数据来源:L2Beat

数据截止至2025年10月12日

Base和Arbitrum分别以38.26% 和35% 的市场份额占据前排,本周Base依然在以太坊Layer2的TVL中位居第一。

数据来源:footprint

数据截止至2025年10月12日

7. 稳定币市值与增发情况

据Coinglass数据,稳定币总市值为3,100亿美元。其中USDT市值为1,794亿美元,占稳定币总市值的57.87%;其次是USDC市值为754亿美元,占稳定币总市值的24.35%;DAI市值为53.6亿美元,占稳定币总市值的1.73%。

数据来源:CoinW研究院,Coinglass

数据截止至2025年10月12日

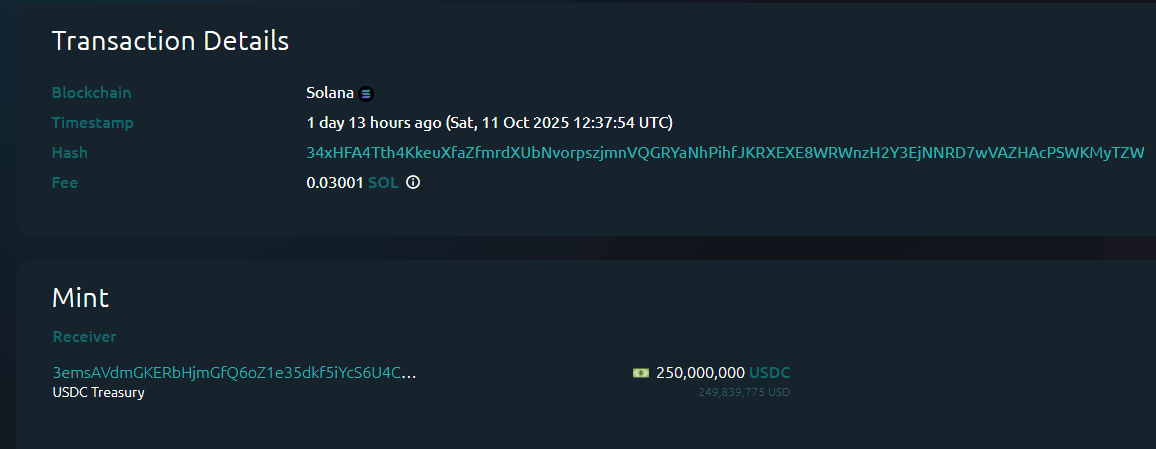

据Whale Alert数据,本周内USDC Treasury总计增发26.5亿枚USDC,Tether Treasury总计增发10亿枚USDT,本周稳定币增发总量为36.5亿枚,较上周稳定币增发总量40.4亿,本周稳定增发总量跌幅约为9.65%。

数据来源:Whale Alert

数据截止至2025年10月12日

二.本周热钱动向

1.本周涨幅前五的VC币和Meme币

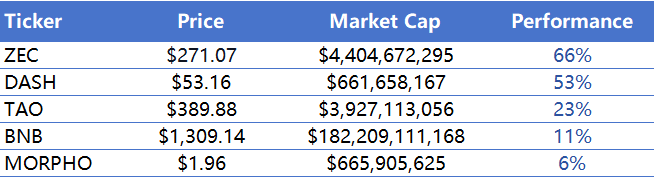

过去一周内涨幅前五的VC币

数据来源:CoinW研究院,coinmarketcap

数据截止至2025年10月12日

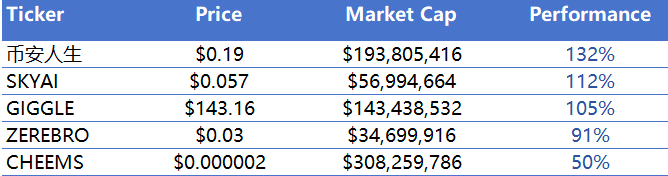

过去一周内涨幅前五的Meme币

数据来源:CoinW研究院,coinmarketcap

数据截止至2025年10月12日

2.新项目洞察

Aborean 是专为 Abstract设计的DeFi协议,旨在提升资金效率。Aborean通过整合流动性提供、治理机制与激励结构,为 Abstract 生态构建灵活而稳健的流动性基础设施。

XSY 是专注于构建数字合成美元 $UTY 的 DeFi 协议,旨在以结构化、可扩展的方式释放区块链生态中沉睡的价值潜力。XSY聚焦于合成资产与稳定币协议 的创新设计,提供更高效的链上流动性与资本利用率。

Punk.auction是建立在以太坊上的去中心化协议,旨在通过自动化机制购买并拍卖 CryptoPunks。其独特之处在于在每次交易过程中都会销毁部分代币供给,从而形成通缩性的经济模型。

三.行业新动态

1.本周行业大事件

专注于将 GitHub 代码库代币化和交易的平台 GitFish V2 已在 Solana 上线。GitFish 支持开源,其表示每个 GitHub 项目都能转换成一个金币,且热门项目启动需要更多金币。

由第九城市(The9 Limited)打造的新世代 Web3.5 游戏平台 The9Bit 推出终极 BitBox 宝箱活动,活动总奖池为 1000 枚 SOL。参与者可通过开启虚拟宝箱获得即时奖励,最高奖项为 900 枚 SOL。此次活动是在前期测试版基础上的升级,旨在完善社区激励机制。老用户将自动获得参与资格,新用户则可通过完成任务获取积分后参与。

YZi Labs孵化计划Easy Residency第二季已于10月6日启动,覆盖Web3、AI和生物科技领域。

2.下周即将发生的大事件

Solana生态流动性协议Meteora表示,不会因为市场变化而推迟 TGE 时间,TGE 仍将按计划在 10 月 23 日进行。

Aster 宣布新的 Aster 第 2 阶段空投查询已上线,用户仍可选择领取空投或全额退还 S2 交易费。领取选项选择截止日期为10 月13日,ASTER 空投开放时间为 10 月 14 日,交易费退款申请开放后,于10月16 日前完成。

AI代理与虚拟影响力平台Fleek将在10 月14日进行 TGE,Fleek被称为AI界的Shopify,支持开发者、创作者及品牌在其平台上构建并变现AI代理及虚拟人。

Intuition将在10月15日进行TGE,Intuition是去中心化身份基础设施,允许用户创建关于任何主题的证明,以易于导航、查询和其他应用程序利用的方式存储信息。

AI驱动的RWA Layer2网络Novastro将在 10 月15日进行 TGE。Novastro.xyz是区块链平台Novastro的线上门户,致力于将股票、大宗商品等现实世界资产进行数字化管理。

3.上周重要投融资

Polymarket 完成 20 亿美元战略融资,最新估值约 90 亿美元,由 Intercontinental Exchange 领投。Polymarket 成立于 2018 年,是去中心化预测市场平台,允许用户基于现实事件进行交易并从预测结果中获利。平台通过交易价格反映市场对未来事件的共识概率,并利用 Chainlink 预言机确保价格结果的可靠性,现已成为全球领先的实时预测与信息市场之一。(2025年10月7日)

Kalshi完成 3 亿美元融资,最新估值约 50 亿美元,由 Andreessen Horowitz、Paradigm、Coinbase Ventures、Sequoia Capital等共同投资。Kalshi 成立于 2019 年,是一家获得美国联邦批准的预测市场平台,允许用户基于现实世界事件交易合约,近期已新增对 Solana 及链上 USDC 的原生支持,并与 Robinhood 合作推出体育赛事预测市场。(2025年10月10日)

Galaxy Digital 完成 4.6亿美元融资,资金主要用于扩展其在数字资产交易、资产管理及投行业务领域的全球布局。Galaxy Digital由 Mike Novogratz 创立,股票代码为 NASDAQ: GLXY,业务涵盖交易、资产管理、主投资务、投资银行与矿业 等板块,致力于为机构及高净值客户提供覆盖全数字资产生态的综合金融解决方案。(2025年10月10日)

四.参考链接

1.Aborean,https://x.com/AboreanFi

2.XSY,https://x.com/xsy_fi

3.Punk.auction,https://x.com/punkdotauction

4.Polymarket,https://x.com/Polymarket

5.Kalshi,https://x.com/Kalshi

6.Galaxy Digital,https://x.com/GalaxyHQ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。