I. Introduction

In the early hours of October 11, the cryptocurrency market experienced a "night of terror." In just an hour and a half, mainstream coins like Bitcoin plummeted by double digits, altcoins crashed, and the total liquidation amount reached a staggering $19.3 billion within 24 hours, setting a record for the largest single-day liquidation in crypto history.

Amid the seemingly prosperous bull market cycle, countless high-leverage positions, circular borrowing, and derivatives created a bubble that laid the groundwork for disaster. A single macro black swan event was enough to trigger systemic risk. When prices collapsed, leverage triggered a chain reaction of liquidations, and liquidity evaporated in an instant. What we witnessed was not only a panic-induced chain reaction but also the "life-and-death test" of the liquidation system under extreme pressure.

What caused the "October 11 flash crash"? What risks and hidden dangers were exposed behind it? What impact and insights did it bring to the market? This article will deeply analyze the background and reasons for this crash, the transmission mechanism, the USDe decoupling incident, impact assessment, and provide predictions and outlook for the market after the fourth quarter of 2025.

II. Background and Reasons for the Crash

1. Trigger of the Crash: Macro Black Swan Strikes the Market

The direct trigger for this crash came from a macro-level black swan event—U.S. President Trump unexpectedly announced a 100% new tariff on Chinese goods. On the evening of October 10, Trump took to social media to threaten a new round of tariff policies, escalating the trade tensions between China and the U.S. This news sharply heightened global investors' risk aversion, with capital flocking to safe assets like the U.S. dollar and U.S. Treasury bonds. The announcement came after the Friday market close, and with traditional stock markets already closed, cryptocurrencies, as high-risk assets, were the first to be sold off.

Emotional factors also cannot be ignored. Concerns about a global economic slowdown and escalating trade wars further deteriorated already fragile investor confidence. Panic often reinforces itself, creating a cycle of selling—decline—further selling. Additionally, the news broke late on Friday (Saturday morning in Asia), which was extremely unfavorable: most institutional traders in both Europe and the U.S. had already left their posts or reduced their positions for the weekend. The combination of a lack of liquidity and sudden negative news set the stage for the subsequent flash crash.

2. Leverage Bubble: The Domino Effect Beneath False Prosperity

Trump's tariff threat was merely the surface trigger, while the deeper reason for the market collapse lay in the high-leverage bubble and hidden risk accumulation that had built up over the past few months.

In the second half of 2025, Bitcoin, Ethereum, and other mainstream coins repeatedly hit new highs, creating an illusion of prosperity. However, analysis shows that a significant portion of the incremental funds was not from long-term spot buying but rather from speculative capital accumulated through contract leverage, circular borrowing, and liquidity mining. In the bullish atmosphere, traders generally increased their leverage bets on rising prices, leading to a rapid increase in the risk of positions held by many crypto hedge funds and institutional investors. As prices continued to rise, the actual leverage ratio in the market increased, masked by the illusion of prosperity.

When negative news hit, this leveraged prosperity backfired on the market: the first wave of declines triggered by the news directly impacted high-leverage long positions, with many leveraged long positions hitting their liquidation lines and being forcibly sold off. These forced liquidations further depressed prices, leading to more long positions being liquidated, creating a snowball effect where hidden high-leverage longs fell like dominoes, ultimately evolving into an avalanche-like chain reaction.

3. Market Structural Defects: Weak Liquidity and Market Maker Exit

This flash crash exposed structural defects in the liquidity supply of the crypto market: market makers were unable to cover extreme scenarios, and there was a severe lack of liquidity for tail assets. When the shock hit, these weaknesses caused the prices of certain assets to plummet almost freely.

The main liquidity providers in the current crypto market are some active market makers (MM). They tend to allocate most of their funds to market making for mainstream assets (like BTC and ETH) while providing limited liquidity support for mid- to long-tail altcoins. Under normal market conditions, funds can cover daily trading fluctuations, but in extreme conditions, they are unable to provide a safety net. Moreover, a large number of new projects have emerged this year, leading to a surge in the number of small coins, but the funds and energy of market makers have not increased proportionately, resulting in the market's liquidity support for small coins being already overloaded. In other words, the market depth for tail assets is extremely weak.

Source: https://x.com/yq_acc/status/1977838432169938955

During the October 11 crash, when macro negative news ignited panic, market makers prioritized ensuring liquidity for mainstream coins, urgently reallocating funds originally designated for small coins to stabilize large-cap assets like BTC and ETH. As a result, the small coin market instantly lost its main counterparties, and the selling pressure came crashing down with no buyers to absorb it, leading to a near-freefall price drop. Multiple coins plummeted by 80-95% in an instant, with the Internet of Things token IOTX nearly crashing to zero, and TUT and DEXE even showing a 99% drop, losing all buy support at one point. This serves as a warning to traders: the normal spreads and trading depth can evaporate in a storm, and the tail risks that are often overlooked can tear the market apart during a crisis.

III. Analysis of the Market Flash Crash Transmission Mechanism

When the market began to rapidly decline in the early hours of October 11, the microstructural issues within the crypto market further amplified the downward trend. The chain liquidations triggered by the initial decline, combined with the exhaustion of liquidity supply, constituted the main transmission mechanism of the flash crash.

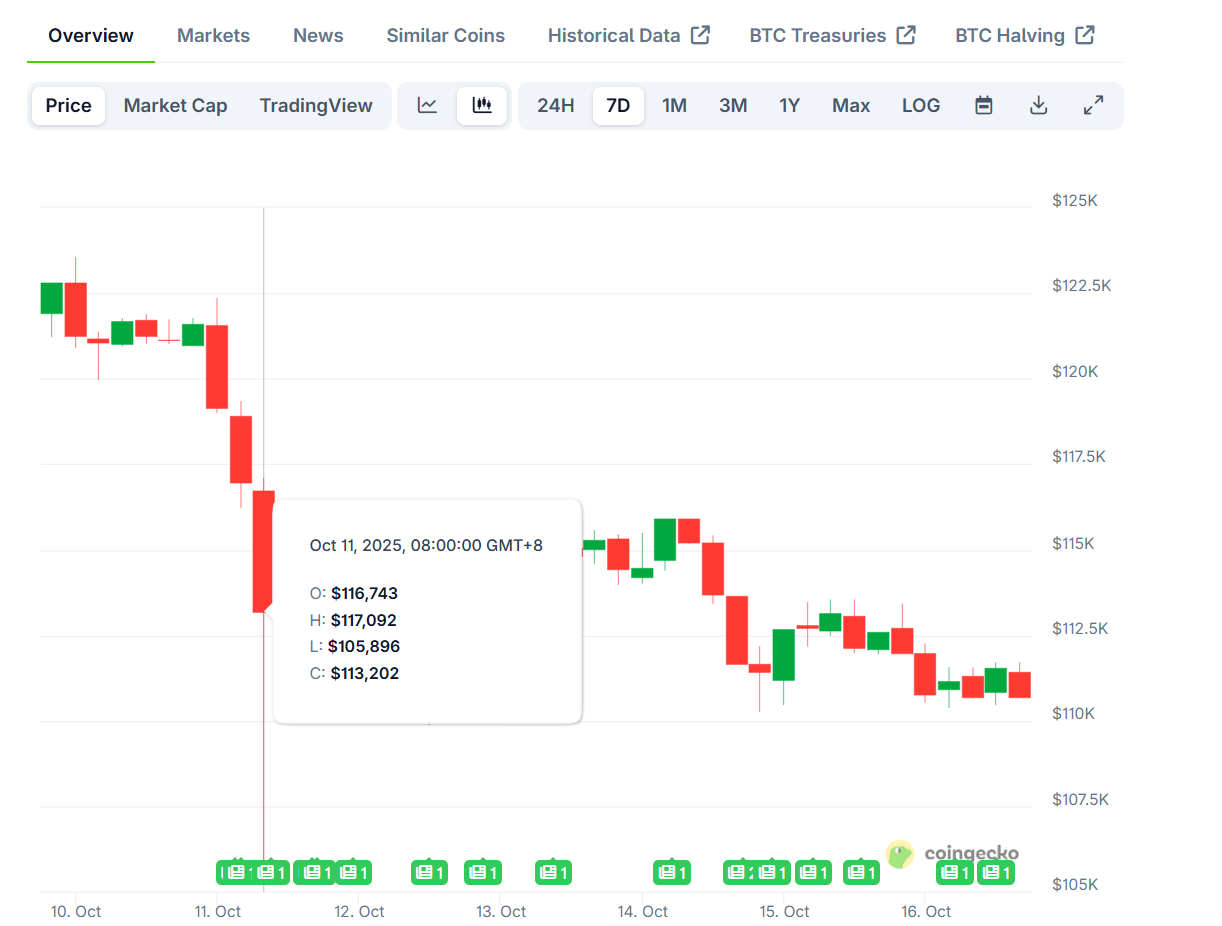

Source: https://www.coingecko.com/en/coins/bitcoin

Phase One (around 5:00 AM): Influenced by the tariff news, Bitcoin began to decline from around $119,000. During this phase, trading volume increased but remained within normal ranges, and the market was still operating in an orderly manner, with market makers maintaining normal bid-ask spreads. Mainstream coins slowly declined, and some highly leveraged longs began to liquidate, but the impact was relatively limited.

Phase Two (around 5:20 AM): About 20 minutes later, the market suddenly experienced a waterfall of liquidations. The decline in the altcoin sector accelerated sharply, with many mid- to small-cap coins crashing within minutes, triggering a new wave of forced liquidations. Observations noted that the total market trading volume surged to ten times its usual level. More dangerously, major market makers appeared to begin rapidly withdrawing orders for self-preservation, causing many trading pairs to lose buy support in an instant. During this phase, market liquidity significantly contracted, and selling pressure began to go unabsorbed.

Phase Three (around 5:43 AM): Approximately 23 minutes after the first wave of liquidations, a more dramatic decoupling crash occurred on Binance. Three specific assets on the Binance exchange—USDe, WBETH, and BNSOL—experienced price crashes almost simultaneously:

The price of the USDe stablecoin plummeted from $1 to about $0.6567, a drop of 34%. Meanwhile, on other trading platforms, USDe remained above $0.90 and did not experience such an extreme decoupling.

The price of WBETH (Binance's staked Ethereum) saw a cliff-like drop, plummeting 88.7% from a price equivalent to about $3,800 to just around $430.

BNSOL (Binance's SOL token) also faced a crash, dropping 82.5% from a normal price of about $200 to a low of $34.9.

This scene marked a complete collapse of market structure, with buyer liquidity on Binance nearing exhaustion, the price discovery mechanism failing, and even stablecoins and pegged assets suffering severe sell-offs.

Final Phase (around 6:30 AM): As major assets decoupled and market makers fully exited, the market fell into a state of disorder around 6:30 AM. Prices fluctuated wildly in panic, and the total forced liquidation amount surged dramatically. By 9 AM, the total liquidation scale over 24 hours had exceeded $19.2 billion, with approximately 1.64 million positions being forcibly liquidated. Among them, the largest single liquidation loss exceeded $200 million. The entire crash process, from the triggering of the news to the market losing control, took only about an hour and a half.

IV. The USDe Decoupling Incident

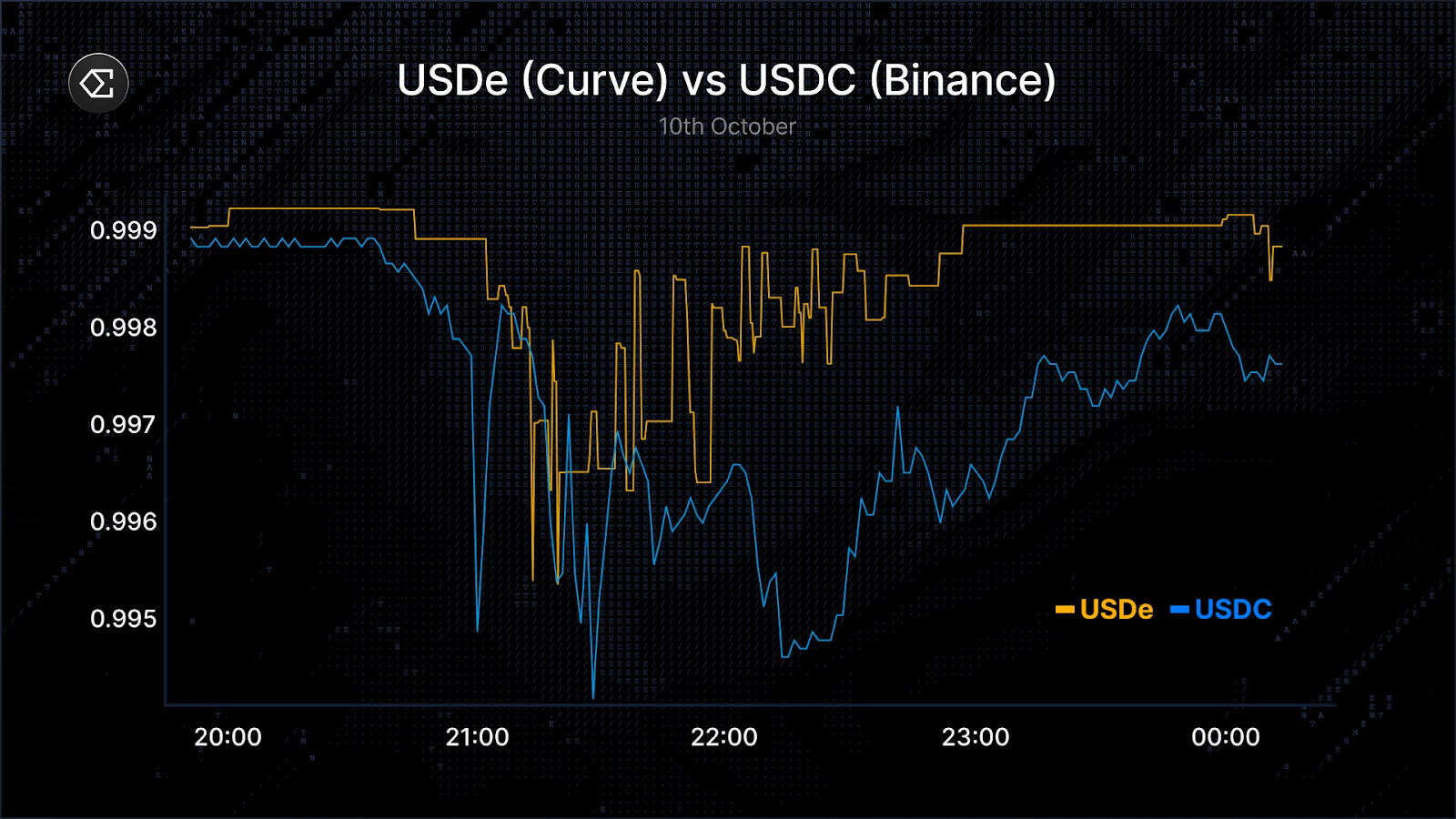

An intriguing subplot of this flash crash was the "decoupling" incident involving the new synthetic dollar stablecoin USDe. However, this significant deviation of USDe was not a typical systemic failure of stablecoins but rather a price misalignment caused by localized liquidity exhaustion on the exchange.

USDe is a synthetic dollar asset launched by Ethena, which maintains a 1:1 peg to the U.S. dollar through a cash and perpetual contract delta-neutral strategy for hedging arbitrage (i.e., "spot long + perpetual short" strategy). It is essentially an over-collateralized stablecoin: users need to provide sufficient collateral to mint USDe, and the protocol hedges price fluctuations by holding spot and shorting futures. Under normal circumstances, USDe can be stably exchanged in on-chain liquidity pools (such as Curve, Uniswap) and supports minting and redemption mechanisms to ensure price anchoring. Prior to the crash, the circulating supply of USDe was approximately $9 billion, and it maintained an over-collateralized state.

During the market's severe turbulence, the USDe/USDT trading pair on Binance experienced an abnormal crash, with the USDe price briefly dropping to about $0.6567. However, almost simultaneously, USDe remained stable on other major trading venues (including decentralized trading pools like Curve and another major exchange, Bybit): the price difference of USDe against other stablecoins in the Curve pool was less than 1%, and on Bybit, USDe only dipped to around $0.92. Clearly, this was not a loss of peg by the USDe protocol itself, but rather a localized phenomenon on the Binance platform.

Source: https://x.com/gdog97_/

The reasons for the sharp drop in the price of USDe on Binance can be summarized in two main points:

Liquidity Shortage and Infrastructure Defects: Binance is not the main trading market for USDe, and its liquidity for USDe is only in the tens of millions of dollars, much shallower compared to platforms like Curve, which have liquidity pools exceeding $100 million. Under normal circumstances, professional market makers can arbitrage between platforms through the minting/redemption mechanism of USDe to ensure price consistency. However, at that time, Binance had not established a direct redemption channel with the Ethena team, and there were temporary obstacles to deposits and withdrawals on Binance during the extreme market conditions. As a result, when Binance's own infrastructure was overwhelmed during the crash, the market price deviated and could not be corrected in a timely manner through external liquidity, leading to the rapid exhaustion of buy orders for USDe on Binance, causing the price to break through its pegged value.

Risk Control and Oracle Design Issues: Binance uses a unified margin account system where different assets share a common margin pool. When the price of USDe plummeted, many accounts using USDe as collateral were instantly liquidated, further exacerbating the selling pressure on USDe and creating a vicious cycle. Additionally, Binance's risk control for USDe's price relied on its own shallow order book prices as oracle prices, rather than referencing external deep market prices like those on Curve. This led to a sharp drop in the marked price of USDe on Binance, triggering automatic deleveraging and a chain of liquidations, further amplifying the price decline.

High Leverage Risk from USDe Circular Lending: Furthermore, Binance offered high-yield financial products for USDe (12% annualized), encouraging users to engage in circular arbitrage, which concealed leverage exposure of up to 10 times. Many traders also used USDe as general collateral, leading to a high concentration of collateral.

In summary, the drastic fluctuations of USDe on Binance were merely an illusion of "decoupling." In fact, throughout the turmoil, the USDe protocol maintained a good over-collateralized state, and the redemption mechanism operated normally. When the price of USDe crashed on Binance, market participants quickly reduced the supply of USDe from about $9 billion to $6 billion through redemptions, with no deadlocks or runs occurring during the process.

This incident also served as a wake-up call for both exchanges and stablecoin issuers: the balance between transparency and security is crucial. On one hand, Ethena provided transparent data and public mechanisms for USDe, ensuring market confidence; on the other hand, exchanges need to improve their risk control models, especially for assets that are not their main trading markets, by adopting more robust oracle sources or limiting unreasonable liquidations during extreme market conditions. In response, Binance quickly patched the loopholes: the pricing mechanism updates for WBETH and BNSOL, originally set to take effect on October 14, were completed ahead of schedule on October 11, and nearly $400 million in losses were compensated to affected users regarding the USDe incident. These measures somewhat alleviated market skepticism but also highlighted the vulnerabilities of centralized platforms during extreme market conditions. In contrast, decentralized platforms like Curve provided deeper liquidity, and protocols like Aave operated smoothly with automatic liquidation mechanisms, demonstrating the resilience of DeFi in coping with extreme volatility.

V. Impact Assessment: Aftershocks, Damages, and Opportunities for Change

Such a drastic market movement, while some effects may take weeks to fully digest, has already shown some widespread impacts on the industry:

1. Confidence in Altcoins Shaken: This event created "big winners" and "big losers." For investors, funds, and even market makers who suffered significant losses, their confidence is bound to be shaken in the short term. Some crypto hedge funds may face liquidation or severe losses. Arthur, the founder of DeFiance Capital, revealed that although their fund incurred losses, it "did not rank among the top five most volatile days in history," which is still manageable. He also stated that this crash significantly set back the entire crypto space, particularly impacting the altcoin market, as the price discovery of most altcoins relies on offshore centralized exchanges. This may prompt some professional funds to reduce their exposure to altcoins and shift towards more reliable investment targets, leading to a prolonged period of stagnation in the altcoin sector, with pessimistic sentiments like "the altcoin season may not return" beginning to circulate.

2. Response and Improvement of Trading Platforms: This incident has caused a certain impact on the reputation of exchanges, especially Binance, and forced the platform to reflect and improve.

Compensating User Losses: In addition to compensating user losses, Binance quickly completed the switch to the WBETH/BNSOL pricing system to avoid similar anchoring price gap vulnerabilities.

Expanding Insurance Funds: Exchanges like Binance may accelerate plans to expand the scale of their insurance funds to better cope with extreme market volatility. Hyperliquid has also announced that it will inject a portion of its daily revenue into a larger insurance pool to enhance the platform's risk resistance.

Adjusting Mechanism Defects: At the same time, Binance may reassess its unified margin model and oracle mechanisms to prevent similar USDe mispricing from triggering chain liquidations in the future.

Introducing Circuit Breaker Mechanisms: When prices plummet beyond a certain percentage in a short time, temporarily halting trading to allow liquidity to recover. This is already standard in traditional finance, and the crypto industry may need to learn from it. However, balancing circuit breakers with the 24/7 trading characteristic poses a challenge.

3. Decentralized Finance Advantages Highlighted: In this turmoil, the DeFi sector withstood the test, highlighting its advantages. Leading protocols like Aave performed robustly during large-scale liquidations, with $180 million in liquidations completed smoothly without human intervention, proving the reliability of smart contracts. Decentralized exchanges like Uniswap saw trading volumes surge while continuously providing liquidity without any significant glitches or failures. Stablecoin pools like Curve successfully mitigated the impact on USDe, maintaining stable prices. This has led more people to reflect on whether the core infrastructure of the crypto market should be more decentralized.

4. Regulatory and Compliance Impacts: Such a drastic flash crash is bound to attract the attention of regulatory agencies. On one hand, regulators may accelerate the establishment of requirements regarding leverage limits and risk reserves to restrict retail investors from excessive leverage and prevent systemic risks. On the other hand, if there is evidence of intentional market manipulation, legal departments in various countries may intervene to investigate and hold accountable the involved institutions or individuals. The U.S. Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) have repeatedly warned about the risks of manipulation in the crypto market in recent years, and this incident may serve as evidence for them to push for stricter regulations. For exchanges, strengthening compliance and transparency will become more urgent; otherwise, investor confidence and compliance qualifications may be affected.

5. Changes in Investor Psychology and Strategies: Events like "312," "519," and now "10·11" are all milestone events in the crypto market, profoundly affecting investor psychology. After this incident, many retail and institutional investors will reassess their risk management strategies. In the near term, the leverage usage in the market may decline, and capital preferences may shift from high-risk altcoins to relatively stable blue-chip coins and core assets like Ethereum. Additionally, users heavily invested in a single exchange may begin to diversify their trading venue risks. These behavioral changes will gradually shape a more mature and rational market ecosystem.

In conclusion, the direct damage from the October 11 crash is significant, but in the long run, it may also bring about opportunities for industry improvement. On the surface, this was an accident caused by a macro black swan, but what truly led to the market collapse was the long-accumulated illusion of leverage and structural defects. If the crypto industry can reform its leverage, liquidity, and risk control frameworks, this disaster may transform into a turning point for healthy future development.

VI. Market Outlook: Risks and Opportunities in Q4

After this baptism, where will the crypto market head in the fourth quarter of 2025? Looking ahead, we must recognize both the risks and challenges as well as the potential opportunities:

1. Short-term Aftershocks and Bottoming Expectations: A crash is usually accompanied by aftershock risks. In the coming weeks, it is possible that some "after-effects" news will emerge, such as individual funds facing liquidation or project teams experiencing funding chain breaks. These secondary negative news may repeatedly impact market sentiment. However, as long as there are no larger storms, the market is expected to gradually digest the negative effects. After this large-scale deleveraging, the selling pressure in the market has been significantly released, and concentrated selling often indicates the approach of a phase bottom. If no new black swans emerge, mainstream coins may complete bottoming in the midst of fluctuations, and sentiment is expected to slowly recover.

2. Macroeconomic Environmental Variables: Macroeconomic factors remain key to influencing Q4 market trends. Continuous attention should be paid to U.S.-China trade frictions and global risk appetite trends. If Trump's tariff threats are not a "one-off" but lead to substantial retaliatory trade actions from both sides, then global risk assets will be under pressure, and the crypto market will find it hard to remain insulated. Conversely, if tensions ease or the news is digested by the market, the crypto market may restore its operational logic. Additionally, the Federal Reserve's monetary policy and inflation data will also play a role in Q4. If inflation remains under control and the Fed hints at halting interest rate hikes or even has expectations for easing, risk assets may receive an overall boost.

3. Market Structure Improvement and Opportunities: After this reshuffling, the market leverage ratio has significantly decreased. A report from Bitwise mentioned that approximately $20 billion in leverage was wiped out during the crash, marking the largest scale of leverage clearing in crypto history. However, it is fortunate that no core institutions collapsed, and there was no systemic failure, preventing a prolonged downturn. Long-term driving factors such as institutional entry, the widespread use of stablecoin payments, and the on-chainization of traditional assets continue to advance. In the short term, the market is healthier after deleveraging, and future price increases will have a more solid spot foundation to support them. If new incremental funds enter the market, they will not need to expend as much effort to combat stubborn long leverage resistance as before, which may make future rebounds lighter.

4. Potential Rebound Catalysts: Looking forward to Q4, potential positive catalysts are also worth noting. For example, the approval progress of diversified crypto asset ETFs is expected to see regulatory decisions around the end of the year; if approved, it would be a significant positive. Additionally, network upgrades within the Ethereum ecosystem, developments in Layer 2, breakthroughs in new applications like AI and RWA this year may reignite market enthusiasm. If no major negative news emerges and the aforementioned positives occur, mainstream coins are likely to regain upward momentum by the end of Q4 or early 2026.

5. Further Differentiation in the Cryptocurrency Landscape: The rebound potential after the crash may significantly differ across sectors. Bitcoin and Ethereum, as the market's cornerstones, may see their market share further increase after this turmoil. Investors may prefer to allocate funds to these assets with stronger "shock resistance," expecting them to recover and reach new highs first. In contrast, the altcoin sector may continue to languish in the short term. It will be difficult for altcoins to replicate the collective surge of an "altcoin season," with only a few high-quality projects with substantial positive developments likely to continue strengthening.

Conclusion: The crash on October 11, 2025, will be recorded as another "anniversary" in the history of cryptocurrency development. This night of market terror, triggered by a macro black swan and exacerbated by the bursting of the leverage bubble, has provided all participants with a thrilling lesson in risk education. Whether or not there were orchestrated efforts behind it, we have seen two faces of the crypto market: one is the fragility of high leverage and low liquidity, which makes it vulnerable in extreme situations; the other is the resilient operation of decentralized finance, the market's self-repair capabilities, and investors' belief in long-term value, which support this emerging market through its darkest moments. Looking ahead, the crypto market will gradually mature through regulatory adjustments and its own innovations. As investors, we must remain vigilant in times of peace, always remembering the iron rule that "survival is the key to the future," while also maintaining confidence in the industry's innovation and growth. Wishing everyone smooth investments and safe progress in the ever-changing market.

About Us

Hotcoin Research, as the core research institution of the Hotcoin exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Research Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Select" (AI + Expert Dual Screening), we identify potential assets and reduce trial-and-error costs. Each week, our researchers will also engage with you live, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。