I. Chinese Meme Explosion: Binance Ignites the Phenomenon of "Binance Life"

In early October 2025, Binance co-founder He Yi's social media post saying "Wishing you a Binance life" unexpectedly ignited the creative enthusiasm of the Chinese crypto community, giving rise to a meme coin called "Binance Life." This concept quickly fermented under community dissemination and KOL promotion, with its market value soaring to $500 million within just a few days, a staggering increase of 6000 times, forming a phenomenal hotspot. According to DeFiLlama statistics, the daily trading volume of BNB chain DEX surged to $6.05 billion, attracting over 100,000 new traders. From the initial explosion of Binance-related memes, the subsequent emergence of Chinese memes has led to the birth of several high-heat memes on BSC, such as:

- PALU: Binance intern IP, previously retweeted multiple times by Binance officials and CZ, now launched on Binance Alpha.

- 4: A classic image of CZ reimagined as a meme, now launched on Binance Alpha.

- Cultivation: Originating from an article by Binance co-founder He Yi published in Binance Square, explaining his entrepreneurial cultivation philosophy of Dao, Fa, Shu, and Qi.

- Hakimi: One of the hottest memes on the internet, combining cats and songs, with no direct relation to Binance. Hakimi has now launched on Binance Alpha.

- Customer Service Xiao He: A reimagined meme featuring He Yi's image, now launched on Binance Alpha.

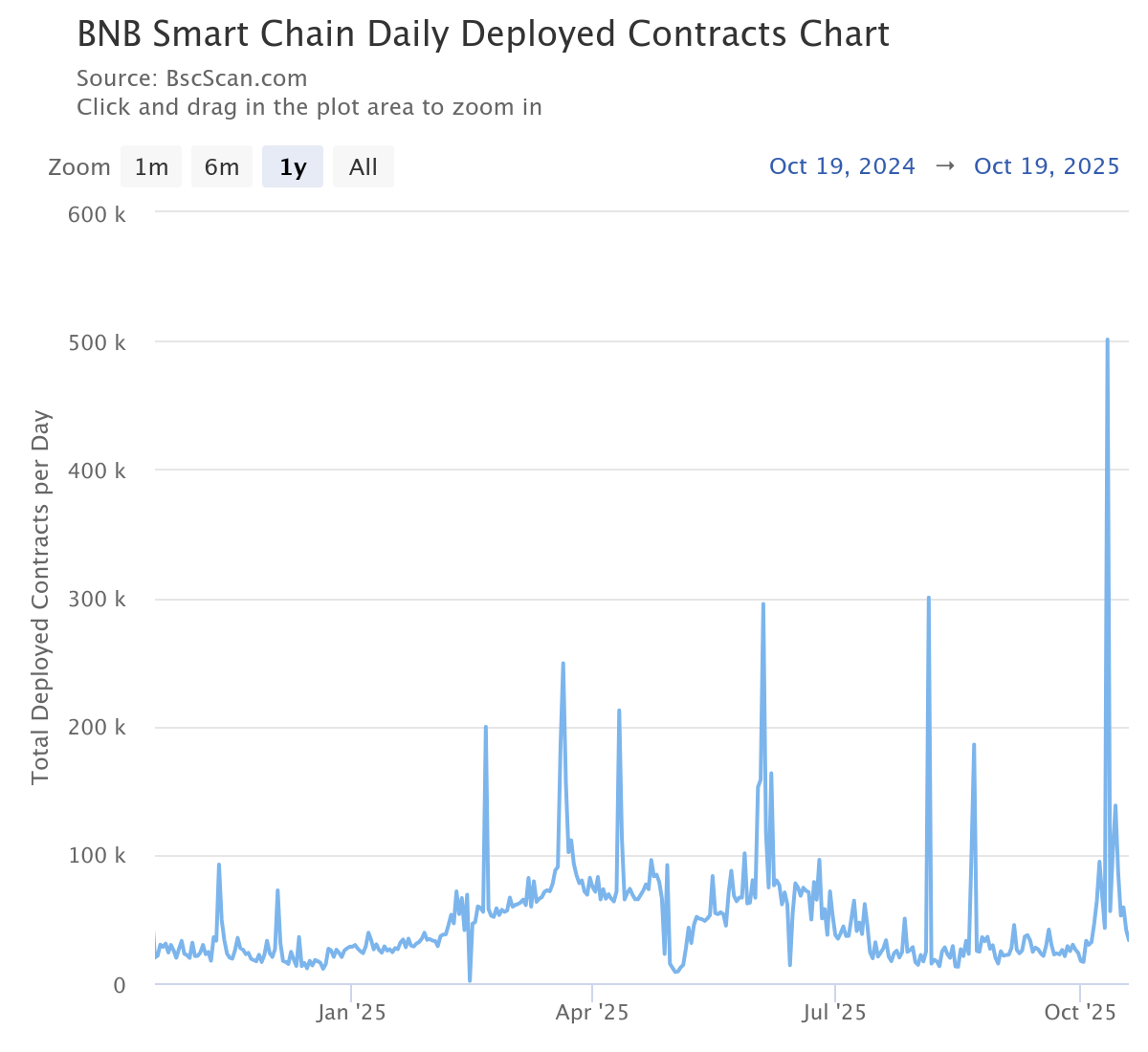

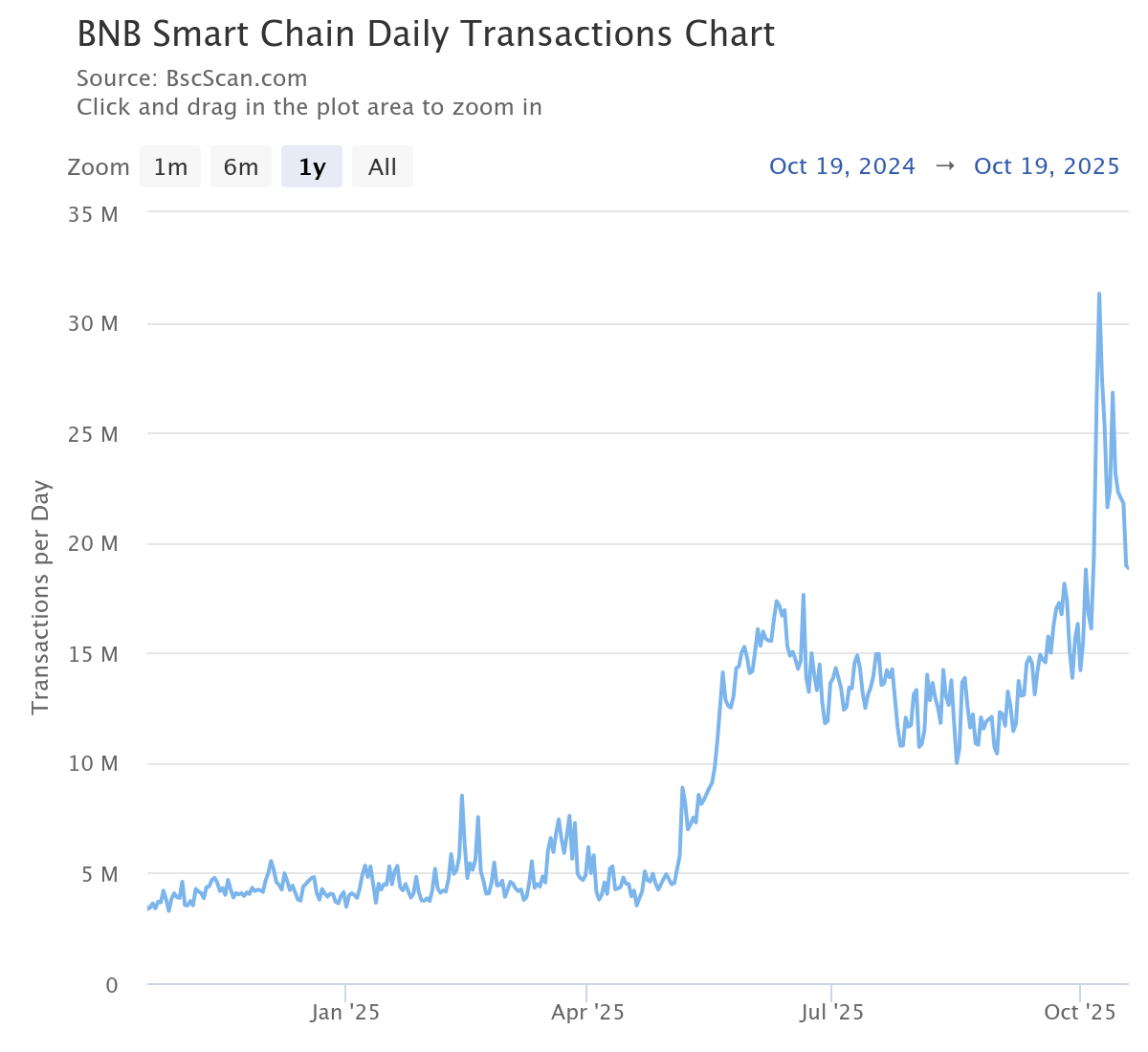

Binance has launched the Meme Rush platform, creating a closed-loop mechanism of "internal incubation - standard migration - external volume" in collaboration with Fourmeme, further amplifying the siphoning effect of the BSC ecosystem. Since then, the activity on the BSC chain has seen a significant increase, with both the number of newly created contracts and on-chain transfer transactions reaching their peak for the year. On October 21, the recently launched prediction project Limitless on the Base chain also took advantage of the situation to set up a prediction market on whether Binance Life would launch on Binance Spot, with 76% of participants agreeing. Subsequently, CZ responded to the discussion on X, stating that community discussions help project growth. That same night, Binance Life was launched on Binance contracts, and Binance officially established a new Chinese meme section, indicating that the popularity of Chinese memes continues to amplify.

II. Meme Retreat Amid Market Turbulence: Extreme De-leveraging Triggers Structural Cooling

On October 11, 2025, the three major U.S. stock indices and risk assets like Bitcoin experienced a sharp decline, triggering a cascade of liquidations in the crypto market—reportedly, about 1.6 million people were liquidated that day, with a total liquidation amount of approximately $19.3 billion, setting a historical record. In this extreme de-leveraging environment, the altcoin sector saw a waterfall-like decline, with most tokens dropping by 80-90% in a single day. On-chain liquidity tightened significantly, with liquidity gaps, trading congestion, and concentrated selling pressure erupting. According to CMC data, on October 11, the market value of meme coins dropped to $44 billion, a nearly 40% decline from the previous day's $72 billion. On October 12, the meme coin market slightly rebounded to $53 billion, a level not seen since July, earlier than the Solana ecosystem meme coin craze that triggered a summer rebound in the sector. Over the past four months, the total market value of meme coins has remained above $60 billion, continuously attracting retail attention, driven by Solana and BNB Chain. However, the recent crash marks a turning point in market sentiment. As of the time of writing, the total market value of the meme coin sector is $57 billion, still far below recent levels.

On October 11, 2025, the three major U.S. stock indices and risk assets like Bitcoin fell in sync, triggering a chain reaction of liquidations and large-scale forced liquidations in the crypto market. Statistics show that approximately 1.6 million people were liquidated that day, with a total liquidation amount reaching $19.3 billion, setting a historical high. In this round of extreme de-leveraging, the altcoin sector faced a cliff-like decline, with most tokens experiencing daily drops of 80% to 90%, and market liquidity rapidly tightened, hindering on-chain fund transfers, with concentrated selling and liquidations erupting.

According to CMC data, on October 11, the total market value of the meme sector plummeted from the previous day's $72 billion to $44 billion, a nearly 40% drop, marking the largest retracement of the year. Subsequently, on October 12, the market slightly recovered, with the total market value of the meme sector rising to $53 billion, a level not reached since July. Over the past four months, thanks to the push from Solana and BSC, the total market value of the meme market has consistently remained above $60 billion, attracting a large number of retail participants. However, this round of crash undoubtedly marks a watershed moment in market sentiment.

III. Solana Ecosystem Under Pressure: Pump.fun Retreat and BSC Fund Diversion

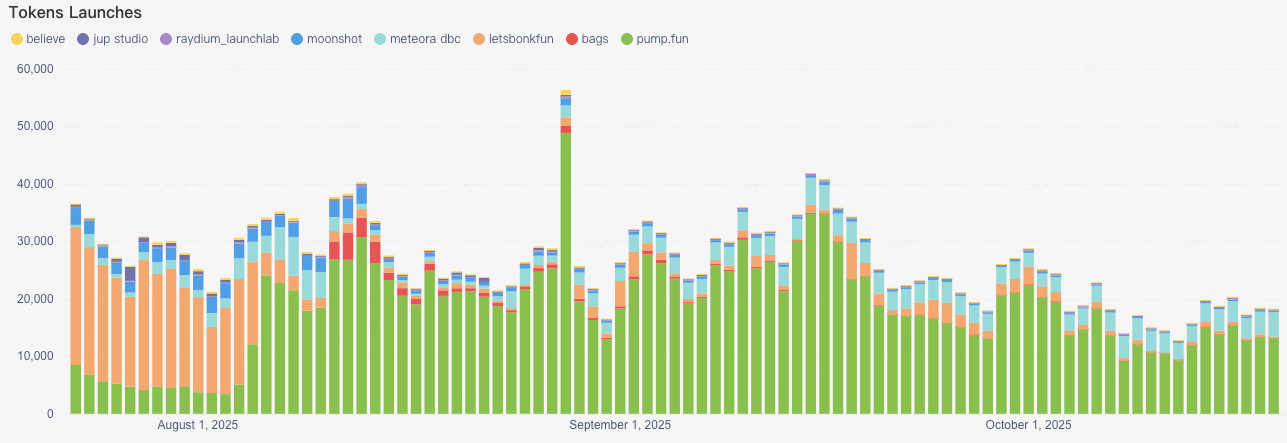

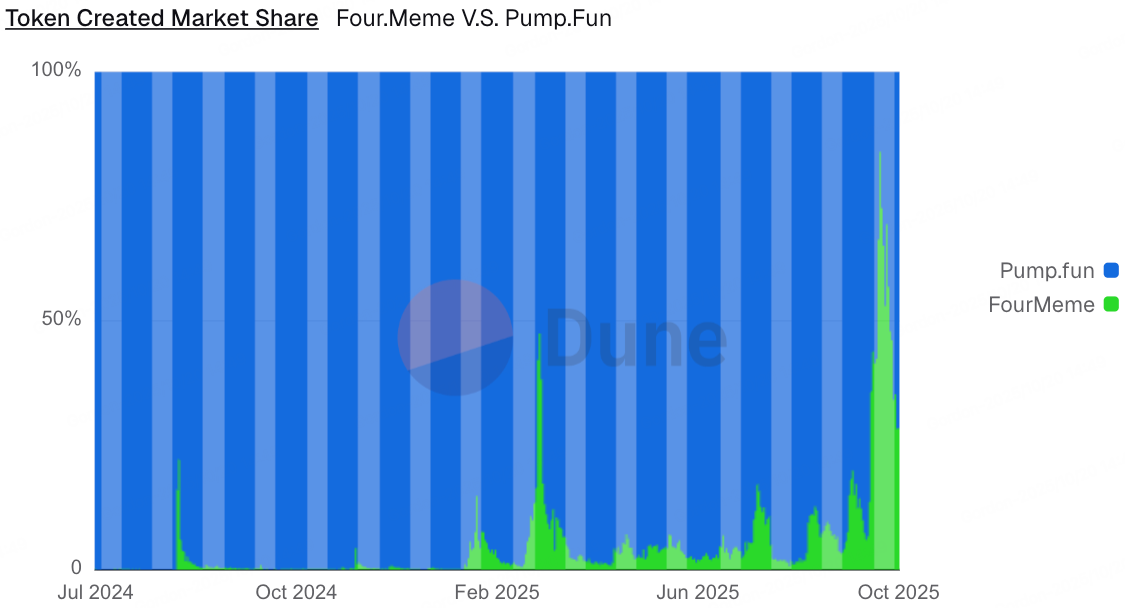

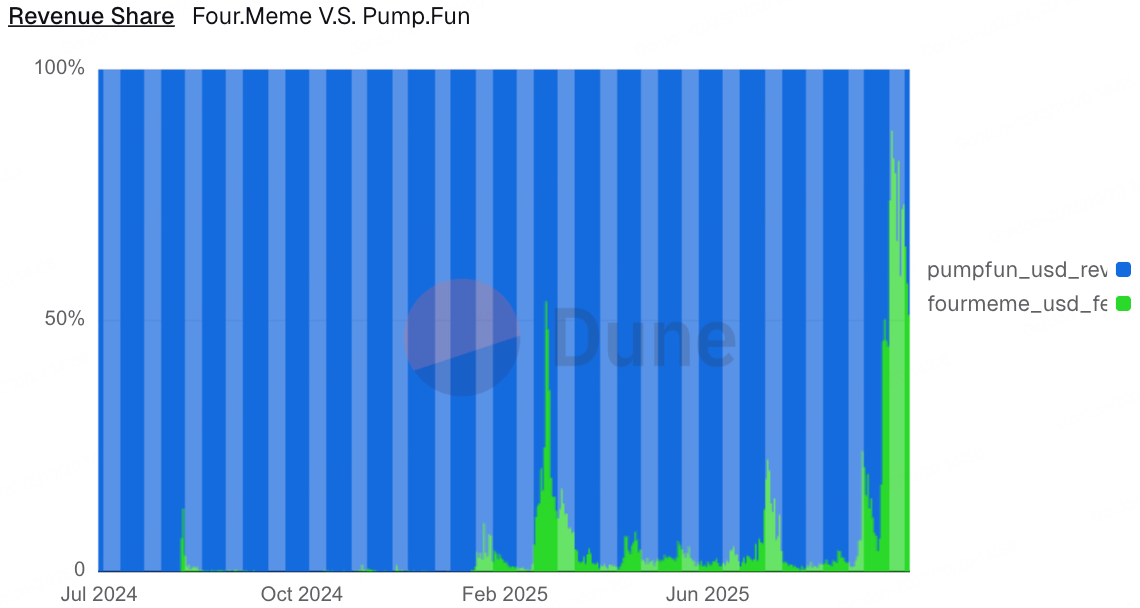

Since August, the number of newly created tokens on the Solana chain has seen a significant decline. Solscan data shows that from August to mid-October, the number of new tokens on Solana dropped from an average of 35,000-40,000 to 15,000-20,000, partly due to the cooling of the crypto market. Additionally, as shown in the chart below, since October, the market share comparison between Fourmeme and Pump.fun shows that Fourmeme's market share peaked at 83.9%, with the highest yield reaching 87.8%. This indicates that the explosion of the Chinese meme craze on BSC since October has diverted a large amount of funds. On-chain data shows that on October 8, the trading volume of BNB chain DEX soared to approximately $6.05 billion, marking the second-highest level of the year, indicating a significant increase in speculative activity within the Binance ecosystem, with much of the liquidity that was originally active on the Solana chain being attracted over.

IV. Conclusion

Overall, the issuance scale of meme tokens on the Solana chain remains considerable, but market activity has significantly cooled. Compared to the previous quarter, both the funding and social heat of the entire meme sector have shown a marked decline, while BSC, leveraging the effects of the Binance ecosystem and the explosion of Chinese cultural topics, is rapidly becoming a new growth center. Currently, the focus of funds and traffic is shifting from Solana to the BNB chain, with investors showing increased interest in emerging meme projects on BSC, while the Solana ecosystem is still waiting for new narratives and hotspots to reignite community vitality.

It is worth noting that the two public chains, Solana and Base, which are the main concentrations of memes, have recently seen a rise in popular Chinese memes. The official Solana Twitter stated that its Chinese name is "Suola La," leading to the emergence of related Chinese memes. The market value of Base Life on Base has also surpassed ten million, and some small-cap Chinese memes have appeared on Base. Currently, it seems that with the consecutive explosions of projects like Binance Life, Cultivation, and Customer Service Xiao He, Chinese memes have already occupied a certain position in the crypto market. With the continued expansion of the BSC ecosystem and the participation of more creators, it is expected that more new meme projects inspired by Chinese topics, character images, or internet hot memes will emerge.

Risk Warning:

The above information is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no express or implied representations or warranties regarding the accuracy, adequacy, effectiveness, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial management) are inherently highly speculative and carry significant risk of loss. Past performance, hypothetical results, or simulated data do not necessarily represent future results. The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully assess whether such investments are suitable for you based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。