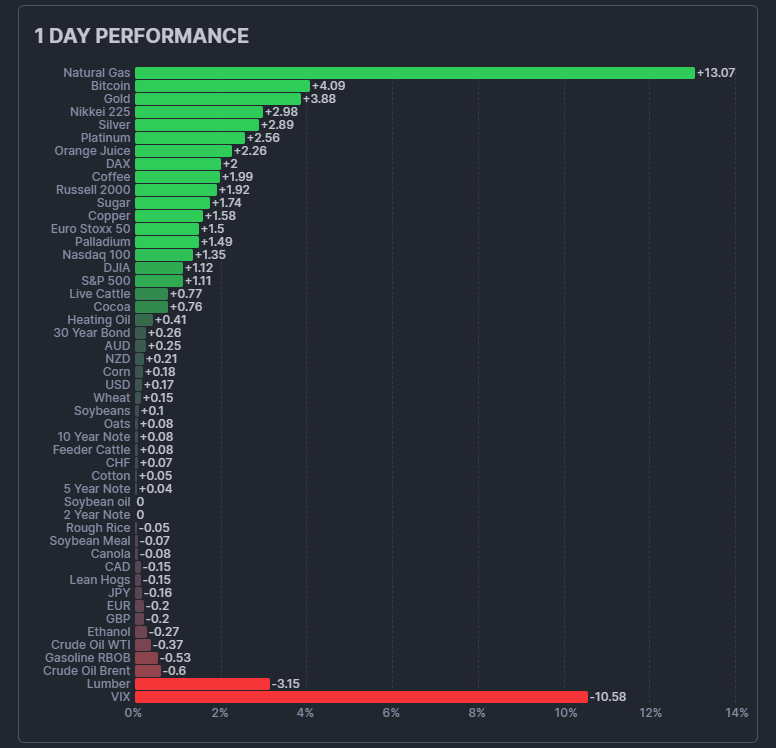

Recently, I have been very fond of reading, especially detailed content, such as the 1 Day Performance of major global assets over the last 24 hours. It reflects the changes in market sentiment and capital flow across different asset classes on the same day. From the chart, we can see that the strongest performer is natural gas (+13.07%), which is a typical supply-demand and weather-driven asset, indicating that the short-term energy market is highly volatile and may be influenced by cold waves, inventory expectations, or geopolitical events.

The second is $BTC (+4.09%), followed closely by gold (+3.88%), Nikkei 225 (+2.98%), and silver (+2.89%). The stock indices generally performed well, with the Nasdaq 100, S&P 500, and Dow Jones all rising about 1%, indicating that the overall sentiment in the U.S. stock market is stable, and there is a strong risk appetite that day. This should be a rebound after Friday's decline, primarily driven by a drop in the VIX of over 10%.

The decline in the VIX indicates a significant reduction in market panic, with funds returning to risk assets. The simultaneous rise of Bitcoin and gold suggests that the market is not in panic but is betting on a recovery in liquidity, a peak in interest rates, or a reduction in geopolitical risks. In simpler terms, the market expects that the downside risks are mostly over. Of course, the market can still be influenced by various factors; for instance, if Trump acts up in the early morning or if China takes a hard stance during the day, there might still be some fluctuations.

However, it is worth mentioning that today the Nasdaq was just 12 points away from breaking its historical high. I really don't see any signs of a collapse in the U.S. stock market. If the U.S. stock market doesn't collapse, then what reason is there for Bitcoin to bear?

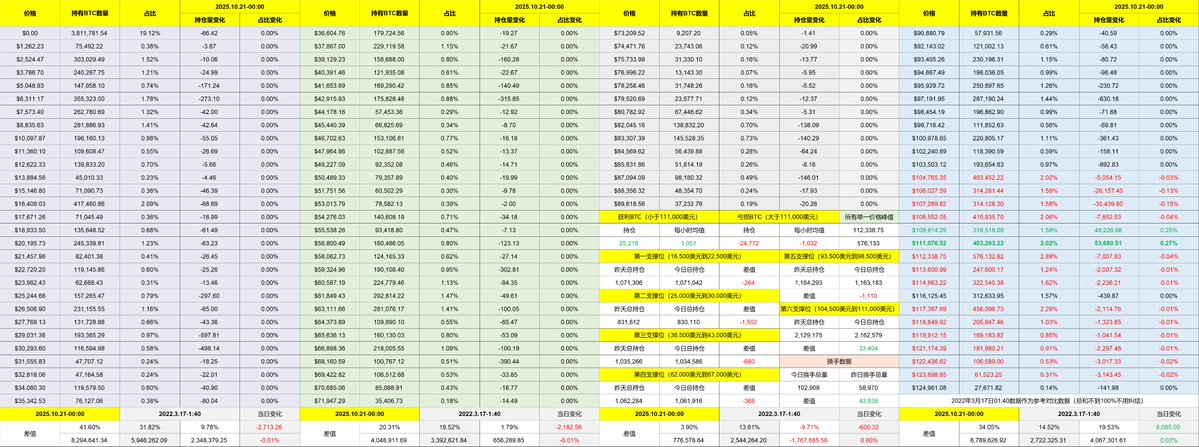

Looking back at Bitcoin's data, it is normal for the turnover rate to increase after the weekend. As long as the turnover rate remains within a normal range, it indicates that even Bitcoin investors are not panicking. The long positions opened at $106,000 are still being held, and there are currently no plans to close them. However, I have withdrawn all my margin, which means the probability of losing money is almost nonexistent.

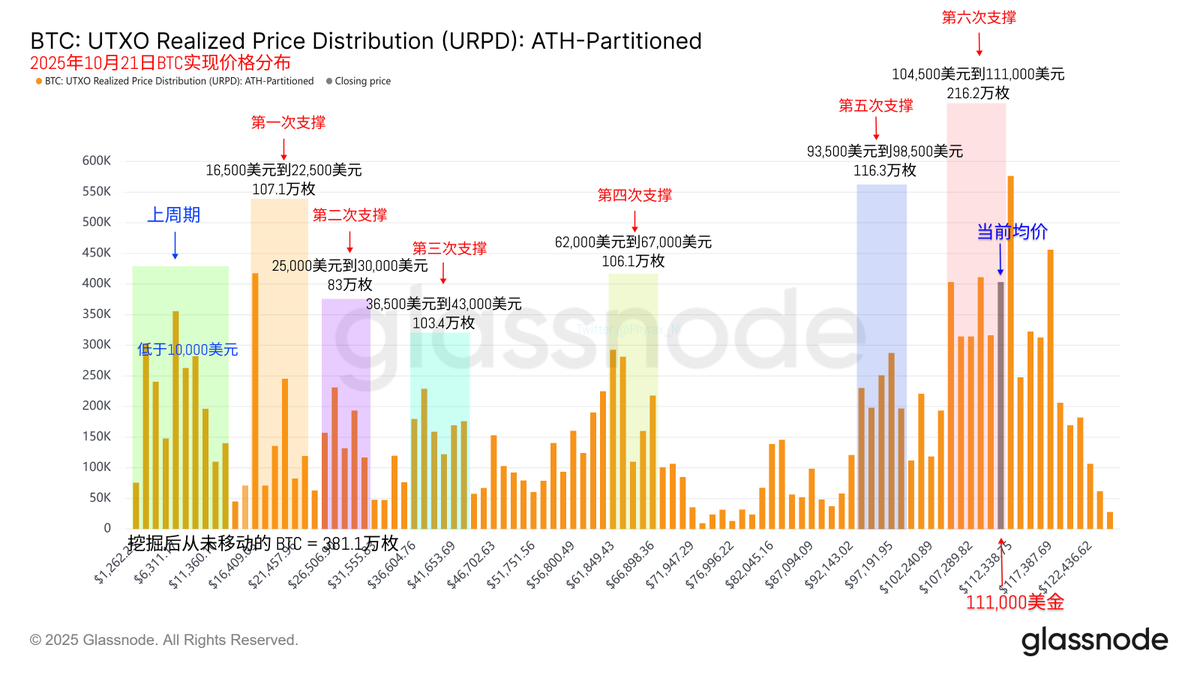

The URPD data also looks normal, with no signs of panic among losing investors, and the distribution of chips remains harmonious. The current game hasn't changed; one factor is U.S.-China trade, where the market believes the probability of a TACO is quite high, and another is the Federal Reserve's monetary policy, where the market also believes the probability of a rate cut in October is significant. If these predictions do not change and there are no new negative factors, it should stabilize things.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。