The gold market changed overnight, with spot gold dropping 6.3%, marking a 12-year record low, while the cryptocurrency market quietly absorbed new funds amid the turmoil.

The global market experienced a baptism of "ice and fire" overnight. Spot gold once plummeted over 6%, hitting a low of $4080.87 per ounce, the largest single-day drop since April 2013.

At the same time, the cryptocurrency market demonstrated an astonishing ability to absorb funds after experiencing significant volatility. Binance saw a net inflow of 525 million USDT in the past 24 hours, while the total liquidation amount across the network exceeded 700 million dollars.

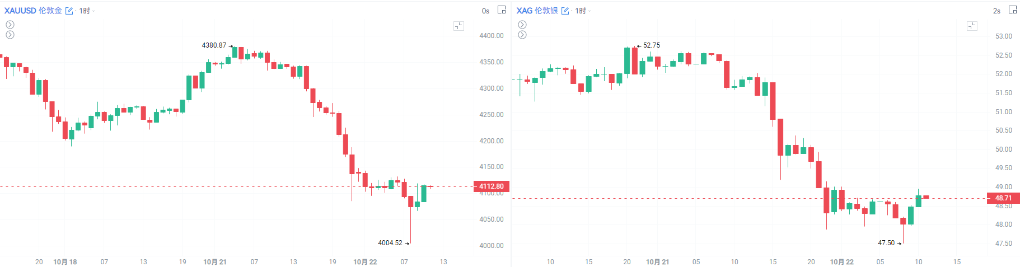

1. Precious Metals Suffer Heavy Losses

This Tuesday, the precious metals market faced a true "bloodbath."

Spot gold saw a maximum single-day drop of 6.3%, the worst performance in 12 years, while spot silver plummeted 7.11%, marking the largest drop since 2021. On the domestic market, the main contract for Shanghai gold fell 4.72% during the day, and the main contract for Shanghai silver dropped 4.91%.

Asset Class

Performance Overview

Future Outlook

Gold

Spot gold plummeted 6.3% in a single day, the largest drop since April 2013

Citibank set a target price of $4000 per ounce for 1-3 months

Silver

Spot silver dropped 7.11%, the largest drop since 2021

After a technical correction, it may retest previous highs

Bitcoin

Fell nearly 3% to $108,112, with total liquidations exceeding $700 million

Short-term fluctuations are building a bottom, while long-term institutional funds continue to flow in

Ethereum

Fell 5.3% to $3,859.65

Key technical support is in the $3,750-$3,720 range

Source: Compiled by AiCoin

This plunge was not without warning. Just last Friday, the Shanghai Gold Exchange's gold Au99.99 contract briefly broke through 1000 yuan per gram, but on the morning of October 22, the contract price also plummeted, with intraday losses exceeding 5%.

The crazy rise of gold has repeatedly set historical highs this year, prompting several banks to issue clear warnings about market risks in the precious metals business and frequently lower purchase amounts.

Analysts pointed out that profit-taking was the main reason for this plunge. Against the backdrop of easing Sino-U.S. trade tensions, White House Chief Economic Advisor Hassett signaled that progress on the government "shutdown" issue is expected this week, leading to a decrease in safe-haven demand.

02 Chain Reaction in the Crypto Market

While precious metals plummeted, the cryptocurrency market also experienced severe volatility.

● Bitcoin's price staged a "roller coaster" performance, with the world's largest cryptocurrency dropping nearly 3% to $108,112.30. After a turbulent start to October, the total market cap of cryptocurrencies evaporated by about $500 billion, struggling to maintain the $110,000 level.

● Severe market volatility has taken a heavy toll on leveraged traders. According to AiCoin data, total liquidations across the network reached $528 million in the past 24 hours, showing a pattern of both long and short liquidations.

● Ethereum, the second-largest cryptocurrency by market cap, fell 5.3% to $3,859.65, breaching the critical $4,000 mark.

● Binance's BNB token dropped 5.7%, while Cardano and Solana fell 4% to 6%.

3. Market Structure Optimization

In this global asset allocation reshuffle, signs of capital rotation have already emerged.

● Leverage cleaning, systemic risk decreases

The most positive signal comes from the derivatives market. According to AiCoin data, Bitcoin's open interest recently plummeted by about 30%. This clearly indicates that a large number of high-leverage long positions were forcibly liquidated, marking a severe "de-leveraging" process.

"A 30% drop in open interest means that the potential explosive power in the market has decreased by nearly one-third," commented cryptocurrency analyst Zhang Wei. "Even if prices drop again, the leverage positions that can be triggered have significantly reduced, and systemic risk has been notably lowered."

● Driving mode switch, laying the foundation for a rebound

The market's driving mode is shifting from the unsustainable "leverage-driven" to a healthier "spot-driven" model. Once high-leverage speculators are washed out, market volatility will be more determined by real buying and holding funds, laying the groundwork for a solid bottom.

● Capital rotation still needs observation, but conditions are more favorable

A key change is that the cryptocurrency market has completed the necessary "self-detoxification" through this round of severe volatility—high-leverage positions have been largely cleared, and open interest has significantly decreased. This process has reduced the inherent fragility of the market, making it more liquid and structurally healthier, thus laying a more solid foundation for potential external capital inflows.

Market

Capital Flow

Influencing Factors

Precious Metals Market

Significant capital outflow

Safe-haven demand cools, profit-taking

Cryptocurrency Market

Net inflow of 525 million USDT into Binance

Capital rotation seeking higher returns

Bitcoin ETF

Net outflow of $40.4 million for the fourth consecutive day

Market sentiment weakens in the short term

Asian Stock Markets

Potential for significant capital inflow

Relatively strong investment appeal in the Asia-Pacific market

Source: Compiled by AiCoin

4. Chaotic Market Environment

In a chaotic market environment, regulatory risks need to be monitored.

● Major exchanges in the Asia-Pacific region, such as the Hong Kong Stock Exchange, are taking action to curb the trend of listed companies shifting their core business to hoarding cryptocurrencies.

In recent months, the Hong Kong Stock Exchange has questioned the "digital asset vault" strategies proposed by at least five companies, regarding the compliance and business rationality of their transformation into "digital asset vaults," deeming it high-risk speculation that does not comply with listing rules, aiming to prevent financial risks from shifting from real to virtual.

This year, Hong Kong will introduce a new regulatory mechanism, particularly establishing a licensing system for over-the-counter (OTC) cryptocurrency trading.

License holders can only conduct spot trading between virtual assets and fiat currencies, and must register and continuously monitor business wallets and all transaction records. Violators can face fines of up to 1 million Hong Kong dollars or imprisonment for two years.

● Meanwhile, negotiations in the U.S. Senate regarding cryptocurrency regulation have also stalled.

A draft known as the "Preliminary Plan for Decentralized Finance Regulation," submitted by Senate Democrats in early October, was leaked and faced strong opposition from the cryptocurrency industry. Due to the industry's dissent, progress on related negotiations has come to a standstill this month.

● Geopolitics. Ukrainian President Zelensky stated he is ready to end the conflict and agreed with Trump to attempt negotiations based on the current front lines. This significantly reduces the market's safe-haven demand.

5. Market Outlook and Strategy

Market analysts have differing views on the future direction, showing clear divergence.

● Citibank expects that the end of the U.S. government "shutdown" and easing Sino-U.S. trade tensions may push gold prices into a consolidation phase over the next three weeks. Citibank stated that in the short term, it is bearish on gold prices (previously bullish), setting a target price of $4000 per ounce for 1-3 months.

● XTB Research Director Kathleen Brooks believes that the sharp drop in gold and silver prices lacks a clear catalyst, and the correction may not be a bad thing, as it shows that investors are not overly enthusiastic, indicating that there is a rational boundary to the rise in gold prices.

● The precious metals research department of Minmetals Futures stated that from a fundamental perspective, the Federal Reserve's current rate-cutting cycle is still in its early stages, and gold prices are expected to continue rising. Against the backdrop of weakened dollar credit, the process of global central banks increasing their gold holdings will not stop. Therefore, the bullish outlook on gold prices should be maintained, with a strategy focused on buying on dips.

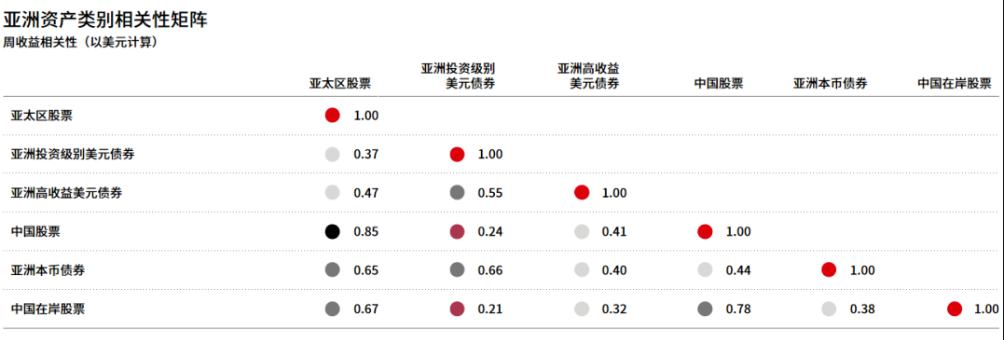

6. The Value of Diversified Allocation Becomes Apparent

In the context of increasing uncertainty in the global market, diversified asset allocation is highlighting its value.

● Bridgewater founder Ray Dalio revealed the risk-hedging principles that span multiple markets, stating that in the long run, cash is a poor investment. Chinese investors tend to overhold a combination of real estate or cash, but balanced diversified asset allocation is crucial at all times.

● In response to questions about geographical diversification, Dalio suggested placing half of the assets locally, paired with overseas assets, such as allocating 10% to each of ten markets, including gold, bonds, etc., to achieve risk balance.

● From a mathematical perspective, adding ten to fifteen non-correlated assets can reduce risk by 60%-80% while keeping returns unchanged, increasing the risk-return ratio fivefold, which is key to investing.

● The Asia-Pacific market, especially emerging markets, shows relatively strong investment appeal, and capital may be more inclined to flow into this region. In the medium to long term, the Asia-Pacific stock market has strong growth potential driven by global economic recovery and industrial transformation and upgrading.

The turmoil in the global market highlights the importance of diversified allocation. For ordinary investors, considering cross-regional and cross-asset class diversified investments in the current market environment may be wiser than chasing single market opportunities.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。