SEC Will Approve Grayscale Spot XRP ETF Tomorrow Amid Shutdown Delays?

The crypto community is looking forward to October 19, 2025, when it is speculated that the SEC will approve the Grayscale spot XRP ETF, which would change its future in the cryptocurrency market.

SEC Approval of Grayscale Spot XRP ETF Tomorrow.

-

The crypto market is humming with speculation as it is expected that the U.S. Securities and Exchange Commission (SEC) might grant Grayscale the much-anticipated spot XRP exchange-traded fund on October 19, 2025.

-

The XRP Trust, the first investment vehicle to be launched by Grayscale, was already noted in September 2024 as one of the few investment vehicles that provide exposure in a security form.

-

The Trust also allows investors to use traditional brokerage accounts, in contrast to the direct purchase and storage of XRP, where one has to navigate through wallets and keys.

-

Grayscale is currently working to turn the Trust into a spot XRP ETF, a decision that would be a historic milestone for the native token of Ripple.

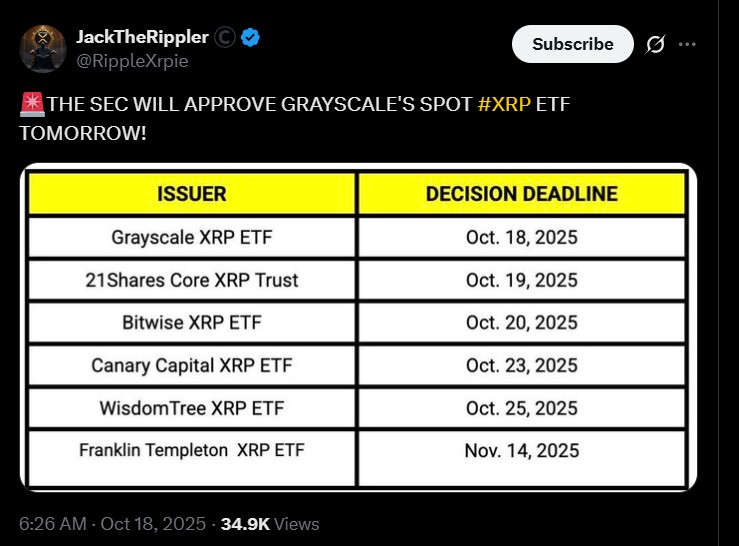

Source: jacktherippler X

The US Government Shutdown Factor

However, there's a twist. On October 1, the U.S. government was partially shut down , and this has affected federal agencies, including the SEC. Since there are few staff members and operations, there has been uncertainty in the approval of several ETFs.

The formal date of the Grayscale ETF is October 18, which leaves questions as to whether the SEC can or will determine the shutdown, particularly during a weekend. This uncertainty is portrayed in community reactions.

Source: X

Although there are those who think that the new leadership of the SEC will help in fast-tracking the approval of crypto-based ETFs, others do not agree.

It has been noted that regulatory announcements are not common on weekends, and any delays will push the schedule further into late October or November when other filings by Bitwise, WisdomTree, 21Shares, and CoinShares are due.

What's at Stake for XRP

The possible acceptance of a spot ETF would potentially have a big impact on the token and the crypto market in general. A spot ETF would enable institutional and retail investors to have direct exposure to the market price of XRP, which could unlock billions of regulated inflows of capital, unlike futures-based products.

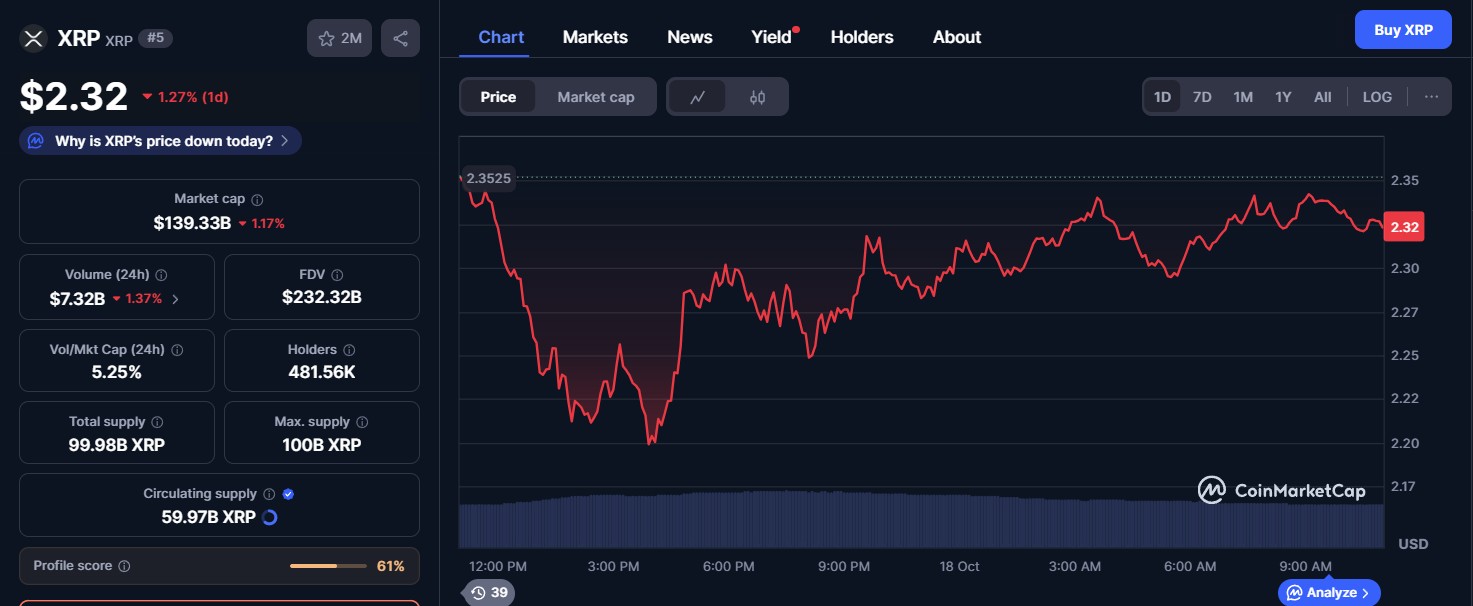

Currently, XRP price today stands at $2.32, down by 1.34% with trading volume $7.31 billion and market cap $139.16 billion.

Source: CMC

Market anticipations indicate that there are a lot of XRP price predictions in case of approval:

-

An immediate short-term rally and the price are likely to increase within weeks to reach between $3.50 and $4.20.

-

The mid-term projections go further, and it is projected that the price will increase to $5.50-$7.00 in the coming year, as liquidity and investor confidence will increase.

-

Even in the long-term scenarios, price will go beyond $8-$10, as long as Ripple keeps expanding its enterprise base and the ETF market takes off.

Ripple has recently acquired GTreasury, one of the most successful treasury management companies. The relocation puts Ripple in a position to access the multi-trillion-dollar corporate treasury market, and it further solidifies its core as regulatory clarity starts to form.

Source: X

A Groundbreaking Crypto ETFs Moment.

Should the SEC approve the Grayscale application tomorrow, it will not only be the first ETF approval, but it will also be a new dawn of crypto ETFs beyond Bitcoin and Ethereum. It would indicate the increased awareness of regulators of alternative digital assets, which would allow more institutions to adopt them.

Nevertheless, one should be cautious. The continuous closure and regulatory stranglehold may put announcements on hold, triggering the market into suspense.

Conclusion

Regardless of whether the SEC gives approval tomorrow or postpones the move because of the shutdown, the fact that investors are excited about the increasing role in regulated markets and how it will grow over time is clear.

All eyes are on Washington--and Grayscale--so far as the clock runs out to October 19.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。