This major crash and liquidation has sparked a public debate.

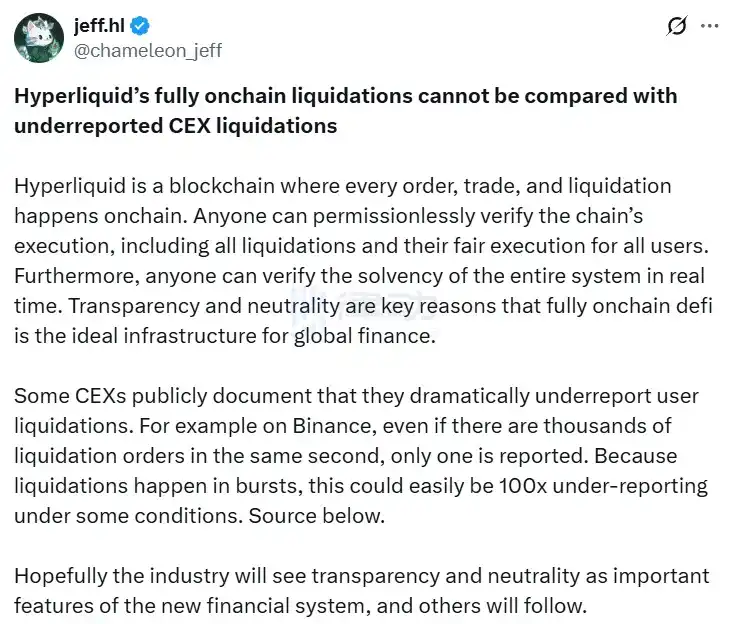

Jeff Yan, the founder of Hyperliquid, directly fired shots on social media: "Some centralized trading platforms publicly state that they severely underreport user liquidation situations. For example, at Binance, even if there are thousands of liquidation orders in the same second, they only report one. Since liquidation is an unexpected event, in some cases, the underreported amount can easily reach 100 times."

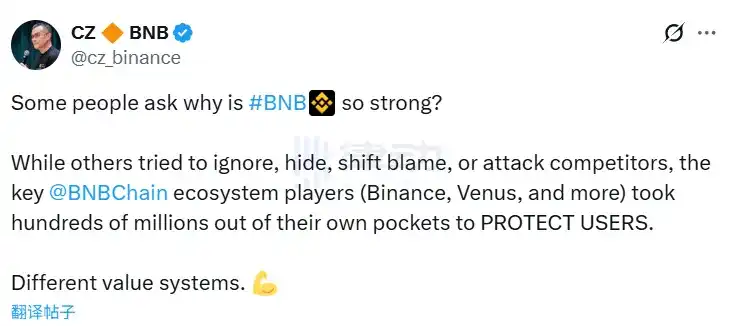

This statement undoubtedly slapped CZ in the face, and soon a response allegedly came from him: "While others try to ignore, hide, shirk responsibility, or attack competitors, key participants in the BSC ecosystem—such as Binance and Venus—have spent hundreds of millions of dollars out of their own pockets to protect users. Different value systems."

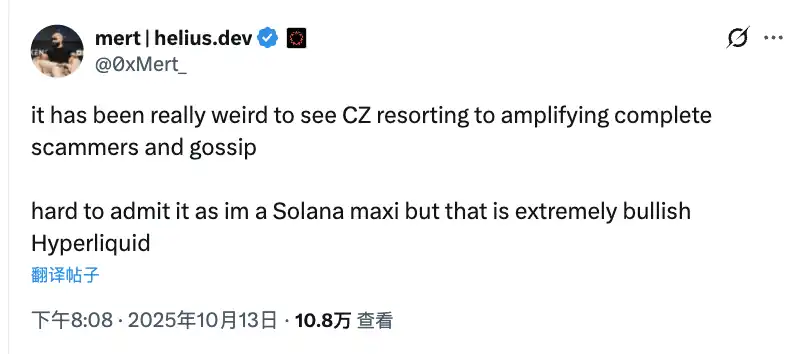

This debate quickly led to a division of sides. DeFi veteran Andre Cronje stood with Binance, while Mert, a core member of the Solana community and CEO of Helius Labs, chose to support Hyperliquid. The entire industry thus split into two camps.

Ultimately, the essence of this matter lies in the fundamental differences in stance between decentralized trading platforms and centralized trading platforms. The most significant reflection of this difference is the ADL mechanism.

If it weren't for this major crash and liquidation, most people might not delve into the differences between Hyperliquid and Binance's ADL. This difference precisely represents two entirely different philosophies in risk management between decentralized and centralized trading platforms.

ADL: The Last Line of Defense

ADL, short for Auto-Deleveraging, is the last line of risk defense for cryptocurrency trading platforms. When the losses from liquidation exceed the capacity of the insurance fund, the trading platform will activate this mechanism to maintain its solvency by forcibly closing profitable positions.

It sounds harsh, but it is a necessary evil. Because if this is not done, the trading platform would go bankrupt, and all users' funds would be at risk.

Hyperliquid's ADL: Rare but Transparent

First, let's look at Hyperliquid's ADL mechanism.

Hyperliquid's ADL system is designed like a multi-layer safety net, only activated when all other mechanisms fail. When a trader's position falls below the maintenance margin requirement—typically 2% to 5% of the nominal value of the position—the system first attempts to match liquidation orders through standard liquidation procedures on the order book. What if the depth of the order book is insufficient to complete the liquidation? Then the position and collateral will be transferred to the Hyperliquid liquidity provider pool, commonly referred to as the HLP treasury.

Only when the value of the HLP treasury or a specific isolated position account turns negative—meaning that the unrealized losses have exceeded all available buffers—will the ADL be truly activated. The specific trigger condition is: insurance fund balance + position margin + total unrealized profit and loss ≤ 0. This mechanism does not have a fixed percentage threshold but is dynamically adjusted based on violations of the maintenance margin. For example, if you are using 2x leverage, you may need to experience a drop of over 50% to trigger the ADL.

Hyperliquid deliberately designs the ADL to be an extremely rare event. The event on October 11, 2025, was the first time in over two years of platform operation that the full liquidation mode of ADL was triggered. Previously, it had only occurred a few times in isolated position mode.

Once the ADL is triggered, the system will queue according to the "maximum whale priority" principle. The ranking formula is: marked price ÷ entry price × nominal position ÷ account value. It sounds a bit complex, but the logic is simple. The ratio of marked price to entry price measures how much percentage you have earned; the higher the ratio, the more you have earned, and the higher your priority for forced liquidation. The ratio of nominal position to account value represents effective leverage; the larger your position relative to your account size, the greater your contribution to system risk, and you will be prioritized.

The entire algorithm considers three factors: unrealized profit and loss (most important), leverage (second), and position size (third). This queue is a dynamic on-chain priority queue, with each asset or perpetual contract having its own independent queue. The queue is updated in real-time based on marked prices and oracle data, approximately every 3 seconds. During execution, the system utilizes the sub-second finality of the HyperBFT consensus mechanism to process in batches. However, it is important to note that because the platform supports cross-asset margining, there may sometimes be unbalanced liquidations, such as only liquidating one side of a hedging strategy.

Compared to centralized trading platforms, Hyperliquid's ADL has several very unique aspects. First is decentralized execution—all steps are automatically run through smart contracts on the Hyperliquid L1 blockchain, without relying on any off-chain engines or human intervention. This brings complete transparency; all liquidation and ADL events can be audited in real-time through a block explorer, leaving no room for black-box operations.

The platform's deep integration with the HLP is also interesting. The profits generated from ADL will flow back to the community treasury, with the platform using 97% of the transaction fees to repurchase HLP and HYPE tokens. To encourage liquidity on the order book, the platform does not charge any fees for liquidations, and the HLP treasury does not selectively engage in only profitable trades, avoiding the so-called "toxic liquidity" problem.

Binance's ADL: Conventional but Opaque

Now let's look at how Binance does it.

Binance's ADL is the last safety valve for its USDT-based futures platform, activated only after the insurance fund is exhausted. The triggering of this mechanism requires several prerequisites: first, the trader's position must reach a bankrupt state, meaning losses exceed the maintenance margin, resulting in a negative account balance; second, liquidation orders must be executed at poor prices, resulting in losses exceeding the margin; finally, the futures insurance fund must be out of money and unable to fully cover this deficit.

Binance has not disclosed any specific trigger threshold percentages; the entire mechanism is dynamic, depending on the specific contract and current market conditions. Essentially, it means that the insurance fund has already hit rock bottom relative to the bankruptcy amount. The platform has set up independent insurance funds for each perpetual contract, funded by transaction fees and surpluses generated during the liquidation process.

Binance uses an ADL score to determine who gets liquidated first. For profitable positions, the ADL score = profit and loss percentage × effective leverage. The profit and loss percentage is unrealized profit and loss ÷ initial margin × 100. Effective leverage is nominal position value ÷ wallet balance. For losing positions, the ranking method is profit and loss percentage ÷ effective leverage, giving these individuals a lower priority. Finally, the user's ADL score ÷ total number of qualifying users yields the final ranking.

For example, if you have a 50% profit with 20x leverage, your ADL score would be 1000 points. This score is much higher than another trader with a 20% profit and 10x leverage, who only has 200 points, so you would be prioritized for liquidation.

Binance provides a five-level light bar system on the trading interface, located just below the position details, allowing you to visually see your ADL risk level. Zero to one green light indicates low risk, placing you in the bottom 80% of the queue, so you basically don't need to worry. Two lights indicate medium risk, ranking between 60%-80%, requiring you to start paying attention. Three yellow lights indicate higher risk, ranking between 40%-60%, suggesting close monitoring.

Four orange lights indicate high risk, ranking between 20%-40%, and you should consider reducing leverage. When all five lights turn red, it indicates the highest risk level, placing you in the top 20% of the queue, meaning you will be among the first to be liquidated in extreme market conditions.

Once ADL is activated, the system will first monitor the bankruptcy situation after liquidation. If it finds that the insurance fund is insufficient, it will activate the queue. Then, it will queue all reverse profitable positions according to ADL scores from high to low. Next, it will forcibly liquidate the highest-ranked position at the bankruptcy price or a better marked price, with the liquidation amount just enough to offset the deficit. This process will continue until the deficit is filled or all positions in the queue are exhausted. In the most extreme case, if the queue is exhausted and the deficit is still not filled, it will result in what is known as socialized losses.

After liquidation, the affected users' profit and loss will be realized, and the insurance fund may receive some surplus. The entire process is executed through a centralized engine, which is very fast, but does not occur on a public order book. Each contract has an independent queue that updates dynamically. The system will automatically exclude positions that are hedged or have too low leverage, and users cannot choose to opt out.

Binance's notification system is quite comprehensive. When ADL occurs, you will immediately receive push notifications on the app, emails, and text messages detailing how much was liquidated, how it affects your profit and loss, and why you were liquidated. Before ADL is triggered, the five-level light bar will give you a warning, and you can also enable push notifications for high-risk rankings in the settings.

After the fact, all ADL events will be recorded in the transaction history, marked as special execution types, and the system will automatically generate customer service tickets for you to raise objections. These notifications are mandatory, and you cannot turn them off.

Key Mechanism Differences Comparison

In terms of execution methods, Hyperliquid uses on-chain smart contracts, completely decentralized; Binance relies on a centralized risk control engine and internal servers. But the bigger difference lies in transparency. All steps of Hyperliquid are verifiable on-chain, and anyone can audit the entire process. Although Binance has disclosed the ranking formula, outsiders cannot see how it is executed, making it a semi-transparent black box.

For instance, during the major crash on October 11, Hyperliquid triggered the ADL, but founder Jeff Yan emphasized that the platform maintained 100% normal operation and zero bad debts, and publicly disclosed all liquidation data. The community regarded this as a model of transparency. Some users stated that while Hyperliquid's ADL mechanism might be "indiscriminate," at least it is honest, unlike centralized trading platforms that may hide information.

In contrast, the "black box" operations of centralized trading platforms have sparked widespread skepticism. During the crash on October 11, some users questioned whether Binance had "non-ADL agreements" with certain large clients, resulting in ordinary users bearing a higher ADL risk. This was seen as a sign of the platform losing its neutrality. Some traders even believed that the order book of centralized trading platforms might be fake, and that the trading platform could use its knowledge of liquidation prices to "harvest" users, then underreport liquidation data through means such as API restrictions.

In terms of ranking algorithms, Hyperliquid uses marked price ÷ entry price × nominal position ÷ account value. Binance uses profit and loss percentage × effective leverage for profitable positions and profit and loss percentage ÷ effective leverage for losing positions.

The structure of the insurance fund is also different. Hyperliquid relies on the HLP community pool, which has about $3.5 billion, along with an independent sub-treasury system. Binance has set up independent insurance funds for each contract, funded by transaction fees, with insurance funds for large contracts like BTC/USDT amounting to several million dollars.

Regarding trigger thresholds, Hyperliquid triggers when account value ≤ 0, which occurs after both standard liquidation and HLP takeover have failed. Binance triggers when the insurance fund cannot cover bankruptcy losses, with no fixed percentage.

In terms of fees, Hyperliquid does not charge for liquidations, aiming to encourage liquidity. Binance charges a 0.015% maker fee and a 0.04% taker fee to replenish the insurance fund. For risk warnings, Hyperliquid's interface displays an ADL risk score, updated in real-time based on on-chain data. Binance provides a five-level light bar that updates according to real-time marked prices.

The possibility of human intervention also differs. Hyperliquid has virtually no human intervention unless there is an emergency governance vote by validators, such as during the JELLY token incident. Although Binance has not publicly acknowledged it, there are allegations that the platform provides special treatment to VIP clients with non-ADL agreements.

Data verifiability is the biggest difference. Hyperliquid is fully auditable, and anyone can verify it through a block explorer and on-chain data. Binance's data can only be disclosed by the platform itself, and external parties cannot independently verify it. In terms of execution speed, Hyperliquid achieves sub-second latency based on the HyperBFT consensus, with a theoretical capacity of 100,000 transactions per second. Binance's centralized engine is typically nearly instantaneous, but may experience delays under high load.

In terms of rarity design, Hyperliquid has made ADL extremely rare; the first full liquidation ADL occurred more than two years after the platform's launch, and it minimizes ADL through position limits and depth linkage. Binance's ADL is a more conventional risk tool, with historical estimates suggesting that less than 0.1% of liquidations lead to ADL.

Ultimately, this represents two completely different philosophies. Hyperliquid opts for structural transparency—enforced transparency through technical architecture, making it impossible for anyone to commit fraud. Binance prioritizes efficiency—trading speed is exchanged for centralization, but at the cost of having to trust that the platform will not act maliciously.

In normal times, these differences may not be very apparent. However, in extreme market conditions like those on October 11, the differences are magnified infinitely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。