Written by: Xiao Za Legal Team

In September, a well-known foreign media outlet released a significant piece of news: China's Securities Regulatory Commission has requested some Chinese brokers operating in Hong Kong to suspend their RWA business. Subsequently, this news was endorsed by several prominent media outlets in China: the mainland's Securities Regulatory Commission conveyed the message to at least two Chinese brokers to suspend RWA business through window guidance, but no written instructions were issued.

This news undoubtedly poured cold water on the RWA, which has gained popularity since 2025: suspending the business not only contradicts the vision outlined in Hong Kong's "Digital Asset Declaration 2.0" released this year but may also indicate a divergence in the development path and trends of RWA and the entire crypto asset sector between the financial regulatory agencies of the mainland and Hong Kong.

In the spirit of caution, the Xiao Za team, based on recent information gathering, would like to discuss what the so-called "suspension of RWA business" entails and the potential impacts that may follow.

01 Is the RWA Suspension Incident Credible?

First, it is essential to clarify that, to date, there has been no official confirmation from any channels or brokers regarding the "RWA suspension" incident. Therefore, any rational person should approach this issue with skepticism.

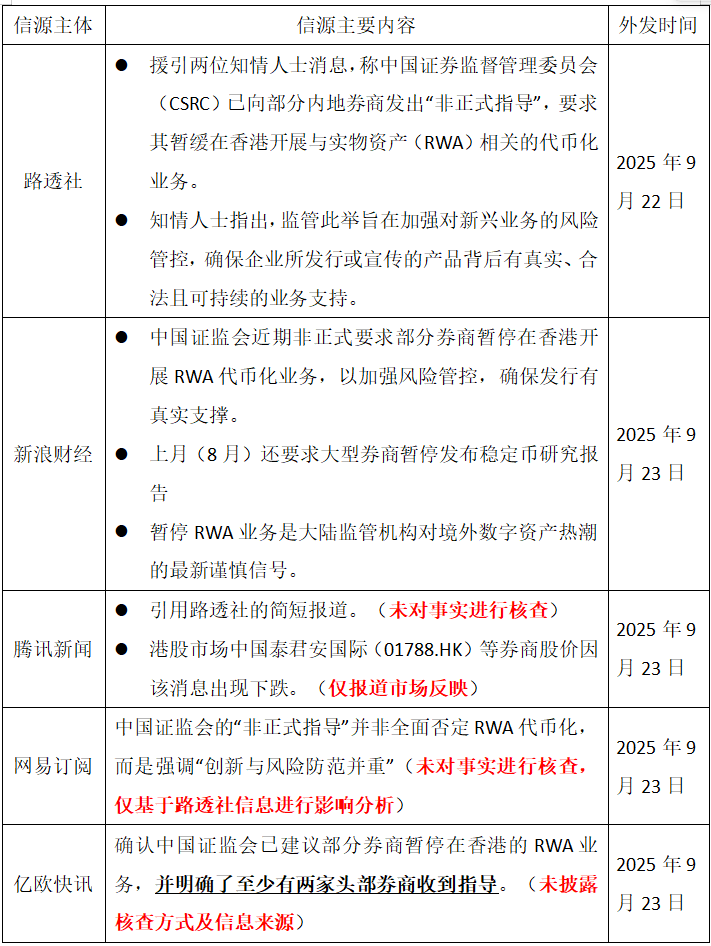

We have summarized the main sources of this information as follows:

Based on the Xiao Za team's recent practical experience, the relevant information may not be unfounded. Compared to Hong Kong's open attitude towards crypto assets and its vision of building a crypto financial center, the regulatory agencies in mainland China are indeed more "cautious" regarding crypto assets (a few years ago, the Xiao Za team might have described it as "passive"). Therefore, in the current context of insufficient practical experience with RWA, inadequate risk identification, and a more emotionally driven market, it is not surprising to hit the brakes.

Additionally, it should be noted that the so-called "suspension of RWA" cannot be entirely blamed on the mainland's financial regulatory agencies. Have the Hong Kong Monetary Authority and Securities and Futures Commission been fully confident in practicing RWA? If we look beyond the surface, it is evident that Hong Kong's financial regulatory agencies, despite the grand rhetoric in the "Digital Asset Declaration" 1.0 and 2.0, harbor a cautious heart. Since certain charging pile projects and photovoltaic projects publicly entered sandbox issuance testing as RWA benchmarks nearly a year ago, no "carp" has jumped over this seemingly low "dragon gate." Instead, a large number of private and semi-private RWA projects have emerged in the market under the banners of "asset on-chain" and "overseas issuance."

It can be seen that at least on the point of "RWA should be cautiously increased and tested over the long term," the financial regulators in mainland China and Hong Kong have already reached a consensus. Even if the "suspension of RWA" news is true, it is by no means a whim of the mainland regulatory agencies.

02 What Legal Issues Are Currently Difficult to Resolve Regarding RWA?

The Xiao Za team has found in practice that there are still many issues that need to be resolved regarding RWA, and these issues are likely to be significant reasons why regulatory agencies remain cautious about this emerging phenomenon.

(1) Cross-Border Fund Obstacles

Currently, the vast majority of RWA projects intended for issuance and testing in Hong Kong use underlying assets that are not located in Hong Kong. A considerable portion of these assets is physically located in the mainland. Moreover, the project companies (limited liability companies or special purpose trusts as SPVs) that serve as the "keys" to these assets are also legally registered entities in China.

To comply with regulations for issuing RWA projects in Hong Kong, the mainstream approach is to establish another SPV in Hong Kong or other offshore countries (such as the Cayman Islands or BVI, which are common offshore financial centers) as the actual issuer of the RWA.

This dual-layer structure is a common practice in traditional capital markets, but for a special financial project like RWA, there are two legal issues that are difficult to resolve:

(1) How can the issuer legally bring funds raised from overseas token investors into the mainland?

(2) How can the issuer separate investment returns from the project and legally deliver them to token investors?

The plan for cross-border fund flow is crucial. If not properly addressed, RWA projects cannot become market-oriented, popular, and scalable financial investment products, nor can they be recognized by regulators. The Xiao Za team has discussed the legal compliance, practical feasibility, and landing costs of two potential paths with several well-known domestic companies when handling RWA business:

The first option: Use the QFLP channel. In simple terms, this plan allows the overseas RWA issuer SPV to become a compliant overseas investment entity, applying for a QFLP license (Qualified Foreign Limited Partners) from the financial regulatory authority where the underlying assets are located, thereby legally bringing the raised overseas funds back to mainland China.

Compared to the traditional FDI model, QFLP allows overseas funds to be converted and invested in domestic private equity funds, and the funds can also be used for targeted issuance and other investments. Additionally, according to the "Opinions on Further Optimizing the Foreign Investment Environment and Increasing Efforts to Attract Foreign Investment" (Document No. 11) released by the State Council in 2023, QFLP has advantages in foreign exchange management facilitation, and the overall policy in China supports compliant entities to directly invest in the mainland with RMB raised overseas.

However, this option faces several practical issues.

First, there is currently no nationwide unified law or guiding document for the QFLP license. It mainly relies on local pilot policies and relevant foreign exchange management and fund regulatory provisions, which means that the issuing entity must extensively research and compare specific policies and requirements in various regions while balancing returns and compliance costs (especially regarding data outflow) to successfully implement the project.

Second, the QFLP license involves foreign exchange control and requires coordination among relevant departments such as the foreign exchange bureau, industry and commerce regulatory authorities, development and reform commissions, commerce departments, and tax bureaus, with varying entry thresholds and approval efficiencies across regions.

Third, given the cautious attitude of mainland regulatory agencies towards crypto assets and the objective situation that RWA has not yet been fully rolled out, there is considerable uncertainty regarding whether the SPV raising funds through RWA projects can successfully obtain a QFLP license.

The second option: Obtain ODI approval/filing. ODI refers to Overseas Direct Investment approval/filing, which is generally a license that mainland Chinese enterprises need to obtain when directly or indirectly investing in overseas projects or companies, commonly seen in situations such as setting up factories, mergers and acquisitions, capital increases, and overseas listings. In RWA projects, this means that the rights holders of the underlying assets or project companies (SPVs) in the mainland directly obtain ODI approval/filing and then establish SPVs in Hong Kong or other overseas countries to issue RWA. The advantage of this option is that it can better address the issue of cross-border fund flow.

However, this option also has certain limitations. The compliance costs for ODI are extremely high, requiring approval from departments such as commerce, development and reform commissions, and foreign exchange bureaus (banks) to obtain. During the review process, the domestic entity must explain the investment purpose, the authenticity and compliance of the specific investment project, and the necessity of the investment, all of which are key points in the ODI review. Given the attitude of mainland regulatory agencies towards RWA, the success rate of applying for ODI for the purpose of "issuing RWA" may not be high.

(2) Uncertainty in Judicial Protection

Since the projects used for issuing RWA are actually located in the mainland, overseas investors also have concerns regarding judicial remedies for breaches of contract by the project parties.

Currently, in China's judicial practice, there is a general attitude of "legal actions are invalid, risks are borne by the parties" regarding transactions and investments involving crypto assets, and the protection of investors' rights is not sufficient. Recently, some overseas investors discussed this issue with the Xiao Za team, but we could not provide a clear answer, as there are too few reference samples available (strictly speaking, only the charging pile and photovoltaic projects), and the market has not yet developed to the stage of resolving disputes over breaches of contract by project parties.

Therefore, many overseas investors, based on the uncertainty of judicial protection, may hesitate to invest real money, even if the underlying assets are indeed high-quality.

In Conclusion

Overall, the Xiao Za team believes that a suspension does not equate to a ban but rather represents an orderly advancement. Regardless of the truth of the news, the attitudes of mainland China and Hong Kong towards RWA are relatively consistent: RWA pilots must be gradually rolled out only after ensuring proper risk identification and effective regulatory testing. Therefore, partners need not be overly pessimistic; orderly advancement is certainly better than being abruptly stifled after wild growth.

This concludes today's sharing. Thank you to the readers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。