Author: Zhou, ChainCatcher

According to official news, Coinbase has acquired the cryptocurrency investment platform ECHO for $375 million, marking its eighth acquisition since 2025. From integrating the privacy technology project Iron Fish at the beginning of the year, to taking over the derivatives exchange Deribit and the token management platform LiquiFi mid-year, and now ECHO, Coinbase's acquisition scope in the core areas of the crypto ecosystem is expanding.

Behind this series of operations, Coinbase is attempting to shift from a "compliant exchange" to an "asset-end ecological platform," building a full-stack ecosystem around asset generation, issuance, and circulation.

1. The Compliance Dividend is Fading, the Old Moat is Collapsing

In recent years, Coinbase built its moat with "compliance licenses + listing windows," allowing it to be the first to list mainstream tokens (such as SOL, APT, AVAX), thereby attracting both institutional and retail investors and forming a differentiated asset advantage.

However, this advantage is rapidly diminishing. As the SEC expands licensing and more exchanges pursue compliance, compliance has shifted from a scarce label to an industry standard. This change directly weakens Coinbase's core competitiveness and brings multiple challenges: the high fee model is under pressure, retail trading profit margins are compressed, and an increasing number of users are inclined to choose low-cost platforms like Binance (average fee 0.015%-0.1%) or Robinhood.

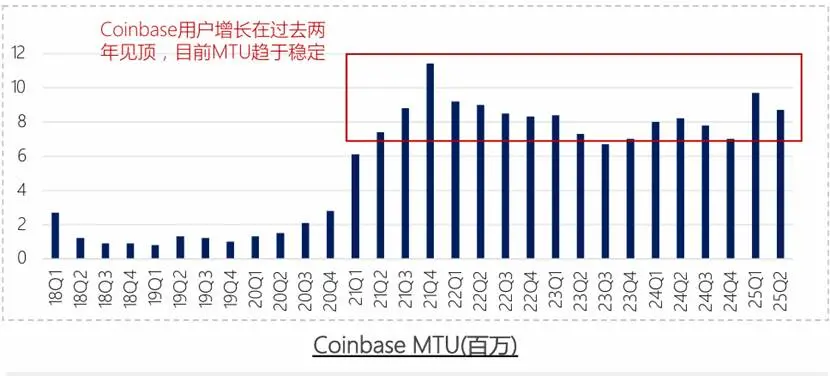

Meanwhile, Coinbase's MTU (Monthly Trading Users) growth has stagnated, having peaked in Q4 2021 and not showing significant rebound since 2022. User growth has become highly dependent on market fluctuations, making the traditional trading-driven model difficult to sustain.

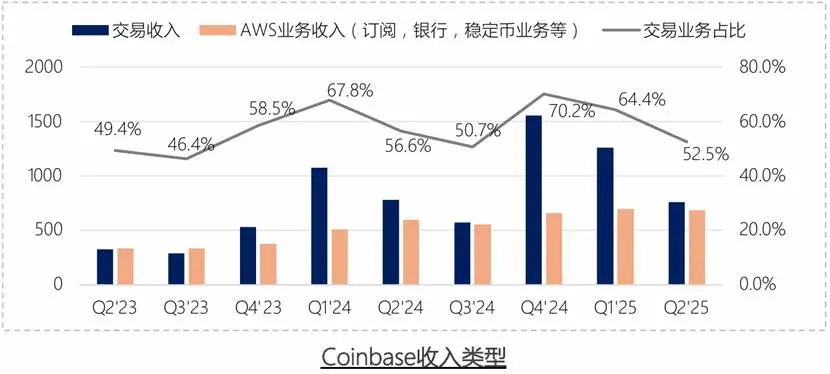

To mitigate volatility risks, Coinbase has been promoting a "cloud-like AWS" transformation over the past two years, hedging cyclical fluctuations through non-trading businesses such as stablecoin yields, staking rewards, interest, and subscription services. Although the proportion of non-trading revenue in total revenue has risen to 36.8% in 2024, overall expansion growth remains slow, and a clear second growth curve has yet to form.

As the compliance dividend is no longer a moat, Coinbase must redefine its relationship with assets and users.

2. From Exchange to Ecological Platform: Seeking a Second Growth Curve

This year, Coinbase has significantly accelerated its acquisition pace on the asset side. It is no longer just a matching platform but is attempting to establish dominance in the "asset generation—issuance—circulation" process.

The list of eight acquisitions in 2025 is as follows:

- January 8: Roam.xyz (Blockchain Explorer / Social Entry): Strengthens on-chain consumer entry, lays out a browser-level Web3 interaction layer, and improves user acquisition efficiency.

- January 31: Spindl (On-chain Advertising and Attribution Analysis): Used to improve on-chain traffic tracking and ad attribution, providing a data foundation for ecological growth.

- March 12: Iron Fish (Privacy Technology Protocol): Introduces privacy trading capabilities to the Base network, enhancing the infrastructure layer.

- May 8: Deribit (Cryptocurrency Derivatives Exchange): Expands derivatives business, filling the product depth gap with competitors like Binance.

- July 2: LiquiFi (Token Management and Equity Distribution Platform): Builds token creation and issuance services, connecting the primary market.

- July 11: Opyn (DeFi Options Protocol): Enhances on-chain derivatives trading capabilities, complementing Deribit.

- September 9: Sensible (DeFi Consumer Finance Team): Strengthens on-chain consumer finance scenarios, improving C-end product experience.

- October 21: ECHO (On-chain Fundraising Platform): Captures on-chain financing entry, completing the asset-end closed loop.

From these actions, it is evident that Coinbase is no longer betting on fee competition but is shifting towards ecological control: driving retention through asset diversification and reducing dependence on trading pairs through upstream and downstream integration.

Reports indicate that ETF trading volume has accounted for nearly 50% of U.S. spot trading, and it is expected that within 1-2 years, ETFs may become the largest distribution channel, forcing CEXs to lower fees and reshape their positioning. Coinbase's acquisitions are clearly a response to the "erosion of the trading distribution end": if distribution channels are taken over by ETFs, then it must control asset supply.

From the revenue structure, the company's total revenue in 2024 is projected to reach $6.2 billion, with the proportion of non-trading revenue increasing from 20% in 2021 to 36.8%. Among these, stablecoin yields have become the core of growth (over the past three years, Coinbase has received 50% of Circle's revenue).

The Q2 2025 shareholder letter shows that Coinbase's revenue for the quarter was $1.5 billion, with a net income of $1.4 billion. The derivatives business saw a surge in Q2 2025, but this was mainly due to fee rebates and market-making incentives, raising questions about sustainability. The AWS-like business is still in its early stages and has not yet fully offset the volatility of trading revenue.

In other words, Coinbase's current transformation is more focused on ecological integration, essentially extending the growth cycle and reshaping competitive barriers.

3. ECHO: A Key Entry Point for Asset End, Competing with Binance Alpha?

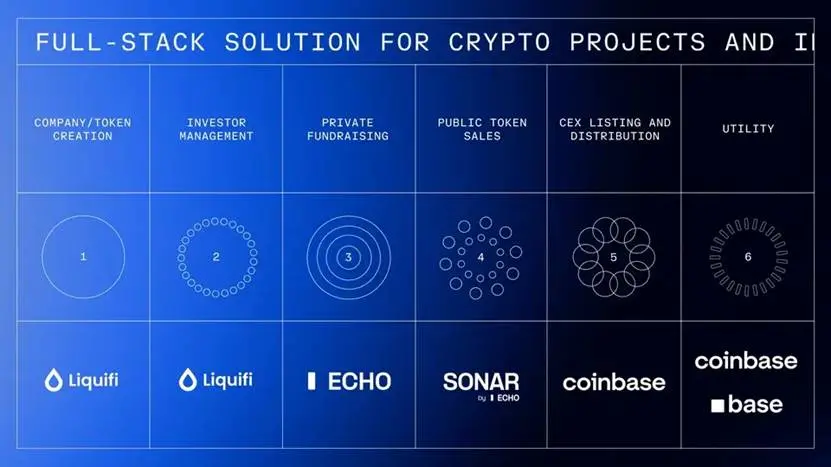

ECHO is a key piece in Coinbase's asset-end layout. It facilitates token financing through group private placements and the Sonar public sales tool, simplifying the participation process for community investments.

Specifically, the group private placement model involves well-known investors or KOLs acting as lead investors, screening Web3 startups and inviting the community to co-invest. It has currently supported early financing for projects like Ethena, MegaETH, and Morpho.

Additionally, ECHO launched Sonar in May 2025, a self-custody token sales tool that allows project parties to initiate compliant fundraising on chains like Hyperliquid, Base, and Solana, using a time-weighted deposit mechanism. Participants deposit USDT or USDC, with longer deposit times yielding more token shares, on a first-come, first-served basis. As of October 2025, Sonar has supported over 30 projects in raising more than $100 million, with the first case being Plasma XPL in September.

For Coinbase, the value of ECHO lies in:

- Enhancing user stickiness: Sonar allows over a hundred million Coinbase users to directly participate in early financing, increasing user engagement;

- Feeding back into the Base ecosystem: ECHO has supported over 40 Base projects and received backing from Paradigm and Hack VC, bringing new projects and traffic to the L2 network.

- Filling the gap in the primary market: Connecting early financing stages to introduce new token supply and trading scenarios for the platform.

It is worth noting that Binance Alpha (focusing on pre-IPO projects) has attracted a large number of Alpha native users by continuously launching high-profit projects with an efficient listing mechanism. However, Coinbase has long had a slow listing pace and lacked the ability to filter quality projects, missing out on traffic dividends. This is related to its compliance review process and reflects its shortcomings in project acquisition, while ECHO's early project investments somewhat compensate for this shortcoming.

The two have differentiated positioning, but essentially both aim to seize new narrative power as they enter the stage of competing for existing users.

Conclusion

Coinbase's transformation resembles a self-rescue effort; when the fee dividend and regulatory barriers are no longer protective charms, it chooses to rebuild its walls on the asset side. Can Coinbase still thrive? At least these actions indicate that as the crypto market enters a phase of competing for existing users, it has finally realized that the era of relying on compliance dividends and early listing windows to retain users has ended.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。