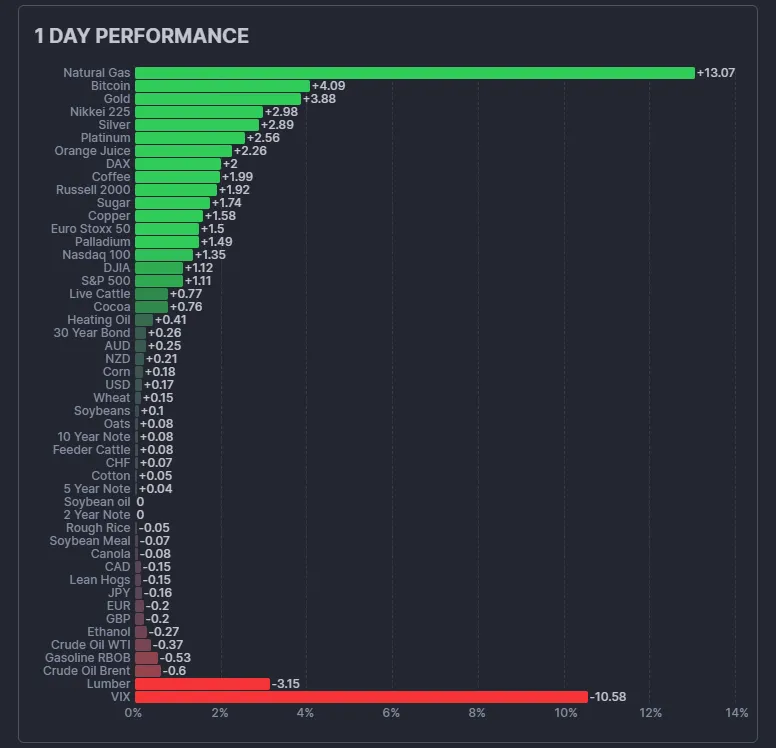

The global asset performance in the last 24 hours shows a rapid recovery in market sentiment. The three major U.S. stock indices and $BTC have all risen, reflecting a reallocation of funds into risk assets and an overall increase in market risk appetite. A key factor driving this sentiment recovery is the VIX index, which fell over 10% in a single day, indicating a significant decrease in market panic.

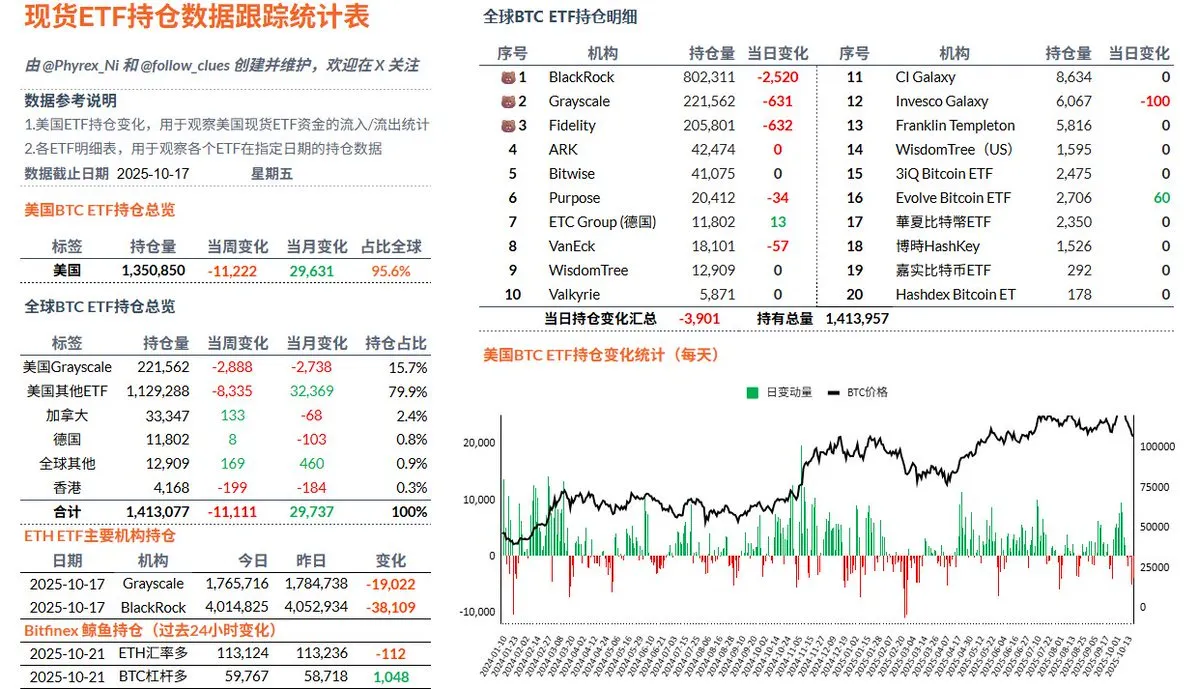

Structurally, the simultaneous rise of BTC and gold suggests that the market is not in a state of panic but is betting on a recovery in liquidity and a peak in interest rates. The Bitcoin turnover rate has increased but remains within a normal range, and URPD data is stable, indicating that investors are not fleeing in panic. The current focus of speculation remains on U.S.-China trade relations and expectations for Federal Reserve interest rate cuts.

As long as these two logics are not broken, the market still has a stable foundation in the short term.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。