🧐 #Binance HODLer Airdrop Project 43 – Hemi (HEMI) @hemi_xyz Investment Mining and Price Analysis——

Recently, some lazy HODLer airdrop research projects have been delayed, and I've been urged to update them twice. Let's continue updating today:

After the HODLer airdrop, I didn't pay much attention to Hemi's information, but recently I took some time to look at the entire project and found a bit of a "Bitcoin programmable layer finally landing" feeling:

Although BTCFi has faced many challenges along the way, and people are not buying into it, Hemi is not just wrapping another layer of wBTC; instead, it integrates a complete BTC node into the EVM (hVM) and pairs it with a PoP (Proof-of-Proof) to anchor security to the Bitcoin main chain.

This is quite interesting! Below are the key points and my own trading observations for reference.

1️⃣ Project Positioning: Infrastructure for BTC to Become "Active Capital":

hVM: EVM contracts can directly read BTC block headers, UTXOs, transactions, and other states → Truly native BTC programmable, no bridges or oracles needed.

PoP Consensus: Hemi's blocks are "etched" into the Bitcoin timeline, achieving near BTC-level "super finality" after 9 PoP confirmations.

Tunnel: A cross-domain asset channel for "proof" (non-traditional bridge), allowing for bidirectional verifiable transfers between BTC/ETH and Hemi.

·······

Progress: Since the mainnet launch, TVL is approximately $1.2B, with over 70 protocols integrated, and daily user and developer data is on the rise (suitable as a traffic entry point for BTCFi).

In a nutshell: Hemi aims to transform BTC from "gold bars in a vault" into "collateral & yield-generating assets that can be called upon."

2️⃣ Why It Might "Break Out"

1) Truly Native BTC:

hVM makes BTC a "first-class citizen," allowing contracts to directly perceive BTC states → Lending, collateral, yield, and DAOs can all be done natively.

2) Security Narrative:

PoP lends finality to the application layer, satisfying institutional preferences for "verifiability" (treasury/market-making/custodial funds will care about this).

3) Ecosystem Paving:

Sushi, LayerZero, Pyth, Redstone, Swell, Safe, Gearbox, Spectra, Zerolend, River, etc., are already on the way or have been integrated.

4) BTC Staking Track:

The grand trend of "BTC as a yield-generating asset" resonates with the heat of re-staking/AVS.

3️⃣ Risks and Observation Checklist

Technical Realization: Milestones such as BitVM2 Tunnel, hVM's ZK provability, multi-client support, and decentralized publishers need to be advanced on schedule.

Release and Inflation: 9.78% initial circulation + 3%–7% annual issuance + ecosystem incentives, pay attention to unlocking rhythm and selling pressure windows.

Compliance and Security: Operation and maintenance of cross-domain channels, PoP participation, contract and risk control frameworks.

Competitive Pressure: Displacement effects from other BTC L2s, bridge alternatives, and on-chain BTC staking/yield solutions.

Signals I will monitor:

The launch rhythm of Tunnel v1 / hVM provability;

Actual yield/scale of native BTC staking products;

Whether institutional users (market-making, custody, treasury) enter the market;

Increase in the "real BTC proportion" within the TVL structure, rather than just EVM asset circulation.

4️⃣ Token and Economic Model:

Total Supply: 10 billion tokens

Circulating Supply: 977,500,000 (9.78%)

Inflation: Annualized 3%–7% (adjusted by phase)

Uses: Gas, PoP security aggregation payments, veHEMI staking (governance, ranking, DA/state publishing, hBitVM tunnel, providing economic security for dApps, etc.).

Less than 10% circulating, under the narrative + TVL endorsement, the chip structure leans towards "controlled"; however, there is gradual inflation and ecosystem incentive releases to watch for on the timeline.

5️⃣ Market and Price Strategy (personal rhythm, not advice)

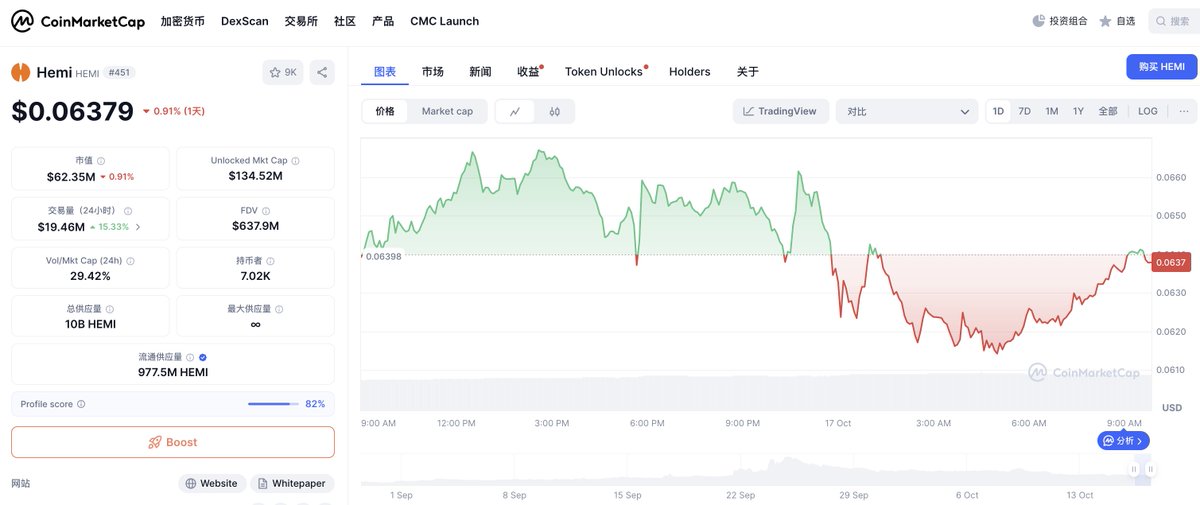

Current Observation (based on CMC screenshot):

Price around $0.063–0.064, showing a "high pullback → sideways weak rebound" rhythm over the past two weeks;

Market cap $62M, FDV $635M, circulating ~9.8% (977.5M), 24h trading ~$19M, turnover ~29%, not cold.

Mid-term (1–3 months)

The narrative remains BTCFi + native BTC programmability; if PoP/tunnel/ecosystem integration continues to land, it could easily provide a reason for "re-pricing" the valuation;

However, FDV is relatively high + the release curve needs to be respected (HODLers still have quotas, annual inflation of 3–7%).

My approach is: follow the data—TVL, active wallets, number of ecosystem protocols weekly increase & major milestones (Tunnel v1, hVM provability, partnership launches) before increasing holdings; otherwise, maintain a flexible position for trading.

Long-term (1–3 quarters)

Foundational Logic: Transform BTC from "passive store of value" to "programmable yield-generating asset." If this path is validated by the market, HEMI has the opportunity to capture "infrastructure premium" in the BTCFi track.

Reverse Risks: Competitive pressure in the track (other BTC L2s/sidechains), slow progress on technical challenges, and continuous dilution of valuation from unlocking/inflation.

Long-term positions will only be placed after a fundamental turning point appears (e.g., tunnel mainnet stabilization, non-custodial BTC staking running smoothly, significant improvement in TVL/user retention of leading protocols).

6️⃣ One-sentence Summary:

Hemi is working on "Ethereum-izing Bitcoin" without sacrificing Bitcoin's authenticity and finality.

If this path is successful, HEMI's value will come from the scale of "BTC truly being called upon," rather than from the emotional peaks of a single narrative.

However, the current track is quiet, requiring more observation and patience!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。